As we step into the vibrant world of India’s startup ecosystem, the month of March 2024 stands out as a period marked by significant movements in startup funding dynamics.

Through a meticulous examination of funding data, we uncover compelling insights that shed light on the trends, shifts, and key players shaping the landscape.

Let’s dive into the full report covering:

- Startup Funding Deal Volume

- Startup Funding by Value

- Top 3 Deals

- Top Investors

- Deal Volume by Investor Type

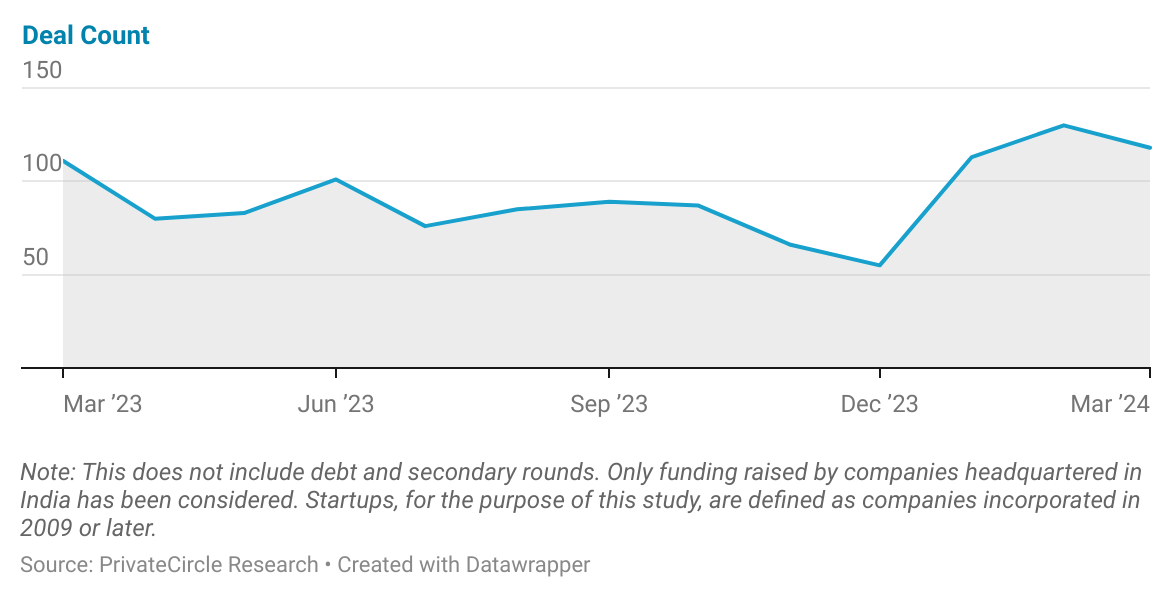

Startup Funding Deal Volume (Mar 2023 – Mar 2024)

While funding values soared, deal volume experienced a slight dip of 9% compared to the previous month.

However, when viewed in the context of the broader trend, March 2024 still reflects a commendable 6.3% increase in deal volume compared to the same period last year.

This nuanced perspective underscores the ongoing vibrancy and dynamism within the startup funding space, where fluctuations in deal volume are part of the natural ebb and flow of investment activity.

