The Indian private markets witnessed a dynamic funding landscape in March 2025.

With a total of ₹9,916 crore raised across 113 deals, the month saw a mix of large-scale investments, shifts in investor behavior, and a surprising surge in Tier 2 & 3 city funding.

Here’s a comprehensive breakdown of the key trends shaping private market investments this month.

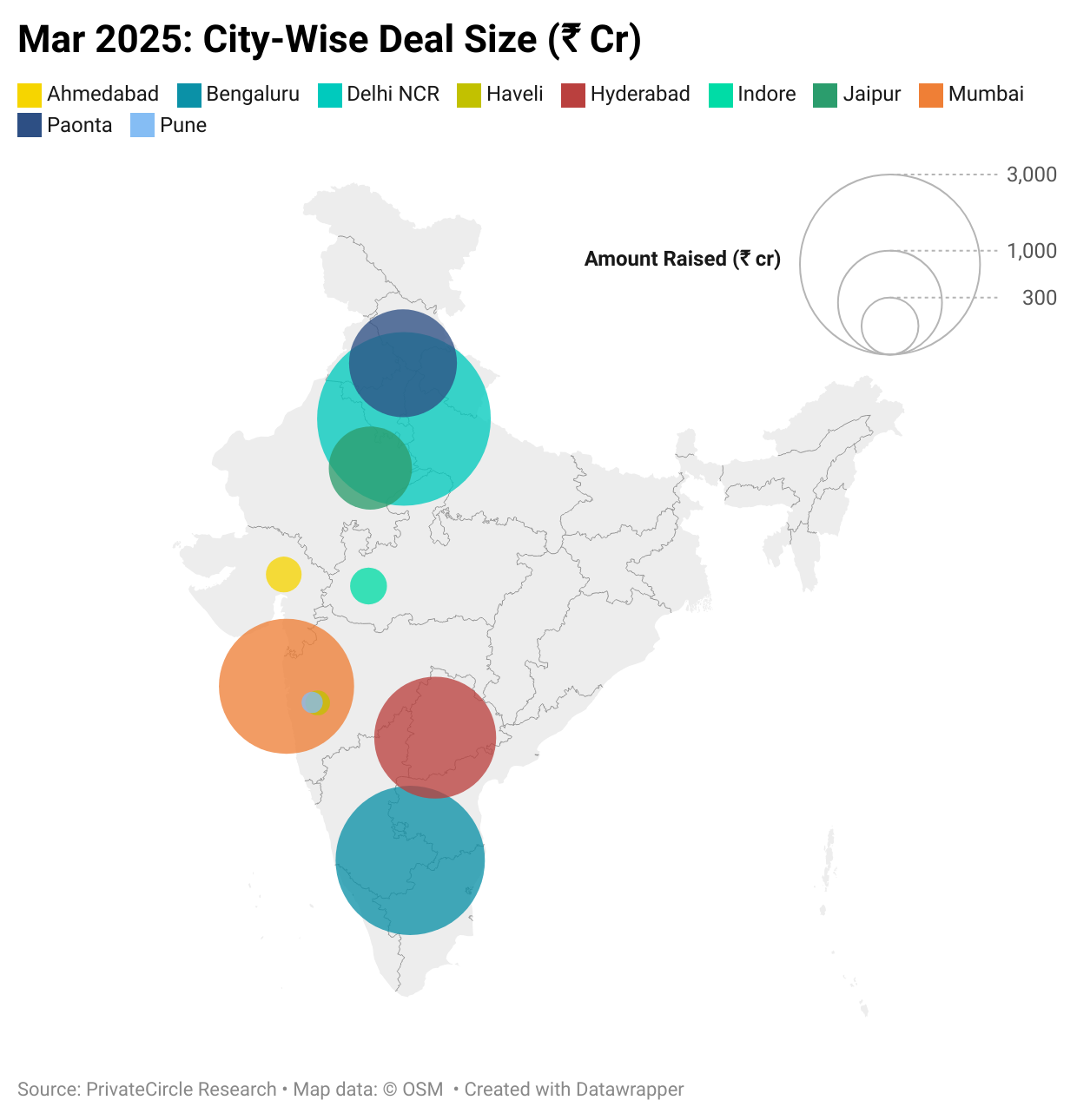

Which Cities Got the Most Funding?

