The co-working space market in India has experienced a surge in growth over the past few years. The rising number of startups, entrepreneurs, and freelancers, who are opting for flexible and cost-effective workspaces, has been a major driving force behind the growth of this market.

According to a report by JLL, there has been a continuous increase in the number of places dedicated to flexible workspaces. The coworking spaces market is majorly determined by the accelerated increase in the number of start-ups in the country.

Highlights:

- India is one of the fastest-growing markets for co-working spaces, with an estimated 3.8 million square feet of space leased in 2020, all set to pass 50 million square feet in 2023.

- India is the world’s second-largest market for co-working, following the USA.

- The number of co-working members in India grew by 54% from 2019 to 2020, with an estimated 1.2 million members.

- Co-working spaces are particularly popular in the technology and start-up sectors, with 65% of members in these sectors.

- The average cost of renting a seat in a co-working space in India is around Rs. 3,000 per month.

- The co-working industry in India is expected to grow at a CAGR of 12-15% over the next five years.

- The total market size of the co-working industry in India is estimated to reach Rs. 10,000 crore by 2025.

Co-working spaces are becoming increasingly popular with corporates, due to the cost and time-saving benefits they offer. It is likely that big companies will continue to consolidate their spaces and move away from traditional office setups. This trend is being followed by MNCs, Indian corporates, and small & medium enterprises, indicating favorable growth for the industry.

