As we say farewell to 2023, it’s crucial to reflect on the trends that shaped the Indian startup funding landscape in the last month of the year – December 2023.

In this blog post, we analyze the latest data to provide a comprehensive overview of the funding landscape, highlighting key trends and noteworthy developments.

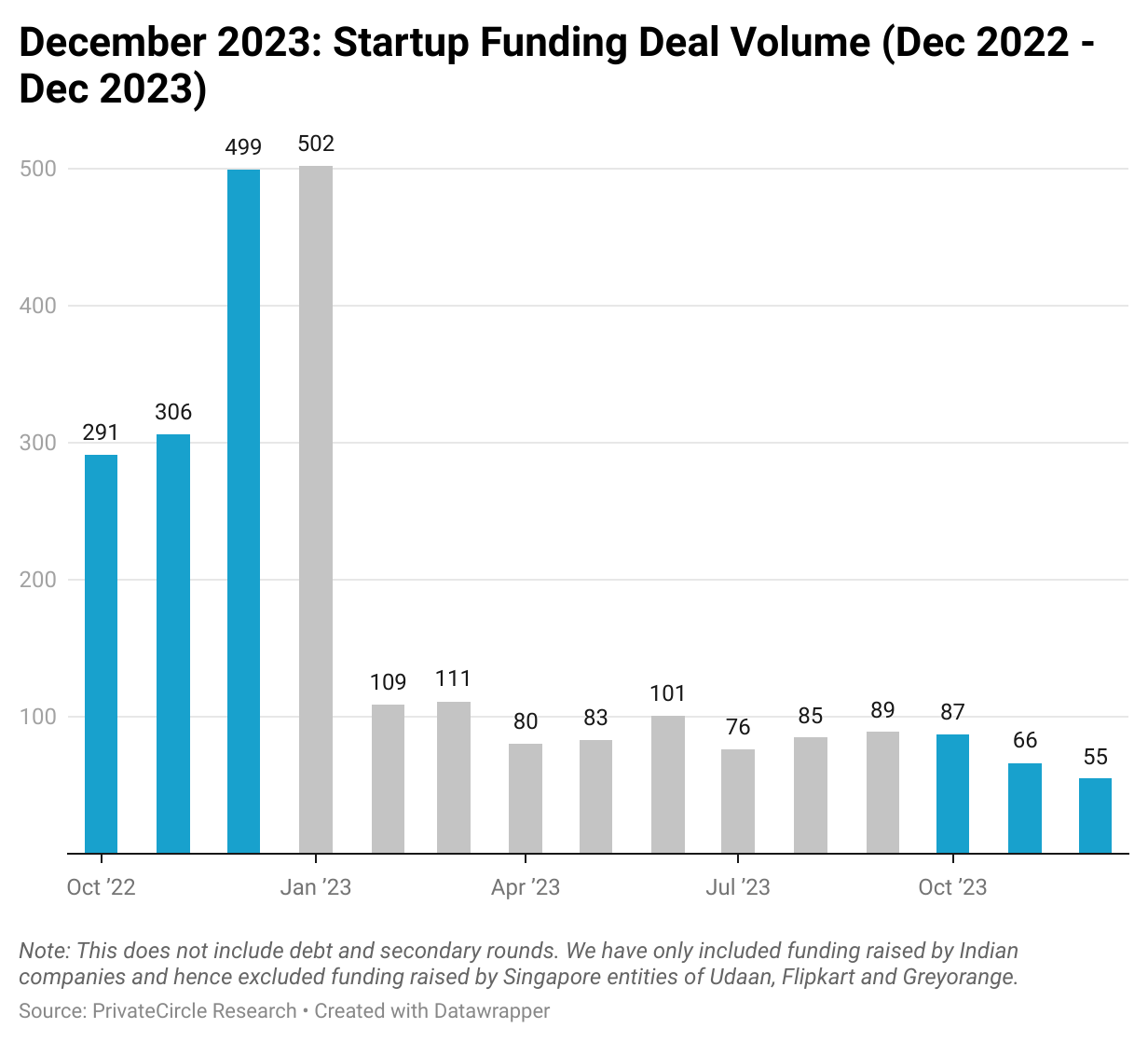

The numbers tell a story of a consistent drop in startup funding deal volumes. In December 2023, deals dropped to 55, down from 66 in November, 2023.

