Wakefit Innovations, founded in 2016 by Ankit Garg and Chaitanya Ramalingegowda, began as an online mattress brand and expanded into a full home-solutions company offering furniture, sleep products, and décor.

With five manufacturing units, a fast-growing omnichannel presence, and a strong brand recall, Wakefit has built one of India’s largest D2C home and sleep ecosystems.

The IPO marks a major milestone in the company’s transformation from a bootstrapped startup to a publicly listed consumer brand.

Journey to the IPO: Wakefit’s Growth Story

Key Milestones

- 2016–2018: Rapid online traction in mattresses through D2C distribution.

- 2018: Peak XV (Sequoia India) leads Series A; Wakefit begins scaling.

- 2020–2021: Verlinvest & SIG join as growth-stage investors; brand expands into home furniture.

- 2023: Investcorp leads ₹320 Cr Series D; retail stores and manufacturing capacity scale up.

- FY23–FY25: Revenues jump from ₹820 Cr → ₹1305 Cr; losses narrow sharply.

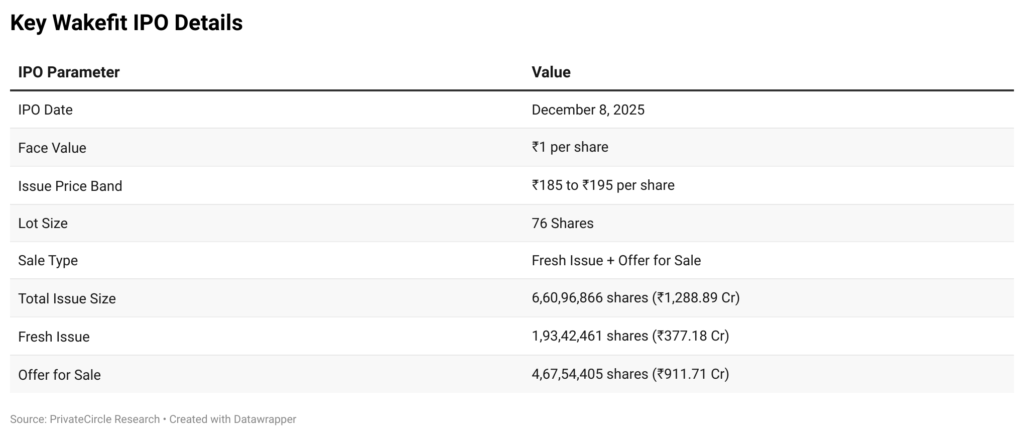

IPO Key Details

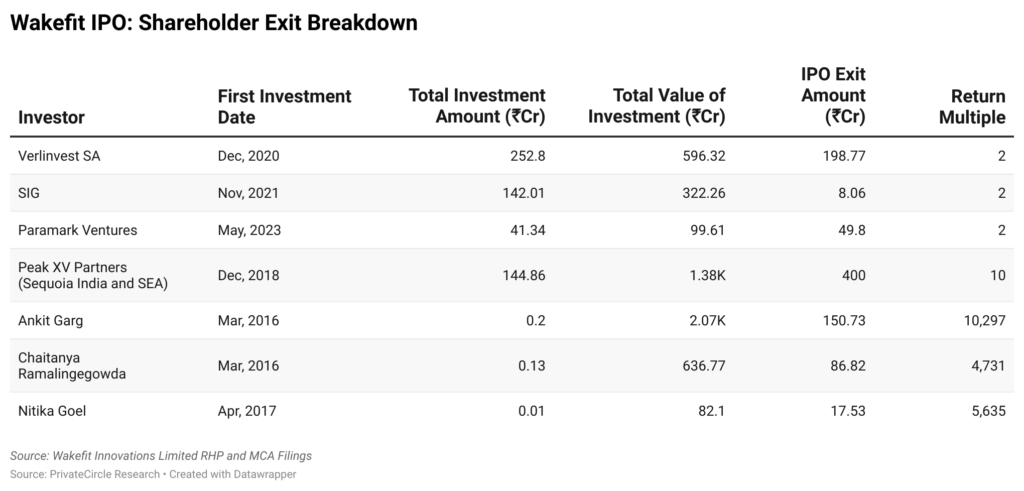

Who’s Cashing Out? Interactive OFS Shareholder Returns Table

Interactive Insights

- Founders’ Wealth Creation: Both co-founders turned minimal capital into life-changing wealth.

- VC Outcomes:

- Peak XV enjoys a 10x return.

- Growth-stage investors (Verlinvest, SIG, Paramark) clock 2× returns; reasonable for late-stage entries.

- Peak XV enjoys a 10x return.

- Employee Wealth Unlock: Early team member Nikita Goel earns a staggering 5,636× return.

- Notably, Investcorp & Elevation Capital are not selling, a strong bullish signal.

What the IPO Signals

- Maturity of Indian D2C Brands: Wakefit is among the first large-scale D2C consumer brands to hit public markets, setting a precedent.

- Profit Path Wins: Unlike some earlier tech IPOs, Wakefit shows a clear journey from growth to profitability.

- Valuation Discipline: A 5x revenue multiple suggests conservative pricing compared to private round highs.

- Founders Still Invested: With Ankit and Chaitanya retaining majority stakes, leadership remains aligned with future performance.

Conclusion: Wakefit’s IPO Is a Defining Moment for India’s D2C Story

Wakefit’s IPO highlights:

- The power of India’s digitally-enabled consumer brands

- The value of the patient’s long-term capital

- The shift toward sustainable, profitable growth

- Massive wealth creation for founders, team members, and investors

As Wakefit steps into the public markets, its next challenge is delivering consistent growth and profitability under greater scrutiny.

For investors, the IPO is more than a listing; it’s a signal that India’s D2C brands are entering their next phase of maturity, driven by omnichannel expansion, improving unit economics, and rising consumer demand.

🔎 For deeper IPO insights, investors, ESOPs, valuations, and financial history, track it all in minutes on PrivateCircle.