Embark on a journey into the heart of financial markets with our debut Monthly Funding Summary Report for October 2023. As a leading private markets data and intelligence company, we are thrilled to present an insider’s perspective on the ebbs and flows of the investment landscape.

In this inaugural report, we unveil a wealth of insights, unveiling the latest trends, groundbreaking deals, and the strategic moves that have shaped the financial narrative throughout October.

As staunch advocates of data-driven decision-making, we bring you reliable numbers that decipher the complex dance of capital in the private markets.

This report sheds light on deal volumes, funding values, top deals, and prominent investors in the Indian startup landscape. Let’s dive into the data and explore the dynamics of India’s thriving entrepreneurial ecosystem.

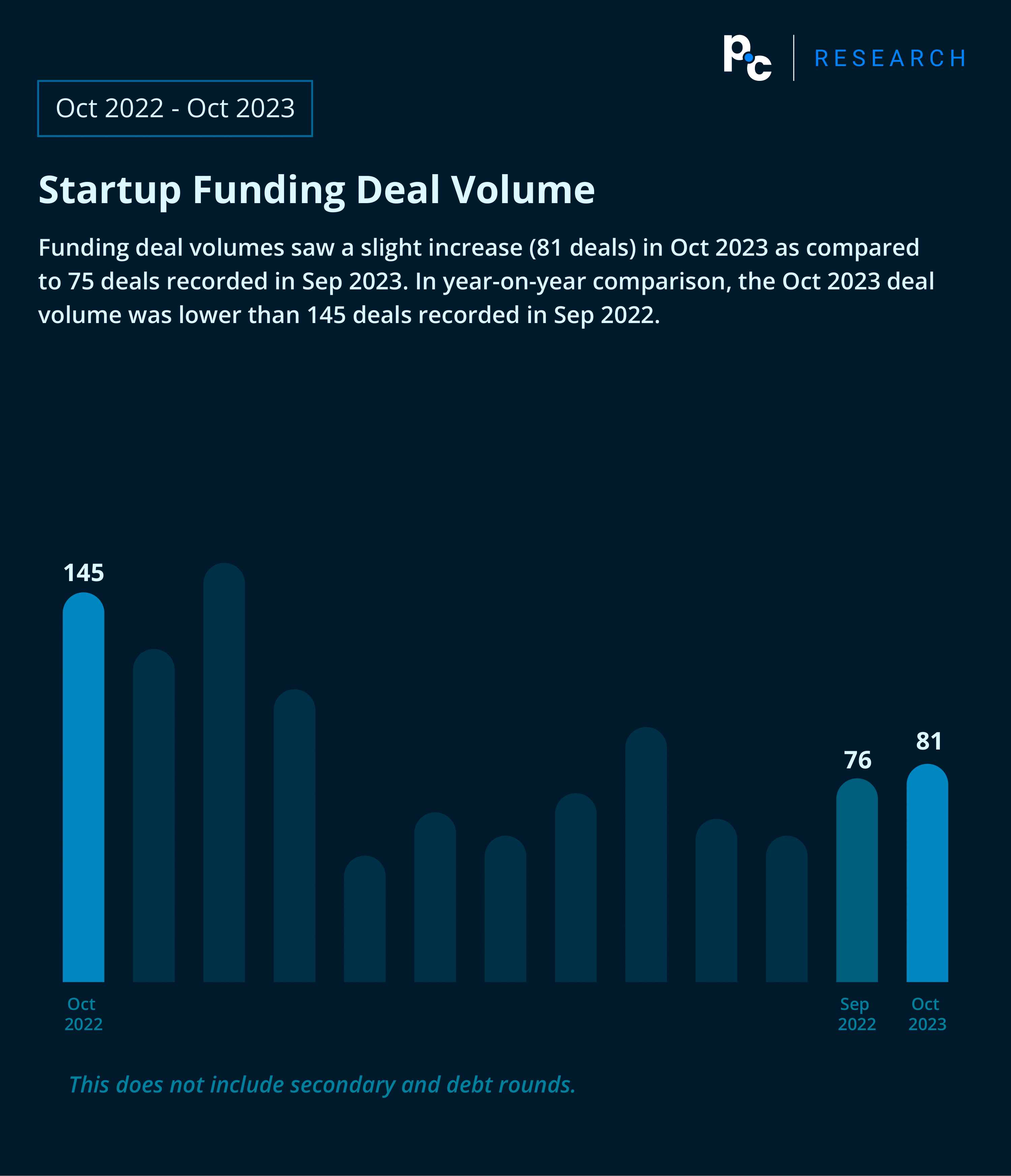

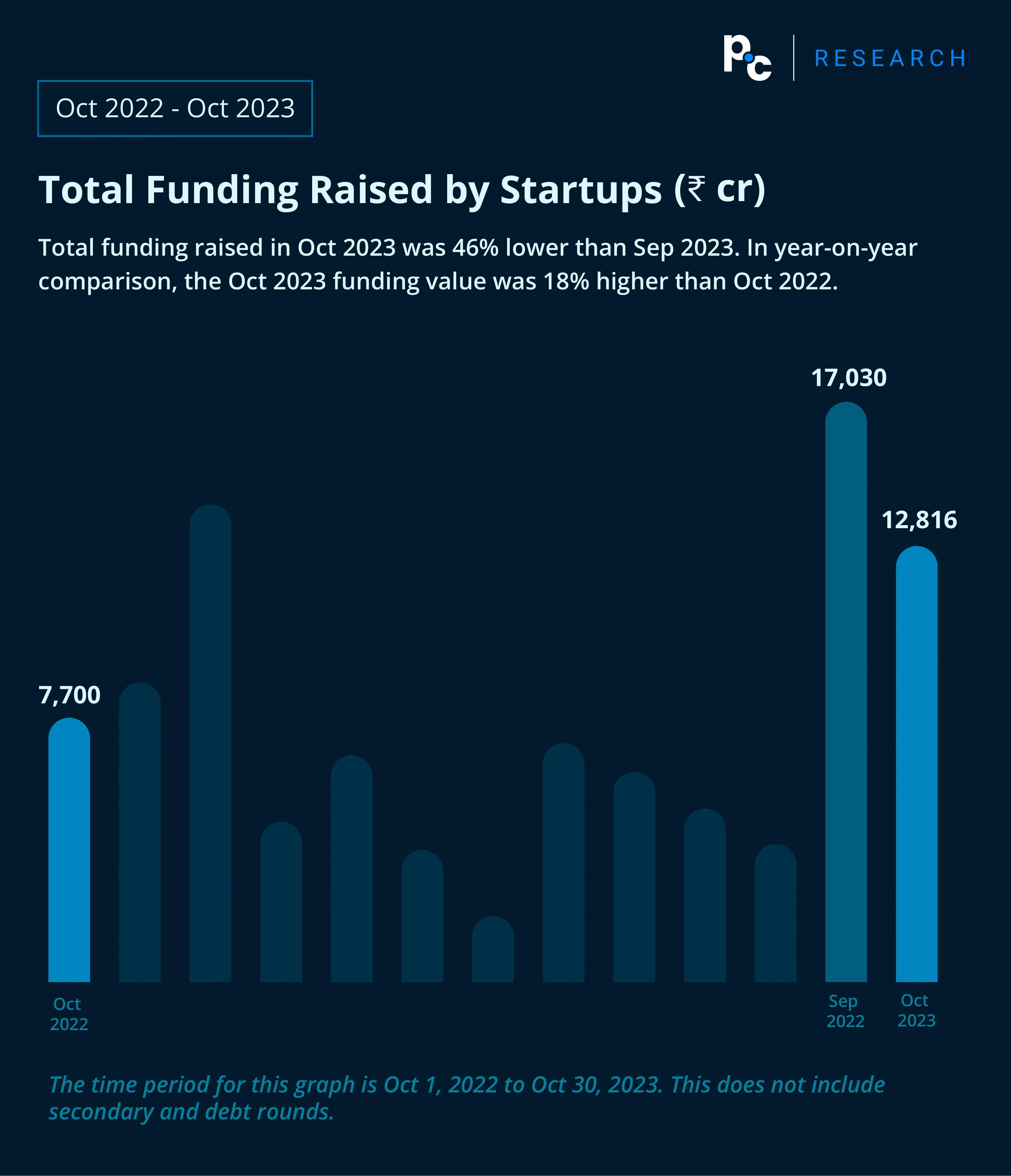

This data suggests that while deal volumes have remained relatively stable in the short term, there is a significant year-on-year reduction in the number of funding deals.

This could be indicative of various factors affecting the startup ecosystem, including economic conditions, investor sentiment, or regulatory changes.

