As we delve into the financial landscape of the startup ecosystem for November 2023, a nuanced story emerges.

The data, illustrated across four slides, provides a comprehensive overview of the funding dynamics, showcasing both highs and lows in deal volumes, total funding raised, top deals, and the key players driving investment.

Let’s unpack the trends and contextualize the numbers for a deeper understanding of the current state of startup financing.

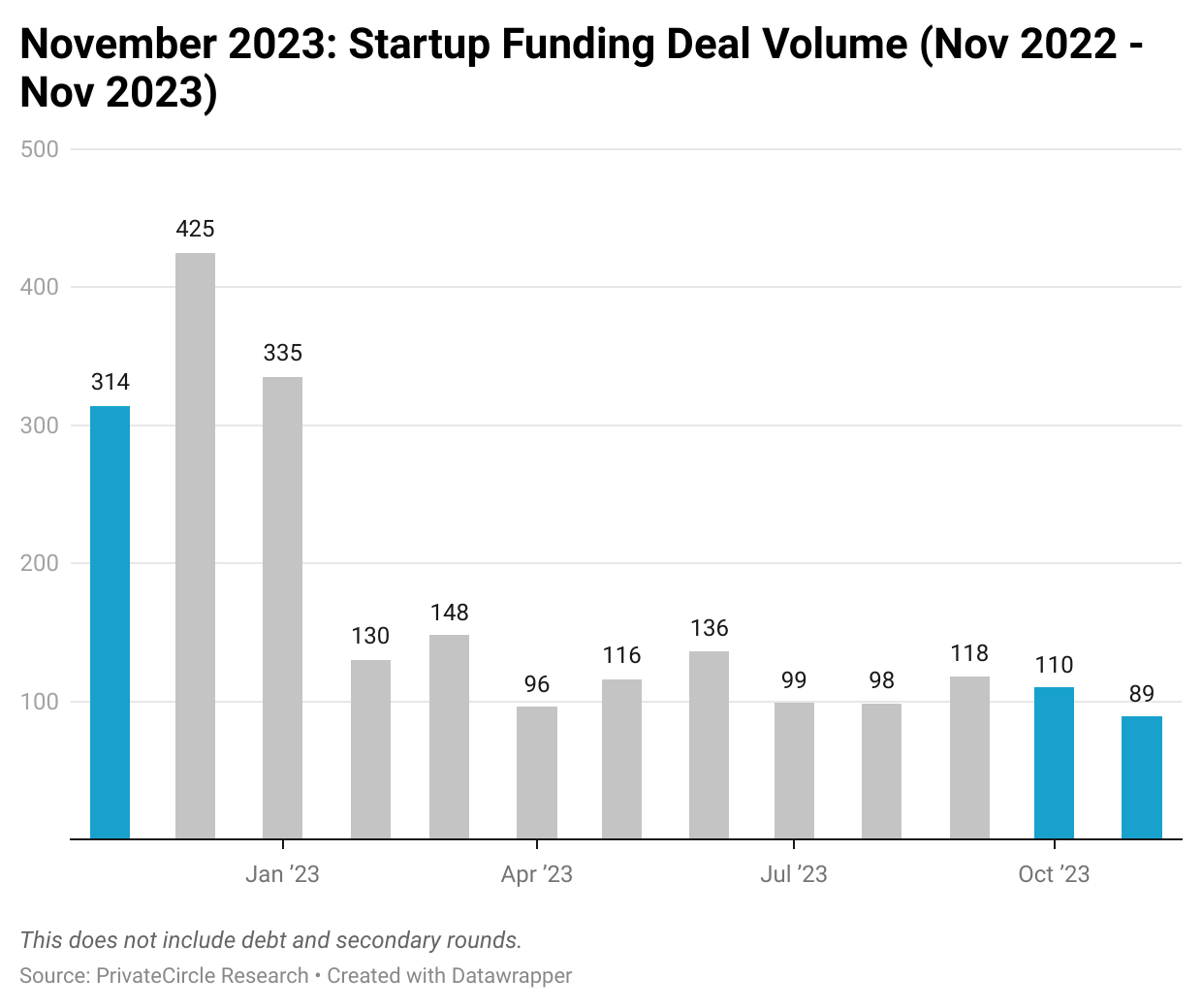

Notably, the month witnessed a decline in deal volumes, dropping from 110 deals in October 2023 to 89 deals. However, the most compelling insight comes from the year-on-year comparison, revealing a significant decrease from the robust 314 deals recorded in November 2022.