The usual suspects – Delhi NCR, Bengaluru, and Mumbai – continued to dominate private market deal activity, collectively raising over ₹6,500 crore across 84 deals.

- Delhi NCR led with ₹2,790.04 crore raised across 37 deals.

- Bengaluru followed with ₹2,047 crore across 28 deals.

- Mumbai secured ₹1,670 crore across 19 deals.

- Other notable cities included Hyderabad (₹1,351 crore), Paonta (₹1,050 crore), and Jaipur (₹611.52 crore).

- Smaller cities like Indore, Ahmedabad, Haveli, and Pune also contributed, reflecting the broadening reach of venture capital in India.

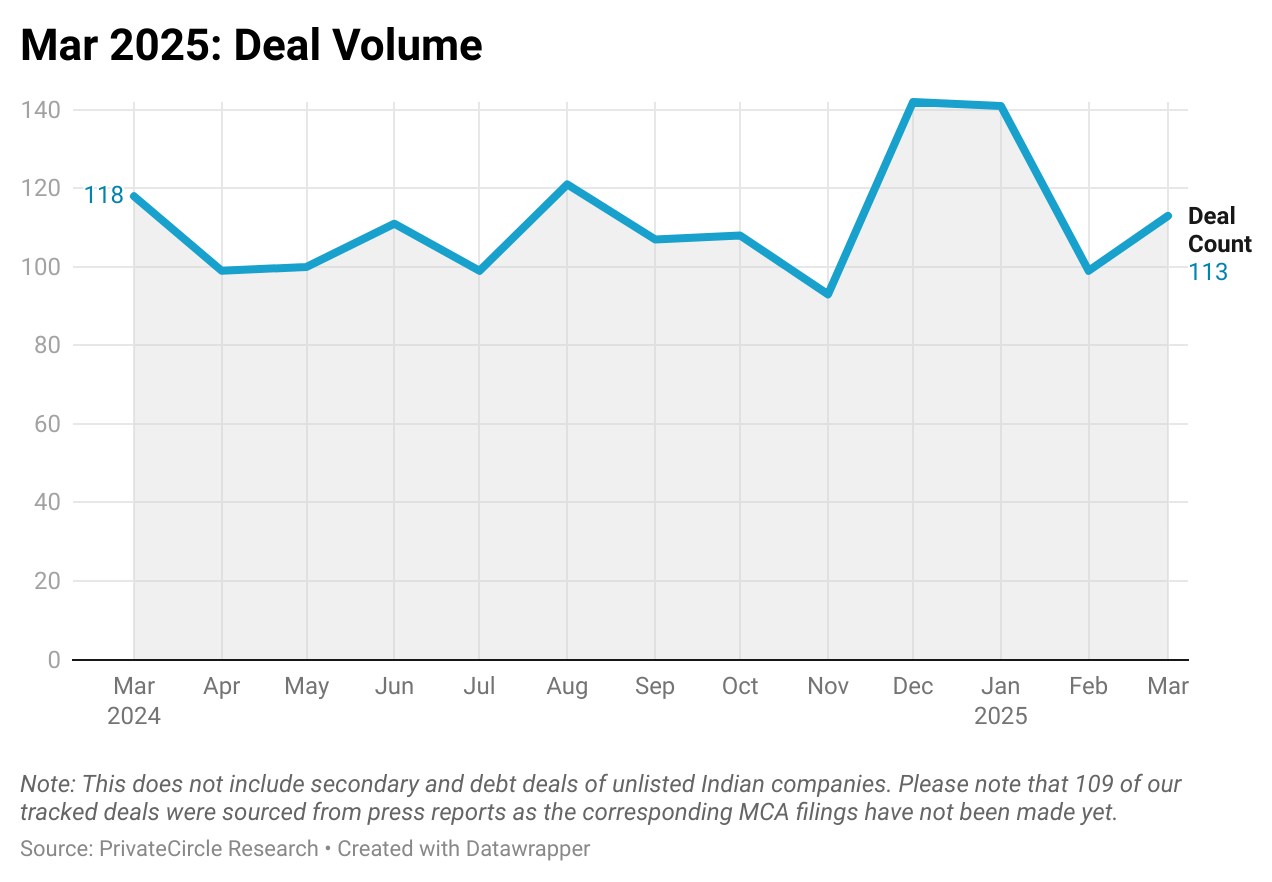

