A comprehensive analysis of 39 startups founded by former Razorpay employees

How Razorpay Became a Founder Factory

Razorpay has emerged as more than just a fintech unicorn, it has become a breeding ground for operator-led founders. Over the past few years, early employees and operators have spun out to create their own ventures, collectively forming what is often referred to as the Razorpay Mafia.

This report explores 39 startups founded by Razorpay alumni, examining their founding timelines, sectors, educational backgrounds of the founders, valuations, and workforce scale. Using public records, EPFO filings, and incorporation data, this analysis highlights how Razorpay’s culture and operational experience translate into a broader founder ecosystem, shaping India’s startup landscape beyond payments and fintech.

Razorpay Alumni Startups: Who Built What

Between 2017 and 2025, 39 startups were founded by Razorpay alumni, spanning fintech, SaaS, AI, and niche B2B and consumer sectors. The network includes both early-stage ventures and high-valuation startups.

Key Insights:

- Most spin-offs occurred after 2020, reflecting Razorpay’s role as a launchpad for founder talent.

- Founders leverage operator experience gained at Razorpay to build product-first, scalable startups.

| Brand Name | Founder(s) |

|---|---|

| AceIPM | Saksham Chauhan |

| Appsmith | Abhishek Nayak |

| Mynaksh | Piyush Nagle |

| Ayna | Aastha Rajpal |

| Setu | Sahil Kini |

| CHARA | Bhaktha Keshavachar |

| Clapgrow | Subhangee Agarwal Jhunjhunwala |

| Potpie AI | Aditi Kothari |

| Karta | Abhishek Kushwaha, Vijaypal Singh |

| Echovane | Himadri Roy |

| Basis | Hena Mehta |

| Gistr | Arun Antony |

| Glomo | Akash Arun |

| Goodfit | Rohit Venugopal |

| GrowthX | Udayan Walvekar |

| Chargeback Zero | Sudhir S |

