Industry Overview

India’s $80 billion jewellery market is one of the country’s most culturally significant and economically resilient consumer sectors. Deeply rooted in tradition, gold and precious jewelry are not only symbols of wealth and status but also integral to weddings, festivals, and the preservation of generational wealth.

Over the past decade, the market has witnessed a clear shift from fragmented, family-run stores to organized, professionally managed regional and national brands. Large-format showrooms, transparent pricing, hallmarking standards, and omni-channel retail strategies are accelerating formalization. As a result, structured jewellery retailers are gaining market share and scaling rapidly across key consumption hubs in India.

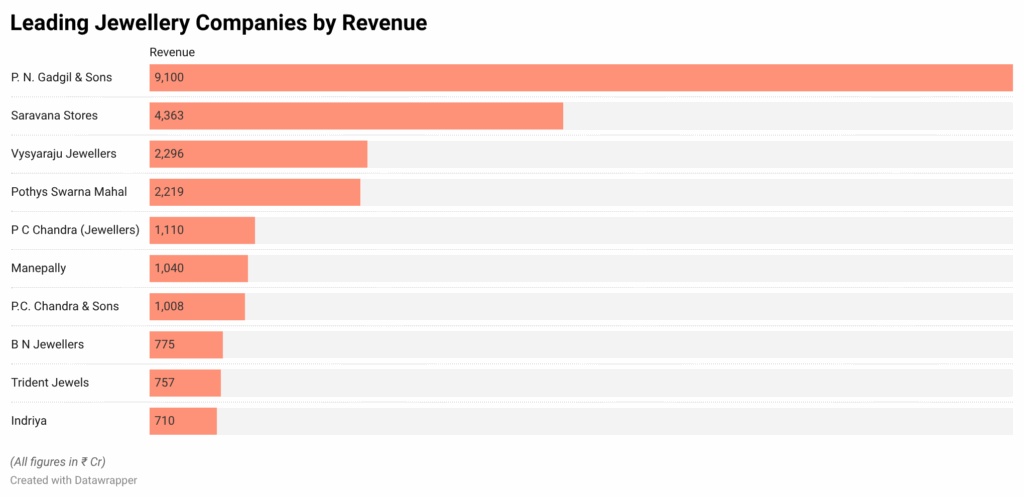

Top Revenue-Generating Jewellery Companies

Company Snapshots

P. N. Gadgil & Sons: P. N. Gadgil & Sons is a rapidly scaling, organized jewellery retailer with deep roots in Maharashtra. The brand blends legacy trust with modern retail practices, offering a wide portfolio across gold, diamond, platinum, and bridal jewellery.

Key Features:

- Strong regional dominance in Maharashtra with expanding multi-city presence

- Extensive bridal and traditional gold collections catering to wedding-driven demand

- Large-format showrooms designed to deliver premium in-store experiences

- Focus on brand-led expansion and structured retail growth

Saravana Stores: Saravana Stores operates a high-volume jewellery business integrated within its broader department store ecosystem, leveraging massive footfall and value-focused positioning to drive gold sales.

Key Features:

- Mass-market positioning with competitive pricing strategies

- High customer footfall driven by its multi-category retail model

- Volume-driven sales approach, ensuring consistent turnover

- Strong focus on gold jewellery for investment and wedding purposes

Vysyaraju Jewellers: Vysyaraju Jewellers is a prominent jewellery retailer based in South India, specializing in traditional gold jewellery and regionally inspired bridal designs that resonate with local cultural preferences.

Key Features:

- Strong foothold in South Indian markets with deep local brand loyalty

- Emphasis on traditional and temple-inspired gold jewellery

- Gold-dominant product mix with select diamond offerings

- Bridal collections tailored to regional customs and occasions

Pothys Swarna Mahal: Pothys Swarna Mahal is the jewellery arm of the well-known Pothys retail group, leveraging its strong brand equity in textiles to expand into organized gold and diamond retail.

Key Features:

- Benefits from cross-brand trust built by the Pothys textile legacy

- Strong wedding and festive jewellery collections

- Structured retail expansion in South India

- Bridal collections tailored to regiFocus on family-oriented and occasion-based purchasesonal customs and occasions

Manepally: Manepally is a premium South Indian jewellery brand known for its intricate craftsmanship, heritage-inspired designs, and strong bridal gold portfolio.

Key Features:

- Premium positioning with emphasis on detailed craftsmanship

- Strong bridal and high-value gold jewellery collections

- Designs reflecting traditional South Indian artistry

- Focus on quality assurance and customer trust

P.C. Chandra & Sons: P C Chandra & Sons operates as a corporate entity within the historic P C Chandra Group, driving organized retail growth across gold, diamond, and bridal jewellery categories.

Key Features:

- Heritage-backed brand with decades of market trust

- Strong presence in Eastern India

- Diverse portfolio spanning gold, diamonds, and lightweight collections

- Consistent focus on wedding-driven and festive demand

P C Chandra (Jewellers): P C Chandra (Jewellers) functions within the broader P.C. Chandra ecosystem, contributing significantly to branded jewellery retail with a focus on structured expansion.

Key Features:

- Multi-category jewellery offerings, including gold and diamonds

- Organized showroom network

- Operates under an established and trusted group brand

- Emphasis on maintaining heritage while modernizing retail formats

Indriya (Novel Jewels Limited): Indriya is a new-age jewellery brand positioned as a modern, organized retail player focusing on contemporary design and structured business expansion.

Key Features:

- Modern branding and retail-first approach

- Focus on contemporary and lightweight jewellery designs

- Organized corporate structure with expansion-driven strategy

- Targeting younger and aspirational consumer segments

B N Jewellers: B N Jewellers is a growing regional jewellery retailer specializing primarily in gold ornaments and bridal jewellery, with a steadily expanding footprint.

Key Features:

- Strong regional customer base with loyal repeat buyers

- Focus on traditional gold jewellery and wedding collections

- Expansion through organized showroom formats

- Emphasis on trust, purity assurance, and transparent pricing

Trident Jewels: Trident Jewels is an emerging organized jewellery retailer focused on scaling gold and diamond collections through regional showroom expansion.

Key Features:

- Growing presence in organized jewellery retail

- Balanced portfolio across gold and diamond categories

- Focus on bridal and occasion-led purchases

- Expansion-oriented business strategy

Key Takeaways

- Rapid Scale: Even recently incorporated companies are crossing ₹1,000 Cr+ revenue within a few years.

- Regional Strength: South India continues to dominate organized jewellery revenues.

- Formalization Trend: Structured private limited entities are driving organized retail growth.

- Consolidation Potential: Revenue concentration suggests room for expansion and potential IPO or PE interest.

- Wedding & Daily-Wear Demand: Strong cultural demand continues to fuel consistent top-line growth.

Conclusion

- India’s jewellery market remains culturally strong and investment-driven, with consistent demand from weddings and festivals.

- Organized retailers are steadily gaining ground over unorganized players, accelerating industry formalization and transparency.

- Newly incorporated companies are scaling rapidly, supported by strong brand positioning and showroom expansion.

- Regional leaders, especially from South and East India, continue to dominate organized jewellery revenues.

- With modern retail formats and omni-channel strategies, these front-runners are well-positioned to drive the next phase of growth in India’s $80B jewellery market.

Private Circle helps you identify jewellery market leaders through verified filings and disclosures. Turn structured financial data into actionable business intelligence.