The Manipal Education and Medical Group family office, lead by chairman Dr. Ranjan Pai is a Venture Capital fund founded in 2016. It is primarily based out of Bengaluru, India.

MEMG family office 2024 report highlights;

- Combined Revenue

- Year-On-Year Investment Trend

- Sector Investments

- Founders’ Alma Mater

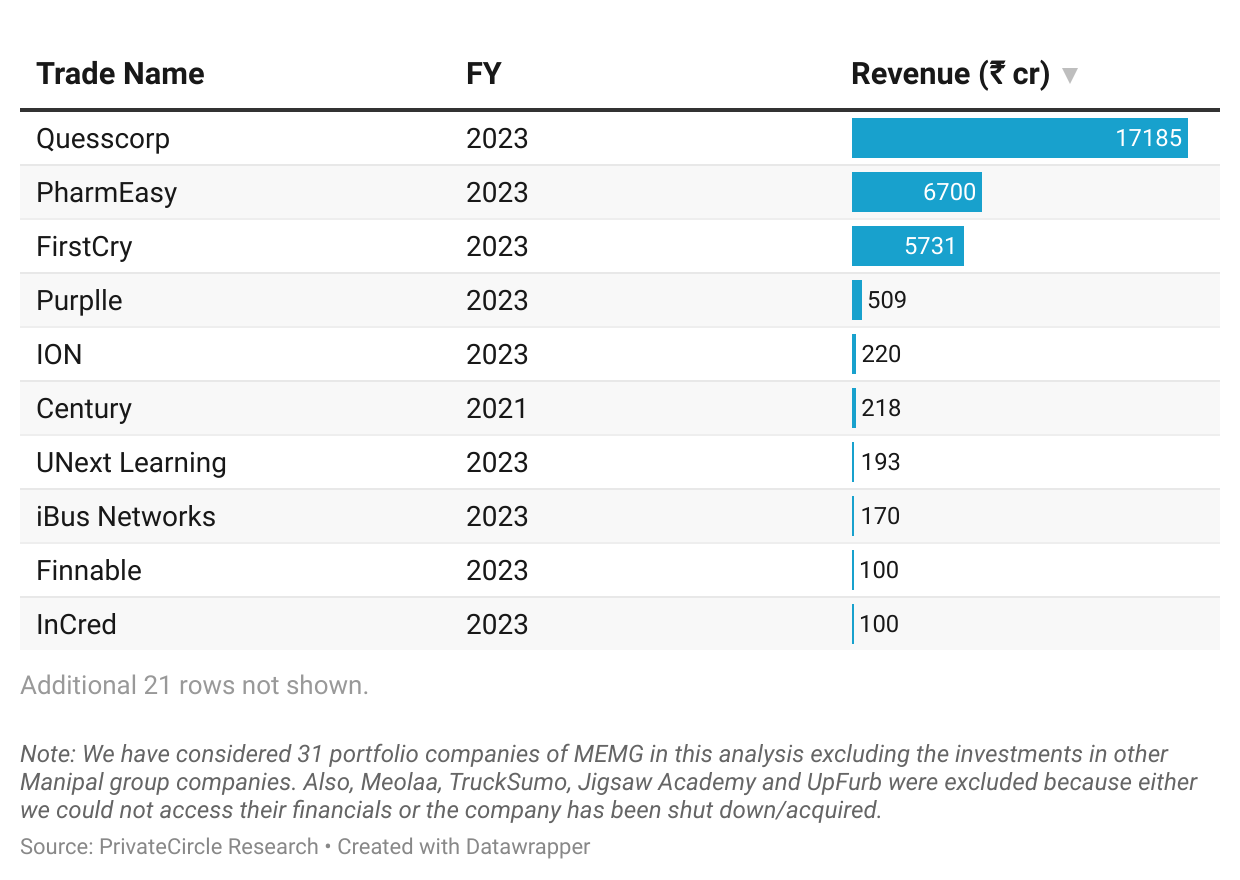

Combined Revenue

The portfolio generated a combined revenue of over ₹31,598 cr with Quesscorp, Pharmeasy and FirstCry topping the list.

