India’s economy has been one of the fastest growing in the world in recent years. This has been mainly due to rising urbanization, changing consumption patterns, a rising huge domestic market to cater to, and several other key contributing factors.

The younger population of India, making up two-thirds of the population has created a thriving market for snack products. The Indian snack and confectionery products consist of sweet and salty snacks such as Namkeen, potato chips, tortilla chips, and crackers, as well as bakery items like preserved biscuits, pastries, and cakes.

According to a November 2022 report by Godrej Yummiez, in association with InQognito Insights (a market research company);

- Consumers in India are now looking for STTEM factors – Safety, Technology, Taste, Ease, and Mood uplifters when considering and purchasing snacks.

- Factors such as ingredient quality, preparation process, storage, use of oil and preservatives, packaging, and delivery are being monitored closely.

- Consumers have developed their own methods to help assess and determine whether to accept or reject snacking items.

Highlights:

- The savory snacks market in India was worth $5.57 billion in 2020 and is expected to reach almost $13 billion by 2026.

- The industry is largely dominated by snack giants and scattered regional brands.

- Innovation has proven key in the Indian snack industry with the introduction of new flavors inspired by the diversified food culture of the country.

- The demand for ready-to-eat and on-the-go snacks has increased due to increasing per capita income, higher disposable incomes, and the fast-paced lifestyles that have coincided with the Work-From-Home conditions.

- Consumers now prefer products that are not only tasty and convenient to procure, but also nutritious.

- Growing FDI and collaborations in the industry further accelerate the growth of the Indian snacking and confectionary industry.