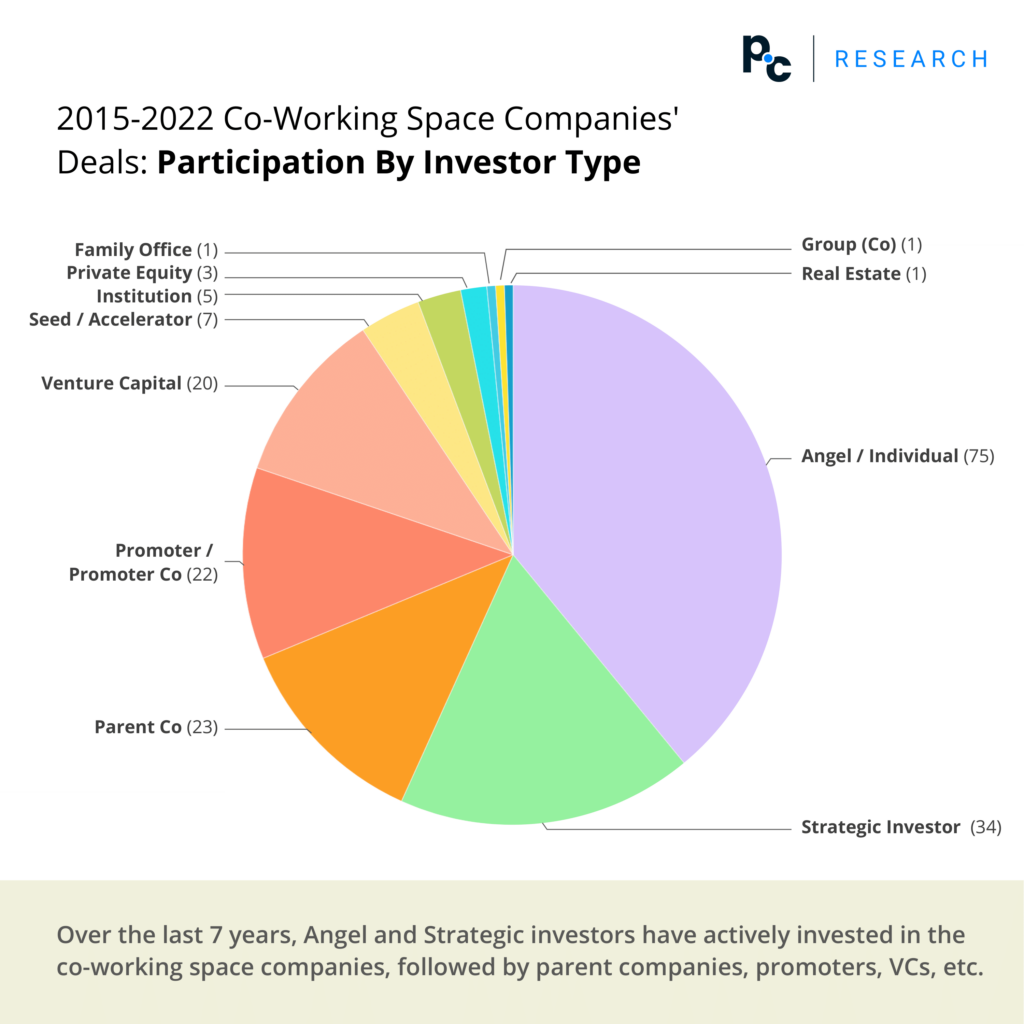

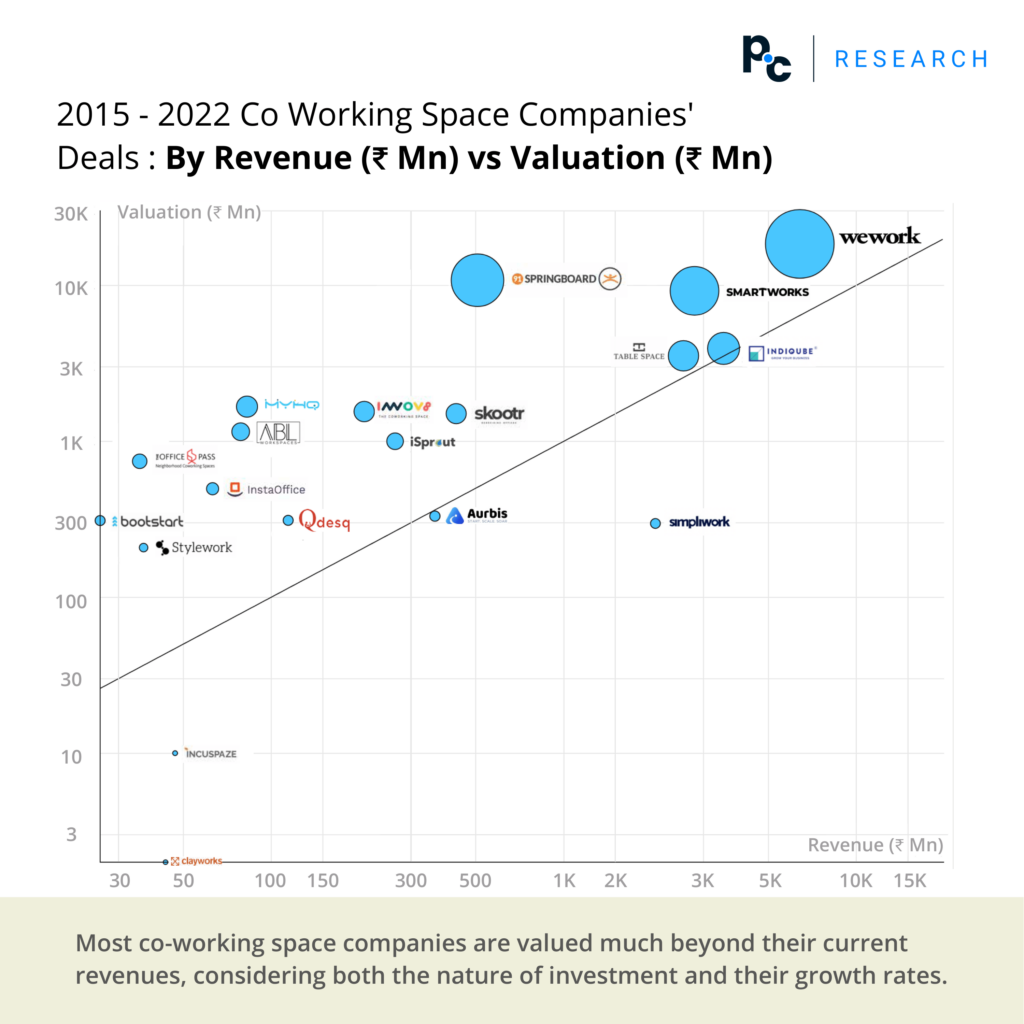

In this blog, we will explore the co-working space companies deals that went through from 2015 to 2022 of all the AI-based solutions in India. Measured criteria are company stages, investor types, locations, mega deals, keywords, revenue vs valuation, and company growth in two years.

