Top 5 Funding Deals (Jan 16 – Jan 22, 2026) Deals dominated India’s startup ecosystem this week, with major funding activity across mobility, finance, robotics, consumer brands, and space-tech. Between Jan 16 and Jan 22, 2026, investors backed high-growth companies solving real-world problems, showing that large deals are increasingly flowing into infrastructure-heavy and deep-tech sectors…

Read moreTag: Bengaluru

India Funding Deals Pulse (Jan 09–Jan 15, 2026): ₹2,611 Cr Across 28 Deals

India’s startup funding deals remained active in mid-January 2026, with investors backing a mix of wealth platforms, healthcare models, hygiene brands, and education-led scale plays. Between Jan 09 and Jan 15, 2026, India recorded ₹2,611 Cr across 28 deals. The week’s funding deals were clearly led by a few large rounds, showing that bigger cheques…

Read moreWho’s Leading India’s FemTech 2.0 Revolution in Women’s Wellness?

When we think of women’s health in India, fertility often dominates the conversation, and for a long time, that’s been understandable. But the emerging wave of FemTech 2.0 is radically expanding the narrative. Today’s women-led (or women-focused) startups aren’t just solving reproductive issues; they’re addressing the full spectrum of women’s wellness, from sustainable period care…

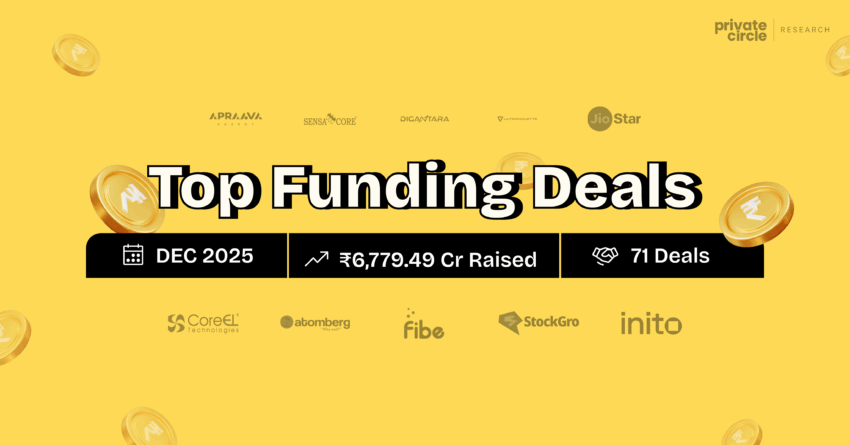

Read moreDecember 2025 Funding Roundup: India’s Biggest Startup Deals

India Startup Funding Snapshot – December 2025 India’s startup ecosystem closed December 2025 with ₹6,779.49 crore raised across 71 deals, reflecting steady investor confidence despite selective capital deployment. Funding activity was anchored by large, late-stage and strategic rounds across energy, healthcare devices, EVs, fintech, and deep-tech. While deal volumes stayed consistent, capital was clearly concentrated…

Read moreYour Switch to Plant Protein=Their Valuation Boost

India’s Plant Protein & Alternative Meat Innovators Where conscious eating meets next-gen food technology India’s plant-protein and alternative meat ecosystem is no longer niche, it’s a fast-scaling food-tech movement reshaping how the country eats. Driven by urban consumers, sustainability shifts, and the pursuit of healthier protein, these startups are building everything from tempeh and soy-based…

Read moreD2C Streetwear Brands Redefining Swag in India

India’s streetwear revolution has moved far beyond niche fashion circles. What began as a subculture inspired by hip-hop, sneaker communities, and indie creators has now become a mainstream movement. Today’s youth want drops instead of traditional collections, identity-led designs instead of generic fashion, and brands that speak their culture, not just sell clothing. This shift…

Read moreDecember Funding Watch: Top 5 Deals (Dec 12–18, 2025)

The Indian startup ecosystem continued to attract steady investor interest in the Third week of December 2025, despite year-end slowdown expectations. Between December 12 and December 18, startups raised a total of ₹1,462 Cr across 25 deals, reflecting sustained confidence in growth-stage companies. What stands out this week is the clear tilt toward Series B…

Read moreThe Funding Week That Broke the Pattern- November’s Final Stretch Turns Red-Hot

What a way to close the month.The final funding week of November didn’t just close the month, it rewrote the month’s leaderboard. With ₹1,911 Cr raised across 32 deals, this became the highest deal-count week of November 2025, proving once again that founders who keep building win, even when the market moves in slow motion….

Read moreWhere Is iD Fresh’s Revenue Really Coming From in FY25?

India’s fresh food category has transformed massively in the last decade, and iD Fresh Food has been one of the biggest forces behind this shift. From turning simple idli–dosa batter into a ₹681-crore+ business to expanding into parotas, dairy, beverages, and chapatis, the company has built a strong ready-to-cook ecosystem. But what does this ₹681…

Read moreFrom Village Roots to Global Shelves: The TBOF Growth Story

The Organic Revolution: A “Soil-First” Approach Organic farming is no longer just a niche trend; it is a fundamental shift in how the world consumes food. Leading this charge from Bhodani village, Maharashtra, is TBOF Foods Private Limited (widely known as Two Brothers Organic Farms). Founded by siblings Ajinkya and Satyajit Hange, what began as…

Read more