Welcome to the ‘It’s-a-big-deal’ blog, powered by PrivateCircle Research. It’s-a-big-deal is a video series where we dive into the world of Indian private markets and analyze deals to provide context with insights.

In this episode we will look into the significant deals that happened between 13th March and 15th April of 2023.

Try out the PrivateCircle Research dashboard through the free trial, where you can explore the latest trends and developments in the Indian private market landscape with ease and do your own analysis like this one.

Notable PE/VC Deals

Topping the list of impressive investment activities in the Indian private markets is Lenskart, an online eyewear retailer, which raised a staggering ₹4,000+ crore or $500 million.

Following closely is DMI Finance, a non-banking financial company (NBFC) specializing in digital lending, securing ₹3,000+ crore or $400 million. Both deals are noteworthy, as they involve substantial investments from foreign institutional investors.

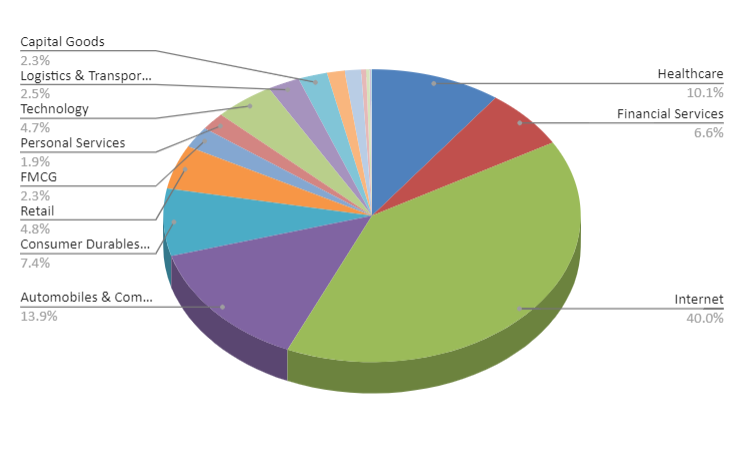

Deals Spread Across the Industries

The Internet sector accounts for the largest share, raking in 40% of the deals. Automobiles & Components come in second at 14%, followed by Healthcare at 10% and others.

These statistics shed light on the growing prominence of the digital landscape and the evolving needs of the Indian market.

A Promising Non-Institutional Deal

Among the notable non-institutional deals, Eatfit stands out, having raised ₹300 crore or approximately $37 million in venture capital funding.

Previously a part of the health and fitness startup Cure.fit, Eatfit became an independent entity in 2020. This success story piques curiosity about its progress and funding journey. It also serves as an indicator of the recovery of the cloud kitchen market, which suffered significantly during the pandemic.

The Cure behind Eatfit

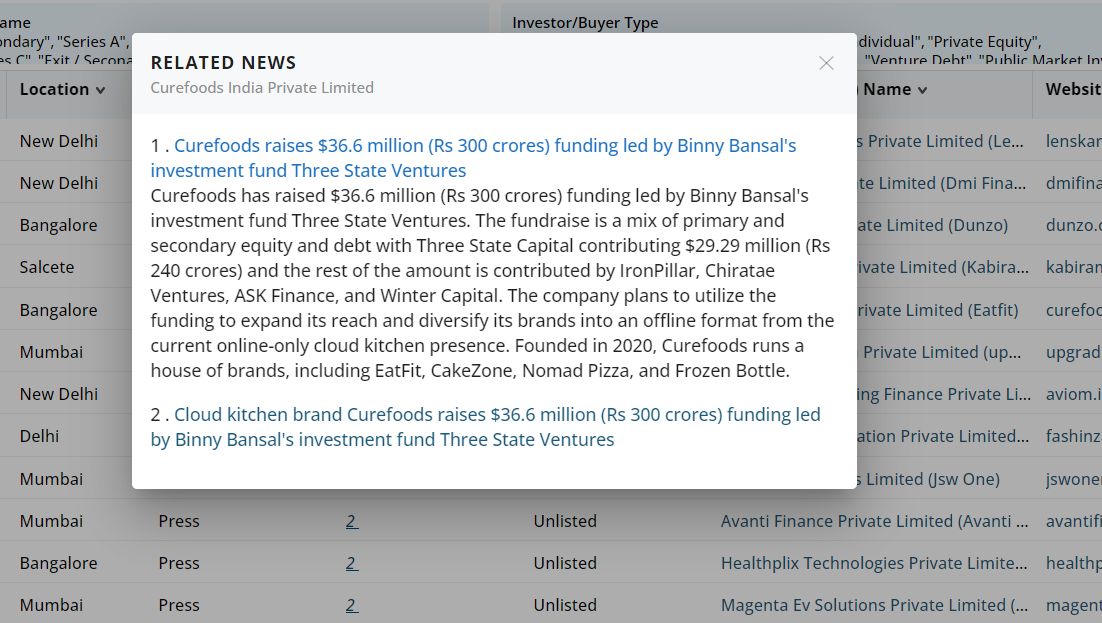

Curefoods, the registered company behind the Eatfit brand, operates cloud kitchens across various cities in India. To gain a deeper understanding of Eatfit’s investors, it’s worth examining how the deal was covered in the news.