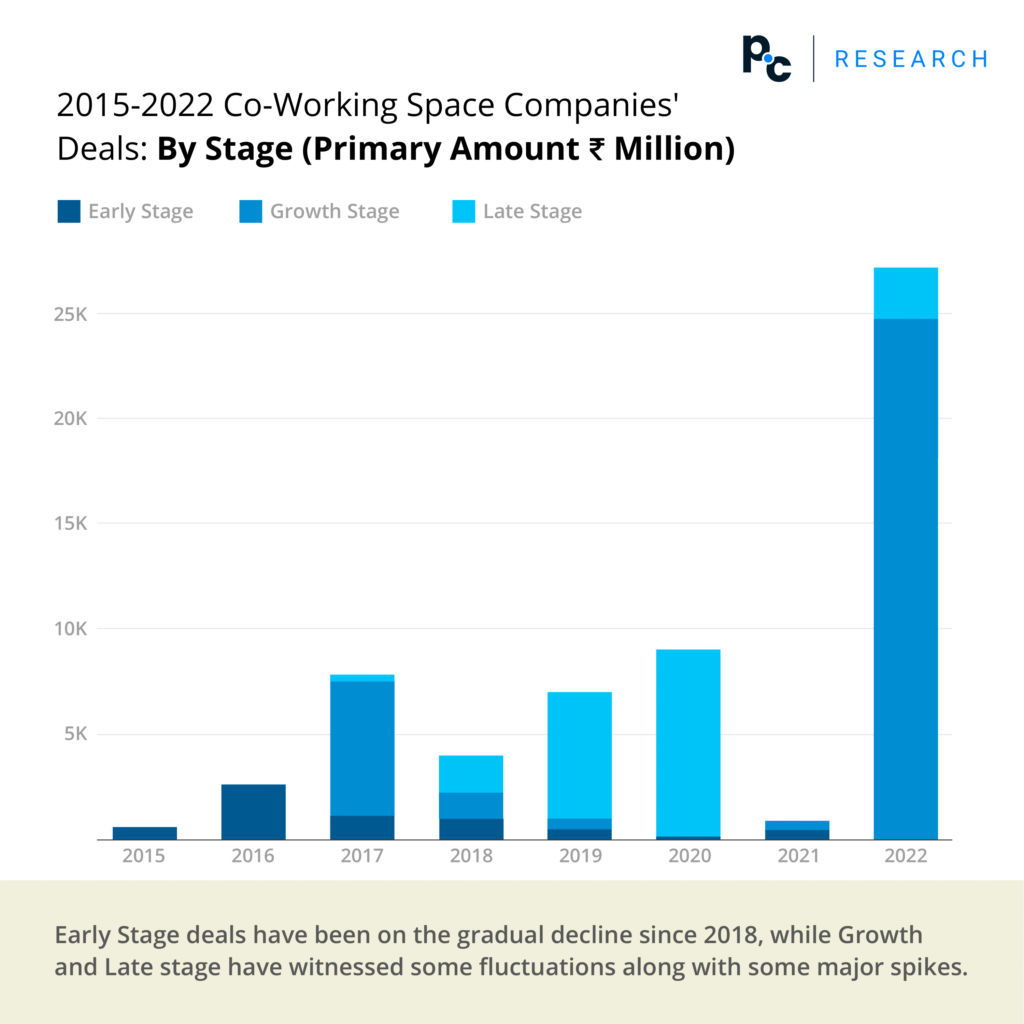

- 2015 – Total Deal Volume 517 – Early Stage 517

- 2016 – Total Deal Volume 2140 – Early Stage 2140

- 2017 – Total Deal Volume 6525 – Early Stage 925 / Growth Stage 5342 / Late Stage 258

- 2018 – Total Deal Volume 3450 – Early Stage 860 / Growth Stage 1081 / Late Stage 1509

- 2019 – Total Deal Volume 5819 – Early Stage 166 / Growth Stage 448 / Late Stage 5205

- 2020 – Total Deal Volume 8429 – Early Stage 2 / Growth Stage 60 / Late Stage 8367

- 2021 – Total Deal Volume 856 – Early Stage 39 / Growth Stage 417 / Late Stage 400

- 2022 – Total Deal Volume 27110 – Early Stage 19 / Growth Stage 24829 / Late Stage 2262

