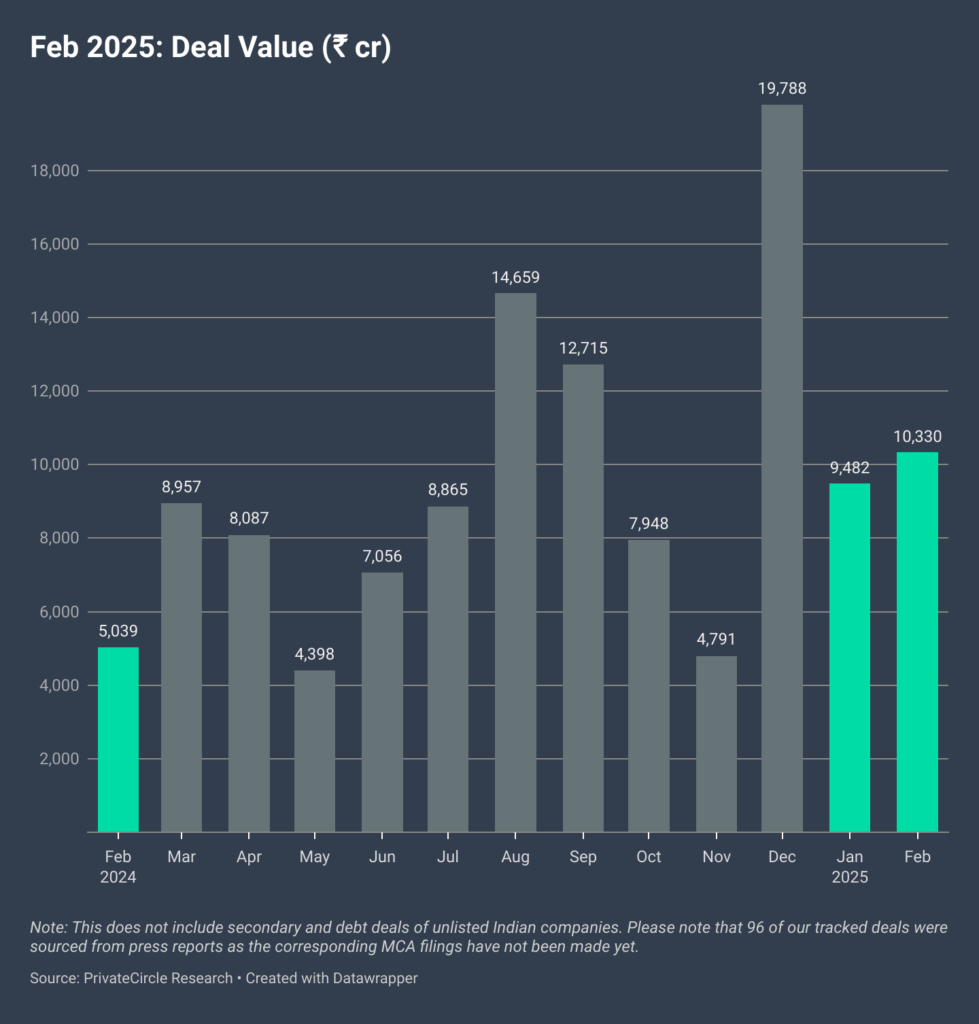

The Indian private market recorded a total investments of ₹10,330 crore across 99 deals in in February 2025. While this was lower than the December 2024 peak of ₹19,788 crore, it still shows strong investor confidence early in the year.