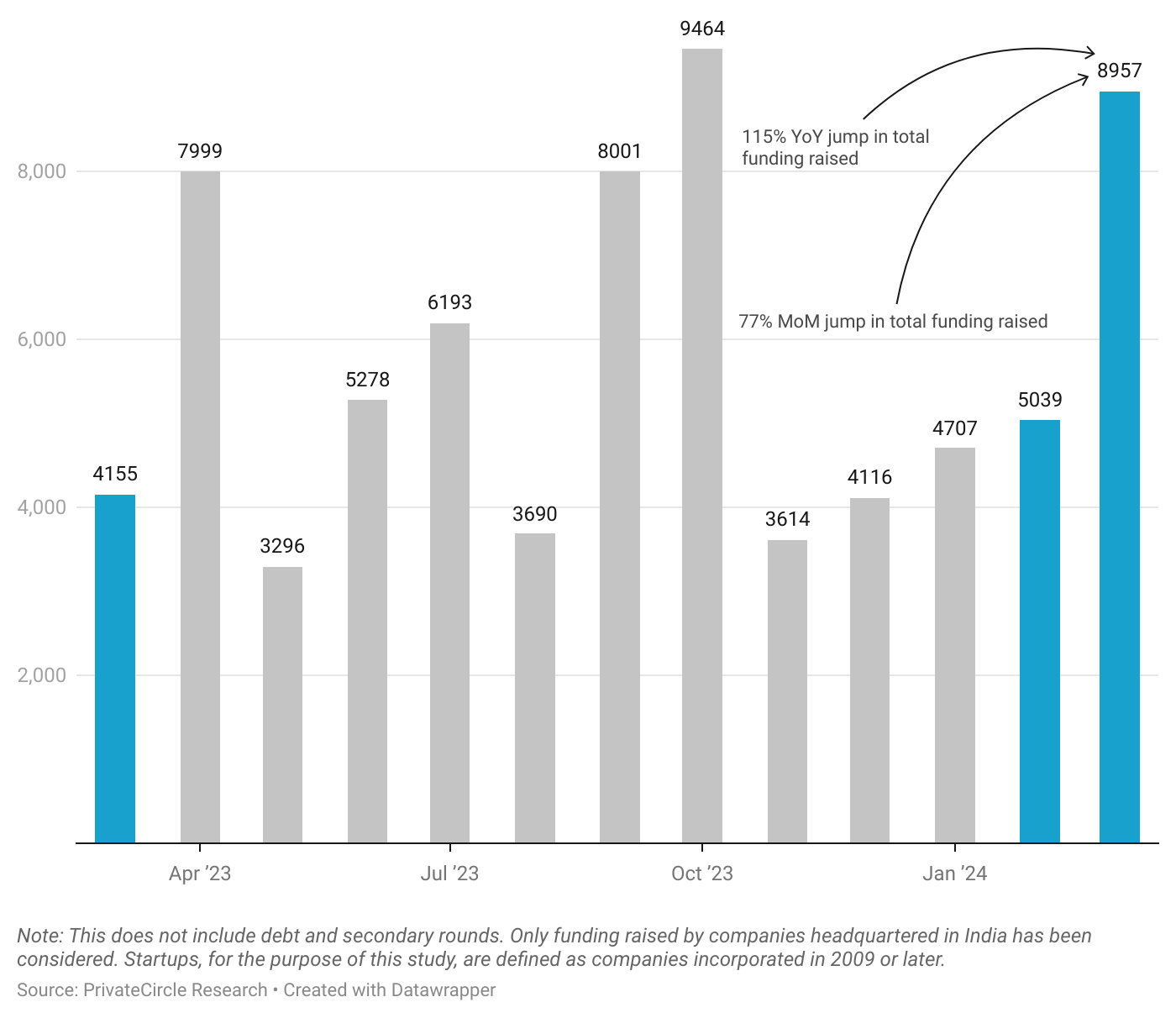

Startup Funding by Value (Mar 2023 – Mar 2024)

The data reveals a remarkable surge in startup funding, with March 2024 witnessing a staggering 77% increase compared to the previous month.

This surge represents a robust investor sentiment and a heightened appetite for investment opportunities within the ecosystem.

Furthermore, the year-on-year growth of 115% showcases the resilience and growth trajectory of India’s startup ecosystem, despite the challenging global economic landscape.