It’s worth noting that these figures exclude secondary and debt rounds. The decrease in funding from September could be attributed to various factors, including seasonal fluctuations, market conditions, or the types of startups that received funding during the month.

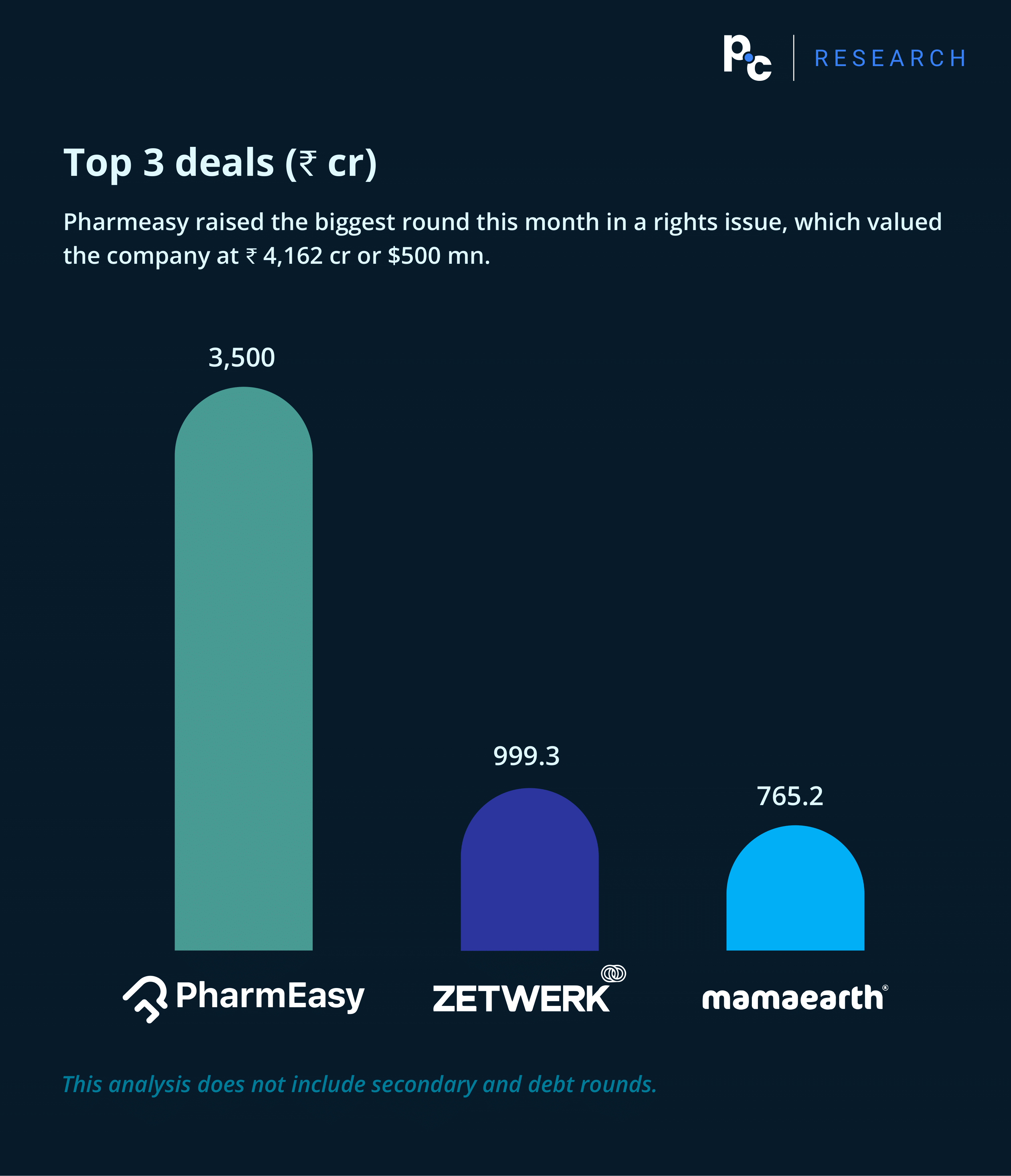

These deals represent the financial milestones achieved by some of India’s most promising startups during the month. Such deals can significantly impact the startup landscape and provide insights into industry trends and investor preferences.