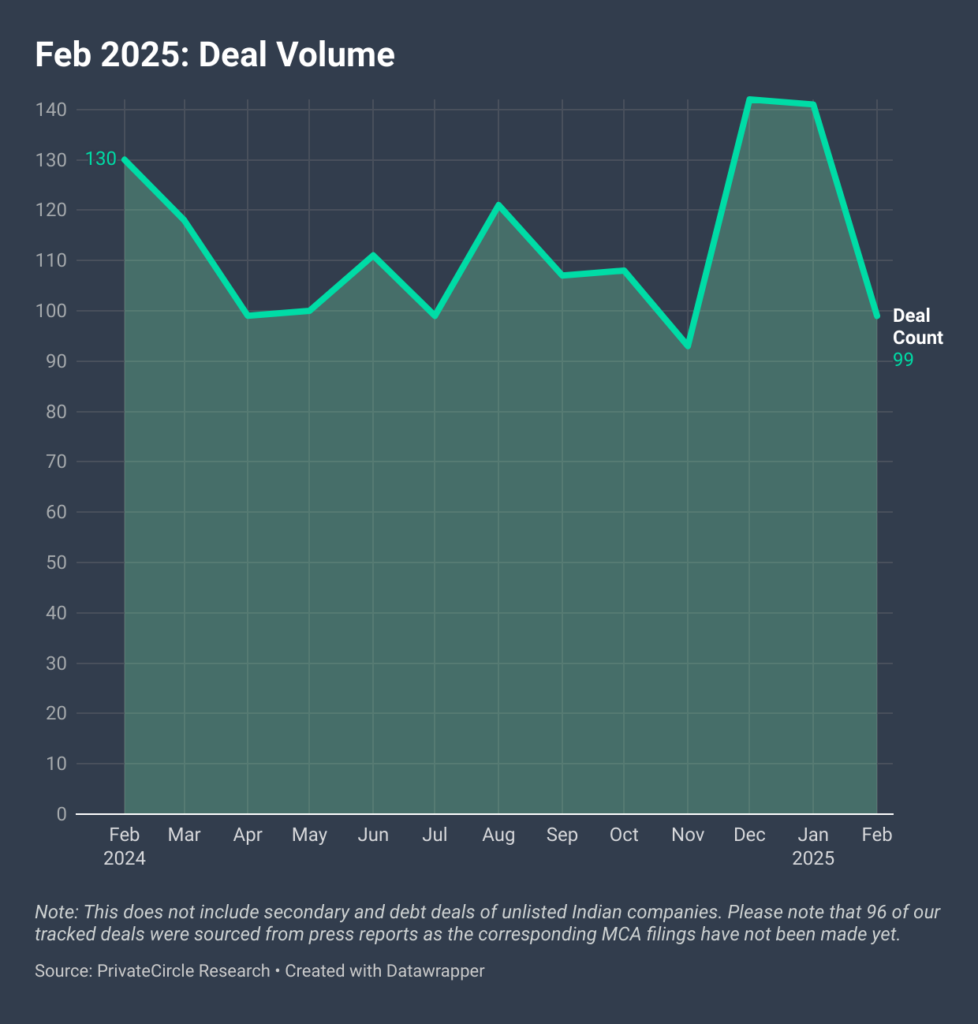

How Many Deals Happened?

After a strong finish in December 2024 (142 deals) and January 2025 (141 deals), the number of deals fell to 99 in February. This dip is normal—many investors rush to close deals before year-end, so early-year slowdowns are expected. However, the numbers still show plenty of investment activity.