| OfScale | Vijay Akkaladevi |

| LeanKloud | Siddharth Dhamija |

| Komplai | Rishi Ayyalasomayajula |

| CASTLER | Kumar Amit |

| Fleck | Nishant Chauhan |

| Taqtics | Vivek Azad |

| Prompt IQ | Chendil Kumar |

| Culture Travel | Rajat Jhajhria |

| Rupifi | Anubhav Jain |

| Seezo | Sandesh Mysore Anand |

| SuperKalam | Aseem Gupta |

| SpotInfo AI | Akshat Singhal |

| Yowww | Ramkumar Palani |

| TrueGradient | Namrata Gupta |

| SocioShop | Raana Chatterjee |

| UPoS | Rahul Vilas Hirve |

| Rapida | Prashant Srivastav |

| WYZION | Arjun Venkatachalam |

| Zango | Shashank Agarwal |

| NeoSapien | Dhananjay Yadav |

| Zillout Social | Nayan Mishra |

| Zivy | Prashanth YV |

| Nudge Lab | Arun Antony |

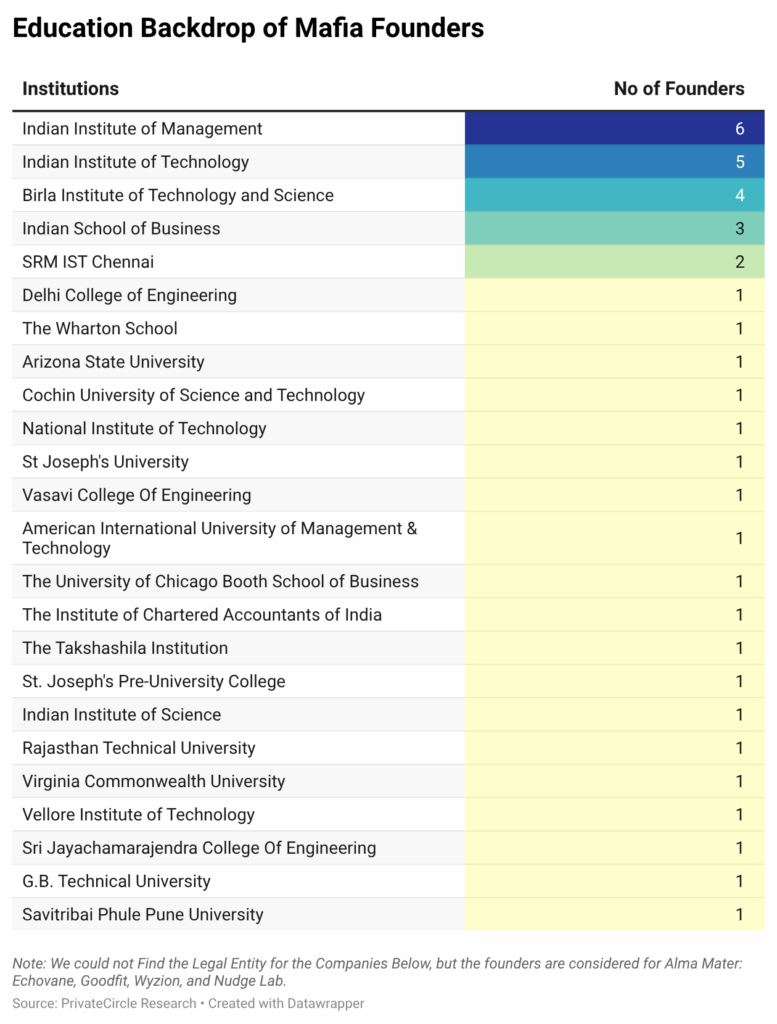

Educational Background of Founders

Razorpay alumni come from a diverse academic background, yet elite institutions dominate the founder pool. Over 45% of the founders graduated from top-tier institutions such as IITs, IIMs, ISB, BITS, or globally recognized business schools. This concentration highlights Razorpay’s ability to attract high-caliber talent capable of becoming repeat founders.

Insight:

- Razorpay’s alumni are heavily skewed towards elite engineering and management programs, suggesting a strong “pedigree effect” in its founder ecosystem.

- Global exposure (Wharton, University of Chicago Booth, Arizona State) complements domestic talent, adding diversity of thinking.

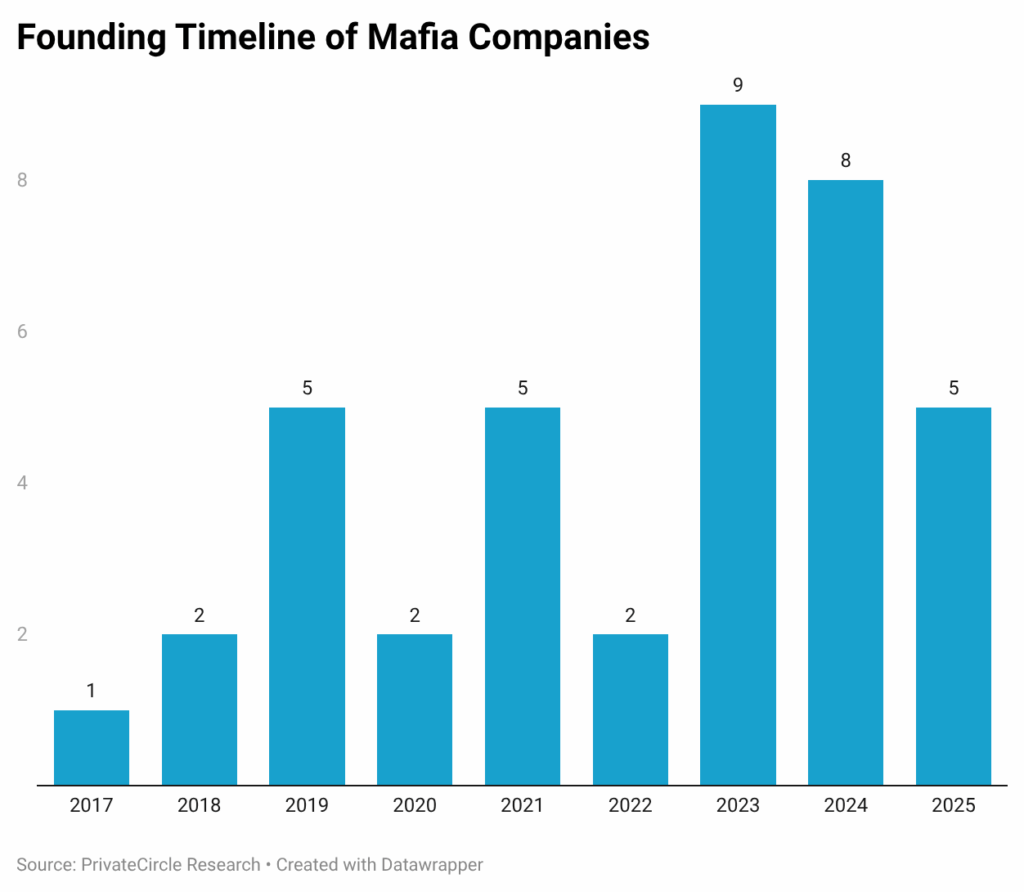

Founding Timeline of Razorpay Alumni Startups

Razorpay alumni have steadily spun out to build their own ventures since 2017, but activity has accelerated significantly in recent years. Between 2023 and 2024, nearly half of all 39 startups were founded, marking the peak of the Razorpay Mafia startup wave.