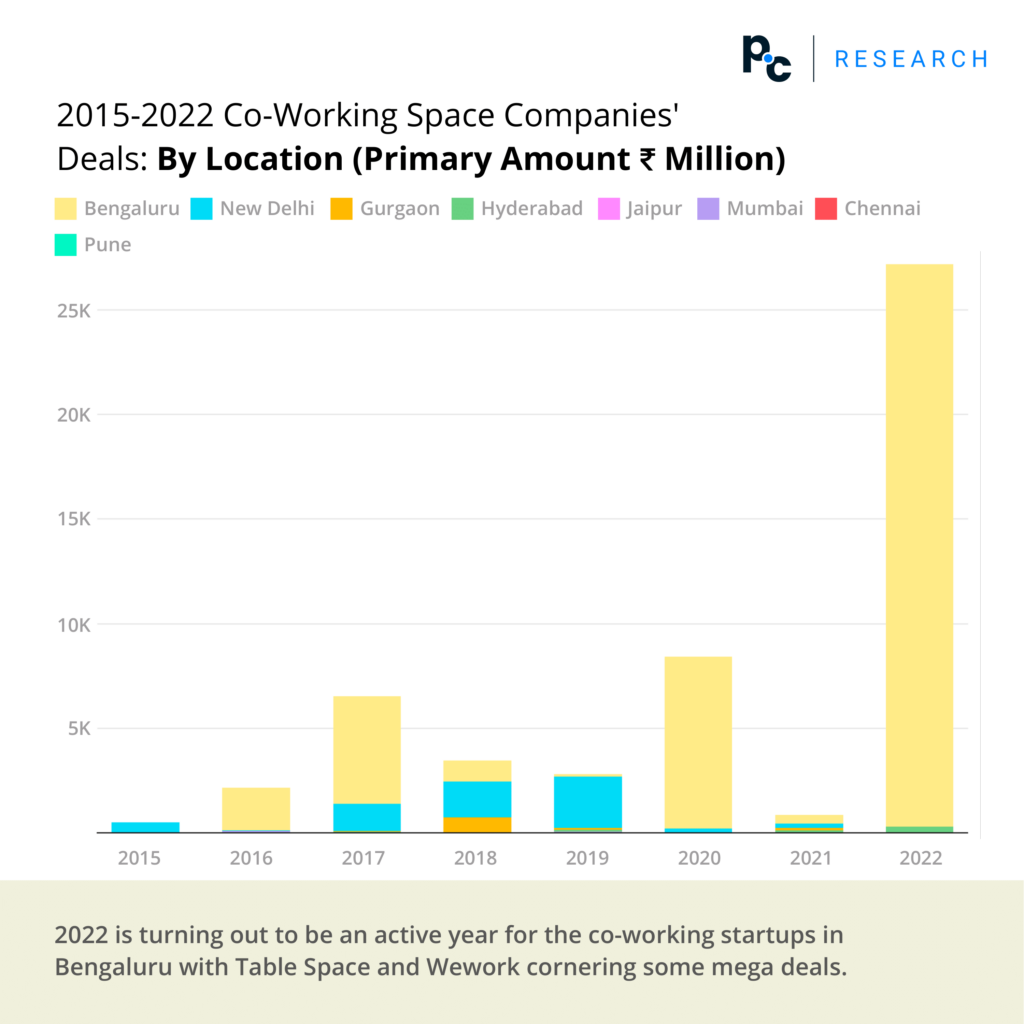

- 2015 – New Delhi 510 / Mumbai 7

- 2016 – Jaipur 35 / Mumbai 47 / New Delhi 43 / Bengaluru 2000

- 2017 – Pune 3 / Jaipur 29 / Mumbai 2 / Hyderabad 13 / Gurgaon 52 / New Delhi 1000 / Bengaluru 5000

- 2018 – Chennai 12 / Mumbai 2 / Hyderabad 27 / Gurgaon 690 / New Delhi 2000 / Bengaluru 1000

- 2019 – Pune 34 / Mumbai 11 / Hyderabad 117 / Gurgaon 65 / New Delhi 2000 / Bengaluru 118

- 2020 – New Delhi 218 / Bengaluru 8000

- 2021 – Pune 10 / Hyderabad 100 / Gurgaon 132 / New Delhi 200 / Bengaluru 414

- 2022 – Hyderabad 304 / Bengaluru 27000

New workplaces in India’s tier II and III cities such as Jaipur, Chandigarh, Pune, Ahmedabad, and Kochi are primarily based on a Flexi workspace concept. The demographic composition of the workforce in these locations the scarcity of suitable Grade A premises, and the nature of the firms have all contributed to this shift in approach in comparison to traditional offices.

A JLL survey found that mainstream corporations and major enterprises had 40-45 percent of the business opportunity to utilize available flexible office space in the country.

