The Organic Revolution: A “Soil-First” Approach

Organic farming is no longer just a niche trend; it is a fundamental shift in how the world consumes food. Leading this charge from Bhodani village, Maharashtra, is TBOF Foods Private Limited (widely known as Two Brothers Organic Farms).

Founded by siblings Ajinkya and Satyajit Hange, what began as a local farming venture in 2012 has blossomed into a globally respected brand. By marrying traditional Indian farming wisdom with modern D2C strategies, TBof is proving that ecological sustainability and financial scalability can coexist.

Company Profile: Rooted in Regeneration

TBof is not just selling food; they are selling a philosophy of “Soil-First” regenerative agriculture.

- Headquarters: Bhodani Village, Maharashtra

- Established: 2019 (Operational roots since 2012)

- Certifications: FSSAI, IAF, AQSR, USDA Organic, ECOCERT, and the US FDA

- Global Footprint: Serving customers in over 50 countries

- Core Portfolio: A2 Ghee (flagship), Cold-pressed oils, Jaggery, Ancient grains, and functional foods.

The Mission: To revive traditional farming methods, generate rural employment, and solve public health and climate challenges through chemical-free food production.

Financial Trajectory:

Annual Revenue Growth (INR Cr)

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 3.03 | 11.65 | 16.45 | 24.29 | 38.37 |

| Revenue Growth (In %) | – | 284.49% | 41.20% | 47.66% | 57.97% |

TBof Foods grew revenue from ₹3.03 Cr to ₹38.37 Cr over 4 years, demonstrating a 12x expansion. Its strong year-on-year growth highlights rising demand and effective scaling in the organic foods market.

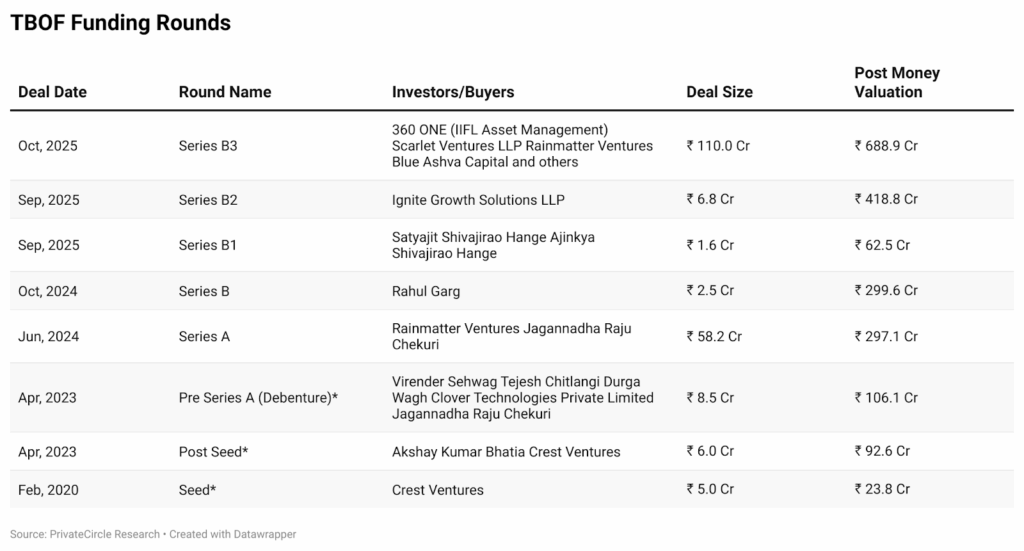

Investor Confidence & Funding

The market has validated TBof’s vision with significant capital injection. To date, the company has raised approximately ₹198.7 Cr (~$24 Mn), with a current valuation standing at ₹688.9 Cr ($78.4 Mn).

Key Investor:

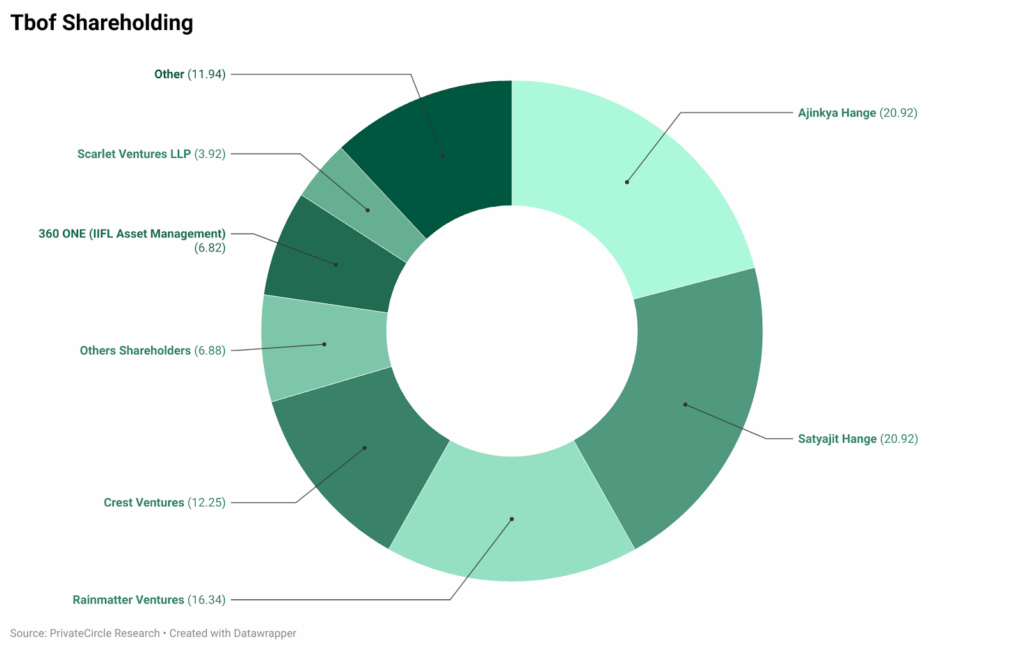

Key Insights: TBof Foods remains promoter-led with the Hange brothers holding 41.8%, ensuring strong founder control. Major institutional investors own a significant share, reflecting high market confidence, while the rest is distributed across strategic angels, creating a balanced and stable cap table.

The Verdict: Why it Matters

Two Brothers Organic Farms exemplifies Ethical Entrepreneurship.

In an era of hyper-processed foods, they are betting on the fact that consumers are willing to pay a premium for health, transparency, and environmental stewardship. By nurturing soil biodiversity and empowering the rural economy, TBof is setting the gold standard for what the future of Indian Agriculture looks like.

PrivateCircle gives you deeper, faster, and sharper intelligence on companies, capital flows, and markets, so you always stay a step ahead.