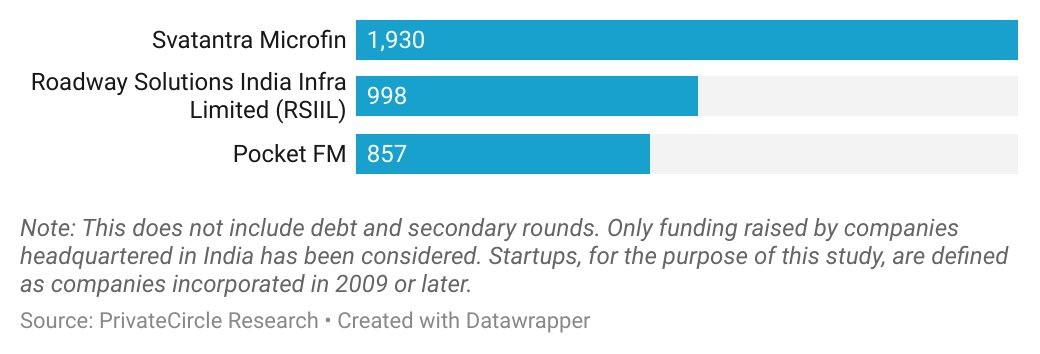

Top 3 Deals

One standout highlight of March 2024 is the monumental funding round secured by Mumbai-based Svatantra Microfin, amounting to a staggering ₹1,930 cr from Advent India PE Advisors.

This landmark deal underscores the growing investor confidence in India’s fintech sector and highlights the potential for transformative growth within the industry.

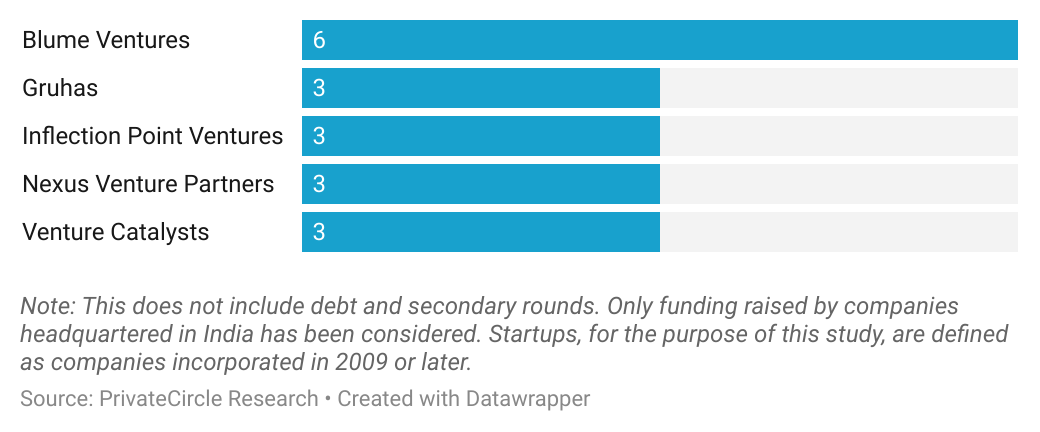

Top Investors (Deal Volume)

An esteemed early-stage investment fund, Blume Ventures emerged as a prominent player in March 2024 with a total of 6 investments.

This remarkable deal volume underscores Blume’s strategic positioning within the startup ecosystem and its pivotal role in fostering innovation and growth among early-stage ventures.