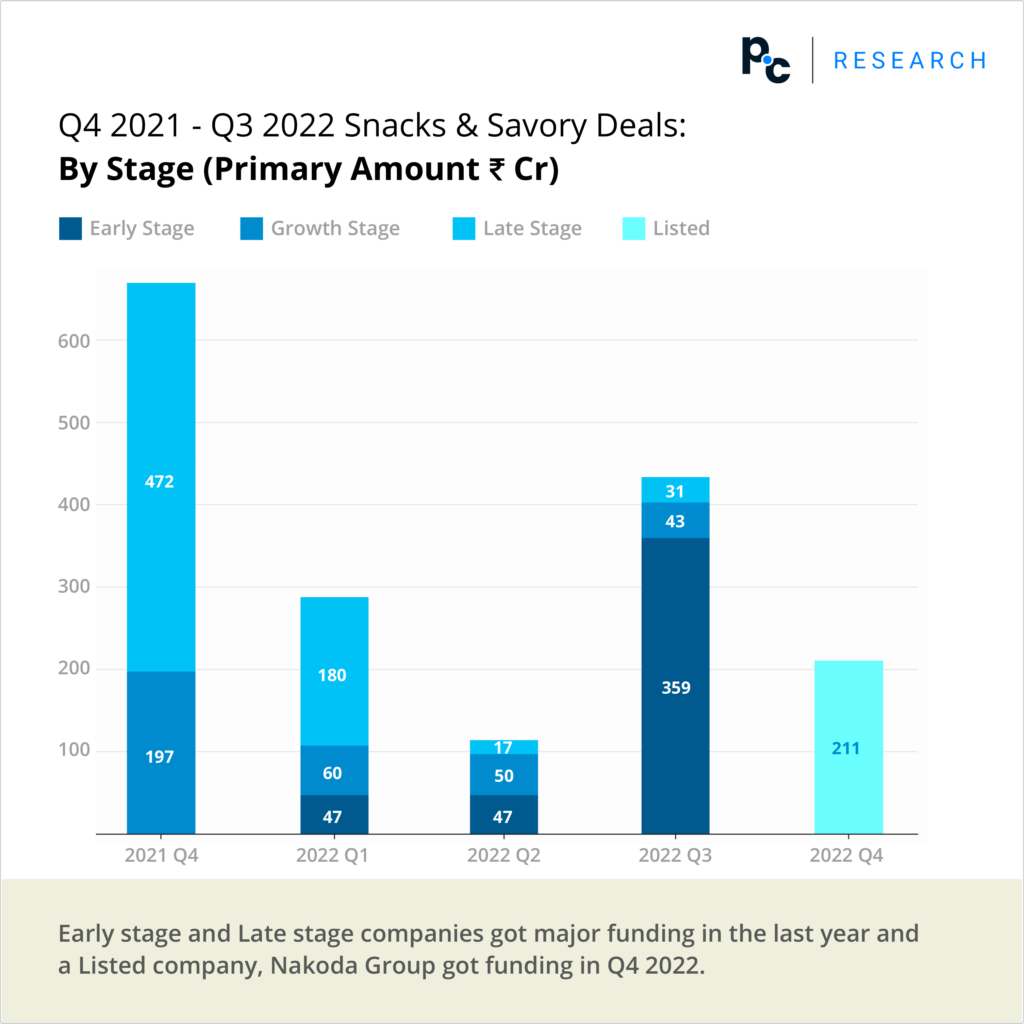

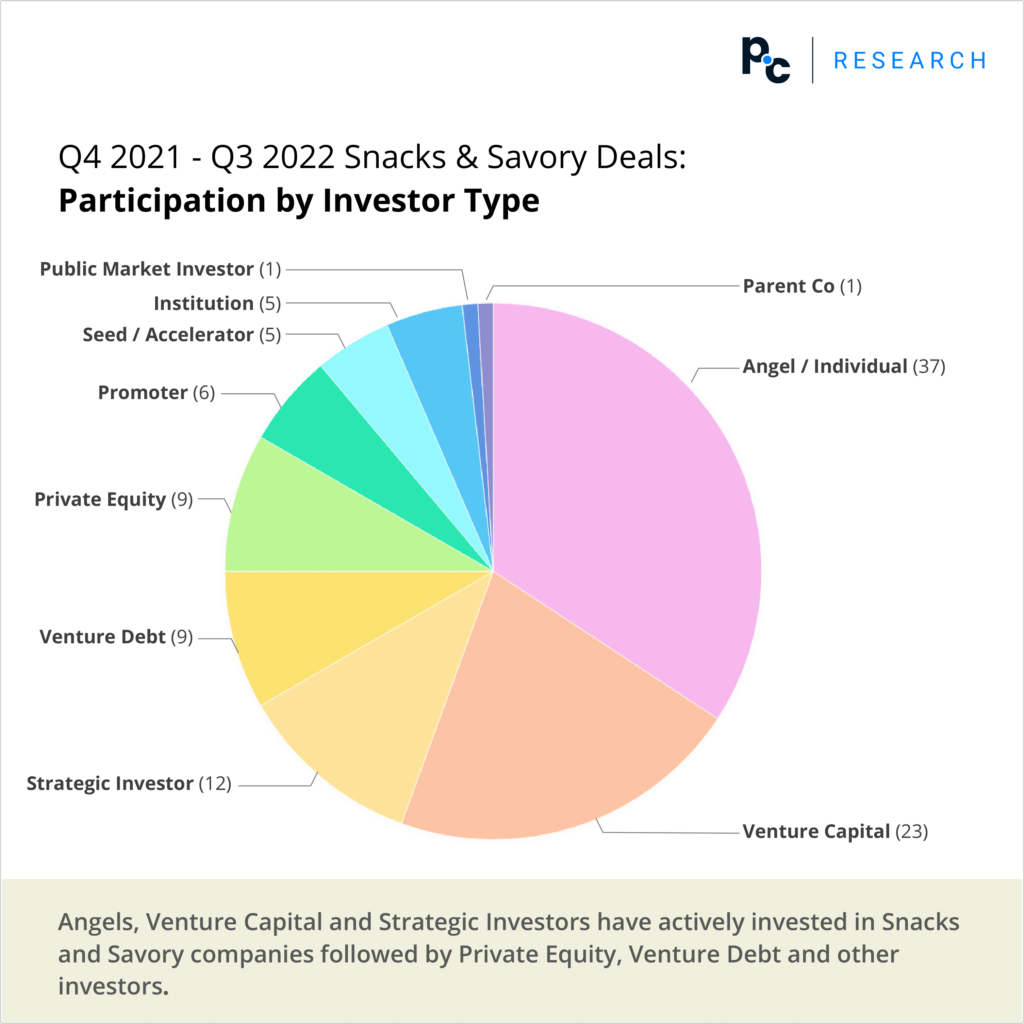