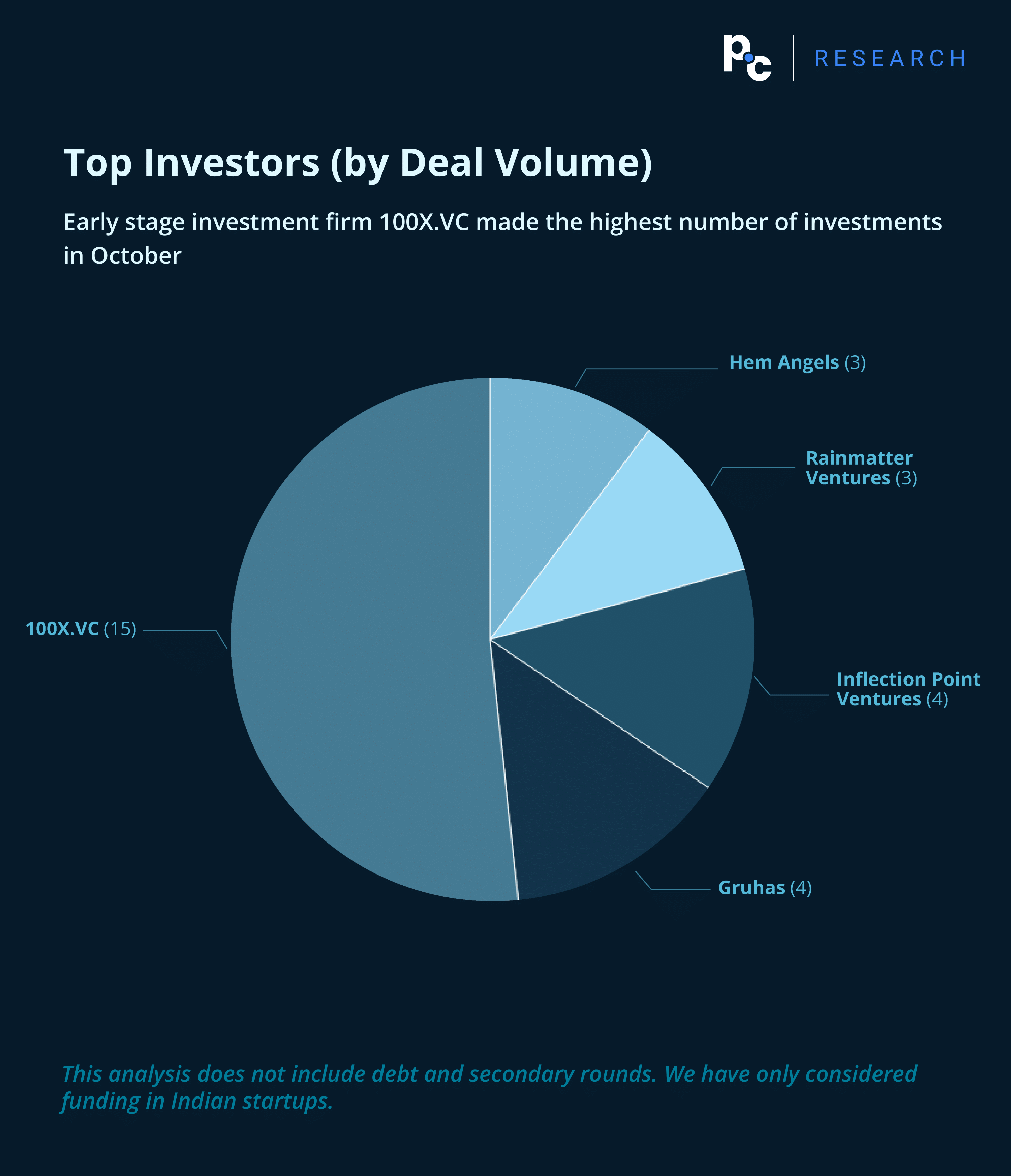

The preferences of prominent investors can provide valuable insights into the sectors and startups that are currently attracting attention and capital.

In conclusion, the Indian startup landscape is a dynamic and ever-evolving space. The October 2023 Monthly Funding Summary provides a glimpse into the trends, challenges, and opportunities that characterize this ecosystem.

Whether you are an investor, entrepreneur, or industry enthusiast, staying informed about the latest developments in the Indian startup scene is crucial for making informed decisions and contributing to its growth.

We look forward to keeping you updated in the coming months as we continue to monitor and analyze the progress of India’s vibrant startup community.