Welcome to the ‘It’s-a-big-deal’ blog, powered by PrivateCircle Research. It’s-a-big-deal is a video series where we dive into the world of Indian private markets and analyze deals to provide context with insights.

In this episode, our criteria includes all the unlisted companies in India that secured PE/VC deals between 06-12 March, 2023.

We have 19 deals in total and the largest deal among them is from Mintifi. Mintifi raised a significant amount of ₹900 crore in the deal. In comparison, the largest deal from the previous week episode was SpotDraft, which was around ₹200 crore.

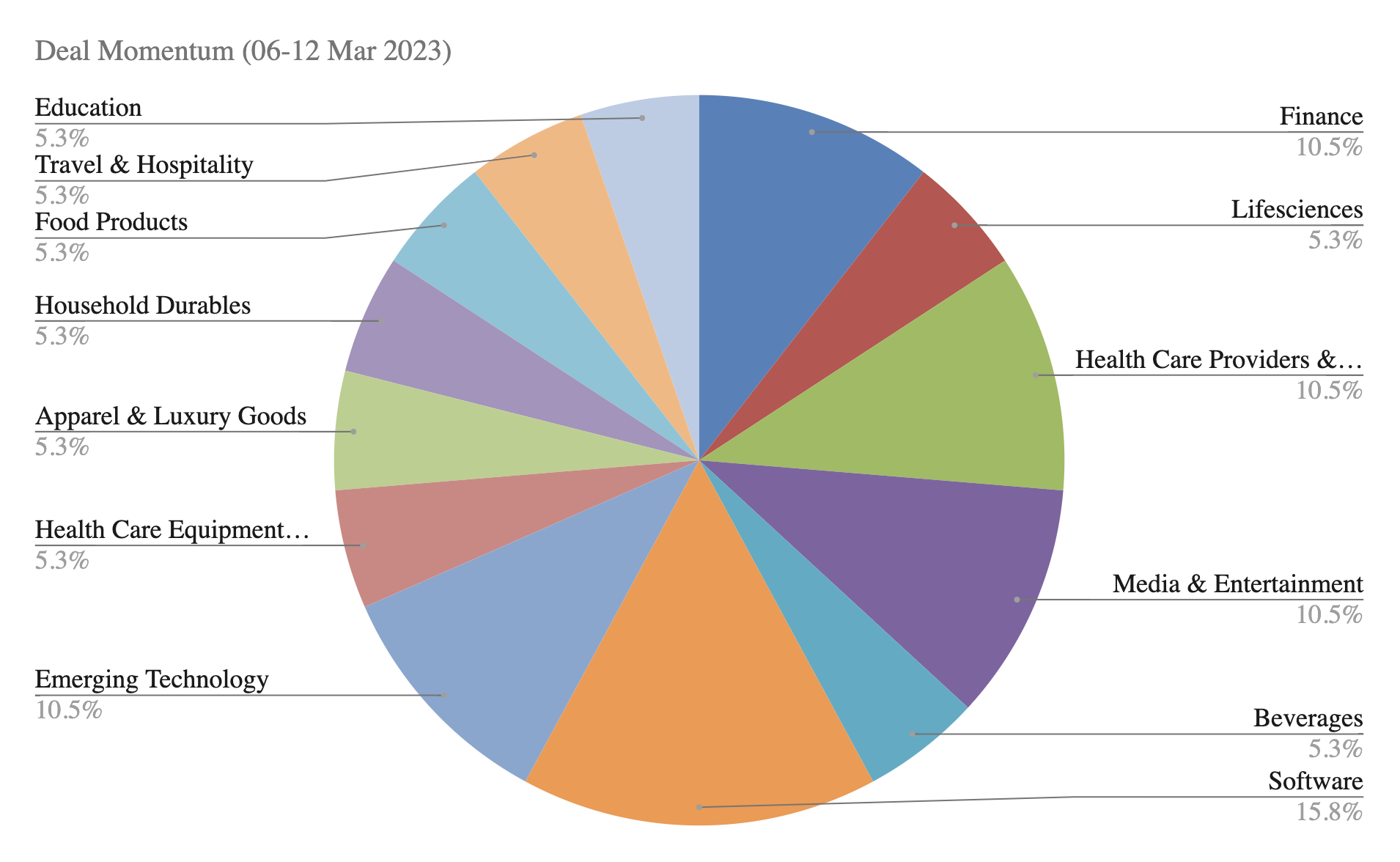

Deals Spread Across the Industries

Looking at the sector-wise deals in descending deal numbers, we can see that the highest is from software (15.8%), emerging-tech (10.5%), healthcare (10.5%), media (10.5%) and finance (10.5%), and others scattered across different sectors similar to the previous week episode.