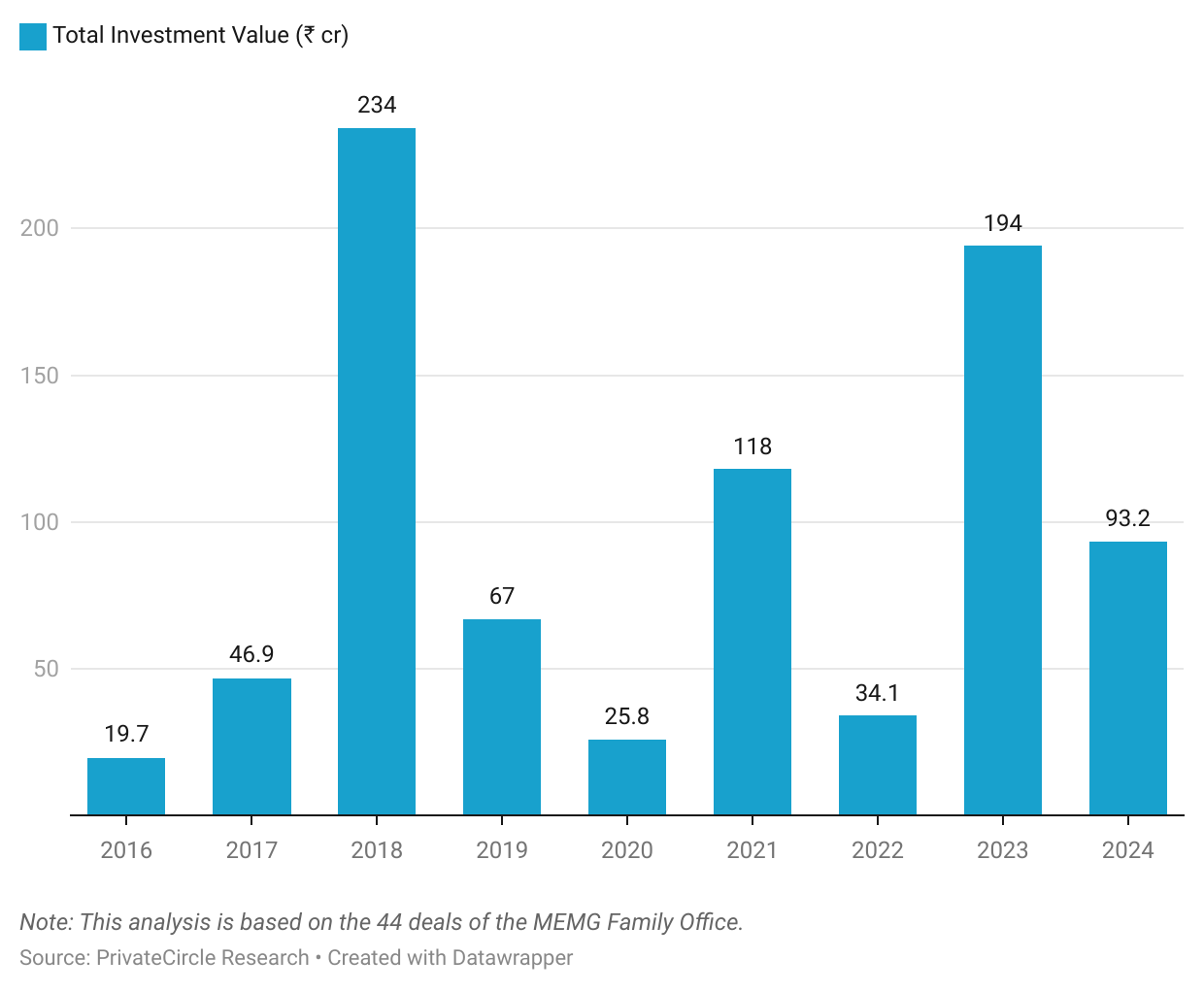

Year-On-Year Investment Trend

MEMG Family Office investment value saw spikes in 2018, 2021 and 2023. Showing the firm’s increased activity even in the middle of a funding winter.