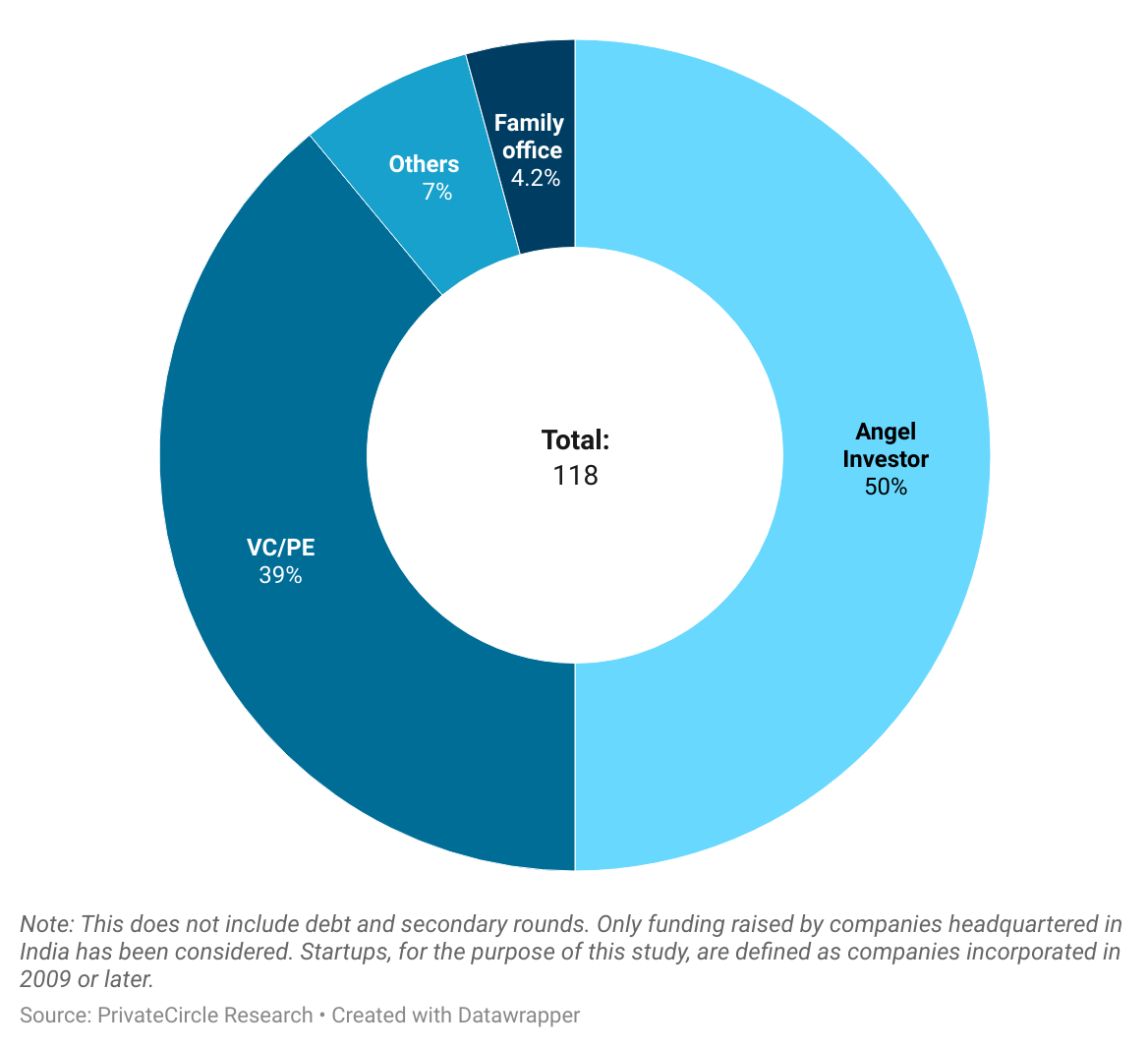

Deal Volume by Investor Type

The breakdown of deal volume by investor type provides valuable insights into the diverse funding landscape of India.

Angel investors led the charge in March 2024, accounting for 50% of funding rounds, closely followed by Venture Capital/Private Equity deals at 39%, and Family offices at 4.2%.

This distribution highlights the multifaceted nature of funding sources driving the growth and expansion of startups across various sectors.

Conclusion

In March 2024, India’s startup ecosystem thrived with robust investor interest, innovative ventures, and supportive regulations, reflecting its evolution and vitality.

Despite deal volume fluctuations, the overall trend indicates sustained growth and resilience in India’s startup ecosystem, making it a prime opportunity for both investors and entrepreneurs. March 2024 serves as a testament to the unwavering spirit of innovation and entrepreneurship that defines India’s vibrant ecosystem.

As we eagerly anticipate the future, one thing remains certain – the journey of India’s startups is poised for unprecedented growth and success on the global stage.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.