How Many Deals Happened?

A total of 113 deals were closed in March 2025, reflecting a 4.2% decline from 118 deals in March 2024 but a 14.9% increase month-over-month from February 2025’s 99 deals.

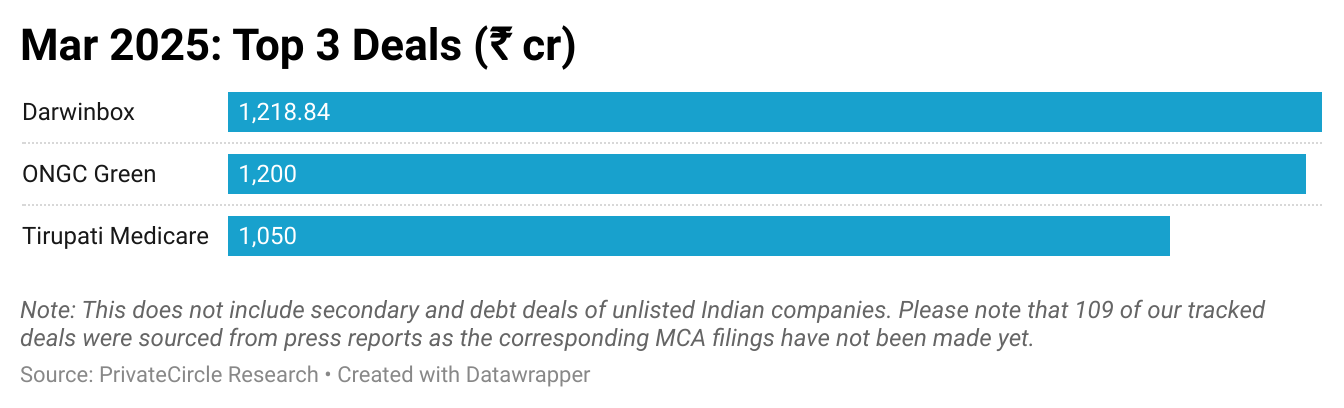

Biggest Funding Deals in March 2025

This month saw some major funding rounds, with three deals exceeding ₹1,000 crore:

- Darwinbox – ₹1,218.84 crore

- ONGC Green – ₹1,200 crore

- Tirupati Medicare – ₹1,050 crore (A major Tier 2 city deal in Paonta)

These large deals highlight continued investor interest in enterprise tech, sustainability, and healthcare.