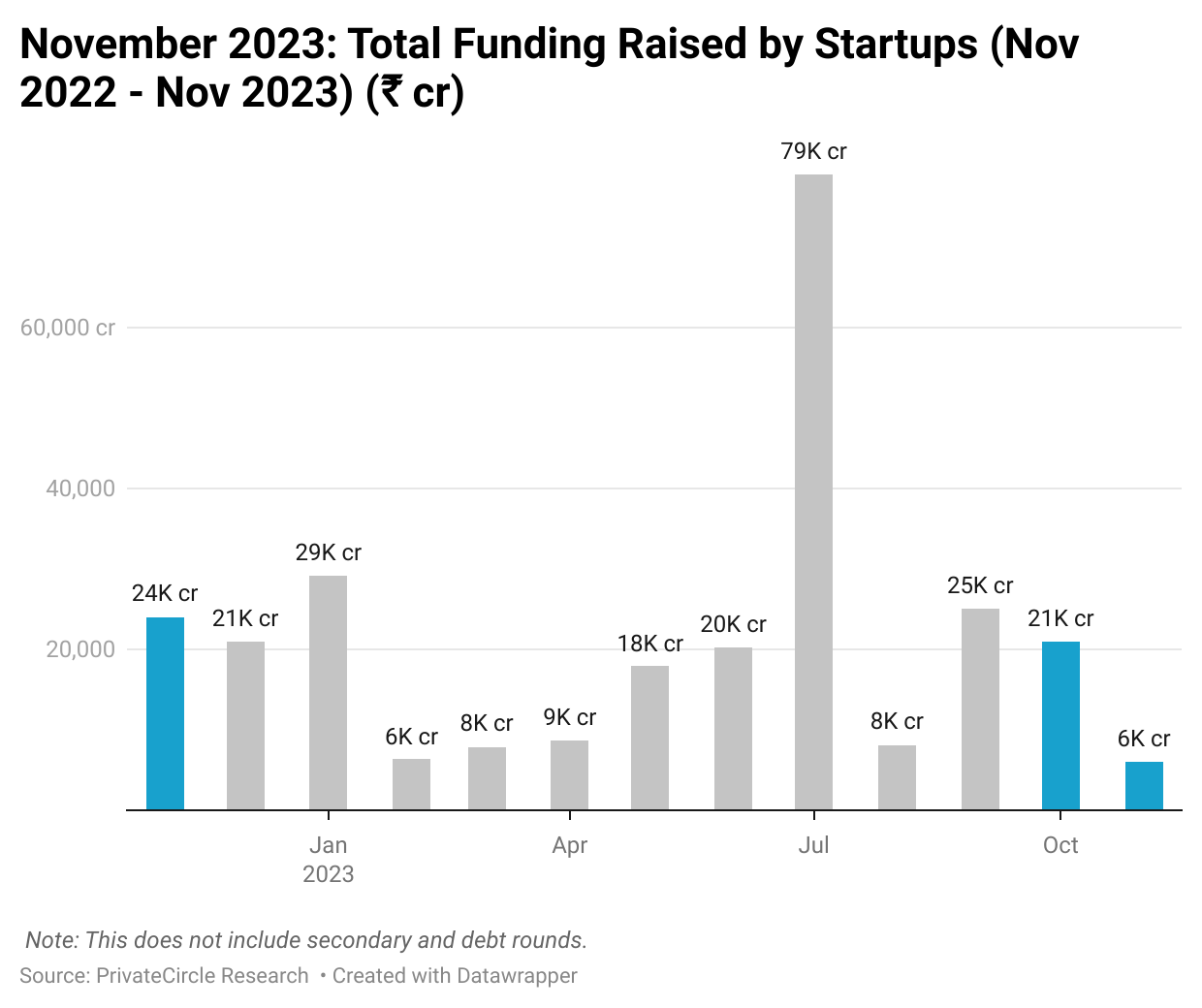

The data indicates a substantial 71% decrease compared to October 2023. The year-on-year perspective is even more revealing, with a 74% reduction from the funding levels seen in November 2022.