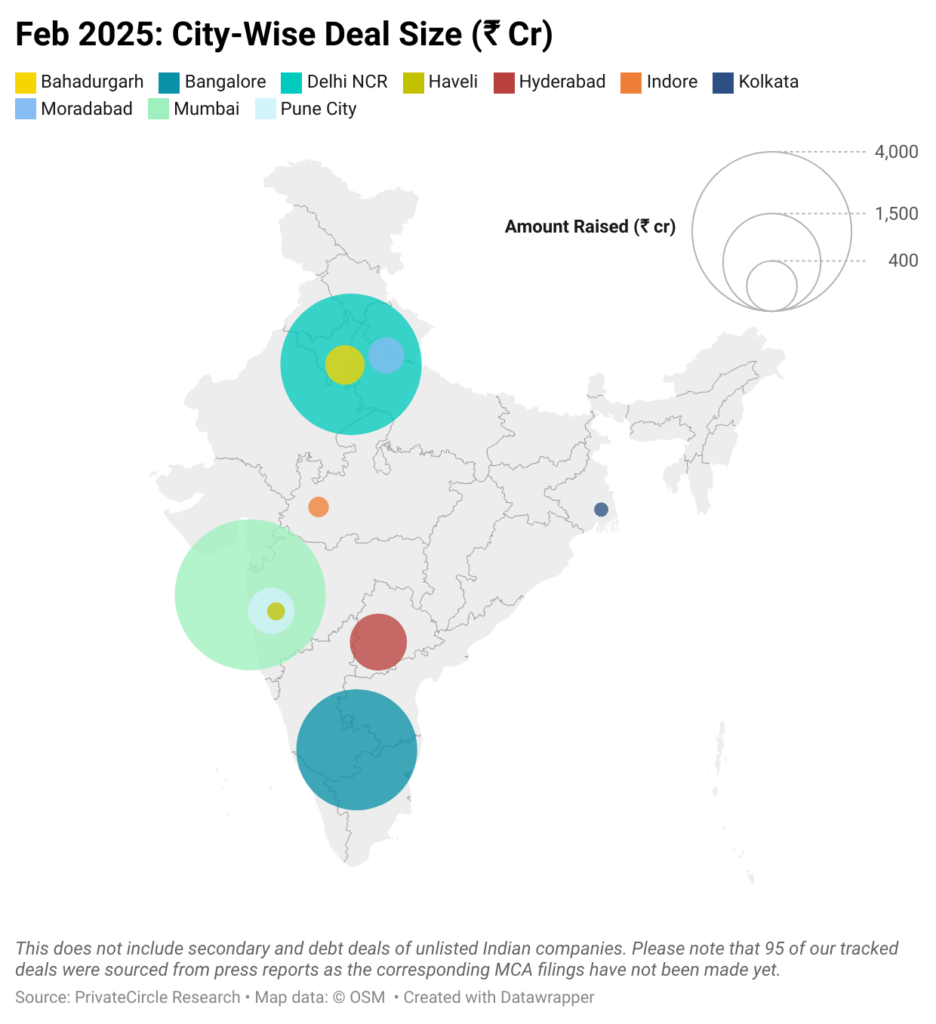

Which Cities Got the Most Funding?

As expected, big cities led the way:

- Mumbai: ₹3,588 crore across 24 deals

- Delhi NCR: ₹3,138 crore across 24 deals

- Bangalore: ₹2,280 crore across 27 deals

While Tier 1 cities remained dominant, smaller cities also made an impact:

- Bahadurgarh (Haryana): ₹220 crore

- Moradabad (Uttar Pradesh): ₹182 crore

- Indore (Madhya Pradesh): ₹50 crore

This shows that investors are starting to look beyond metro areas for opportunities.

Biggest Funding Deals in February

The biggest winners of the month were:

- Blinkit (quick commerce) – ₹1,500 crore

- Dream11 (fantasy gaming) – ₹1,489 crore

- Scootsy (delivery service) – ₹1,000 crore

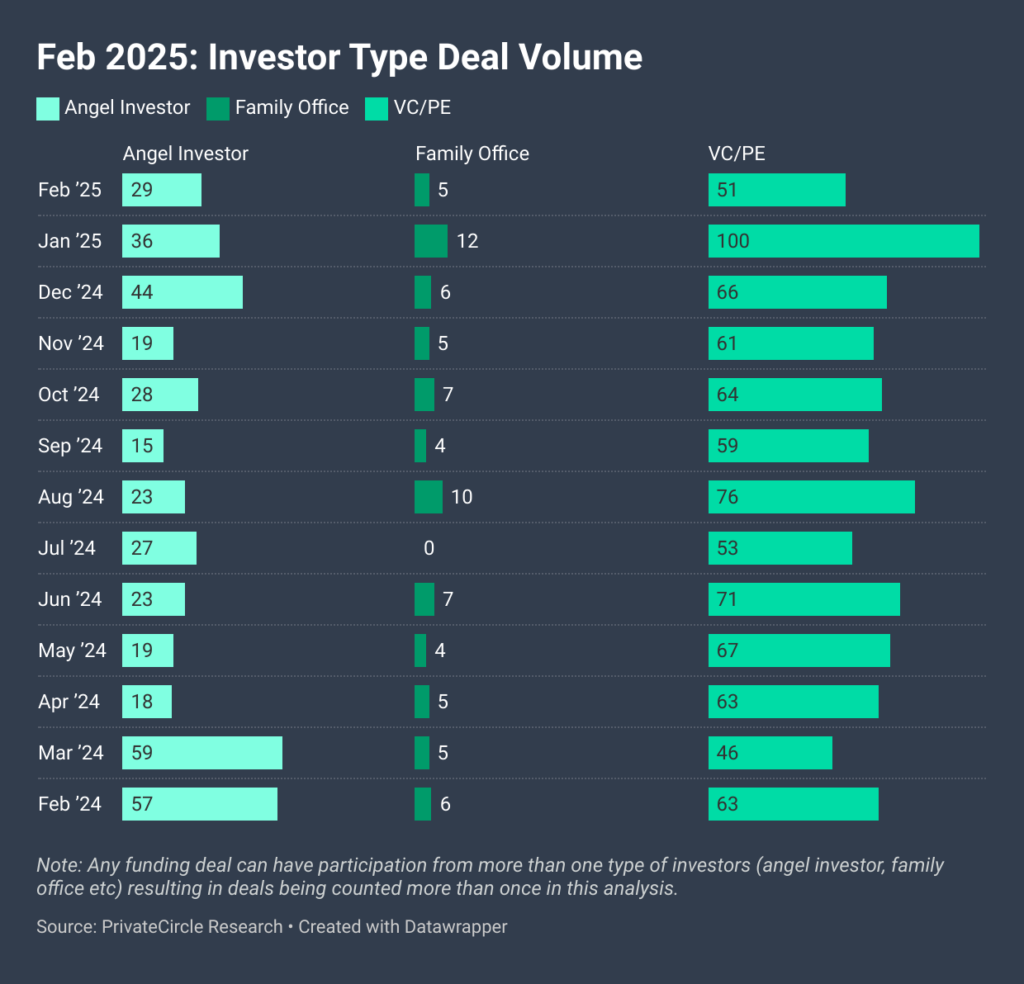

Who Invested the Most?

- VCs and Private Equity firms led with 51 deals

- Angel investors followed with 29 deals

- Family offices had 5 deals

Angel investors remained consistent, while family office investments dropped slightly.

Tier 1 vs. Tier 2 & 3 Cities: A Big Gap

- Tier 1 cities raised ₹9,817 crore, a huge jump from January’s ₹113 crore.

- Tier 2 & 3 cities secured ₹513 crore, showing steady but smaller investment levels.

Despite some promising deals in smaller cities, the numbers clearly show that the biggest funding still happens in metro hubs.