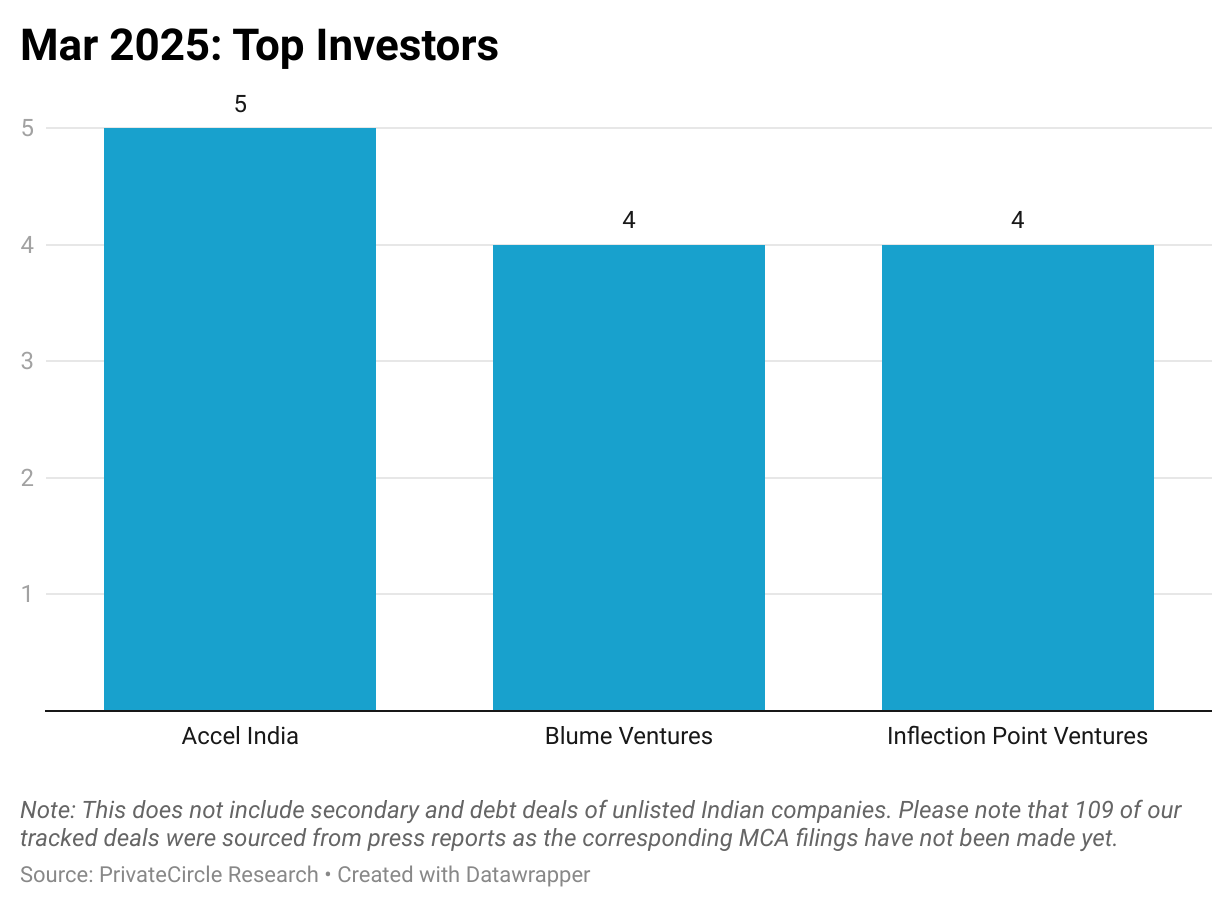

Who Invested the Most?

Accel India led March’s investment activity, closing 5 deals. Blume Ventures and Inflection Point Ventures followed closely with 4 deals each.

