Introduction

Corporate borrowing activity in December 2025 highlights where capital is flowing across India’s unlisted ecosystem. Large charge creations often signal capacity expansion, refinancing, project execution, or balance-sheet restructuring, making them a strong proxy for sectoral momentum.

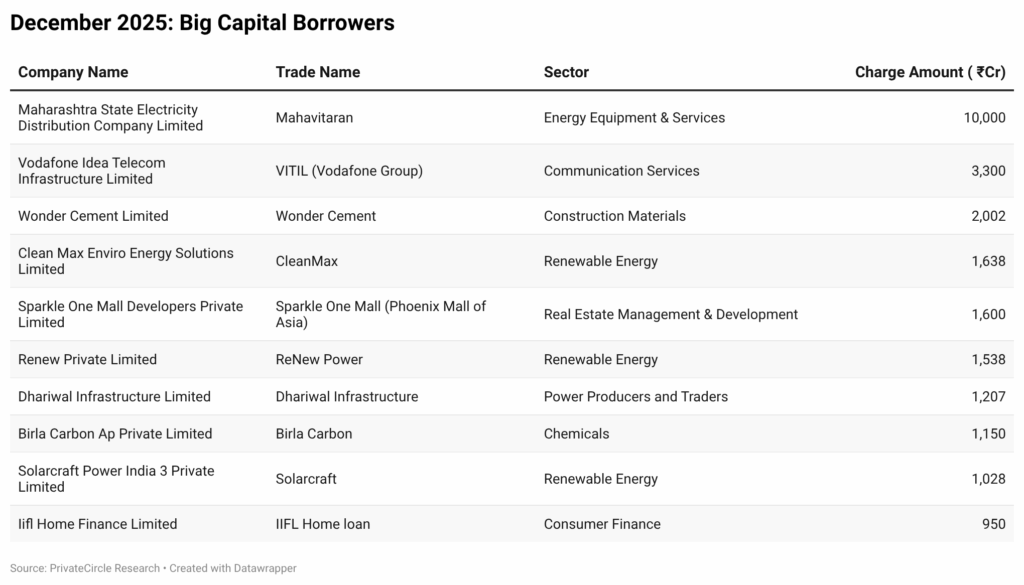

This month’s data reveals a clear tilt towards energy, infrastructure, telecom, and real estate, with both public utilities and private enterprises raising significant debt. Below is a snapshot of the top 10 unlisted companies that registered the highest charge amounts in December 2025, offering insights into where lenders are placing their bets.

Top 10 Borrowers Among Unlisted Companies – Dec 2025

Key Takeaways

1. Energy Dominates the Borrowing Landscape

Power and renewable energy companies account for a majority of the total borrowing value. From state utilities like Mahavitaran to private renewable leaders such as ReNew Power and CleanMax, debt continues to fuel India’s energy transition and grid stability.

2. Telecom Still Heavily Leveraged

The ₹3,300 Cr charge by Vodafone Idea Telecom Infrastructure underscores ongoing capital needs for spectrum obligations, network investments, and balance-sheet support in a highly competitive telecom market.

3. Infrastructure & Real Estate Stay Capital-Intensive

Borrowings by Wonder Cement, Dhariwal Infrastructure, and Phoenix Mills’ Sparkle One Mall Developers point to sustained investment in manufacturing capacity, power assets, and premium commercial real estate.

4. Renewables Attract Structured Debt

Multiple renewable SPVs and platforms appear in the top 10, highlighting lenders’ comfort with long-term, cash-flow-backed green assets.

5. Financial Services Remain, Active Borrowers

IIFL Home Finance’s presence reflects continued demand for retail housing credit, supported by secured borrowing and institutional funding.

Conclusion

December 2025’s borrowing trends reaffirm a familiar pattern: capital follows infrastructure, energy, and essential services. While equity markets capture headlines, debt markets quietly reveal where execution is actually happening.

For investors, lenders, and policymakers, these charge creations offer early signals of sectoral confidence, capex cycles, and balance-sheet strategies among India’s largest unlisted players. As India scales its power capacity, telecom infrastructure, and urban assets, structured debt will remain a critical growth engine.

From funding trends to corporate charges, PrivateCircle streamlines India’s private market intelligence.

Stay ahead with accurate data you can trust.