In the bustling world of travel gear, one brand has been making waves with its innovative designs and impressive growth trajectory.

Let’s explore Mokobara‘s performance in the fiscal year 2024 (FY24) and explore what sets this company apart in the competitive luggage market.

A Snapshot of FY24

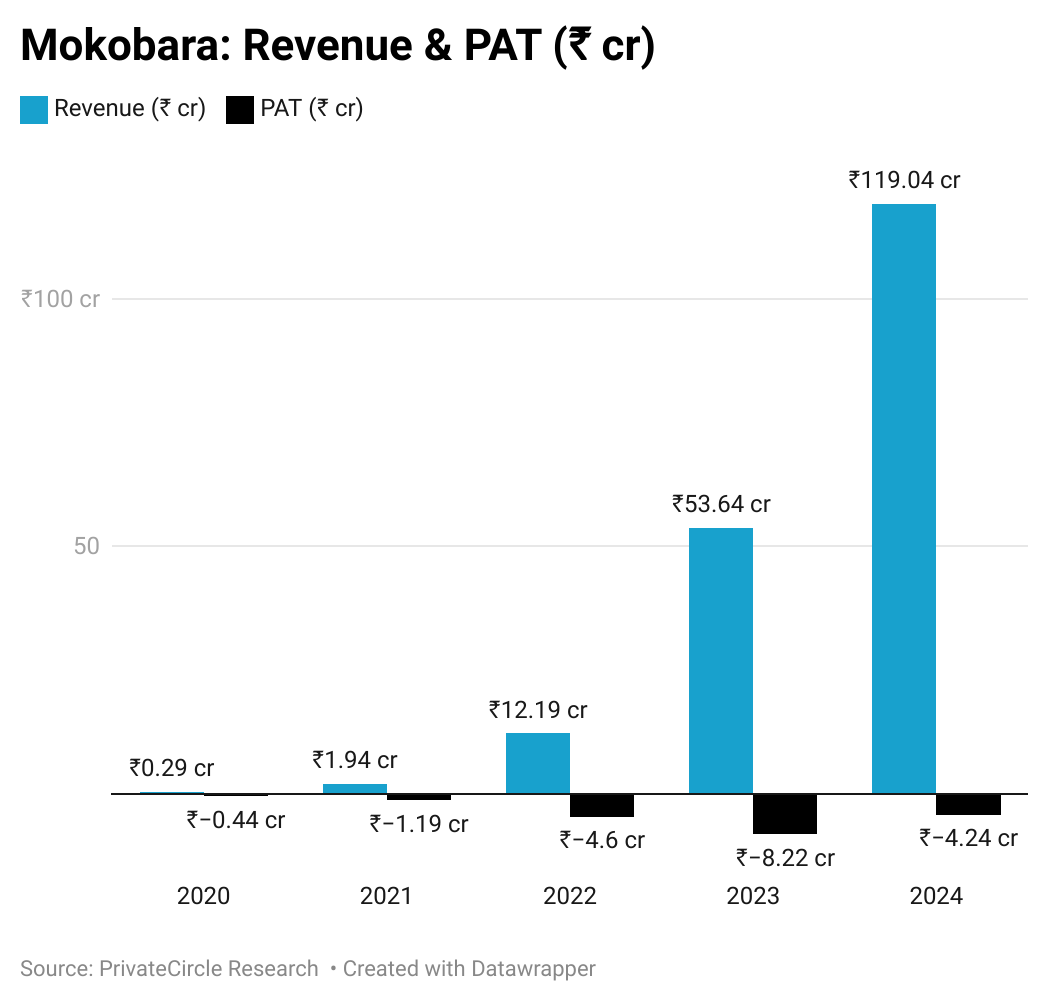

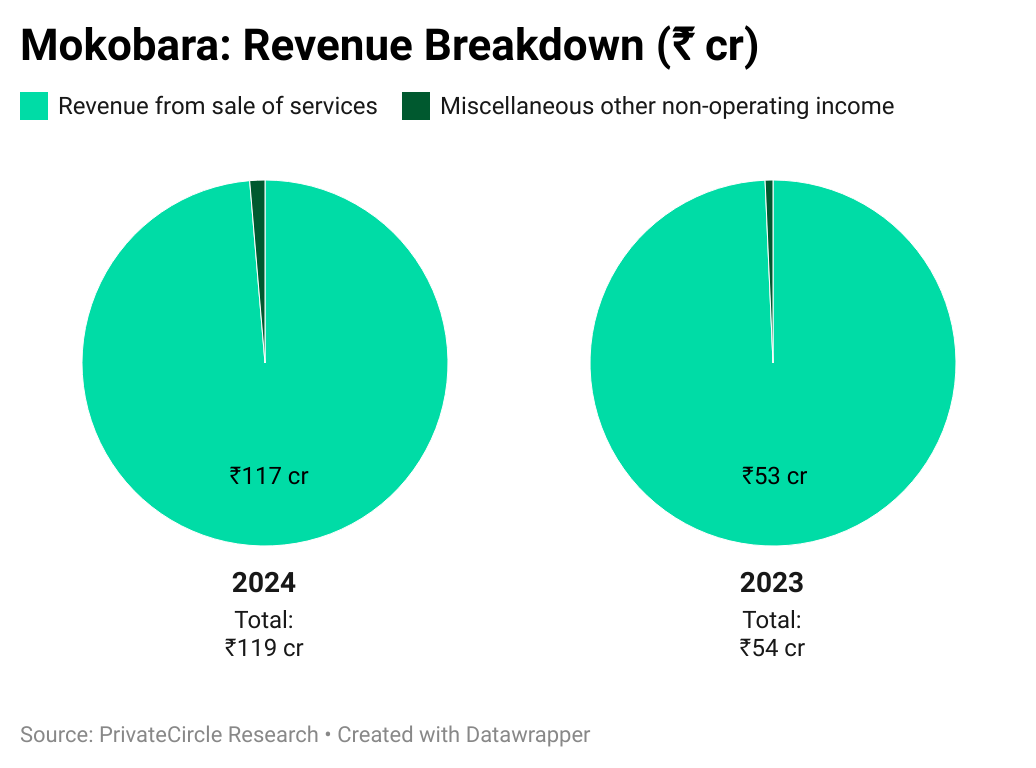

- Revenue: Mokobara’s revenue from operations surged to ₹117.44 crore in FY24, marking a 120% increase from ₹53.27 crore in FY23. Including other income, the total revenue stood at ₹119.04 crore.

- Profit After Tax (PAT): The company reported a loss of ₹4.24 crore in FY24, a significant improvement from the ₹8.22 crore loss in the previous fiscal year.

