Over the past decade, India has undergone a quiet yet profound shift in how it perceives pets. No longer seen merely as guard dogs or utility animals, pets today occupy a central emotional space in Indian households. This transition is most visible in bustling urban centers, where the lines between pet ownership and parenthood are increasingly blurred.

In metros and smaller cities alike, pets have become a source of companionship, stress relief, and even identity for young professionals and families. From birthday parties for Labradors to Instagram accounts for Persian cats, pet culture is not just growing, it’s being celebrated. This surge in affection has naturally given rise to a demand for better food, smarter healthcare, and more indulgent experiences for pets.

Simultaneously, the digital revolution has made it easier than ever for brands to reach pet parents directly. Social media has amplified awareness, e-commerce has broken distribution barriers, and content marketing has allowed brands to tap into the emotions and aspirations of modern pet owners.

This new era of pet care is being shaped by a generation that is informed, expressive, and unafraid to experiment. Whether it’s feeding grain-free food, trying Ayurvedic shampoos, or booking a spa session, pet parents are constantly seeking better solutions, and startups are rising to meet these needs.

In this report, we take you through 20 of India’s most promising and high-performing PetTech companies. Each of them is building with a mix of empathy, innovation, and execution, creating not just products, but ecosystems around modern pet lifestyles.

Introduction: The Rise of the Pet Economy in India

A Cultural Shift

India is witnessing a transformation in pet ownership. What was once a rural, utility-driven relationship with animals has now become an urban, emotionally driven lifestyle choice. Pet dogs and cats are increasingly viewed as family members, and millennials and Gen Z pet parents are setting new expectations for nutrition, healthcare, grooming, and entertainment.

Macro Tailwinds Driving the Boom

- Urban Nuclear Families: Dual-income, no-kids households are opting for pets as companions.

- Digitization: eCommerce and social media have enabled discovery and D2C brand building.

- Global Influence: Exposure to Western pet lifestyles through content and migration.

- Wellness Mindset: Human trends like organic, grain-free, cruelty-free are entering pet care.

- Investor Interest: VC money is now flowing into pet startups across D2C, InsurTech, and vettech.