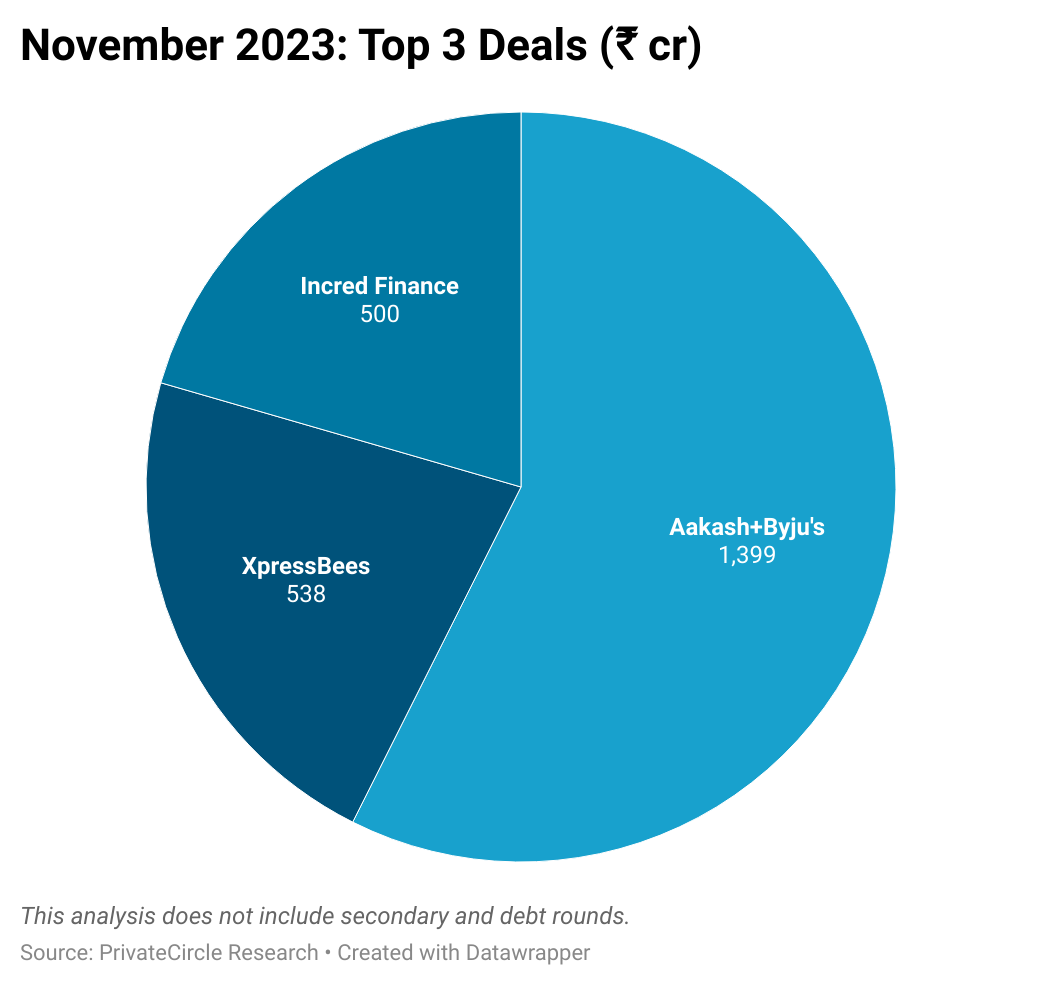

Aakash+Byju’s secured the largest funding round of the month, raising a significant sum from billionaire investor Ranjan Pai, followed by XpressBees and Incred Finance.