When compared to leasing traditional office space, a flexible working space in India’s key cities, Delhi National Capital Region (NCR), Mumbai, Bengaluru, and Pune, is anticipated to result in cost savings of 20-25 percent.

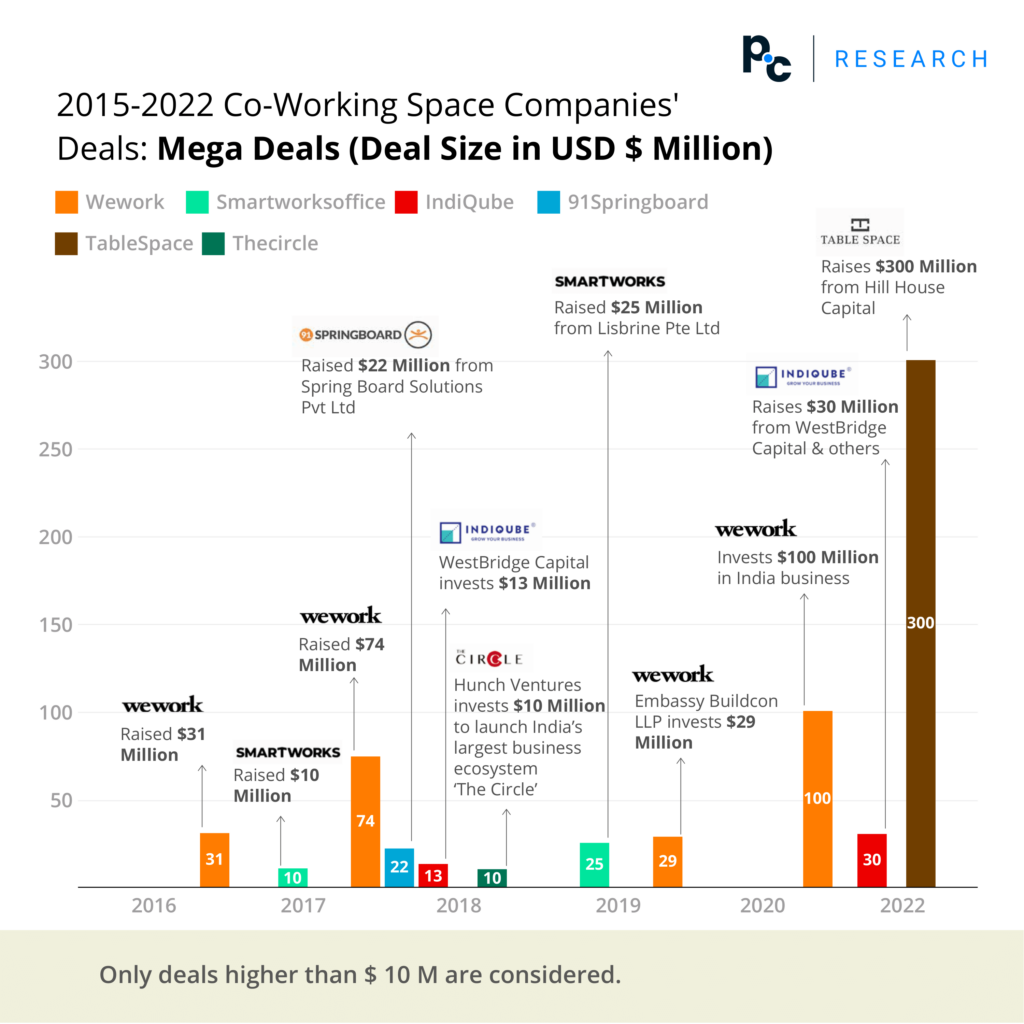

Latest news on companies with Mega Deals:

- WeWork India raises Rs 550 crore from funds managed by BPEA Credit / 26 Dec 2022

- Smartworks aims to reach its target of Rs 1,000 crore annual revenue by end of 2022 / 08 Dec 2022

- 91Springboard opens 300-desk platinum hub at Gurugram’s Vatika Triangle / 24 Nov 2022

- SaaS firm Facilio leases 40,000 sq ft of flexible office space from IndiQube in Chennai / 19 Dec 2022

- The Circle: Founders Club successfully accelerates 13 South Korean startups in India as part of their APAC cohort / 04 Jan 2023

- Tablespace Technologies leases 1.2mn sq feet in the first and second quarters of 2022 / 30 Aug 2022

For more industry-specific summaries, reports, and everything else you need for business and capital growth, get onboard privatecircle.co.