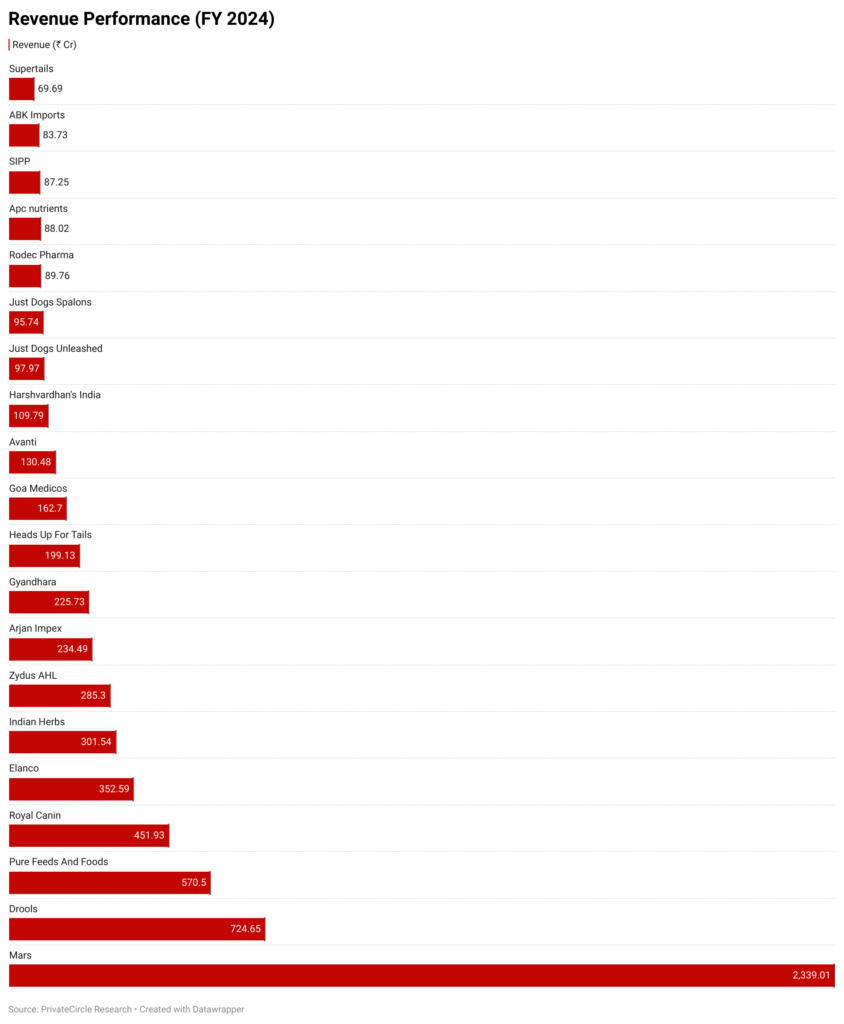

📊 The PetTech Leaderboard: Top 20 by Revenue (FY24)

Company Profiles: Food & Nutrition Giants

1. Mars International India (Mars) – ₹2339.01 Cr

- Global powerhouse behind Pedigree and Whiskas.

- Dominates India’s urban vet clinics and supermarkets.

- Aggressive ad spends on emotion-driven campaigns.

- Manufacturing base in Telangana supports local SKUs.

- Facing competition from agile Indian brands.

2. Drools Pet Food Pvt Ltd (Drools) – ₹724.65 Cr

- Pioneer in affordable premium pet food.

- Strong omnichannel strategy: D2C + retail.

- Exporting to 22 countries.

- Introduced species-specific diets (puppy, large breed, etc).

- Backed by IB Group (Chhattisgarh).

3. Pure Feeds and Foods Pvt Ltd – ₹570.50 Cr

- White-label pet food supplier to D2C brands.

- Infrastructure strength: owns 3 manufacturing units.

- Focused on functional foods (digestive, joint support).

4. Royal Canin India Pvt Ltd (Royal Canin) – ₹451.93 Cr

- Global leader in breed-specific nutrition.

- Trusted by vets for prescription diets.

- High ASP, elite positioning.

- Import dependency creates pricing pressure.

Company Profiles: Pharma, Wellness & Ayurveda

5. Elanco India Pvt Ltd (Elanco) – ₹352.59 Cr

- Global vet pharma giant.

- Core strength in parasite control, vaccines.

- Building tele-vet advisory channels in India.

6. Indian Herbs Specialities Pvt Ltd (Indian Herbs) – ₹301.54 Cr

- Pioneer of herbal pet wellness.

- Sells across poultry, cattle, and companion animals.

- Ayurvedic vet tonics are now gaining urban traction.

7. Zydus Animal Health & Investments Ltd (Zydus AHL) – ₹285.30 Cr

- Zydus Cadila’s animal health spin-off.

- R&D-driven approach to pet vaccines and diagnostics.

- Leveraging pharma distribution muscle.

8. Harshvardhans Laboratories Pvt Ltd (Harshvardhan’s India) – ₹109.79 Cr

- Ayurveda meets companion animals.

- Developing oils, balms, sprays for skin, anxiety.

- Limited but loyal urban clientele.

Company Profiles: Grooming, Retail & D2C Lifestyle

9. Earth Paws Pvt Ltd (Heads Up For Tails) – ₹1991.30 Cr

- Sequoia- and Verlinvest-backed D2C brand.

- Leading in accessories, grooming, and nutrition.

- Flagship stores in Delhi, Mumbai, Bengaluru.

- Influencer collaborations.

10. Just Dogs (Justdogs Unleashed) – ₹97.97 Cr

- India’s largest physical retail chain for pets.

- Franchise model across 30+ cities.

- Launched private label grooming and treats.

11. Apc Nutrients Pvt Ltd (Apcnutrients) – ₹88.02 Cr

- Regional player expanding via Amazon & Flipkart.

- Focus on fish protein-based kibble.

- Pet treats and dental care are in the roadmap.

12. Sai International Pet Products Pvt Ltd (SIPP) – ₹87.25 Cr

- White-label manufacturer for 5+ Indian D2C pet brands.

- ISO-certified facilities, exports to SEA.