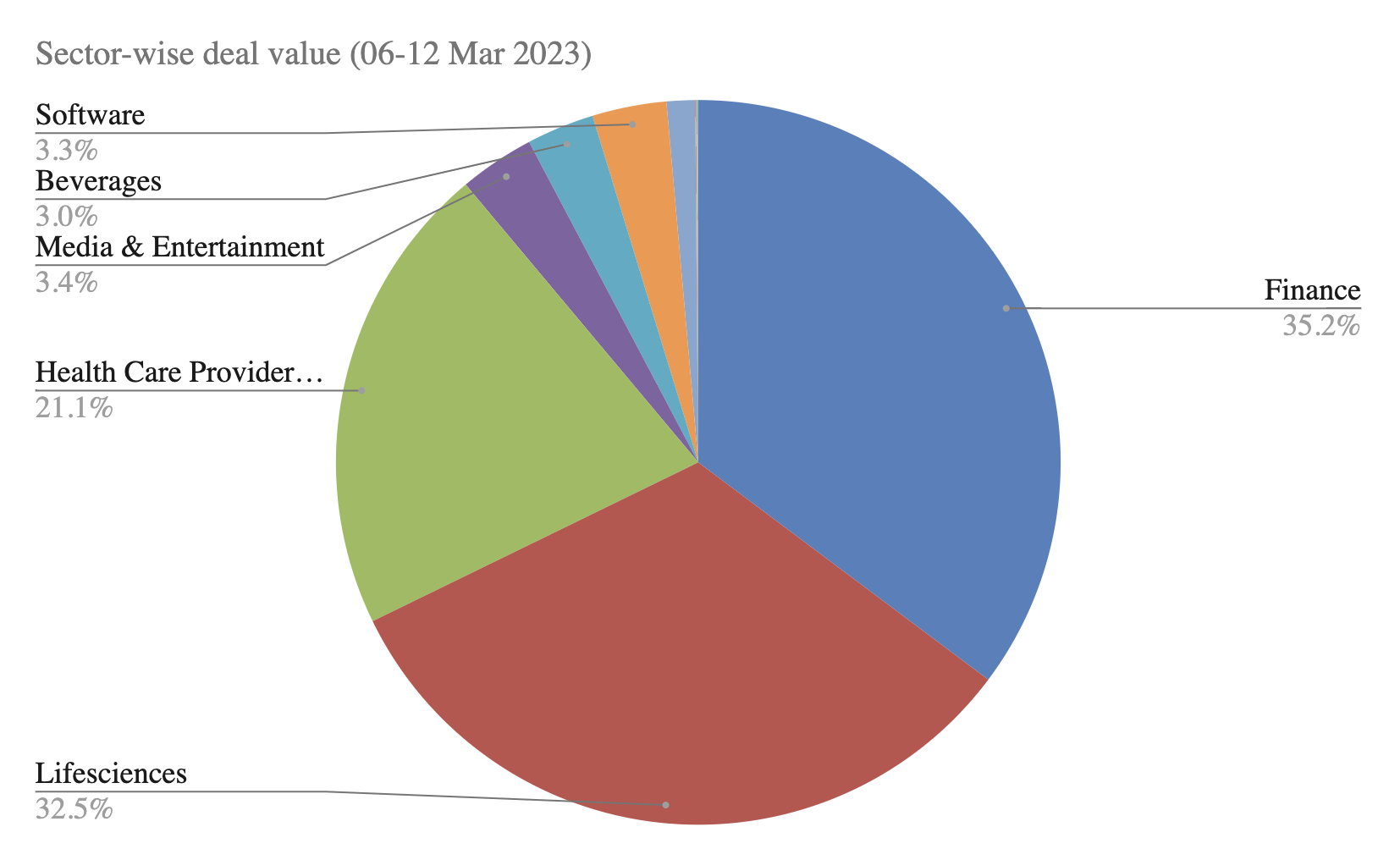

Digging deeper focusing on a sector-wise chart based on the value of deals, we can see that just three sectors – finance (35.2%), life-sciences (32.5%), and healthcare (21.1%) dominate almost 90% of the total value of all the known PE/VC deals from the week.