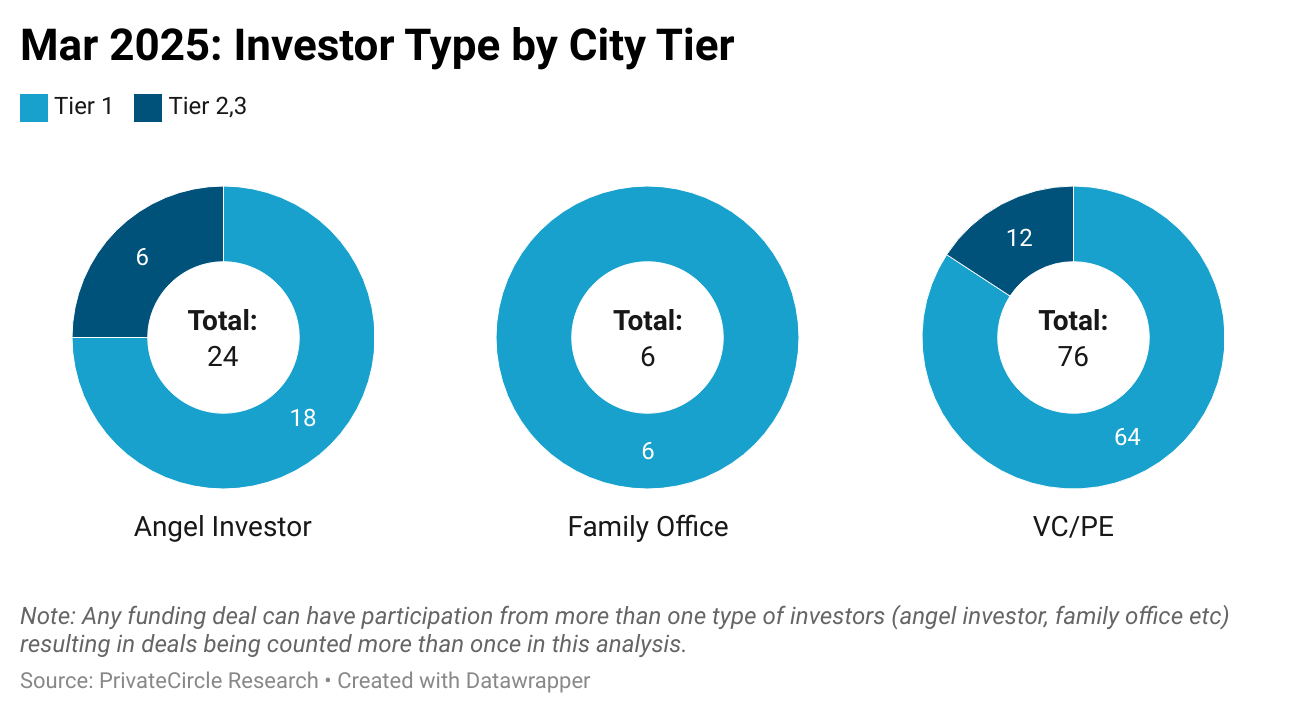

Investor Type Deal Volume

Venture Capital and Private Equity firms dominated deal activity in March 2025, recording 76 investments, a sharp rise from 51 in February 2025.

Angel investor participation dropped slightly to 24 deals from 29 in February, indicating a shift in early-stage funding dynamics. Family offices, however, saw a modest increase, contributing 6 deals, up from 5 in February.