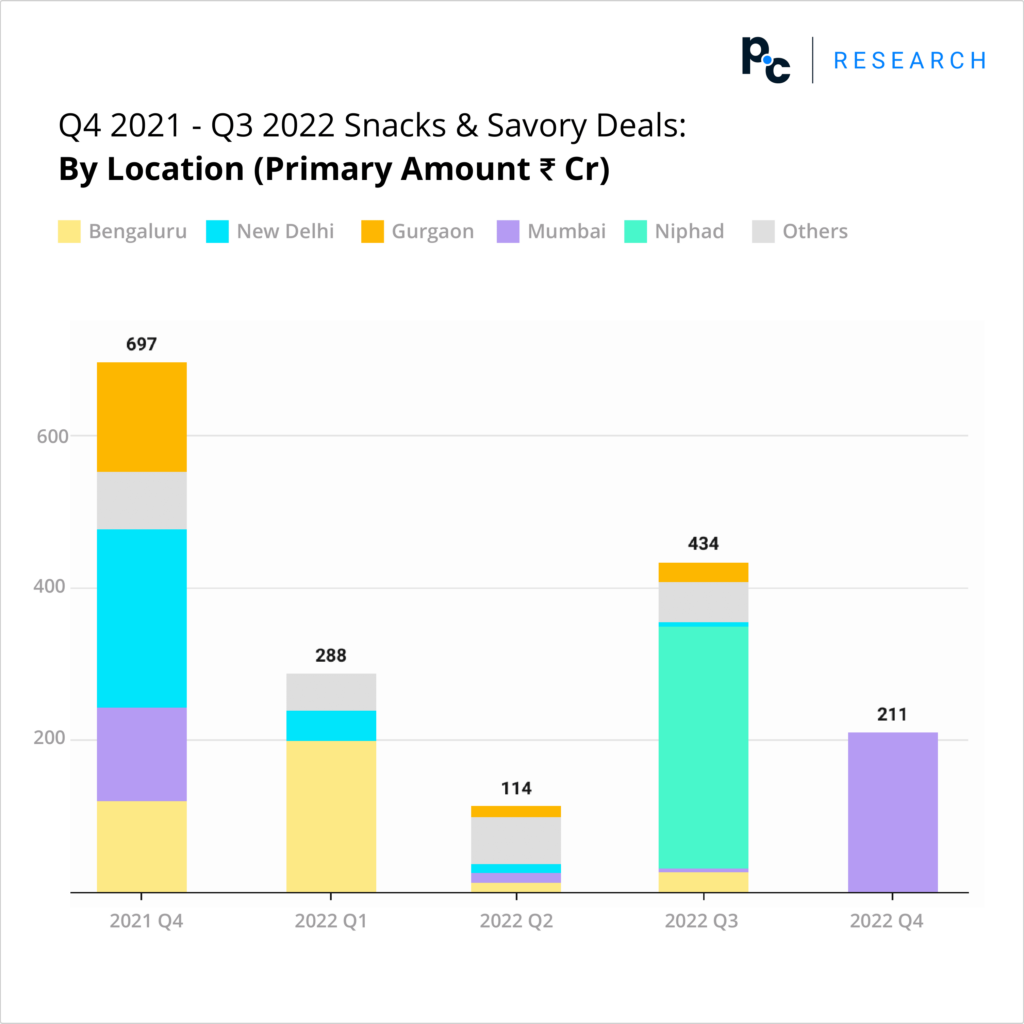

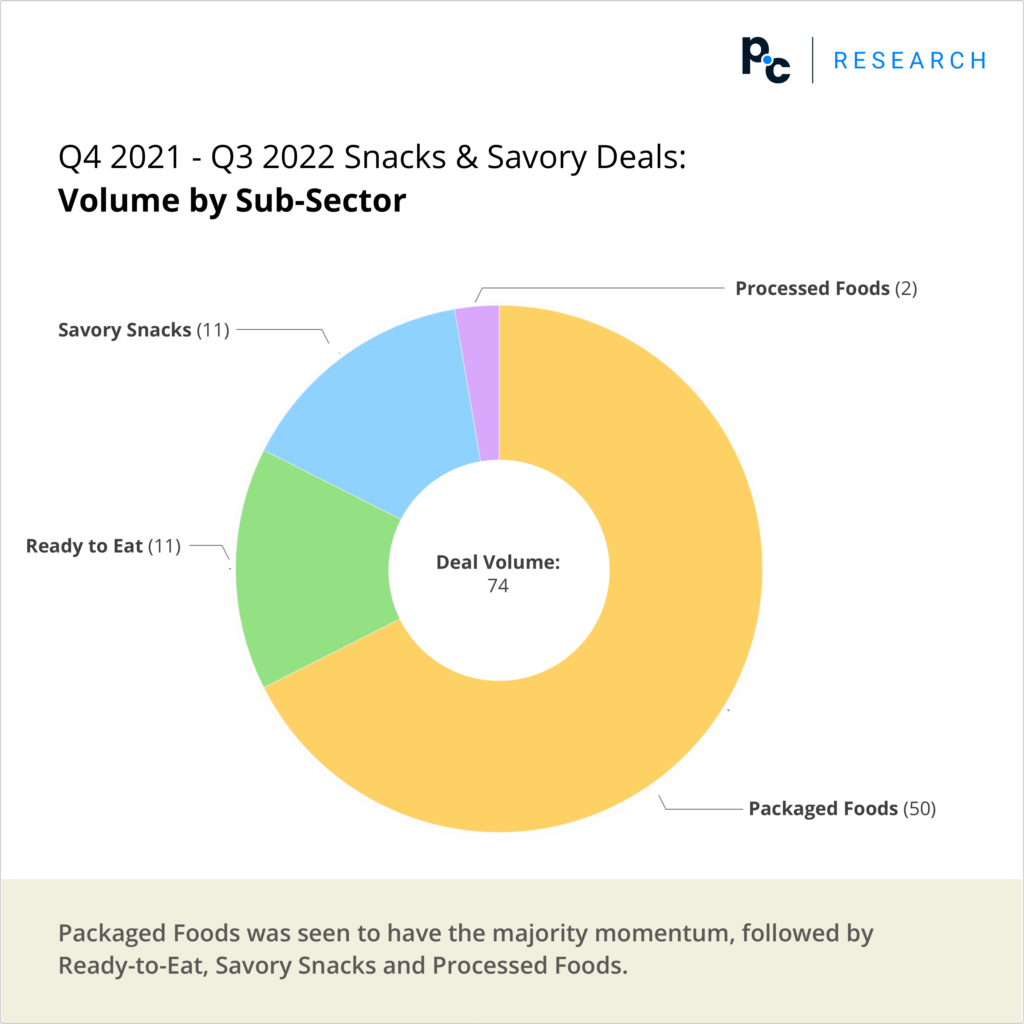

In this blog, we will explore the period from Q4 2021 to Q3 2022 to look at snacks & savory deals that went through in the country.