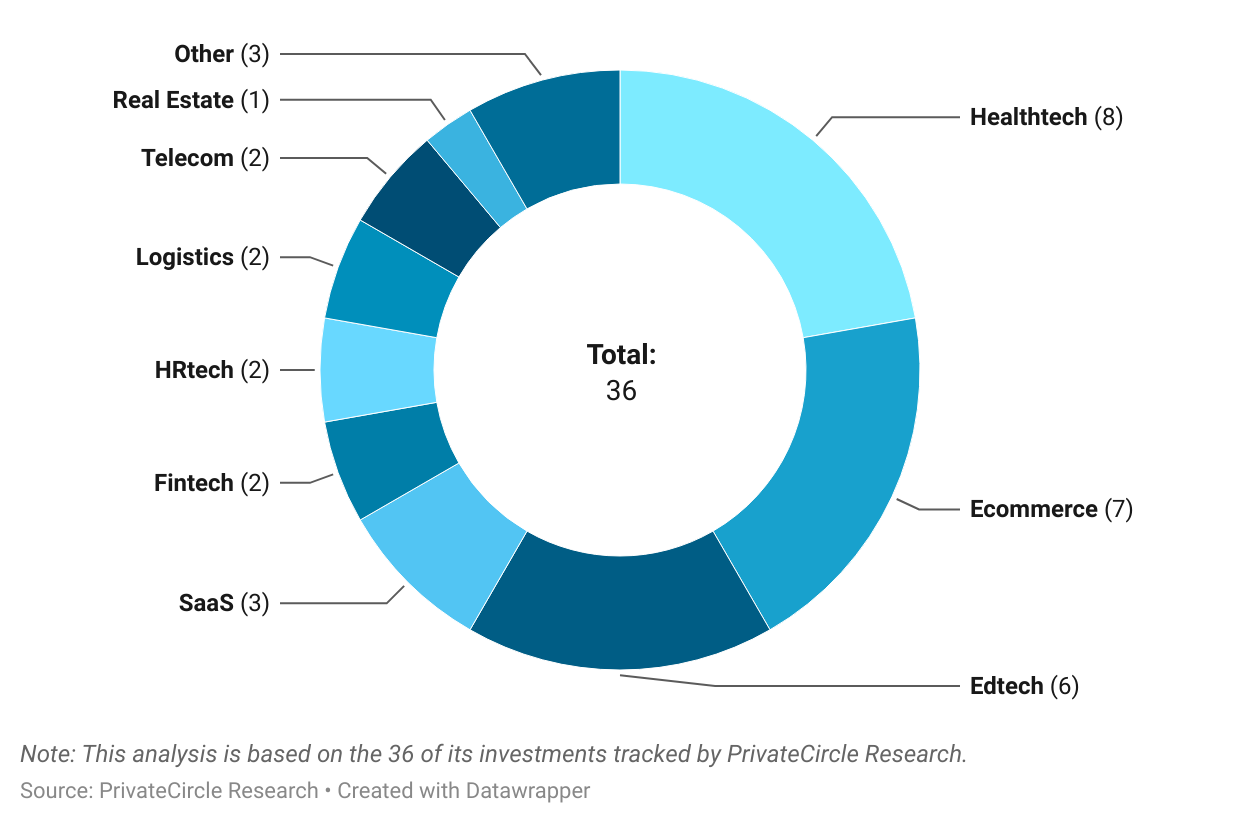

Sector Investments

MEMG Family Office has a sector-agnostic approach to investing with investments ranging from healthtech to e-commerce, edtech and real estate.