Delving deeper into the fiscal perspective, the third quarter of FY2023 witnessed a stark contrast, with 208 deals—a staggering 80% less than the 1096 deals recorded in Q3 FY2022. The startup ecosystem has been recording similar low deal counts for the past three quarters with only seasonal variations.

The numbers do not show any decisive investment action or momentum as compared to last year.

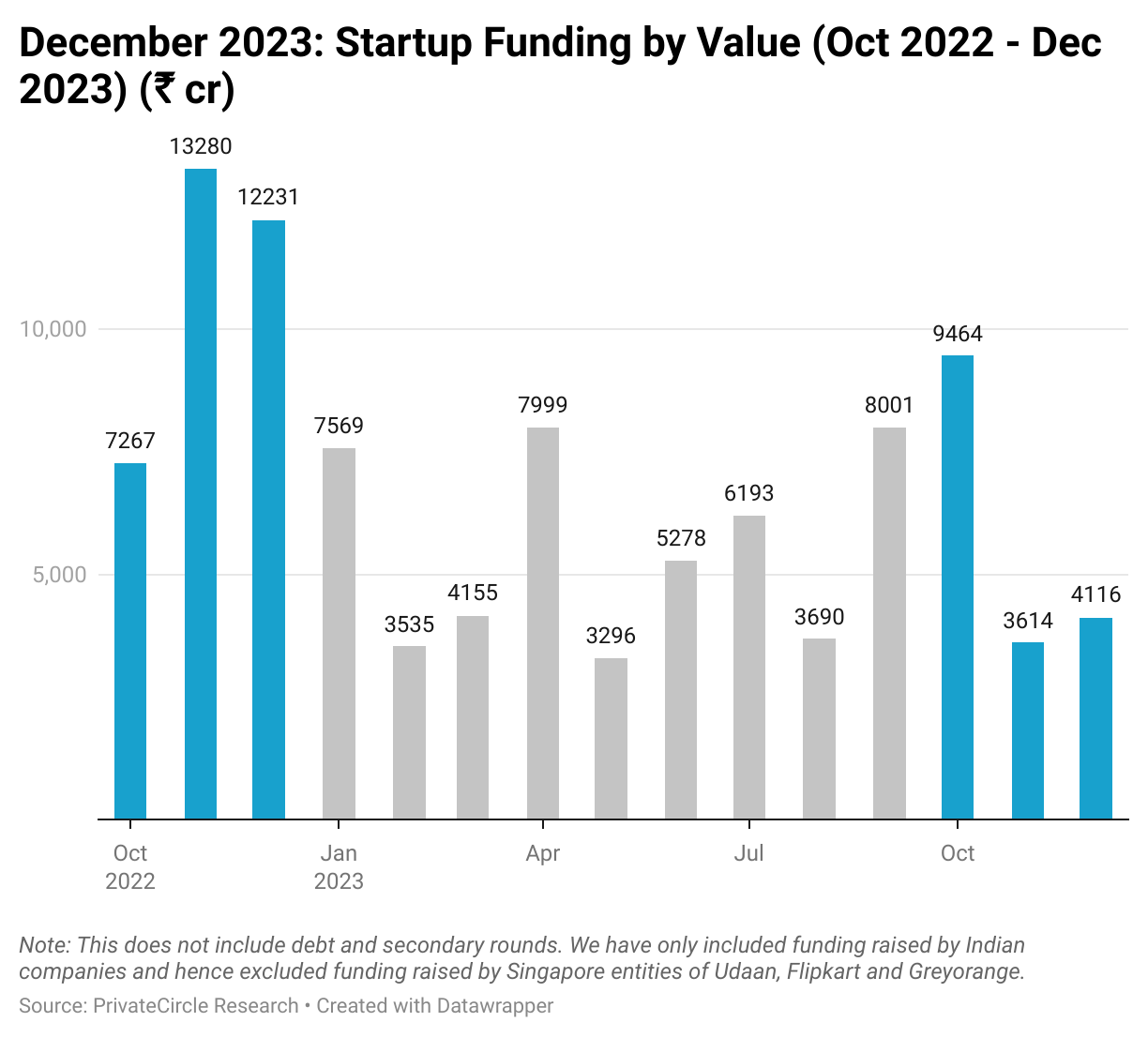

In line with the drop in deal volumes, the funding amount raised in the quarter ending December 2023 also dropped by 48% as compared to the same time period last year.