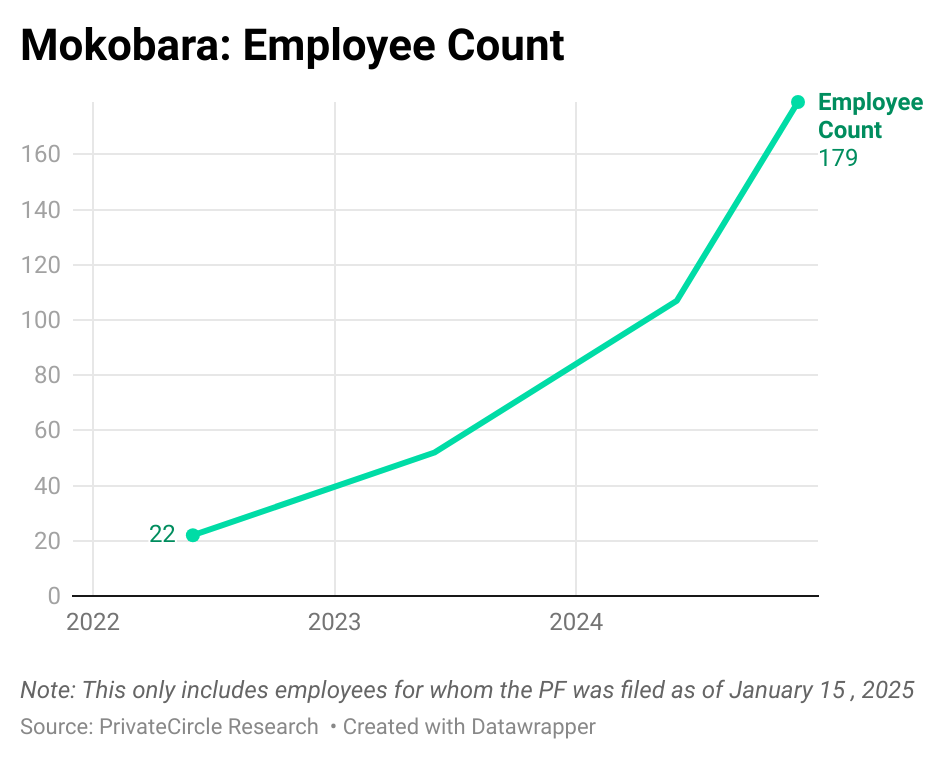

- Employee Count: By December 2024, Mokobara’s team had expanded to 179 employees, reflecting its growth and the increasing demand for its products.

About Mokobara

Founded in 2020 by former Urban Ladder executives Sangeet Agrawal and Navin Parwal, Mokobara is a D2C luggage brand that offers a range of products, including trolley luggage, backpacks, briefcases, handbags, and travel accessories.

The company’s products are known for their innovative features, such as built-in phone chargers, silent wheels, and inbuilt compression systems, enhancing the travel experience for modern travelers.

Revenue Growth

The significant increase in revenue underscores Mokobara’s successful market penetration and the growing popularity of its products among consumers.

Expenses Breakdown

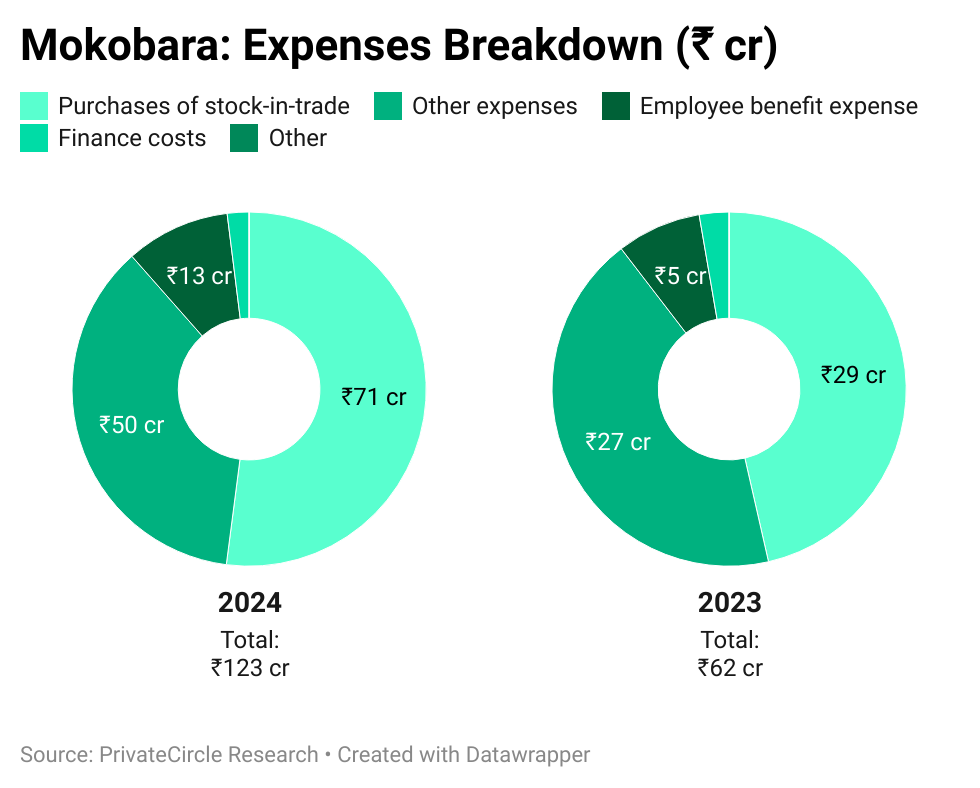

Purchases of Stock-in-Trade: The company invested ₹71.18 crore in stock purchases, up from ₹29.30 crore in FY23, indicating a strategic move to meet rising consumer demand.

Advertising Expenses: Marketing spend increased to ₹22.65 crore from ₹16.42 crore, reflecting efforts to enhance brand visibility.

Employee Expenses: Investment in personnel grew to ₹13.02 crore, up from ₹4.87 crore, aligning with the company’s expansion plans.

