Industry Landscape & Positioning

Unico Housing Finance operates within India’s housing finance sector, a regulated industry under the Reserve Bank of India (RBI). The sector is expanding rapidly, driven by urbanisation, affordable housing demand, and supportive government schemes like Pradhan Mantri Awas Yojana (PMAY).

Unico positions itself as a specialist in affordable housing and property-backed loans, serving lower and middle-income households in urban and semi-urban markets. This niche is vital for India’s financial inclusion and housing growth agenda, giving Unico a long-term opportunity to scale in a growing sector.

Background

- Company Name: Unico Housing Finance Private Limited

- Incorporation Date: 11 Mar 2023

- Regulatory Status: Licensed Housing Finance Company (HFC) regulated by RBI

- Headquarters: Chennai, Tamil Nadu

- Management Team:

- Managing Director & Chief Executive Officer – Babu Vellingiri

- Chairman – N.Rangachary

- Chief Financial Officer – K. Arun

- Managing Director & Chief Executive Officer – Babu Vellingiri

Business Model & Products / Services

Unico follows a retail housing finance model, deploying equity and borrowings to disburse secured housing loans. Its strategy revolves around catering to borrowers underserved by traditional banks.

Key Offerings:

- Home loans for construction, purchase, and extension

- Loan Against Property (residential/commercial)

- Commercial property loans for purchase/resale

Target Segment: Lower and middle-income households, often first-time borrowers or self-employed without formal income proof.

Distribution: A Combination of physical branches, DSAs, and digital channels.

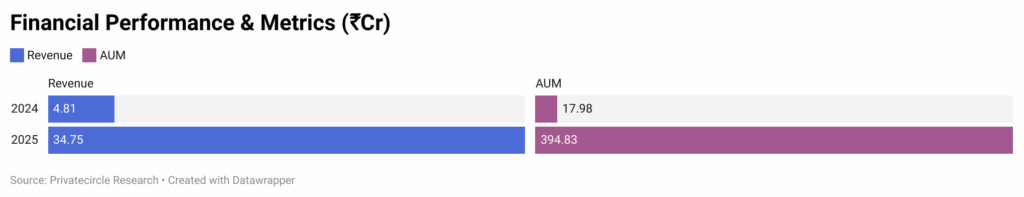

Financial Performance & Metrics (₹Cr)

- Revenue Growth:

- FY2024: ₹ 4.81 Cr

- FY2025: ₹ 34.75 Cr

- FY2024: ₹ 4.81 Cr

- Gross Assets Under Management (Gross AUM):

- As of 31 March 2024: ₹ 17.98 Cr

- As of 31 March 2025: ₹ 394.83 Cr

- As of 31 March 2024: ₹ 17.98 Cr

Key Insight: Unico’s financials demonstrate exponential momentum, with 7.2× YoY revenue growth reflecting strong business expansion and 22× YoY AUM growth highlighting aggressive loan book scaling.

Funding & Capital Structure

Unico’s funding journey reflects a steady build-up of equity and debt to support its growth:

- December 2023 (Equity & Debenture Funding): Raised ₹7.32 Cr in equity from multiple individual investors and ₹222.45 Cr through debentures, marking the company’s first major external funding inflow.

- March 2025 (Debt Funding): Mobilised ₹65 Cr through debt from Anicut Capital, AK Securitisation & Credit & Others, providing leverage for loan book expansion.

- September 2025 (Series A): Closed a large ₹120 Cr Series A round led by Anicut Capital and UC Impower, significantly enhancing its capital base and enabling aggressive scaling.

Key Insight: This flow of funds shows how Unico has progressively transitioned from initial equity and debenture support to large-scale institutional backing, combining both equity and debt to fuel its rapid loan book growth.

Conclusions

Unico Housing Finance has emerged as a high-growth player in India’s affordable housing finance sector, scaling both its revenues and AUM by several multiples in FY25. Its strong positioning in underserved customer segments aligns with India’s financial inclusion and affordable housing priorities.

The company’s progress is underpinned by fresh equity and debt infusions, as well as the support of credible institutional investors. However, as Unico continues to expand, its long-term success will depend on maintaining strict credit quality, diversifying funding sources, and embracing digital tools to drive operational efficiency.

Overall, Unico stands at an inflection point: with the right balance of growth discipline and risk management, it has the potential to establish itself as a credible, scalable housing finance institution in the coming years.

PrivateCircle helps you uncover deep private market intelligence — from funding to ownership — empowering smarter, faster investment and business decisions.

Get the edge with verified data trusted by top investors and corporates.