PrivateCircle Research provides a convenient feature that lets you access the latest news related to any entity, which is one among the 500+ data-points that is accessible to everyone on the platform.

The round was primarily led by Three State Capital, the investment fund of Binny Bansal, co-founder of Flipkart, the renowned Indian e-commerce platform. It will be interesting to see Binny Bansal’s other investments.

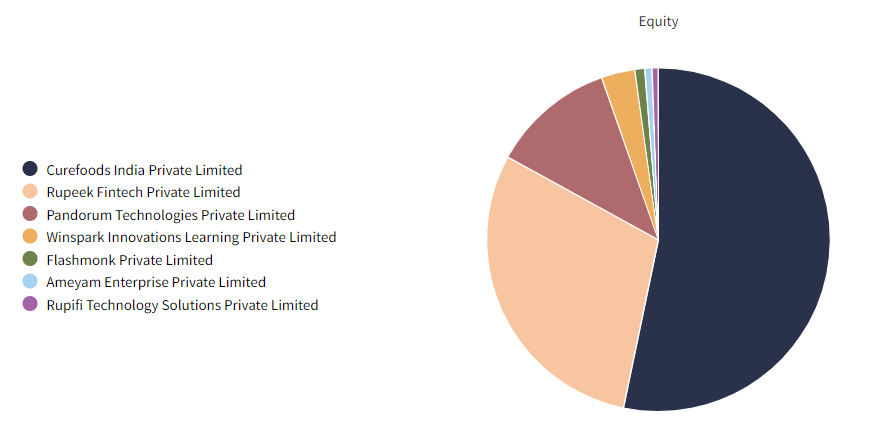

Binny Bansal’s Investment Portfolio

Known for his entrepreneurial success with Flipkart, Binny Bansal has made notable investments through Three State Capital. With a total investment of ₹120 crore, Cloud kitchens emerge as the primary focus of his portfolio.

Eatfit appears to be his most significant bet, with an investment nearly double that of his second-largest venture and accounting for more than half of his total investment. Ankit Nagori, the founder of Eatfit, was previously part of Flipkart’s core team and served as its Chief Business Officer for over six years.

Eatfit’s Performance and Growth Trajectory

To assess Eatfit’s performance relative to comparable businesses, let’s delve into their financials. In their first year of operations, Eatfit recorded a revenue of nearly ₹2 crore. Considering that they were incorporated in October and had only five months of business affected by the pandemic, this figure is commendable.

However, their revenue skyrocketed in FY 2022, reaching approximately ₹94 crore. While Eatfit remains in the early stages of its business journey and operates at a loss, this significant revenue jump indicates a robust recovery and promising growth trajectory for the sector.

Investment and Valuation

Eatfit has raised an impressive capital of around ₹830 crore through multiple funding rounds. Apart from various venture capitalists, Bollywood actress Nora Fatehi has also invested in Curefoods.

As of June 2022, the last disclosed valuation of the company stood at $247 million post-money. The latest funding round will likely affect their valuation, which we eagerly await to discover through the company’s filings.

Competitors in the Cloud Kitchen Market

Curefoods faces competition from other cloud kitchen brands, including Faasos, Box8, Freshmenu, Hygiene Big Bite, and Kouzina.

Faasos emerges as the revenue leader, generating over ₹900 crore, making it the oldest player on the list. Box8 follows with ₹200+ crore, while Curefoods ranks third with its impressive revenue of ₹94 crore.

Conclusion

This episode showcases the magnitude of recent PE/VC deals in the Indian private markets. Lenskart and DMI Finance secured substantial investments, while Eatfit’s independent success story signifies the recovery and growth of the cloud kitchen market.

With remarkable revenue growth and significant capital raised, Eatfit demonstrates the potential of the sector. Keep an eye on Curefoods as it competes with other established players in the cloud kitchen market.

Disclaimer: The content provided in this article is for educational and informational purposes only and does not constitute professional financial advice. The opinions expressed herein are those of the author and do not necessarily reflect the views of the company / organization. Please consult a qualified financial professional prior to making any financial decisions.

Read more blogs of this series;

It’s a big deal: Epsiode 1 | 27 Feb – 05 Mar 2023

It’s a big deal: Episode 2 | 06 -12 Mar 2023

Check out the ‘It’s a big deal’ video series episodes;

It’s a big deal: Epsiode 1 | 27 Feb – 05 Mar 2023