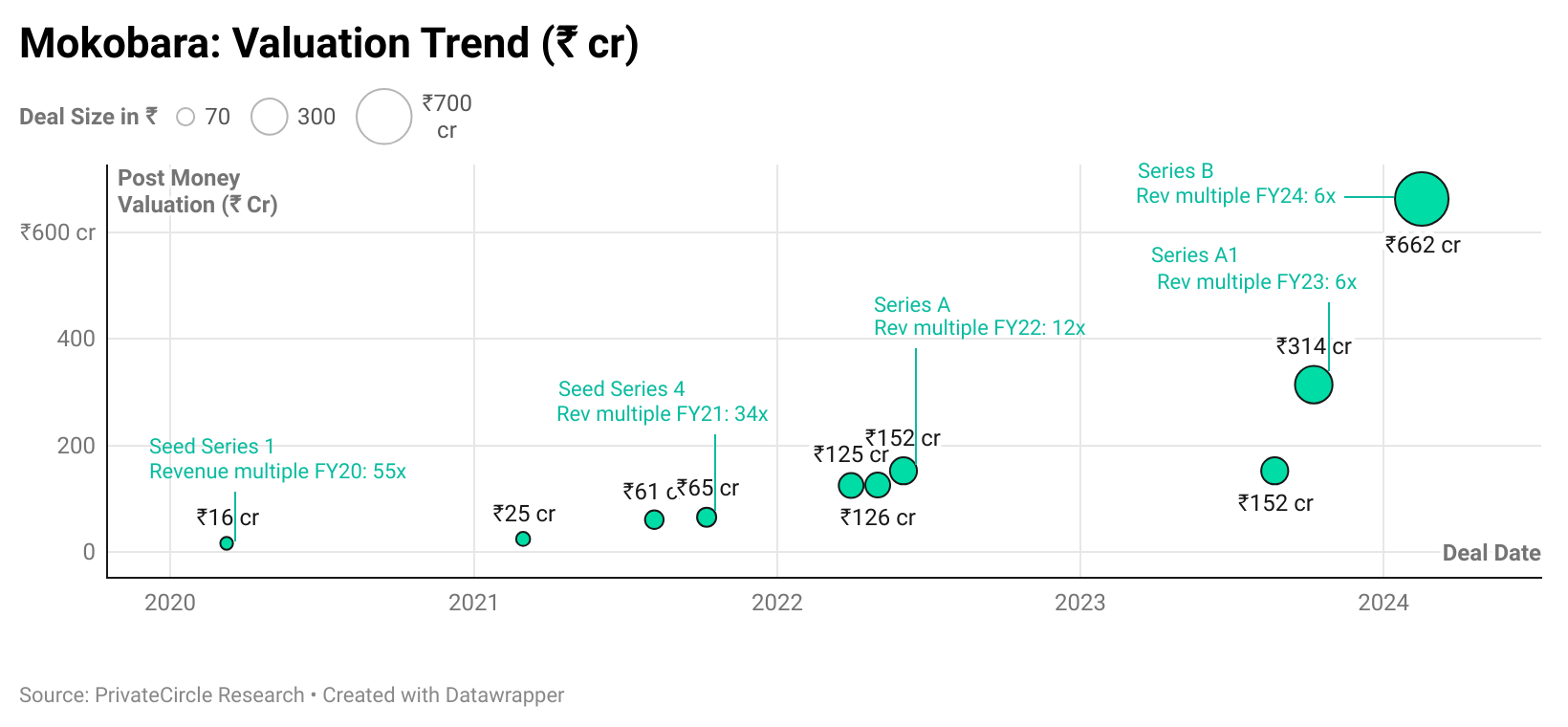

Funding Milestones

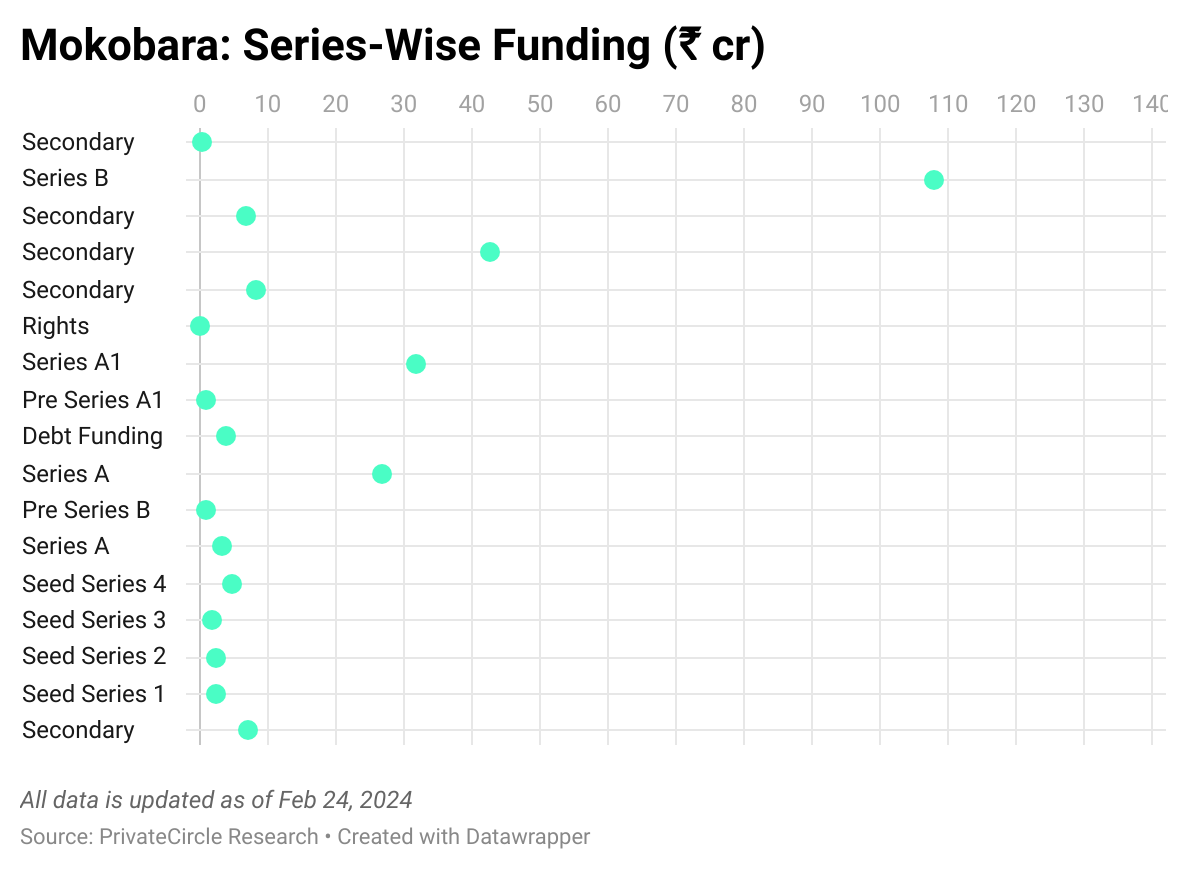

In February 2024, Mokobara raised $12 million in a Series B funding round led by Peak XV Partners, with participation from existing investors Sauce VC and Saama Capital.

This infusion of capital is aimed at accelerating retail and global expansion plans, including opening stores in the UAE.