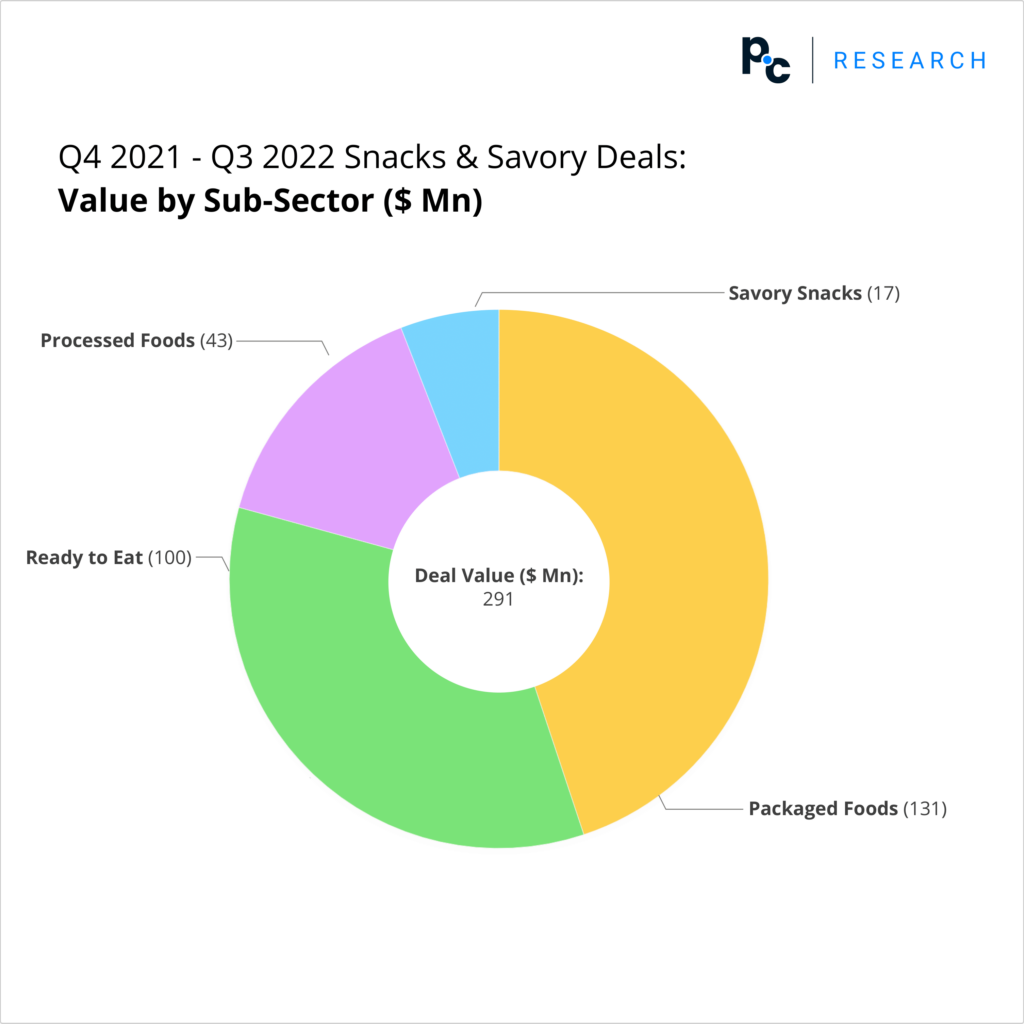

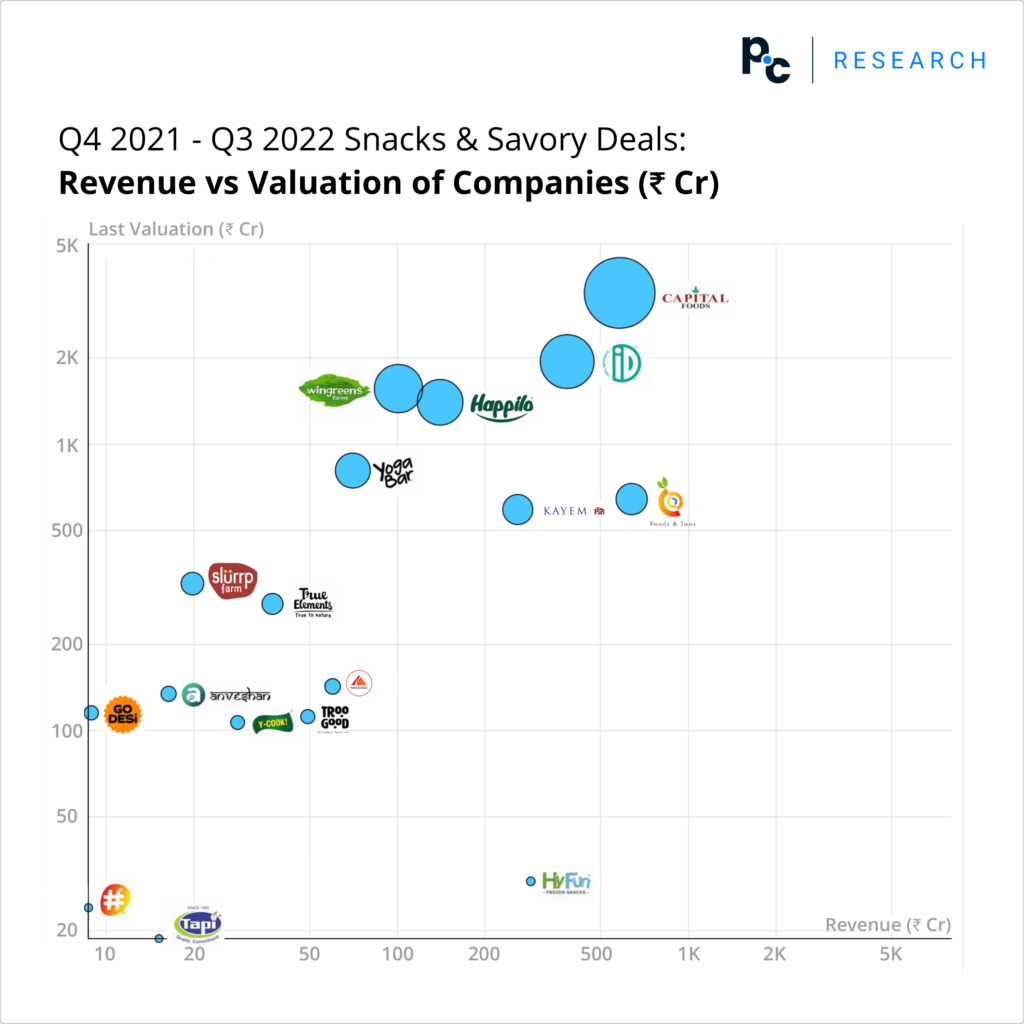

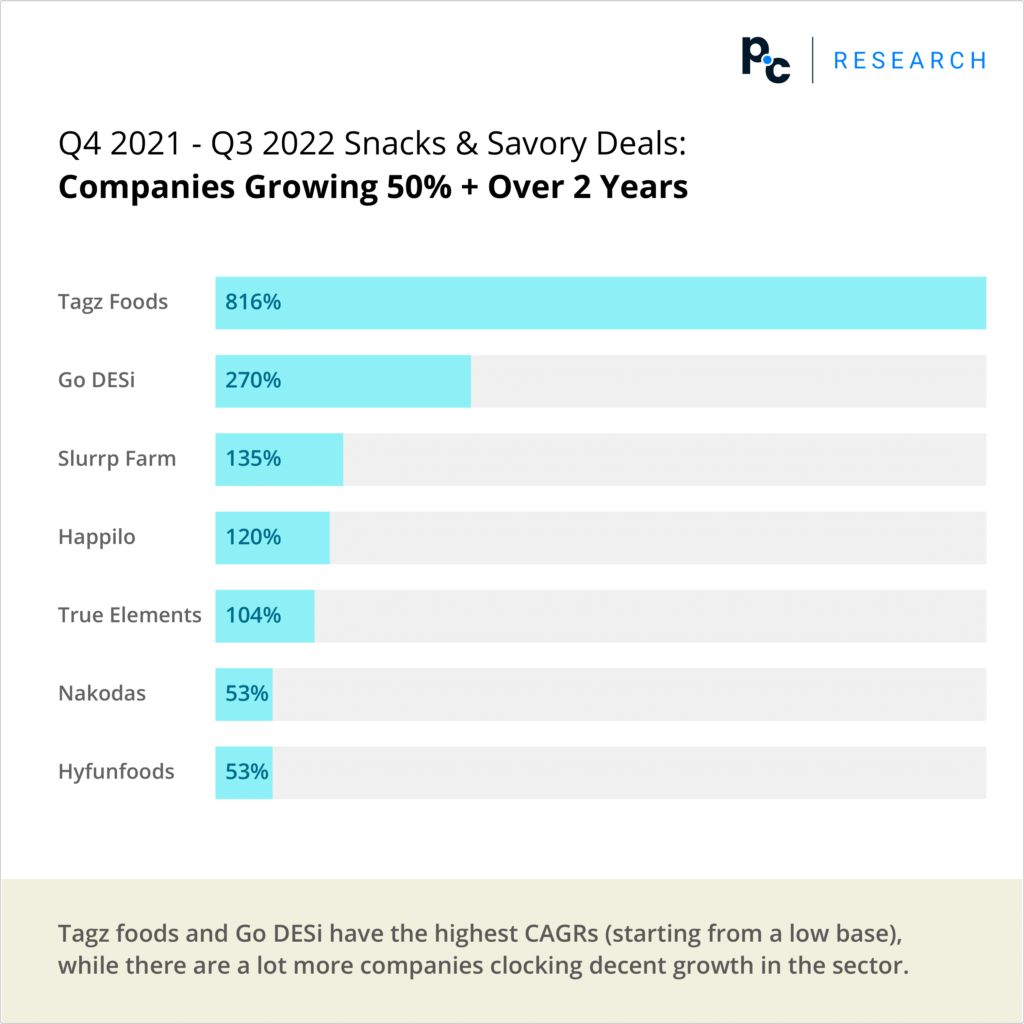

Measured criteria are company stages, participation by types of investors, deals in different locations, the volume of deals by sub-sector, the value of the deals by sub-sector, revenue vs valuation of the companies, and company growth in two years.