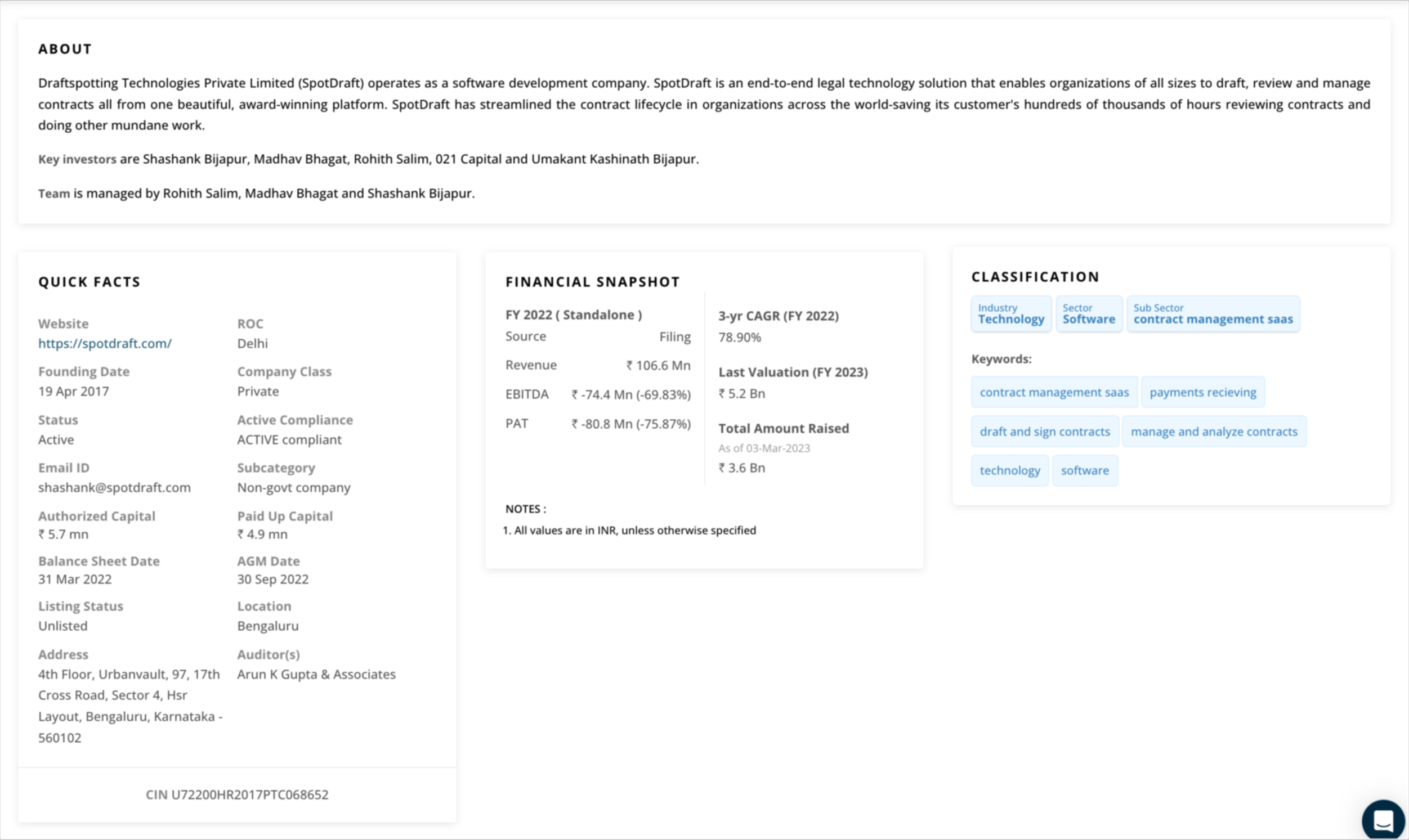

The Mintifi Deal

Mintifi is a lending platform that raised funds in Series D this week. The four investors in this round include Premjiinvest, Norwest Venture Partners, Elevation Capital (SAIF Partners), and International Finance Corporation (IFC).

Premjiinvest was a primary investor in SpotDraft as well, which we covered in the Episode 1 of this series.

Mintifi’s Business Model

Mintifi is a platform that helps finance supply-chain businesses. There is always a need for working capital in such businesses. Typically obtained through overdraft arrangements with traditional banks.

However, relying solely on traditional financing methods can restrict the growth of existing businesses and create barriers for new players to enter the market. Mintifi aims to offer an alternative financing solution to help these businesses grow and succeed at a faster pace.

Mintifi’s platform aims to change this by slowly moving all the transactions in a supply-chain business to a common platform. This way it’s possible to use the business data to offer more efficient working-capital finance to not only the distributors but also to the retailers and manufacturers who need to pay their suppliers on a regular basis.

