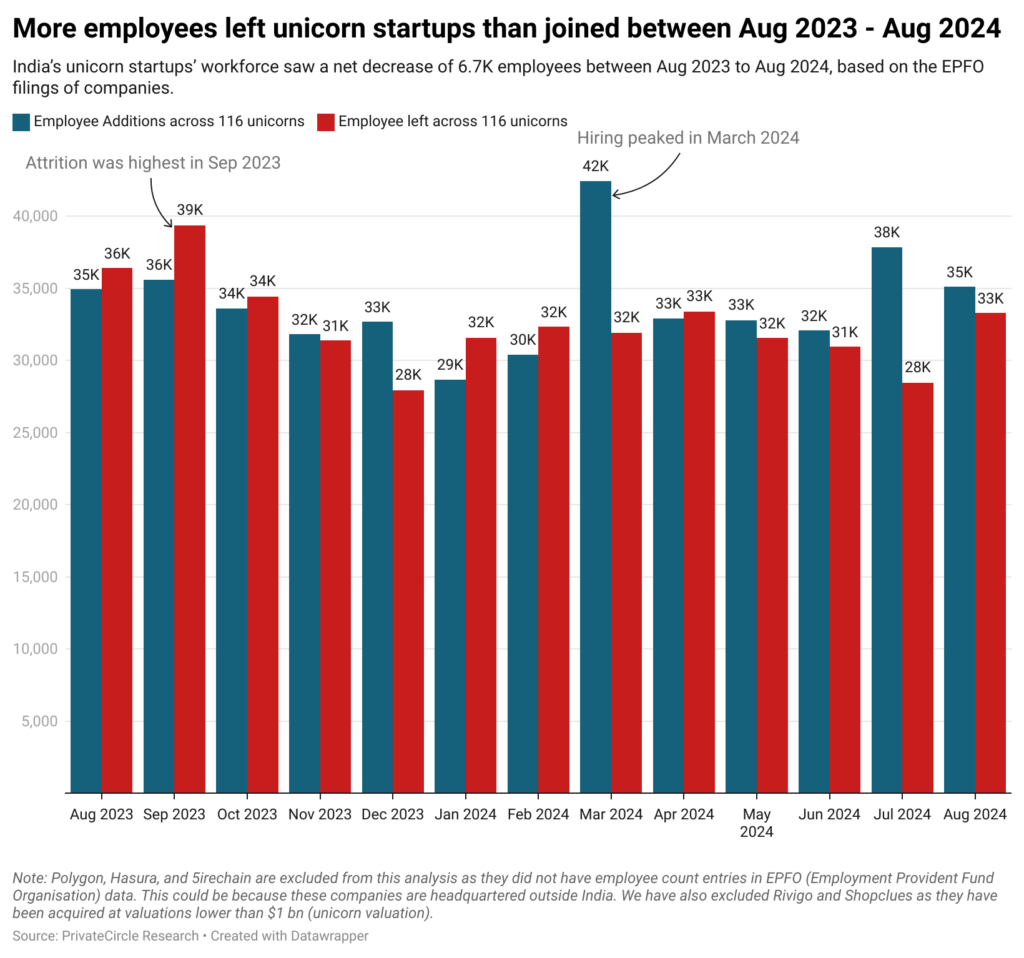

Unicorn startups are huge employers in the country. In August 2024, India’s 116 unicorns collectively employed 4,10,829 people, a drop from 4,17,561 just a year earlier. While these numbers might seem like small ripples in a vast ocean, they reflect larger trends around hiring efficiency, attrition, and regional workforce dynamics. According to an analysis by PrivateCircle Research, Indian unicorns saw a net workforce dip of 6,732 employees in this period.

Let’s dig into the details.

PrivateCircle considered Aug 2023 to Aug 2024 time period for this analysis, in continuation to our last report which analysed the numbers till July 2023. Please note that our analysis only includes employees for whom PF (provident fund) contributions were done.

The number of unicorns considered in this analysis are 116 including the newer additions like Moneyview, Ather and Rapido among others. Polygon, Hasura, and 5irechain are excluded from this analysis as they did not have employee count entries in EPFO (Employment Provident Fund Organisation) data. This could be because these companies are headquartered outside India. We have also excluded Rivigo and Shopclues as they have been acquired at valuations lower than $1 bn (unicorn valuation).

