October closed on a strong note for India’s private markets, with investors doubling down on themes such as renewable manufacturing, digital credit infrastructure, enterprise automation, and electric mobility. Despite a selective funding environment, founders who demonstrate regulatory readiness, operational discipline, and scalable unit economics continued to draw meaningful capital.

This month, late-stage rounds dominated headlines, especially as global LPs, pension funds, and strategic family offices returned to writing conviction-led cheques. Quick commerce, solar modules, and embedded credit emerged as the clear winners, supported by policy tailwinds and evolving consumer behavior.

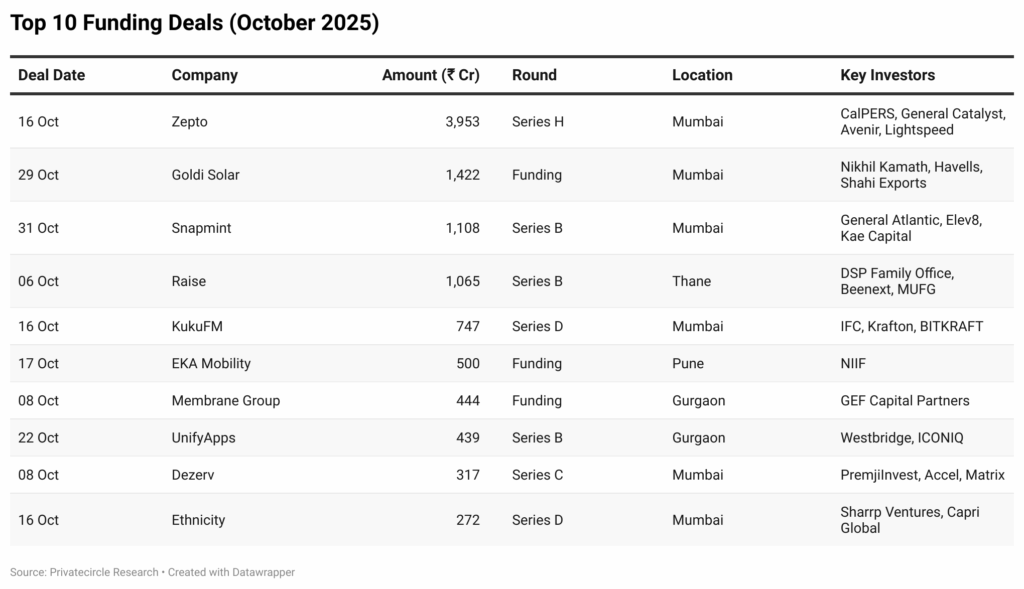

Below is a closer look at the top 10 funding deals that shaped October’s capital narrative.

Top 10 Funding Deals (October 2025)

Here’s a snapshot of the ten largest funding transactions that shaped India’s private market activity in October 2025. These deals highlight where investor conviction is flowing, from renewable energy and quick commerce to fintech, enterprise automation, and EV manufacturing.

Key Highlights: Top 10 Funded Companies

1️⃣ Zepto (₹3,953.25 Cr, Series H)

- One of India’s fastest-growing quick commerce platforms delivering essentials in under 10 minutes.

- Capital focused on store-level profitability, dark store expansion, and private-label scaling.

- Funding led by global institutional giants like CalPERS and Avenir, signaling deep conviction.

- Now aggressively closing the gap with Blinkit while improving margins.

2️⃣ Goldi Solar (₹1,422 Cr, Funding)

- Among India’s largest solar module manufacturers, riding the renewable infrastructure wave.

- Funding arrives at a critical inflection point for domestic demand and export ambitions.

- Backed by marquee investors like Nikhil Kamath and Havells, indicating strategic industry alignment.

- Supports India’s “solar manufacturing self-reliance” agenda under PLI schemes.

3️⃣ Snapmint (₹1,108 Cr, Series B)

- Consumer BNPL and embedded credit provider targeted at mid-income shoppers.

- Strong merchant partnerships across electronics, lifestyle, and e-commerce.