- Bengaluru – 2021 Q4 121 / 2022 Q1 199 / 2022 Q2 13 / 2022 Q3 26 / 2022 Q4 0

- New Delhi – 2021 Q4 234 / 2022 Q1 39 / 2022 Q2 12 / 2022 Q3 5 / 2022 Q4 0

- Gurgaon – 2021 Q4 145 / 2022 Q1 0 / 2022 Q2 14 / 2022 Q3 26 / 2022 Q4 0

- Mumbai – 2021 Q4 123 / 2022 Q1 1 / 2022 Q2 13 / 2022 Q3 5 / 2022 Q4 211

- Niphad – 2021 Q4 0 / 2022 Q1 0 / 2022 Q2 0 / 2022 Q3 318 / 2022 Q4 0

- Others – 2021 Q4 75 / 2022 Q1 49 / 2022 Q2 62 / 2022 Q3 53 / 2022 Q4 0

According to a survey conducted in November 2021 in India, 32% of consumers were of the opinion that purchasing the highest quality products was a crucial factor for shopping groceries. Likewise, 31% of respondents considered a balance between good price and quality as an essential factor while grocery shopping.

Deeper highlights across the STTEM factors:

SAFETY – Hygienic Preparation and Use of Preservatives

- 62% Indians limit their snacking consumption under the belief that there are preservatives present

- 51% Indians feel less guilty to consume preservative-free frozen snacks

- 55% parents feel guilty as they feel frozen snacks contain preservatives

- 52% women will consume more frozen snacks if they are preservative-free

- 52% Indians prefer frozen snacks as they feel it is more hygienic

TECHNOLOGY – Individual Quick Freezing (IQF) Technology

- 53% Indians could recall they have heard of IQF technology (Delhi and Kolkata ranked amongst the top two cities)

- 17% could further manage to explain what IQF stands for

- 60% women recalled IQF technology better as compared to 46% men

TASTE – India’s Preference for Potato/Vegetarian Frozen Snacks

- 73% Indians feel taste is the biggest reason for snacking

- 62% Indians feel potato-based snacks is an omnipresent part of their snacking platter

- 65% Indians prefer vegetarian frozen snacks (North India being the leading region)

- 65% Indians prefer potato-based snacks (potato bites, samosa, cheese bites, etc)

- 41% consume vegetarian frozen snacks daily

- 39% East and 38% South India prefer non-vegetarian frozen snacks

- 61% prefer Indian snacks over other options

- 43% parents believe children like frozen snacks

EASE – Convenience of Access, Storage, and Preparation

- 51% believe that frozen snacks are easily available and hence make it easier for consumption

- 50% Indians believe frozen snacks are convenient to cook

- 44% Indians believe that frozen snacks is easier to prepare by households without house help

- 55% Indians prefer frozen snacks on special occasions (parties, weekends, etc)

- 83% mothers feel frozen snacks are quick-fix hunger solutions for kids

- 65% Indians confessed to indulging in anytime snacking

- 76% women snack more often than men

- 54% working women find snacking convenient for hunger management

- 52% fathers cook frozen snacks more than mothers

MOOD UPLIFTER – Correlation of Emotions to Snacking

- 55% Indians binge on frozen foods as a mood uplifter on various occasions

- 72% Indians confessed to snacking when they are happy

- 74% women snack when they are happy

- 70% men snack when they are happy

- 60% women snack when they are sad

- 52% men snack when they are sad

Click here to discover further information regarding India’s FoodTech Industry in 2023.

Report data & research by Pratheek Kumar & Sharath B Shetty Design by Shradha Naik SEO by Anshi Agarwal Article curation by Ananth Monnappa

References

2022 report by Godrej Yummiez in association with InQognito Insights