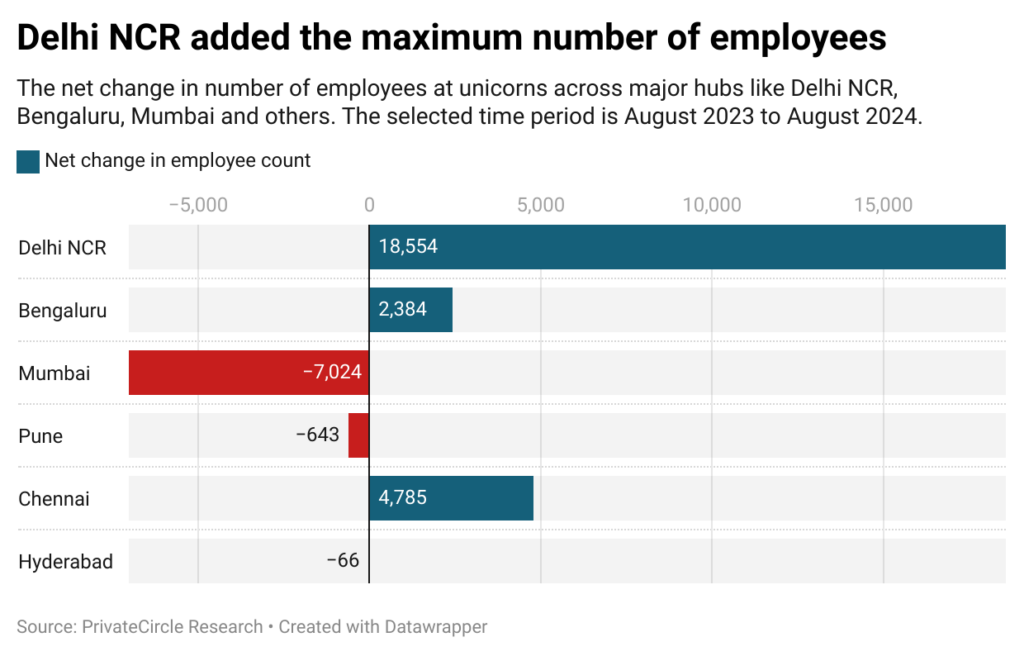

Delhi NCR Leads the Hiring Parade

If unicorn hiring were a competition, Delhi NCR would be proudly waving the winner’s trophy. Startups from this region, including heavyweights like PolicyBazaar, Blinkit, and Zomato, led the charge in workforce expansion between August 2023 and August 2024.

The Chennai unicorns weren’t far behind, proving that southern hospitality extends to hiring as well. Even Bengaluru, India’s undisputed startup capital, saw steady additions to its workforce. But here’s the twist: Mumbai, the city of dreams, saw a net decrease of 7,024 employees. It’s almost as if Mumbai unicorns collectively decided to hit the brakes.

Cities like Pune and Hyderabad also witnessed workforce reductions, suggesting that not all startup hubs are on a hiring spree.

Attrition: The Unicorn Achilles Heel

The average attrition rate across Indian unicorns stood at 4.5%, but some companies managed to buck the trend.

Take Zerodha, Zoho, and MapMyIndia, for instance. These companies achieved an attrition rate of 1% or lower, practically unheard of in the high-pressure startup world. That’s like having a fridge full of ice cream in the summer and not losing a single scoop.

Other honorable mentions with attrition rates below 2% include Ather Energy, Dream Sports, Druva, and Uniphore. What’s their secret? Maybe it’s the free snacks, maybe it’s stellar leadership, or maybe they’ve figured out how to keep the office coffee machine working 24/7.

March Madness and September Blues

Hiring peaked in March 2024, when unicorns collectively added over 42,000 employees in a single month. Companies like Paytm, BigBasket, and PB Fintech were in full swing, seemingly preparing for a season of rapid growth.

But just six months earlier, in September 2023, unicorns attrition was at the lowest, with 39,000 employees leaving in a single month. Whether it was layoffs, voluntary exits, or the aftershocks of startup burnout, the exodus was hard to ignore. It’s safe to say that for unicorn HR teams, September wasn’t exactly a month to remember.

Efficiency Over Expansion

Interestingly, PrivateCircle’s analysis shows that despite these workforce fluctuations, most unicorns managed to maintain stable employee numbers while achieving double-digit revenue growth over two years period. This suggests a shift in focus: less about hiring in droves and more about maximizing productivity with existing teams.

In other words, unicorns are growing up. They’re learning to work smarter, not harder – trimming the fat without cutting into the core.

What This Means for the Startup Ecosystem

So, what’s the big takeaway here? For one, unicorns are no longer just about explosive growth. They’re becoming more strategic, focusing on sustainable scaling rather than relentless expansion. The workforce numbers tell a story of adaptation, efficiency, and perhaps a little soul-searching.

But it’s also a reminder that startups, no matter how shiny, aren’t immune to broader economic trends or internal challenges. Employees are rethinking their priorities, and companies are being forced to do the same.

A Quick Look Ahead

As we head into 2025, all eyes will be on whether Indian unicorns can continue this balancing act. Will they bounce back with aggressive hiring sprees, or will they double down on efficiency? Either way, one thing’s clear: the startup ecosystem is as dynamic as ever, and there’s never a dull moment when it comes to unicorns.

About PrivateCircle Research:

PrivateCircle is your go-to platform for private market intelligence, tracking over 3 million companies, 4,800 VC/PE funds, and much more. Whether you’re an investor, founder, or just a curious soul, PrivateCircle’s data insights help you stay ahead of the curve.