- Funding strengthens compliance, credit analytics, and the supply of lending capital.

- Investors believe in rising digital consumer credit penetration across Tier-2/3 regions.

4️⃣ Raise (₹1,065.12 Cr, Series B)

- Wealthtech infrastructure platform enabling goal-based investing and advisory layers.

- Strong traction among millennial investors building long-term portfolios.

- Backed by DSP Family Office, MUFG Capital, and Hornbill, signalling institutional trust.

- Capital likely deployed to scale advisory tech and deepen distribution channels.

5️⃣ KukuFM (₹746.73 Cr, Series D)

- India’s leading vernacular audio content platform, monetizing podcasts, audio stories, and learning content.

- Strong grasp of regional user cohorts across Hindi, Marathi, Tamil, and Bangla.

- IFC, Krafton, and BITKRAFT backing indicates confidence in India’s “audio-first” monetization model.

- Funds to expand the creator ecosystem and global diaspora reach.

6️⃣ EKA Mobility (₹500 Cr, Funding)

- EV manufacturer specializing in electric buses and commercial fleets.

- NIIF investment shows national-level support for fleet electrification.

- Focus on reducing the total cost of operation (TCO), a critical logistics advantage.

- Positioned well as the government pushes clean public transportation.

7️⃣ Membrane Group India (₹444 Cr, Funding)

- Industrial water treatment and filtration solutions enabling cleaner manufacturing ecosystems.

- GEF Capital’s backing aligns with sustainability-linked projects and green compliance.

- Growth driven by stricter industry discharge regulations and ESG priority shifts.

- Expansion likely into industrial clusters and municipal contracts.

8️⃣ UnifyApps (₹439.30 Cr, Series B)

- Enterprise automation platform integrating workflows across SaaS tools and legacy stacks.

- ICONIQ and Westbridge funding signals belief in AI-driven orchestration.

- Helps global teams eliminate manual ops with integrated connectors and automation scripts.

- Positioned well as companies cut costs through automation over headcount.

9️⃣ Dezerv (₹316.79 Cr, Series C)

- Wealth management and portfolio advisory platform for India’s affluent & mass-affluent segment.

- High adoption due to curated portfolios, tax optimization, and transparent fee models.

- PremjiInvest and Accel signal belief in India’s growing personal wealth base.

- Capital is expected to accelerate AIFs, PMS, and high-yield debt products.

🔟 Ethnicity (₹272 Cr, Series D)

- Omnichannel ethnic fashion retailer with strong offline + online integration.

- Leveraging regional fashion signals + premium apparel positioning.

- Backed by Sharrp Ventures and Capri Global, indicating confidence in discretionary spending returning.

- Funds will support store expansion, inventory optimization, and D2C channels.

What These Deals Tell Us About the Market

Across these deals, investors are gravitating toward:

✅ Climate + manufacturing self-sufficiency

✅ Regulated, risk-aware fintech

✅ Commercial fleet electrification

✅ Workflow automation replacing manual ops

✅ Vernacular content monetization

✅ Digital wealth platforms winning investor trust

Capital is now chasing:

- Profitability,

- sustainability,

- compliance readiness,

- enterprise efficiency.

Early-Stage View: Quality Over Quantity

Institutional seed deployment remains cautious.

Founders gaining traction typically show:

✅ GTM repeatability

✅ Compliance readiness

✅ Capital efficiency

✅ Regional scalability

This signals a shift toward sustainability, not vanity metrics.

Macro Takeaways: October 2025 at a Glance

- Family offices remain among the most aggressive allocators

- Manufacturing & industrial tech are gaining ground

- Public institutions (like pension funds) are deploying into India

- Late-stage consolidation is accelerating

- Operating leverage matters more than GMV

India continues to evolve from growth at all costs to growth with discipline.

Powered by PrivateCircle Insights

This monthly analysis is derived from verified filings, valuations, and deal data via PrivateCircle’s intelligence engine, helping founders, investors, and analysts stay ahead of market signals before they hit mainstream news.