This pattern suggests that experience gained at Razorpay—ranging from product development to scaling operations—quickly translates into independent entrepreneurial ventures. Early spin-offs laid the foundation, while the recent surge reflects both confidence in execution and an expanding network of founders and investors familiar with Razorpay alumni.

Key Insight:

Founder activity surged post-2022, with 2023–2024 alone accounting for nearly half of all incorporations, signaling the maturation of the Razorpay alumni ecosystem.

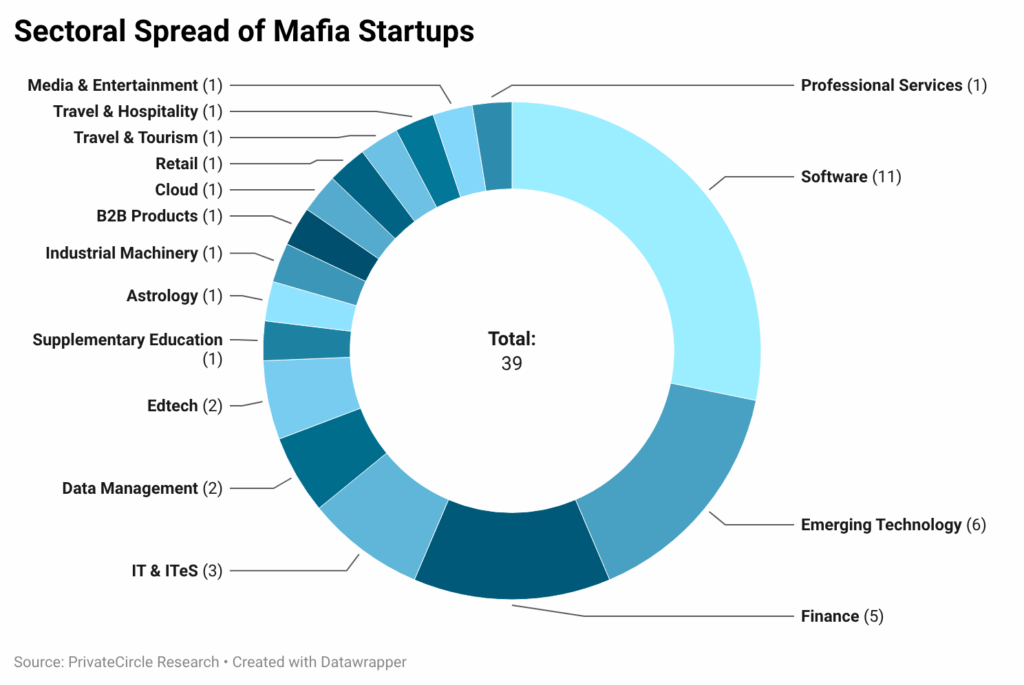

Sectoral Spread of Mafia Startups

Razorpay’s product-first DNA is clearly reflected in the sectors chosen by its alumni. A majority of startups are in software, emerging technology, and fintech, highlighting a natural extension of the skills and market understanding developed at Razorpay. Beyond these core sectors, alumni are exploring a diverse range of industries including retail, travel, media, cloud, and even niche areas like astrology.

Key Insight:

While the core focus remains technology-led and B2B, alumni experimentation across 10 niche sectors illustrates both operator-led curiosity and Razorpay’s broader influence in shaping entrepreneurial thinking.

