Quick Background

It was a phenomenal 2021 in funding and growth among unlisted companies across subsectors in India. The high number of unicorn births and the unforeseen amount of funding for them has some side effects. These effects include industry concentration that can distort the markets. With some of these even being discussed in the parliament, we think it is time to take a step back and see how much concentration has panned across some sub-sectors. Of course as with most of our other analyses, privatecircle.co provides all the necessary information to conduct such research independently. We invite you to give it a try.

Measuring industry concentration: Index definition

Industry concentration is measured using several metrics including the concentration index or Gini index or the Herfindahl-Hirschman Index (HHI). We prefer the HHI because it helps us see the sub-sectors more clearly and has the reasonable acceptance of its ranges beyond which we can consider the industry as concentrated. Here is the basic definition of HHI

HHI = s1^2 + s2^2 +...sn^2Where s is the % share of a particular company in the market with n companies. So the theoretical limit of HHI, in case a single company operates with 100% market share, would be 10000. In general HHI above 2500 can be considered a concentrated market. Although HHI is used for market share, we think the same index can be used for even funding. It will give us clues on investor behavior in chasing already well-funded companies, and HHI will measure funding concentration.

Data considered for measuring the concentration

For this exercise we only chose companies in 3 subsectors, namely learning platforms, personal care products, and regular IT services. Among these we are only concerned with the unlisted entities, that sets aside the listed players in each of these sub-sectors and helps us understand the concentration only in the unlisted private sector space. We also excluded entities that are subsidiaries of foreign companies, which may have unlimited resources from the parent or may already be having a ready set of products/services, to begin with. As this phenomenon is relatively new, we only took companies that were incorporated in the last 11 years and excluded ones that were incorporated in 2020. The metrics that we picked included both the revenues in the trailing FY and the total amount raised by the company till date and had filed with MCA. So the disclaimer here is, that the data will show slightly dated trends, but would still be useful for our exercise.

First, let us look at the distributions of both the total amount raised and the revenue shares of the companies in these sub-sectors. There are 3 graphs below that you can interact with on the data wrapper for the learning platform, personal care products, and IT services and even download the data as needed.

- Learning platform (133 companies) had high funding concentration (HHI 4250) and market concentration (HHI 3298)

- Personal care products (91 companies) had low funding concentration (HHI 1377) and market concentration (HHI 343)