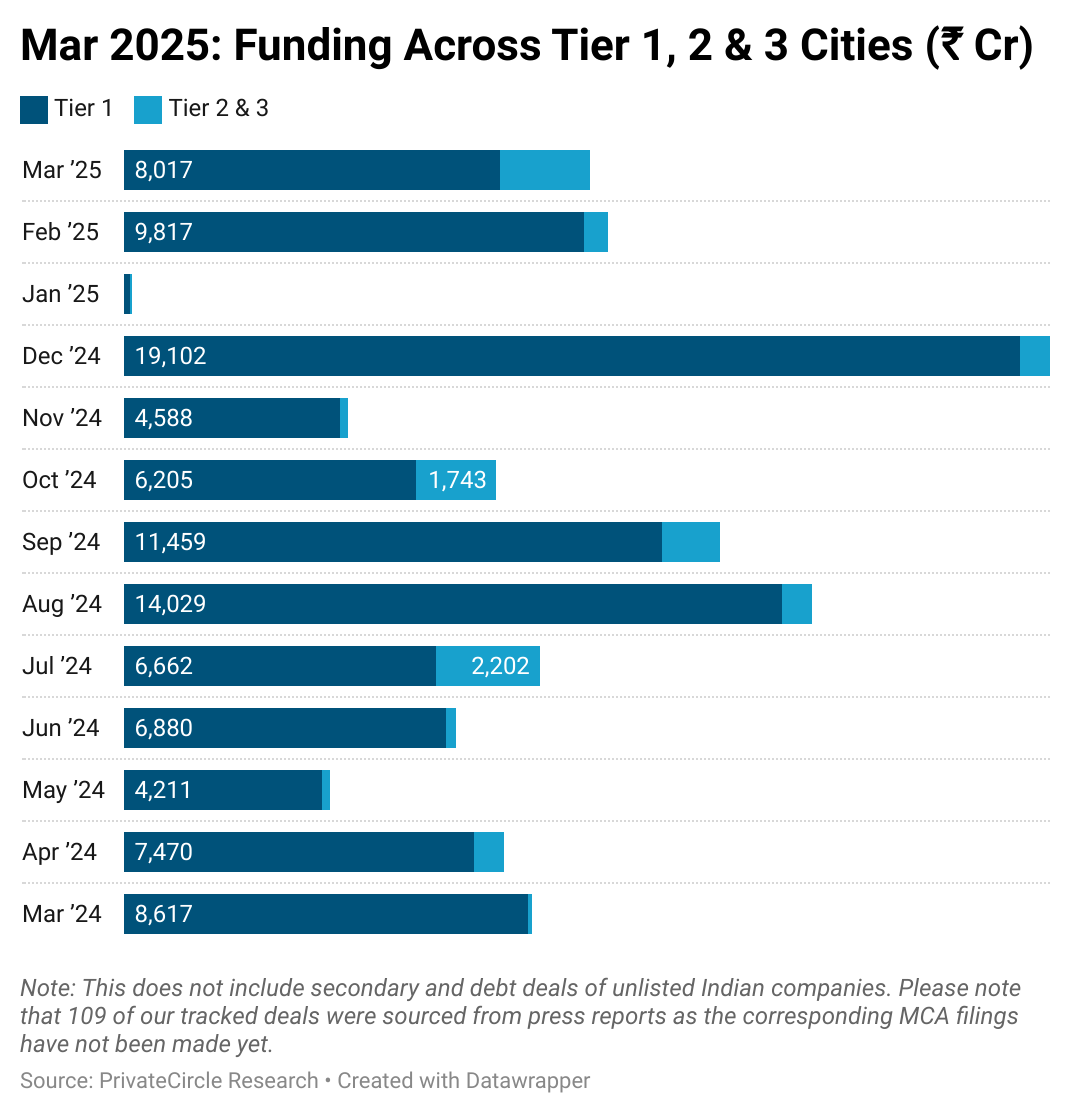

Tier 1 vs. Tier 2 & 3 Cities

Tier 1 cities (Delhi NCR, Mumbai, Bengaluru, Hyderabad, Chennai, Pune, Kolkata, Ahmedabad) dominated funding but saw a notable decline:

- Tier 1 cities raised ₹8,017 crore, an 18.3% drop from ₹9,817 crore in February 2025.

- Tier 2 & 3 cities surged to ₹1,898.93 crore, up from ₹513 crore in February, largely driven by Tirupati Medicare’s ₹1,050 crore round in Paonta.

