Welcome to the ‘It’s-a-big-deal’ blog, powered by PrivateCircle Research. It’s-a-big-deal is a video series where we dive into the world of Indian private markets and analyze deals to provide context with insights.

In this episode, we will review the deals that took place between 16th April and 2nd May 2023, highlighting the key players and industry trends. The video episode 4 is available on Linkedin and YouTube.

Notable PE/VC Deals

Sterlite Power (Serentica Renewables India) makes it to the top of the list which raised over ₹2,000 cr or $250 million from KKR India Private Equity in a PE deal.

This company seems to be a wholly owned subsidiary of a Mauritius based company, thus will be a roadblock for us to dig deeper. So let’s skip this for our analysis.

XpressBees (Busybees Logistics Solutions Pvt Ltd) secured a funding of approximately ₹327 cr or $40 million in a PE deal with Khazanah Nasional Berhad. KNB is the sovereign wealth fund of the Govt of Malaysia. The fund with nearly $40 billion of assets under management.

Deals Spread Across the Industries

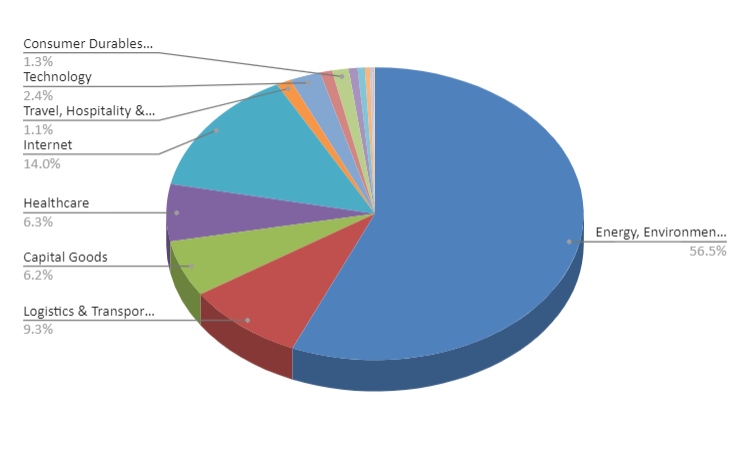

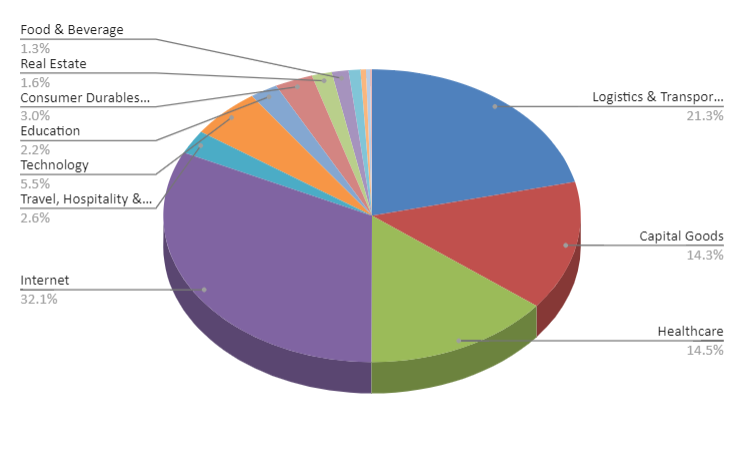

Before we explore the individual deals deeper, let’s take a look at the overview of the industry-wise distribution of deals in this timeframe.

Energy, Environment, and Utilities has the majority (56.5%) share among the others, accounting for more than half of the total. To eliminate skewness, let’s exclude this from our analysis and see what we get.

Internet emerges as the highest at 32.1%, with Logistics & Transport following at 21.3%, followed by Healthcare at 14.5%, Capital Goods at 14.3% and others.

The XpressBees PE Deal

Amidst the e-commerce boom in India, XpressBees emerged as an independent entity in 2015. The company has achieved a successful track record, with its revenue doubling from ₹1,000 cr in FY21 to over ₹1,900 cr in FY22. This remarkable growth, coupled with positive EBITDA, positions Busybees for potentially profitable exits.