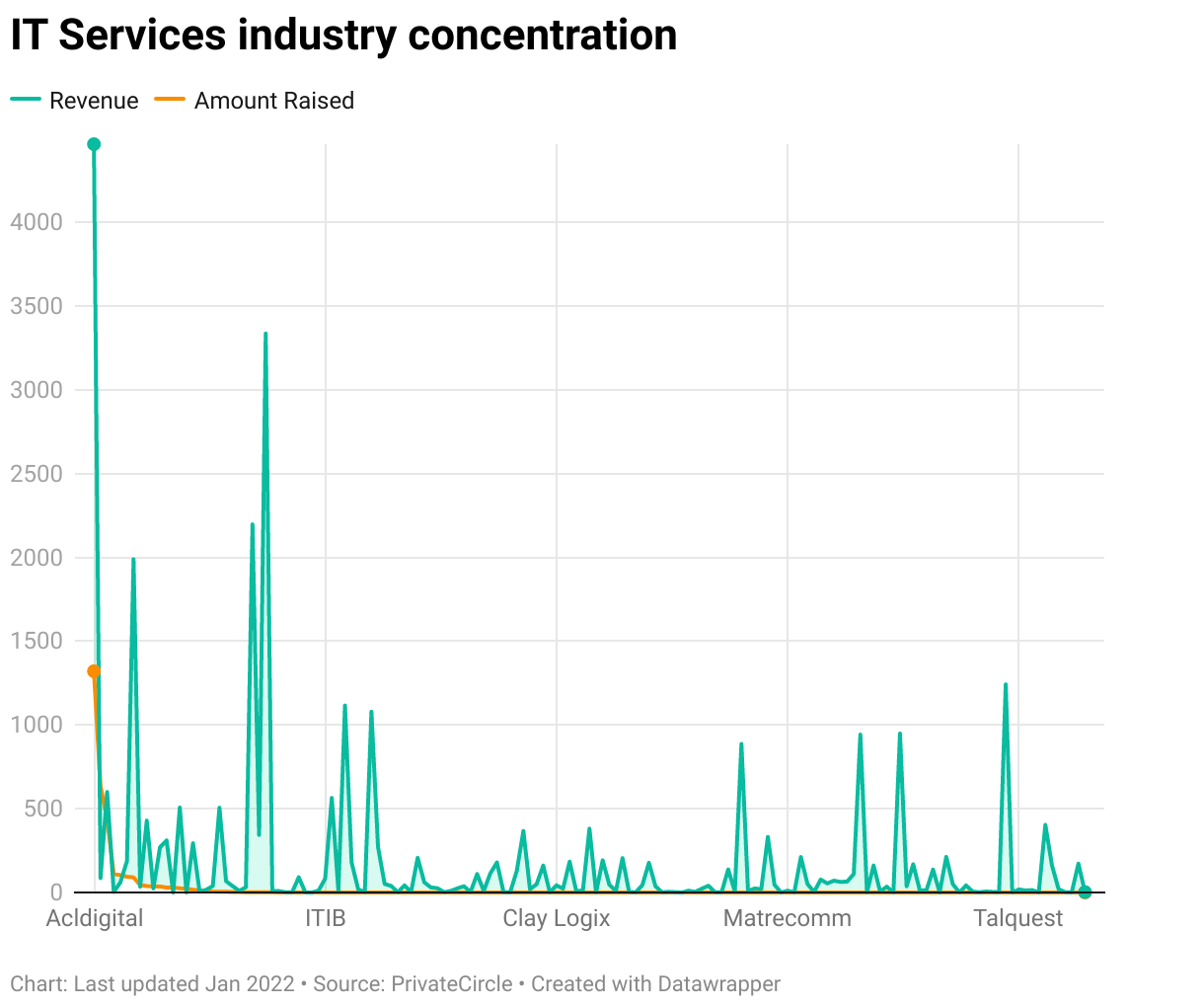

- IT Services (151 companies) had moderate funding concentration (HHI 2444) and low market concentration (HHI 570)

Learning platform concentration

The learning platform with all the companies (names on the x-axis) and funding and revenues (Y-axis) is shown below. Clearly, the amount of funding cornered by the top 5-8 companies is humongous and the HHI values clearly represent that with 4250 above.

Now to see if there are candidates that could potentially be M&A targets cannot be seen easily above. So we simply exclude these top 5 funded companies (BYJUS, Unacademy, Whitehat, Vedantu, upGrad) and get a clearer picture below.

We can now clearly see that companies that are clocking superior revenue, with reference to the amount of funding they have received, appear as peaks in the figure below. These indicate potential targets, for the unicorns and other interested parties, as they have grown better. Our conviction is that these companies would have already gone through the M&A evaluations at the top 5 funded companies or are in advanced stages. In fact, companies like Greater Learning and Whitehat are already acquired by BYJUS.

Now if we look at the other 2 sectors, namely personal products, and IT services, their graphs look like the below.

Personal care products and IT Services concentration

We can see there are too many IT Services companies in the unlisted space that do pretty well, even with no funding. Similarly, the personal care products space also has a lot of intermittent peaks, showing companies that are growing well. These 2 sectors indicate that the long tail of growth is possible across the board and there is potential for roll-up strategies, instead of single acquisitions.

Roll-ups as a strategy

Roll-ups are an interesting way to push valuations up beyond what can be potentially commanded by individual companies themselves. In roll-ups, similar (but presently fragmented) companies can consolidate and potentially integrate and tap the public markets. We are convinced that this approach is viable, especially in complementary/adjacent categories, where companies can distribute their products/services beyond their current reach and also command higher valuations.

In such a scenario, PE players can be expected to become active in pursuing these roll-ups, particularly in the personal care products / D2C space. We made some guesses last year on who could become a “Thrasio for India” player, but last week Thrasio themselves entered India with a $500 mn investment. So we can expect the space to consolidate with many players on the field.

IT services have historically been resistant to roll-ups, but with the newfound public market interest in SaaS and other allied sectors, it is possible to happen in the sector as well.

We just did the exercise as an illustration, as you can imagine, the same analysis can be done for many sub-sectors and also augmented with further data (like CAGRs, product/services overlap, promoter/investor holding, including larger public sector players, etc) available from privatecircle.co.