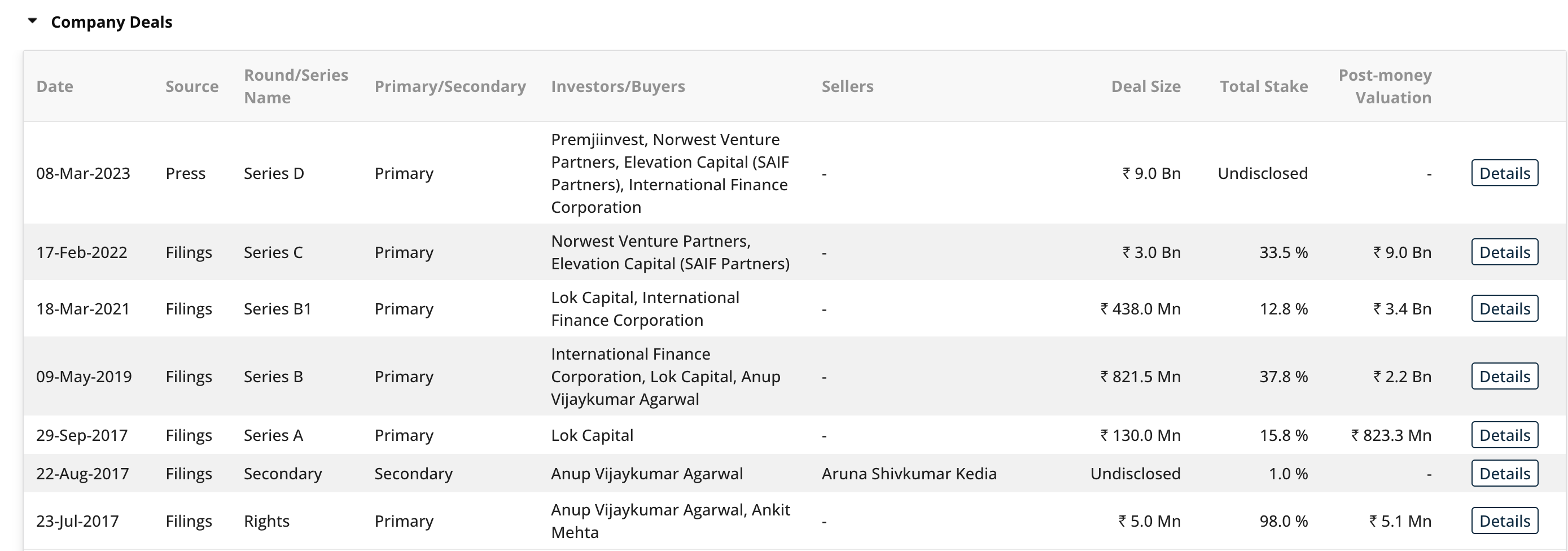

Mintifi’s Funding Rounds

Now that we understand Mintifi’s business model, let’s take a look at its previous funding rounds.

Last year in February, Mintifi raised ₹300 crore in Series C, led by Northwest and Elevation, who also followed up in Series D this time. IFC has also been an existing investor.

The Significance of Premjiinvest’s Investment

Premjiinvest’s investment in Mintifi is particularly noteworthy. Since 2006, Premjiinvest has made over 100 investments to date. Premjiinvest’s portfolio includes notable companies such as Byju’s, PolicyBazaar, and Lenskart.