However, in comparison to November 2023, December saw a small jump in amount raised , reaching ₹4,116 crore compared to ₹3,614 crore in November. Although lower than the ₹12,231 crore recorded in December 2022.

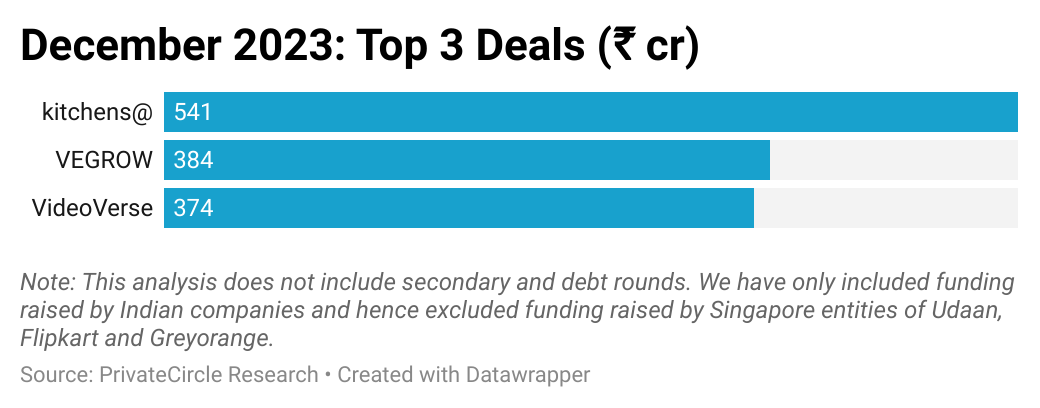

Highlighting the movers and shakers in December, Kitchens@ secured ₹541 crore in funding from Finnest, leading the top three deals.

Vegrow and VideoVerse followed closely, contributing significantly to the month’s funding dynamics.

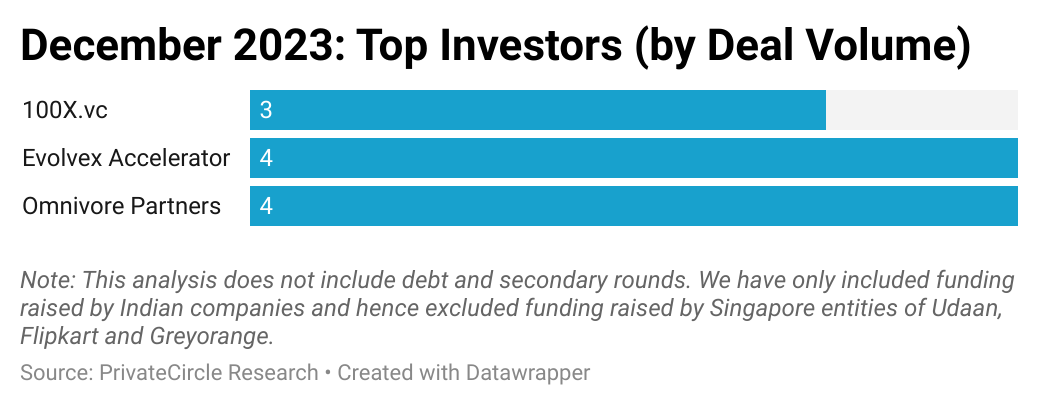

Investment trends in December showcased Evolvex Accelerator and Omnivore Partners as the top investors by deal volume.

Their strategic choices position them as key players in shaping the startup landscape.

Conclusion

The Indian startup funding landscape in December reflected a sustained downturn, marked by reducing deal volumes. The data underscores a challenging environment, with only marginal improvements compared to the previous months.

Notwithstanding the broader industry trends, individual success stories like Kitchens@, Vegrow, and VideoVerse demonstrate resilience and innovation in securing significant funding.

Stay tuned for more updates as we continue to unravel the intricacies of India’s startup funding landscape.