Company Snapshot

SuperOps Technologies Private Limited, better known as SuperOps.ai, is a Chennai-headquartered SaaS platform built for Managed Service Providers (MSPs) and IT teams. Founded in 2019 by Arvind Parthiban (ex-Zarget, acquired by Freshworks) and Jayakumar Karumbasalam, SuperOps is on a mission to replace the clutter of legacy tools with one unified, AI-first platform.

Its offering combines PSA (Professional Services Automation) and RMM (Remote Monitoring & Management), a space historically dominated by global incumbents like ConnectWise, Kaseya/Datto, and N-able.

Funding Timeline

| Date | Round Name | Deal Size (₹ Cr) | Key Investor |

| Jan 2025 | Series C | ₹216.6 Cr | March Capital, Addition, Z47 |

| Oct 2023 | Series B | ₹103.3 Cr | Addition, March Capital, Z47 |

| Jan 2022 | Series A | ₹105.3 Cr | Addition, Tanglin Venture Partners, Elevation Capital, Z47 |

| May 2021 | Seed | ₹22.1 Cr | Elevation Capital, Z47 |

Note: All rounds were raised at the Delaware-incorporated holding entity SuperOps Inc., which controls the Indian subsidiary.

Product Suite – Built AI-First

- Unified PSA + Service Desk: Smart ticket routing, AI summaries, SLA tracking, projects & billing.

- RMM & Endpoint Management: Proactive patching, monitoring, and remote troubleshooting.

- Documentation & Runbooks: In-built IT knowledge base with AI-powered workflows.

- Agentic AI Marketplace (2025, with AWS): Enables MSPs to deploy or monetize autonomous AI agents (e.g., ticket triage, onboarding, remediation).

This “all-in-one from day one” design helps MSPs cut reliance on up to eight separate legacy tools.

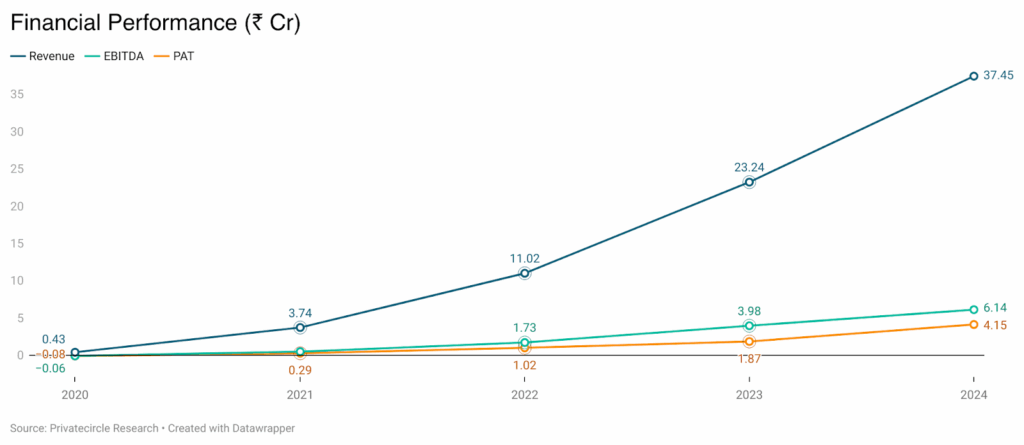

Financial Performance (₹ Cr)

Key Insights:

- Hyper growth: Revenue surged 87x in four years (FY20–FY24), clocking a CAGR of 205.5%.

- Profitability: EBITDA turned positive in FY21 and scaled to ₹6.1 Cr in FY24, with steady margins around 15–17%.

- Bottom-line strength: PAT has remained positive since FY21, reaching ₹4.15 Cr in FY24.

- Capital efficiency: Unlike many SaaS peers, SuperOps is growing fast and profitably, showing strong operating leverage.

Go-to-Market Strategy

- ICP: Small–mid-sized MSPs and internal IT teams.

- Global-first: Actively targeting the US and EMEA, where MSP tool adoption is mature.

- Differentiation: AI-first workflows, intuitive UI, faster deployment compared to older competitors.

- Ecosystem bet: AWS partnership for marketplace + global hackathons to crowdsource agent innovation.

Competitive Landscape

| Category | SuperOps (India-born SaaS) | Legacy Players (ConnectWise, Datto, N-able) | Modern Peers (NinjaOne, Atera, Syncro) |

| Design | Unified PSA-RMM, built from the ground up | Aggregated via multiple acquisitions, complex legacy stacks | Modular, lean, with component-based design |

| AI Focus | Deep AI integration service desk + AI marketplace | Modest AI capabilities mainly through updates & bolt-ons | Early-stage AI integration, growing (e.g., Atera’s AI Copilot) |

| Speed | Fast releases, modern UX, nimble platform | Slower due to architecture and integration complexity | Sleek UX, fast deployment, but narrower in scope |

| Market | Emerging, aiming for global reach | Established, deep MSP footprint across enterprise & mid-market segments | Growing challenger brands, favored by SMB MSPs for agility |

| Strength | Agile innovation + AI-first differentiation | Scale, legacy relationships, enterprise presence | Efficient tools with low switching friction |

Strengths & Risks

Strengths

- AI-first architecture (Monica AI, predictive intelligence).

- Strong revenue growth and improving profitability.

- AWS partnership & marketplace strategy for differentiation.

Risks

- Competing against entrenched global vendors with larger ecosystems.

- The success of the AI marketplace depends on developer adoption and MSP trust.

Conclusion

SuperOps stands at a decisive inflection point. In just a few years, it has transitioned from a promising SaaS entrant to a credible global challenger in the MSP ecosystem. The company’s trajectory, scaling revenue nearly 90x, achieving profitability, and launching bold bets like the Agentic AI Marketplace, signals both execution discipline and product vision.

What makes SuperOps compelling is not just its financial growth, but its ability to redefine the MSP toolkit with AI-first design, seamless integration, and a marketplace model that could reshape how IT services are delivered worldwide. Backed by strong institutional investors and anchored in a global-first mindset, SuperOps is positioned to move beyond being a “better alternative” and towards becoming a category-defining platform in enterprise IT.

👉 For PrivateCircle readers, SuperOps represents the new face of Indian SaaS companies that don’t just compete globally, but actively set the direction for their industries.