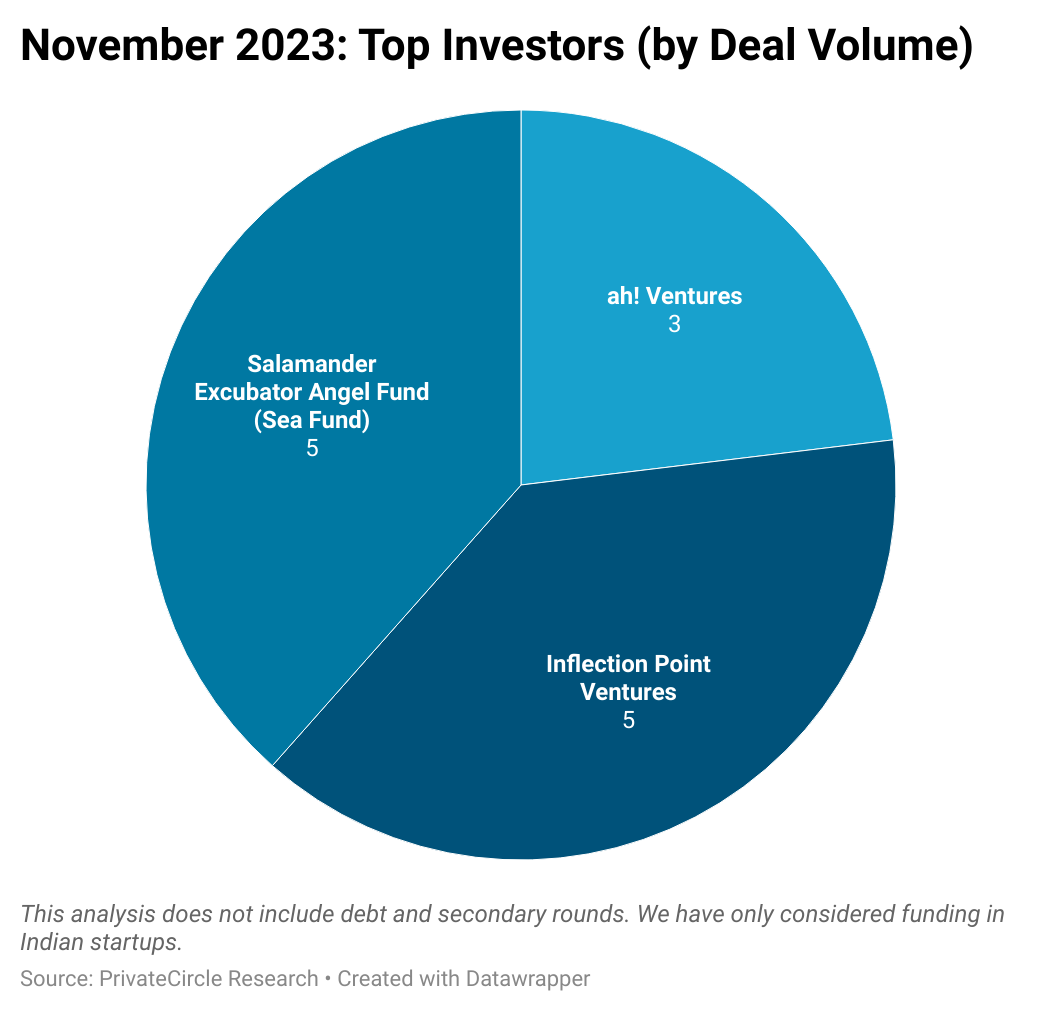

Early-stage investors Salamander Excubator Angel Fund (Sea Fund) and Inflection Point Ventures emerged as the top investors by deal volume in November 2023.

Understanding the investment preferences and strategies of these influential players can provide valuable insights into the sectors or stages of startups that are currently attracting the most attention and support.

Conclusion

In conclusion, the November 2023 startup funding scenario reveals a complex interplay of factors influencing deal volumes, total funding raised, standout deals, and investor dynamics.

To truly grasp the narrative behind the numbers, further exploration into market conditions, industry trends, and the specific contexts surrounding each deal is essential.

Whether you are an investor, entrepreneur, or industry enthusiast, staying informed about the latest developments in the Indian startup scene is crucial for making informed decisions and contributing to its growth.

We look forward to keeping you updated in the coming months as we continue to monitor and analyze the progress of India’s vibrant startup community.