Introduction

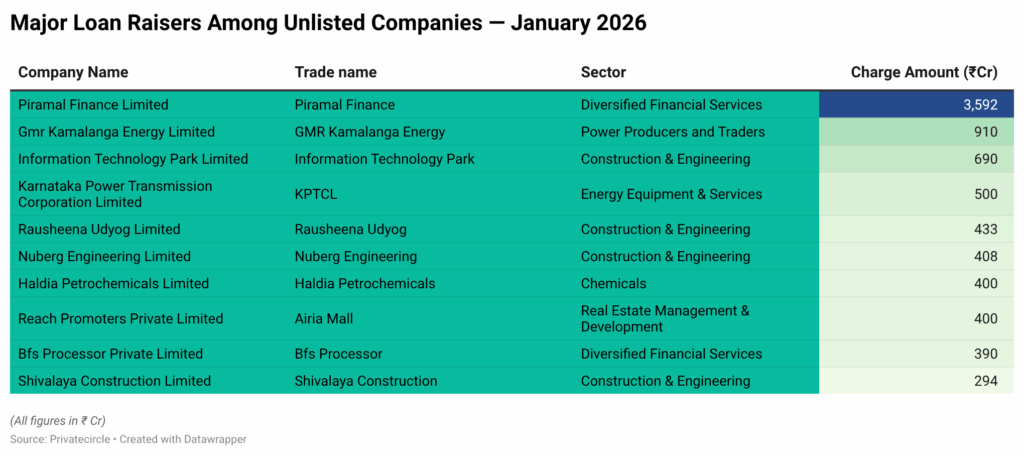

India’s unlisted corporate sector entered 2026 with sustained momentum in institutional borrowing. January witnessed sizeable debt raises across financial services, power, infrastructure, and construction, underscoring continued lender confidence in asset-backed and cash-generating private companies.

As public market volatility persists and equity fundraising remains selective, debt has emerged as a key growth and refinancing tool for unlisted corporates. Tracking these borrowings offers early insights into capital allocation, sectoral priorities, and balance sheet strategies within India’s private markets.

Understanding the Dataset

The data is sourced from MCA charge filings, which record secured loans raised by unlisted companies from banks, NBFCs, and other financial institutions.

These filings help track:

- Institutional credit deployment in private markets

- Sector-wise leverage trends

- Company-level balance sheet expansion

January 2026: Major Loan Raisers?

Key Insights from the Data

🔹 Borrowings are concentrated at the top, with NBFCs accounting for a significant share of total loan value

🔹 Financial services borrowing reflects refinancing and onward lending, not speculative expansion

🔹 Energy and transmission assets continue to attract long-term institutional capital

🔹 Construction & engineering companies dominate mid-sized borrowings, indicating steady project execution

🔹 Real estate participation remains selective and asset-backed, focused on income-generating properties

Sector-Level Observations

- Financial Services: Large-ticket loans signal balance sheet scale-up and capital recycling

- Energy & Power: Stable credit flow into operational and regulated assets

- Infrastructure & Construction: Consistent project-linked funding demand

- Chemicals & Real Estate: Selective but meaningful institutional participation

Closing Thoughts & Conclusion

January 2026 reinforces a clear trend: private market credit in India remains resilient and selective. Institutional lenders continue to favour unlisted companies with operational assets, predictable cash flows, and execution visibility.

As debt increasingly complements equity in private markets, tracking charge filings offers a powerful lens into early-stage leverage build-up, sector momentum, and institutional risk appetite, often well before these trends surface in public disclosures.

PrivateCircle provides deep visibility into India’s unlisted ecosystem by combining MCA filings, financials, ownership data, credit history, and transaction intelligence, all on a single platform.