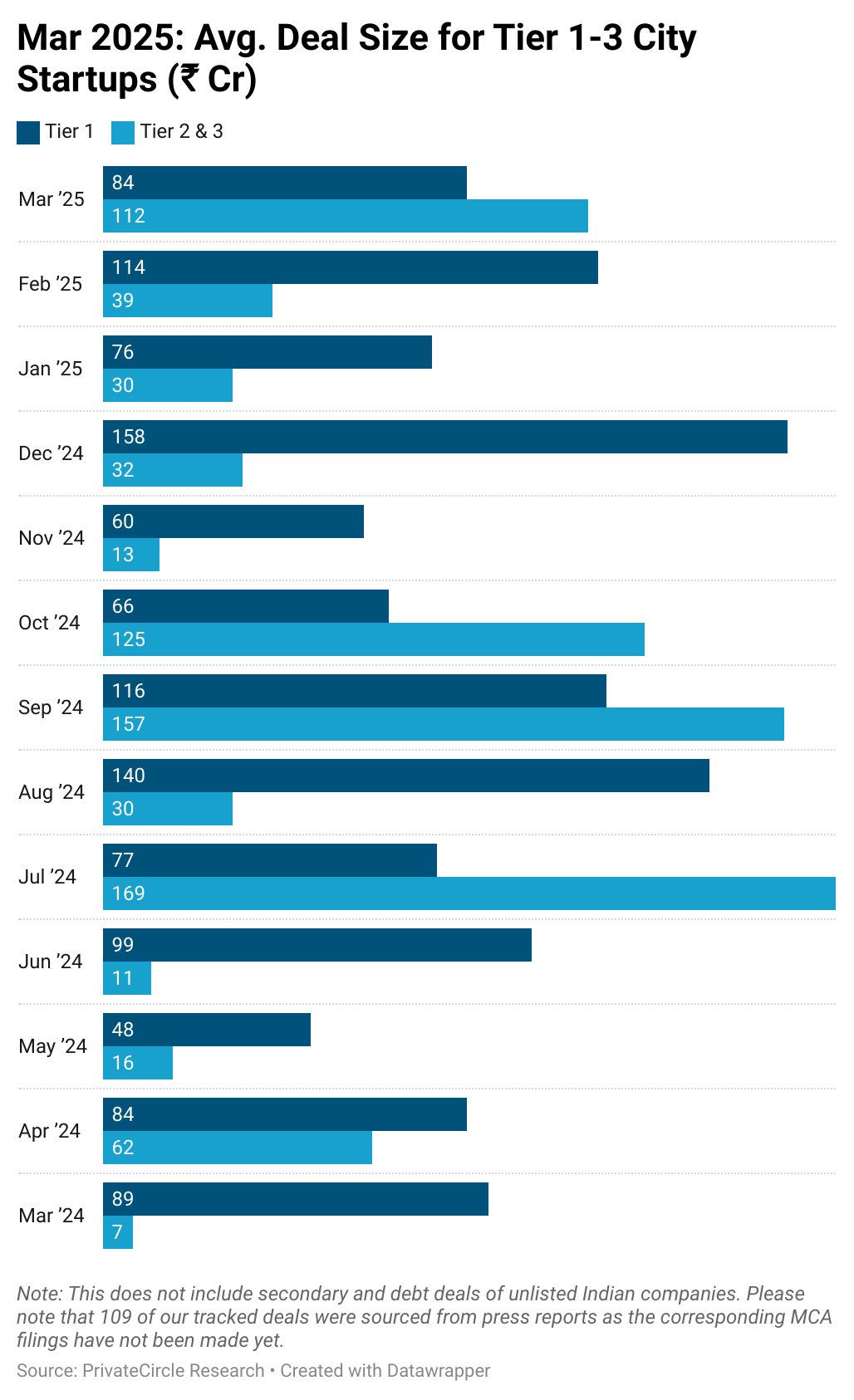

Average Deal Size

The average deal size fluctuated across city tiers:

- Tier 1 cities had an average deal size of ₹84 crore, down from ₹114 crore in February.

- Tier 2 & 3 cities saw a dramatic rise to ₹112 crore from ₹39 crore, underscoring the growing confidence in smaller city-based companies.

Who’s Investing Where?

Investor behavior continued to show clear patterns across city tiers:

- VC/PE firms dominated investments, leading 64 deals in Tier 1 cities and 12 in Tier 2 & 3 cities.

- Angel investors closed 18 deals in Tier 1 cities, compared to 6 in smaller cities.

- Family offices remained exclusive to Tier 1 cities, contributing 6 deals.

Conclusion

March 2025 reaffirmed key investment trends while introducing new dynamics:

- Tier 1 cities continue to lead but face increasing competition from emerging hubs.

- Tier 2 & 3 cities saw a record surge in funding, marking a shift in investor confidence.

- Large-ticket deals remain a driving force, especially in enterprise SaaS, sustainability, and healthcare.

As we step into the next quarter, it will be crucial to watch if Tier 2 & 3 growth is a sustainable trend or a temporary spike driven by a few major deals. Stay tuned for more insights in the coming months!

Stay tuned for more in-depth analyses and insights on the top private market deals, brought to you by PrivateCircle Research.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Explore Previous Funding Recaps:

Startup Funding Recap: December 2024