The Lending-Platform Deals

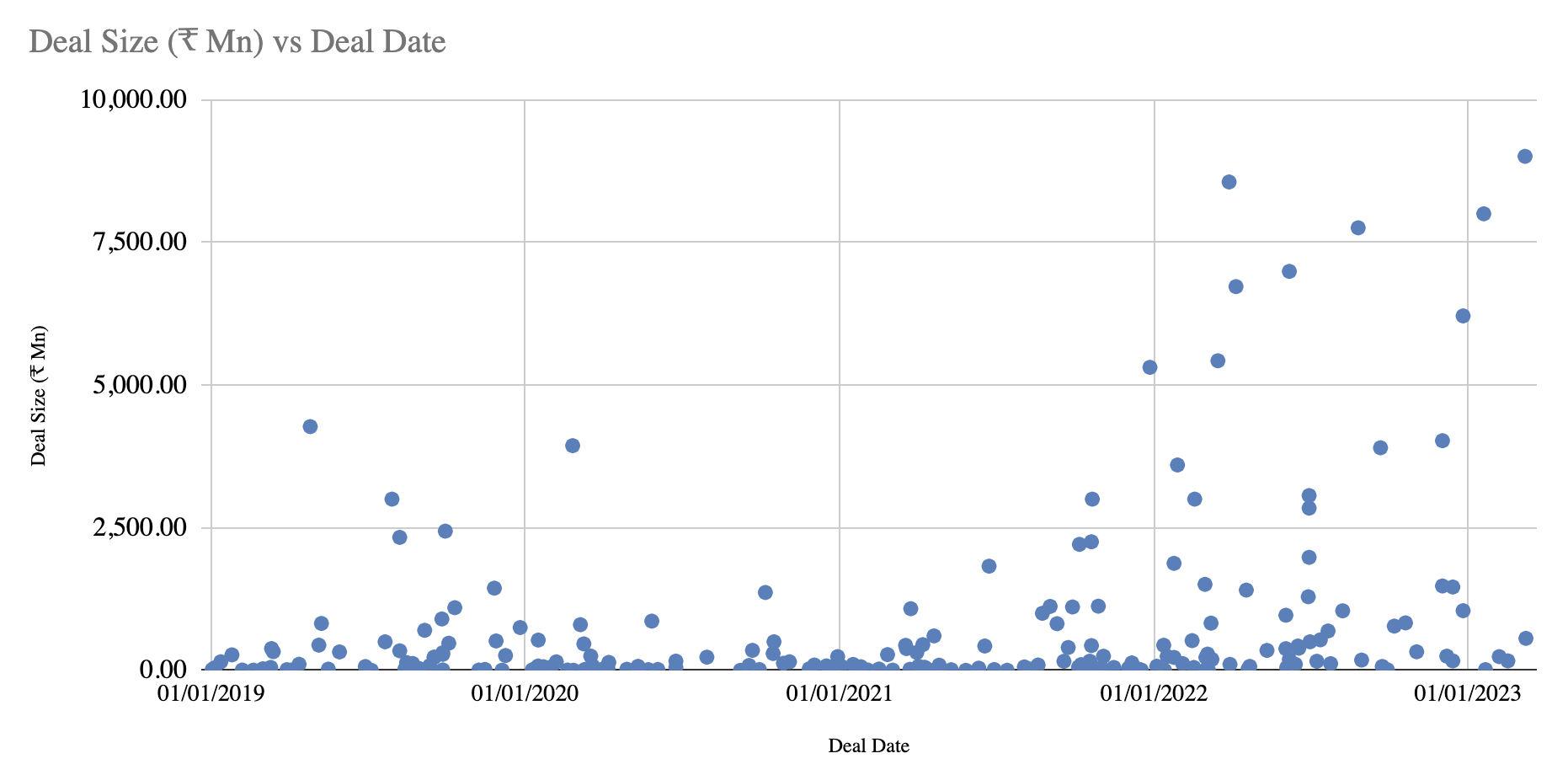

Before we wrap up this blog, let’s quickly explore lending-platform sub-sector deals of unlisted companies over the last five years. Among over 200 deals in the past five years, this week’s fund-raise by Mintifi is the biggest of them all.

There has been a clear increase in the higher-ticket size fund-raises in the lending-platform business since 2022. However, even today, most lending-platform companies that have raised funds are in the early to growth stage, and there have been relatively fewer exits or IPOs in this sub-sector.

This indicates that investors are betting on the long-term potential of these companies and are willing to wait for a few years before seeing returns on their investments. It also suggests that there is still room for consolidation in the market, and we can expect more M&A activity in this sub-sector in the coming years.

Premjiinvest is an investment firm founded in 2006 by Azim Premji, the founder of Wipro. So what does Premjiinvest see in Mintifi? It’s hard to say for sure, but it’s possible that they are betting on the growth potential of the supply-chain finance market in India.

According to a report by EY, the supply-chain finance market in India is expected to grow at a CAGR of 22% between 2021 and 2025, driven by factors such as the increasing adoption of technology in supply-chain finance and the growing number of SMEs in the country. Mintifi, with its focus on using data to provide efficient working-capital finance, seems well-positioned to benefit from this growth.

Conclusion

The Indian private markets saw 19 PE/VC deals for unlisted companies during the week in consideration, with Mintifi’s series D funding round of ₹900 crore being the biggest of them all.

As we saw earlier, the supply-chain finance market in India is expected to grow at a CAGR of 22% between 2021 and 2025. Mintifi’s focus on using data to provide efficient working-capital finance puts it in a good position to benefit from this growth. With its latest funding round, the company can now continue to expand its operations and make its mark in the Indian lending industry.

Disclaimer: The content provided in this article is for educational and informational purposes only and does not constitute professional financial advice. The opinions expressed herein are those of the author and do not necessarily reflect the views of the company / organization. Please consult a qualified financial professional prior to making any financial decisions.

Read more blogs of this series;

It’s a big deal: Epsiode 1 | 27 Feb – 05 Mar 2023