13. Just Dogs Spalons Pvt Ltd (Just Dogs) – ₹95.74 Cr

- Specializes in pet grooming and spa services.

- Complementary to Justdogs retail arm.

- Strong urban clientele and repeat usage.

Others & Emerging Brands to Watch

14. Arjan Impex Pvt Ltd (Arjan Impex) – ₹234.49

- Agro-inputs company is entering the premium pet food market.

- Contract manufacturing for D2C players.

15. Gyandhara Industries Pvt Ltd (Gyandhara) – ₹225.73

- Feed supplements + pet nutrition.

- Ayurveda integration is gaining trust.

16. Goa Medicos Pvt Ltd (Goa Medicos) – ₹162.70

- Leading pharma distributor.

- Expanding vet med vertical post-2021.

17. Avanti Overseas Pvt Ltd (Avanti) – ₹130.48

- Former aquafeed leader now shifting to pets.

- Fish-based recipes for dogs and cats.

18. Rodec Pharma Ltd (Rodec Pharma) – ₹897.67 Cr

- Pet pharma + wound care.

- Scaling a vet-focused digital ordering platform.

19. ABK Imports – ₹83.73

- Importer and distributor of global pet products and grooming tools.

- Known for introducing premium international brands to Indian pet retailers.

- Focuses on quality assurance, training, and support to pet professionals.

- Expanding presence through grooming salon partnerships and retail tie-ups.

20. Pets Centric (Supertails) – ₹69.69 Cr

- Digital-first platform offering vet consultations, pet food, and accessories.

- Backed by Fireside Ventures and DSG Consumer Partners.

- Building an ecosystem around health, nutrition, and pet parenting.

- Differentiated through curated vet advisory and own-label food SKUs.

Investor Trends & Funding Activity

- Bootstrapped success stories: Companies like Drools have built large, profitable operations without raising external capital. Its growth is driven by deep market understanding, competitive pricing, and wide distribution, proving that bootstrapping in PetTech can be a sustainable and strategic choice.

- Venture capital flows into D2C: Investor interest is strongest in D2C pet startups, especially those offering direct emotional engagement with consumers. HUFT, for example, has raised significant funding for expanding its omnichannel presence, product lines, and digital infrastructure.

- Consolidation in grooming and retail: The grooming and physical retail category is undergoing consolidation. With increased competition and customer acquisition costs, several small players are being acquired or edged out by more established chains. Expect a few larger national brands to dominate in the coming years.

- Alternative funding strategies emerging: Apart from traditional VC, startups are tapping into brand accelerators, joint ventures with FMCG/pharma majors, and working capital financing to grow efficiently.

- Investors seek long-term depth: Beyond top-line growth, investors are now looking at unit economics, retention, subscription models, and ecosystem depth, prioritizing pet businesses that demonstrate both consumer love and operational leverage.

- PetTech is moving mainstream: What was once seen as a niche segment is now being recognized as a sticky, emotionally resonant, and high-retention opportunity for the next generation of consumer brands.

Conclusion: The Future of PetTech in India

The evolution of India’s pet care industry is more than just a market story; it’s a cultural shift in motion. As pet ownership becomes more aspirational and mainstream, the demand for thoughtful, quality-driven pet services is expanding far beyond metro cities. What was once a space driven by necessity has become one powered by love, lifestyle, and long-term commitment.

What makes this wave particularly exciting is how deeply emotional the customer journey is. Pet parents don’t just buy products; they seek trust, care, and reassurance. This emotional intensity makes the sector not only sticky and high-retention, but also a fertile ground for innovation.

We are now witnessing the birth of India’s full-stack pet economy, where brands don’t just sell, but support. From tailored nutrition plans to telehealth, from stylish retail experiences to home diagnostics, the future will belong to companies that build with both compassion and conviction.

The road ahead will see newer formats emerge, regional players scaling up, and tech entering even the most personal corners of pet care. As this journey unfolds, founders, investors, and operators alike have a rare opportunity to build businesses that are both commercially meaningful and emotionally resonant.

India’s pet story is no longer at the fringes. It’s front and center, wagging, purring, and growing every single day.

This report is powered by PrivateCircle Research, the intelligence engine behind India’s private markets.

Looking for verified company insights? Think PrivateCircle.