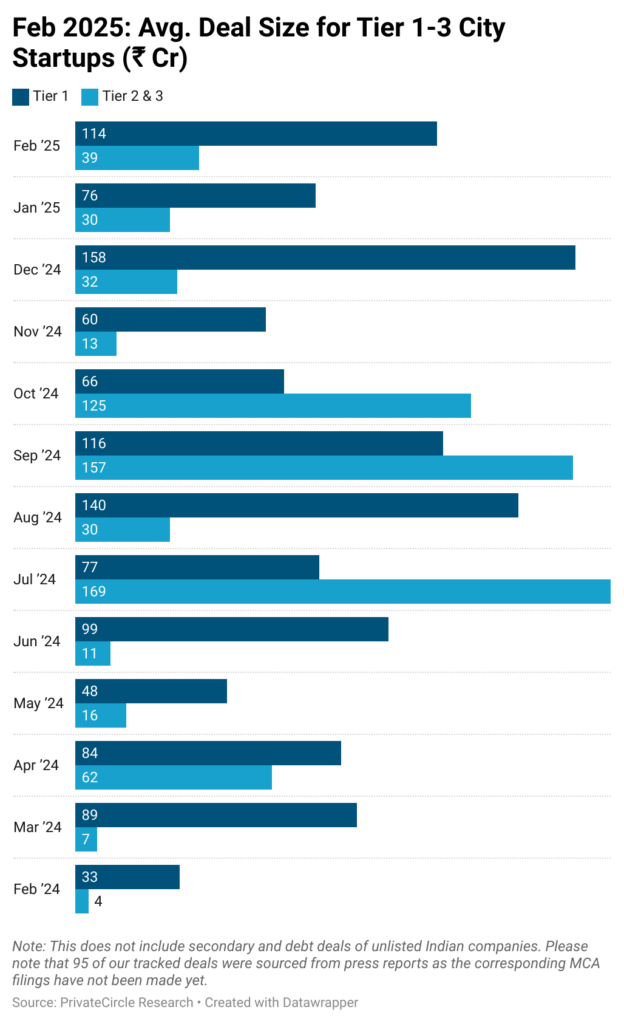

Average Deal Size: Big Cities Get Bigger Deals

- Tier 1 cities: ₹114 crore per deal

- Tier 2 & 3 cities: ₹39 crore per deal

This isn’t surprising. Private companies in big cities tend to be more established, attracting larger investments, while smaller cities still see smaller, more cautious bets from investors.

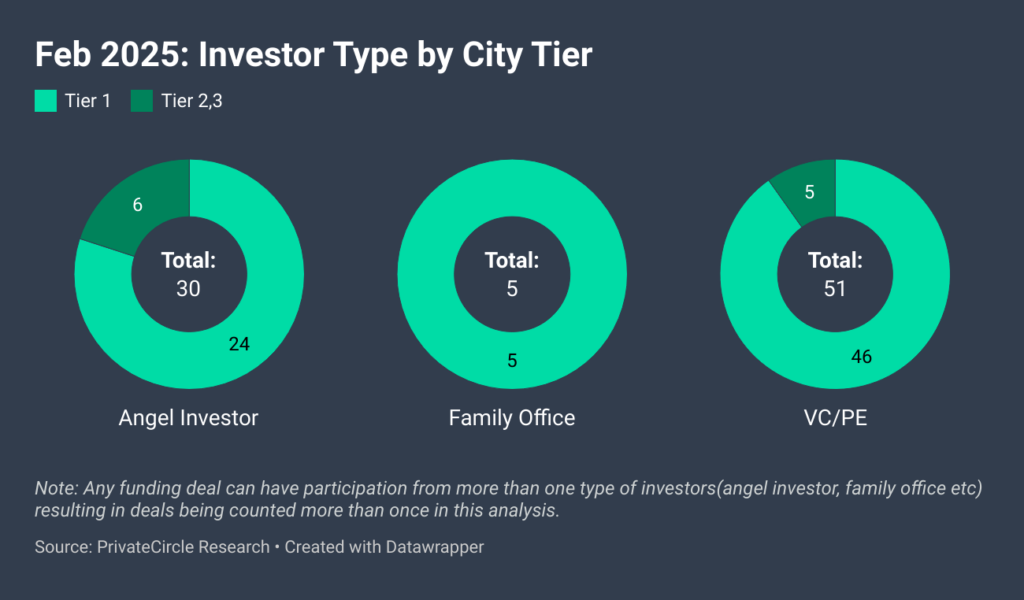

Who’s Investing Where?

- Tier 1 cities: VC/PE firms (46 deals), angel investors (24 deals), family offices (5 deals).

- Tier 2 & 3 cities: Angel investors (6 deals), VC/PE firms (5 deals).

This confirms that big investors still prefer metro areas, while angel investors are more willing to explore smaller cities.

What’s Next?

Despite fewer deals, February’s funding levels remained strong. Big cities continue to dominate, but smaller cities are gaining investor attention.

Trends to watch in the coming months:

- Will deal volume bounce back in Q1?

- Can smaller cities attract bigger investments?

- Will quick commerce and gaming keep getting massive funding?

We’ll find out in next month’s funding recap!