The India November 2025 Funding Report highlights that November 2025 was a powerful month for India’s private market momentum. Despite selective capital deployment across sectors, investors continued to back founders with strong fundamentals, clear profitability paths, and sectoral tailwinds. Renewable energy manufacturing, climate-tech, agritech, digital credit, and consumption-led sectors continued to dominate the investment landscape.

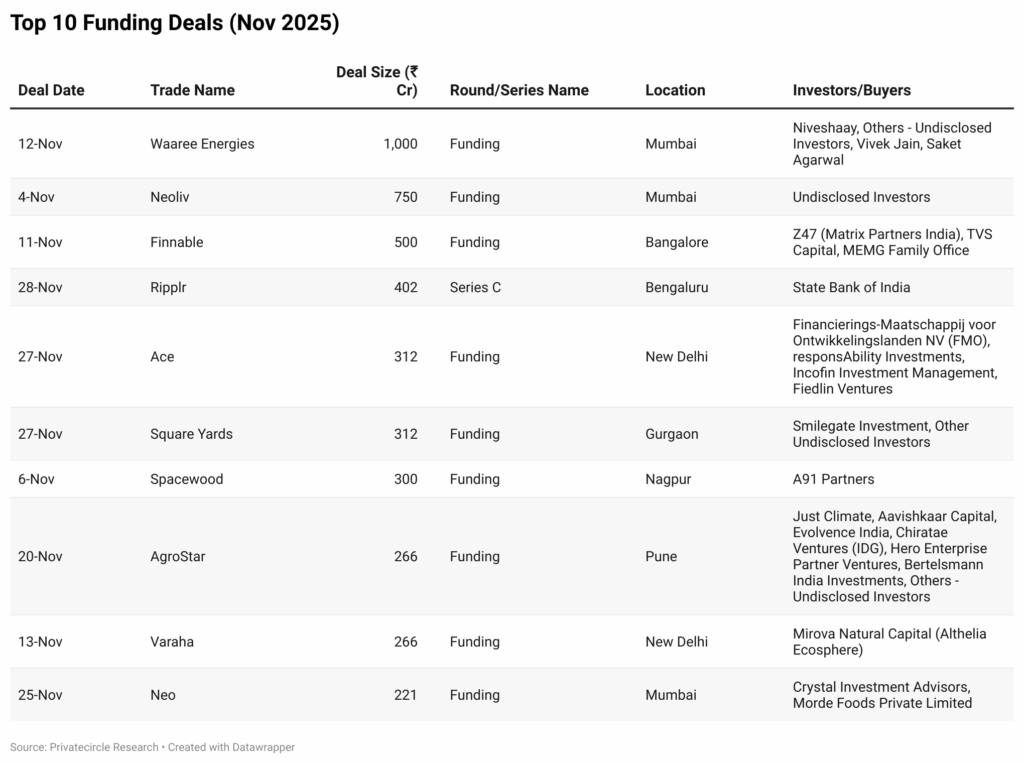

In total, ₹7,233 Cr was deployed across 86 deals in November. The Top 10 deals alone contributed a significant share, reflecting strong conviction from leading domestic and global investors.

This report breaks down the Top 10 largest funding transactions of November 2025, highlights key insights, and provides a crisp narrative on where the capital is flowing.

Key Insights from November’s Top Deals

1. Renewable & Climate-Tech Lead the Capital Flows

With Waaree Energies raising ₹1,000 Cr, climate-aligned investments remain a dominant theme.

Similarly, Varaha’s ₹266 Cr raise shows strong investor appetite for carbon markets, climate mitigation tech, and sustainable agri-value chains.

Investors betting big:

- Niveshaay

- Mirova Natural Capital

- FMO

- responsAbility

- Aavishkaar

- Just Climate

These names reinforce India’s positioning in global climate and sustainability narratives.

2. Digital Credit & Financial Services Continue to Scale

Finnable’s ₹500 Cr fundraise highlights the resilience of India’s lending and consumer credit ecosystem, backed by institutional investors such as Matrix Partners, TVS Capital, and MEMG Family Office.

A strong combination of digital underwriting, risk frameworks, and a growing salaried borrower segment is pushing digital credit deeper into Tier-2/3 India.

3. Consumption & Retail Enablement on Investors’ Radar

Ripplr’s Series C round of ₹402 Cr led by State Bank of India signals:

- Confidence in retail supply chain digitization

- Continued growth of FMCG distribution-tech

- Scaling opportunities across India’s vast kirana ecosystem

Square Yards’ funding further validates India’s proptech renaissance, driven by residential demand and global investor interest.

4. Agritech Continues to Attract Long-Term Capital

AgroStar’s ₹266 Cr raise showcases sustained investor belief in farm-to-market digital platforms.

With participation from Aavishkaar Capital, Chiratae, Hero Enterprise Ventures, Just Climate and Bertelsmann, the deal underscores agritech’s transition from high-burn to high-efficiency business models.

5. Furniture, Home Improvement & D2C Manufacturing Stay Relevant

Spacewood’s ₹300 Cr raise from A91 Partners reinforces stable demand in India’s home improvement and organized furniture manufacturing space.

With macro factors like urban housing growth and rising interior spend, the sector continues to mature.

Company-Wise (Top 10 Deals)

What This Means for India’s Private Markets

November’s funding activity reinforces four big themes:

1. Investors prefer regulatory-clear, operationally strong companies

The top deals came from businesses with strong compliance, capital discipline, and predictable cash flows.

2. Climate-tech is no longer niche; it’s mainstream

Four of the top 10 deals had climate, sustainability, or clean energy at their core.

3. Traditional sectors + tech = major investor confidence

Furniture, retail distribution, real estate, and agritech show strong momentum when digitized.

4. Mature founders are winning larger cheques

Later-stage rounds dominated, reflecting investors’ preference for proven unit economics.

Conclusion

Nov 2025 proved that India’s private market is on a strong upward trajectory. From clean energy and climate tech to digital lending and consumer ecosystems, investors are choosing sectors that combine scalability, sustainability, and strong financial discipline.

As we step into the final month of the year, the momentum across renewable energy, agritech, wealth-tech, retail enablement, and consumer credit is likely to shape early 2026 narratives as well.

This report is structured using verified company and funding insights to help founders, investors, and ecosystem stakeholders track India’s evolving private market landscape.

Stay plugged in to PrivateCircle and never miss a breakout company, investor move, or funding trend again.