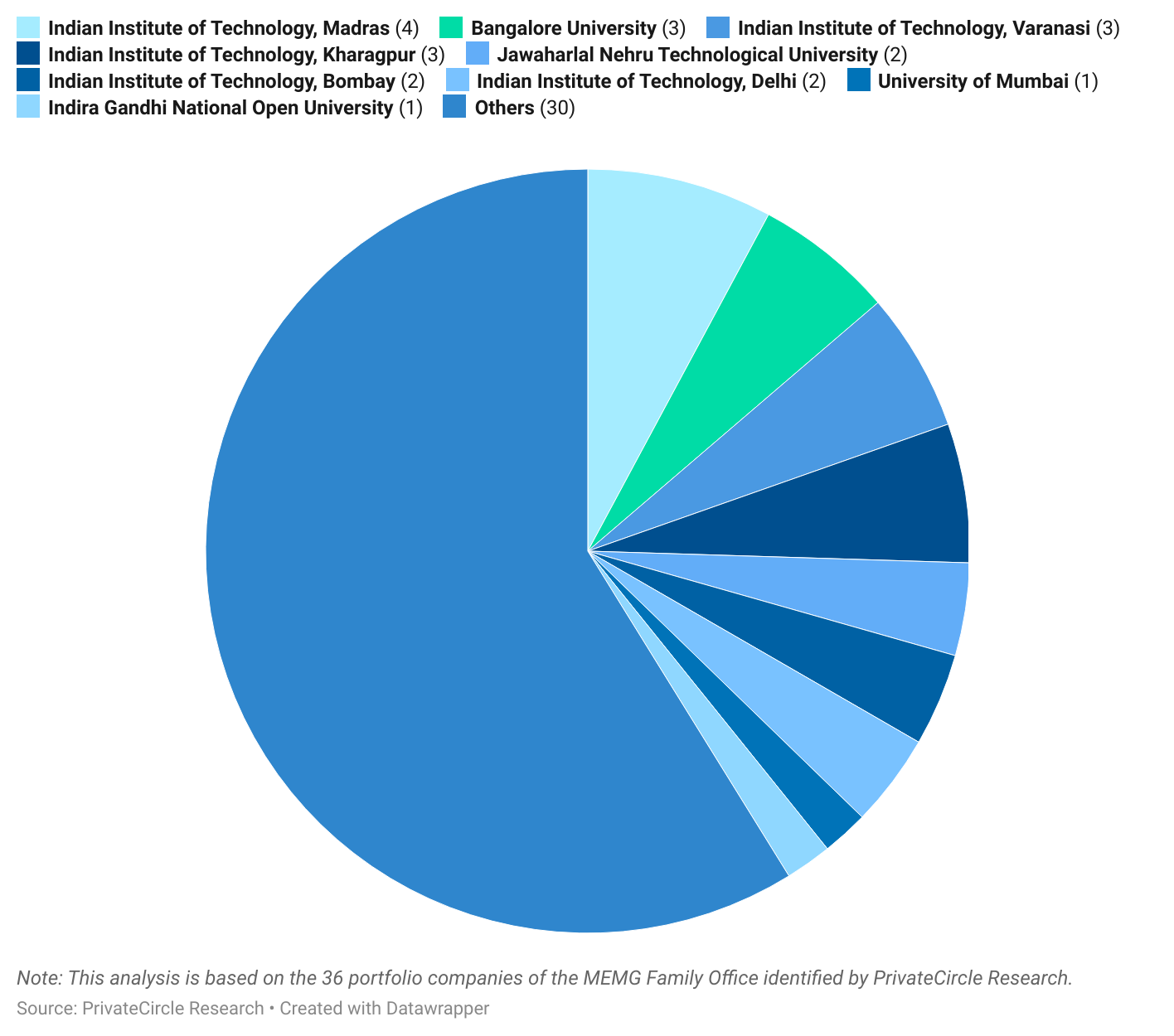

Founders’ Alma Mater

About 30% of founders in the MEMG Family Office portfolio came from the Indian Institutes of Technology.

Only 14 out of the 46 founders went to Indian Institutes of Technology, while the rest came from National Institute of Technology and other state colleges.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.