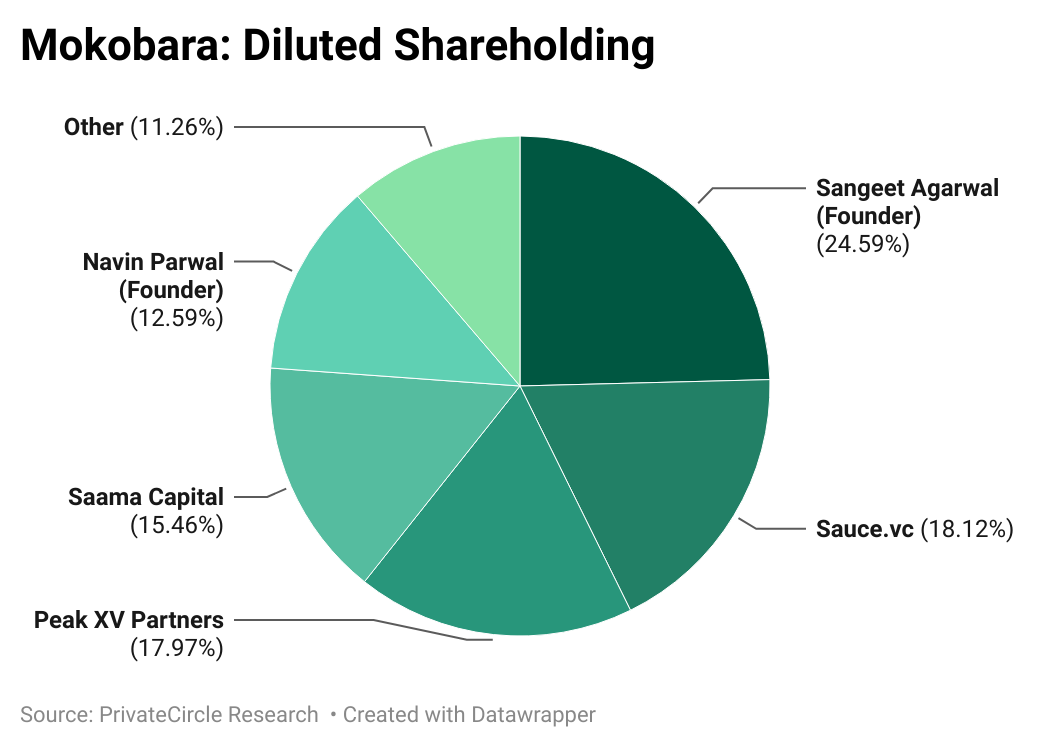

Who Owns Mokobara?

Mokobara has seen multiple funding rounds, and as a result, its ownership structure has evolved.

Institutional Investors: Peak XV Partners, Sauce VC, and Saama Capital hold significant stakes.

Founders & Early Employees: Founders Sangeet Agrawal and Navin Parwal have maintained a notable shareholding, but as with most high-growth startups, dilution is inevitable as they raise capital for expansion.

Employee Stock Option Plans (ESOPs): The company has likely reserved a portion of equity for employees to attract and retain top talent.

As Mokobara moves toward profitability, future funding rounds or a potential exit (IPO/acquisition) will impact its shareholding structure further.

Scaling the Workforce

Mokobara’s headcount reached 179 employees by December 2024, growing significantly over the last few years.

This increase suggests expansion across product design, retail operations, and customer service, aligning with its push for offline retail stores and international expansion (UAE launch plans).

Real-World Parallel: Brands like Away and Horizn Studios have taken a similar hiring approach, expanding their teams across product innovation and customer experience while maintaining a lean tech-focused backend.

Industry Context

The Indian luggage industry has experienced substantial growth, with sales increasing by 50-70% in 2022 compared to the pre-pandemic period of 2019.

Mokobara’s impressive performance and innovative product offerings position it well to capture a significant share of this expanding market.

Looking Ahead

With a strong foundation and a clear vision, Mokobara aims to achieve a revenue run rate of ₹180-200 crore in the current fiscal year and reach a ₹1,000 crore business milestone in the near future.

The company’s commitment to quality, innovation, and customer satisfaction continues to drive its success in the competitive luggage market.

Curious how we uncover in-depth company insights in just minutes? Try it yourself on PrivateCircle Research – privatecircle.co/research.

Start your FREE trial/demo today and unlock reliable data, intelligence, and insights on 3M+ private companies across 500+ data categories. Make informed decisions with confidence.

Stay ahead with expert analysis – follow us for the latest updates on India’s private markets.

Buildern Kitchens is a premier custom design company in Queensland specializing in high-quality Kitchen Cabinets, Wardrobes, and bathroom vanities

https://buildernkitchens.com.au/

Smart Flooring offers premium quality Tiles, Hybrid flooring, Artificial Grass, Composite Decking, Wall Panels, and dedicated installation service in Brisbane, Sunshine Coast, Gold Coast, Ipswich and Toowoomba.

Smart Flooring offers premium quality Tiles, Hybrid flooring, Artificial Grass, Composite Decking, Wall Panels, and dedicated installation service in Brisbane, Sunshine Coast, Gold Coast, Ipswich and Toowoomba.

https://smartfloors.com.au/

Buildern Kitchens is a premier custom design company in Queensland specializing in high-quality Kitchen Cabinets, Wardrobes, and bathroom vanities

https://buildernkitchens.com.au/