Comparative Analysis of Logistics Startups

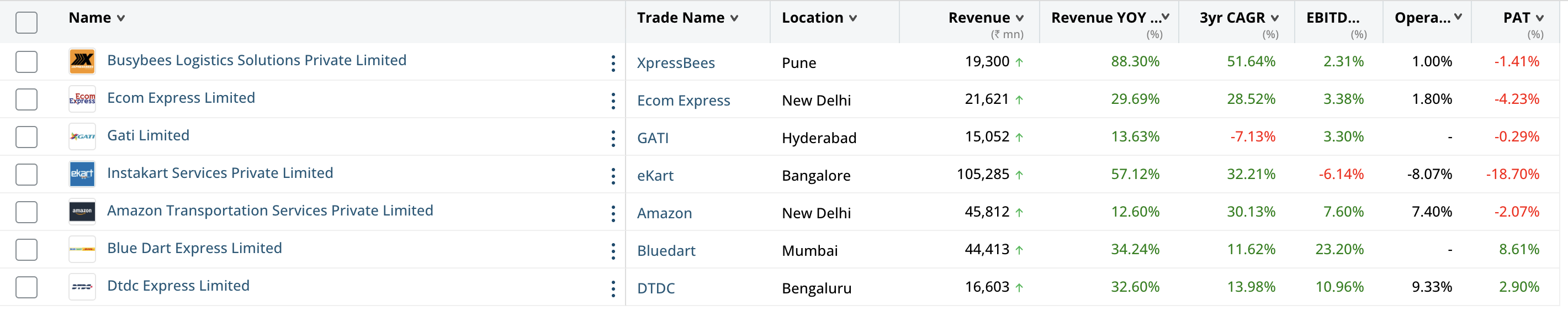

To gain a better understanding of Busybees’ performance in comparison to its peers, let’s use ‘Profiled Companies’ list component in our PrivateCircle Research dashboard. We’ll focus on logistics companies that started as e-commerce-focused ventures and later expanded their services.

Operating EBITDA percentage, which reflects the operational efficiency of a business will serve as a key indicator for this analysis.

eKart, the in-house logistics arm of Flipkart (Instakart Services Pvt Ltd), leads the pack with revenue surpassing Busybees by over five times. In FY22, eKart generated revenue exceeding ₹10,000 cr with a remarkable YoY growth rate of 57%. Delhivery, another prominent player, recorded revenue of over ₹7,000 cr and successfully went public last year.

Amazon Transportation Services Pvt Ltd, providing logistics services to Amazon merchants, generated revenue exceeding ₹4,500 cr with the highest positive EBITDA among the listed companies.

Comparing these logistics startups based on operating EBITDA percentage, Amazon continues to outperform its competitors. However, it is important to note that the difference between the ‘Operating EBITDA%’ and ‘EBITDA%’ is typically small.

Inclusion of Incumbent Logistics Companies

To provide a holistic view, we have added some of the incumbent logistics companies such as DTDC, Gati, DHL, and BlueDart to our analysis. These companies have been operating in the logistics sector for some time now and have also started catering to the e-commerce industry.

DHL and BlueDart fall in the middle range with revenues around ₹5,000 cr, while DTDC and Gati feature at the lower end with approximately ₹1,500 cr in revenue. Interestingly, all four incumbents maintain positive EBITDA, with BlueDart leading the pack at 23%+.

This suggests that logistics companies often require several years, if not decades, to achieve optimal efficiency.

Trends Analysis and IPO Potential

Let’s analyze additional trends, the three-year CAGR and the five-year operating EBITDA percentage trend. These insights will help us understand Busybees’ performance and growth potential.

Busybees stands out with an impressive 52% CAGR and consistent improvement in operating EBITDA over the past five years. These factors likely influenced the recent PE deal and indicate Busybees’ potential IPO preparations.

Conclusion

This episode of ‘It’s a big deal’ highlights the top PE/VC deals in the Indian private markets with a particular focus on Busybees Logistics Solutions Pvt Ltd.

We explored the industry-wise distribution of deals, compared logistics startups and incumbent companies, and analyzed performance indicators such as revenue and operating EBITDA percentage.

The trends observed indicate Busybees’ strong growth potential and preparation for a potential IPO. Stay tuned for future episodes where we will bring you more exciting deals to discuss.

Disclaimer: The content provided in this article is for educational and informational purposes only and does not constitute professional financial advice. The opinions expressed herein are those of the author and do not necessarily reflect the views of the company / organization. Please consult a qualified financial professional prior to making any financial decisions.

Read more blogs of this series;

Epsiode 1 | 27 Feb – 05 Mar 2023

Episode 3 | 13 Mar -15 Apr 2023

Watch more of the ‘It’s a big deal’ video series episodes;

Epsiode 1 | 27 Feb – 05 Mar 2023