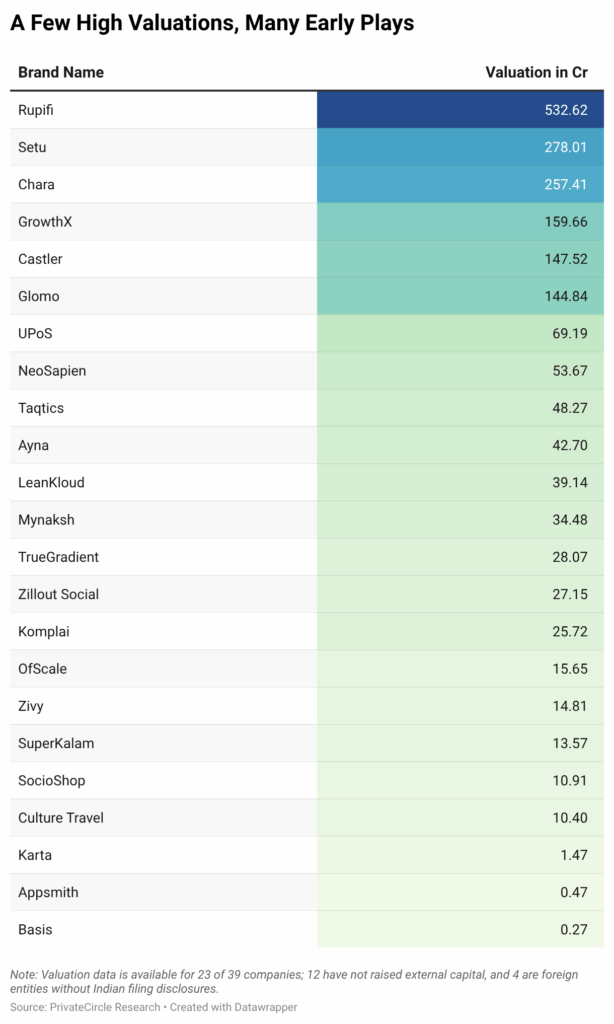

Valuation of Startups

Among the 39 startups, valuation data is available for 23 companies, revealing a top-heavy distribution. The combined valuation of these companies is approximately ₹1,956 Cr, with a few clear leaders driving the majority of the ecosystem’s value.

Note:

- 12 startups have not raised external capital.

- 4 companies are foreign entities without Indian filing disclosures.

Key Insight:

Rupifi leads with a valuation of ₹532 Cr, followed by Setu, CHARA, and GrowthX. Most other startups remain early-stage, highlighting that while a few founders have scaled large ventures, the majority are still in the building phase.

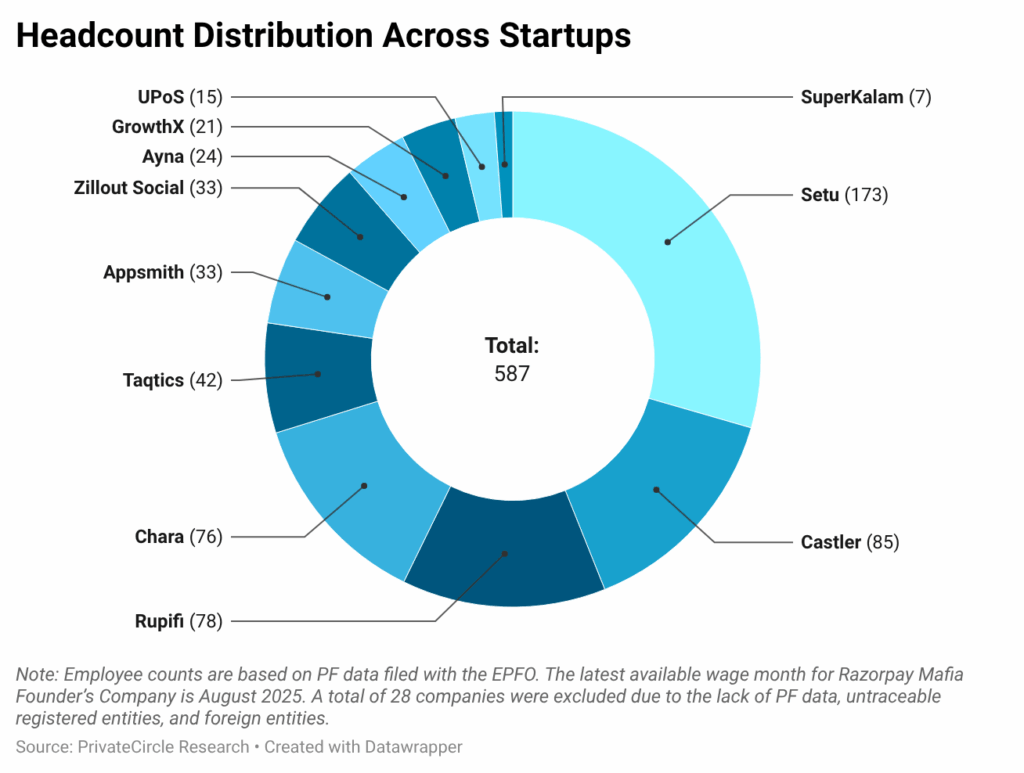

Headcount Distribution Across Startups

EPFO data provides insight into the formal employment generated by Razorpay alumni startups. Headcount distribution is highly skewed, with the largest four companies – Setu (173), CASTLER (85), Rupifi (78), and CHARA (76), employing most of the formally recorded workforce. The remaining startups are lean, reflecting early-stage operations, bootstrapped models, or foreign entity status where PF data is not available.

Key Insight:

These startups collectively employ over 700 people (based on available EPFO data), but the majority of companies remain small or early-stage, demonstrating that the Razorpay alumni ecosystem is still expanding and maturing in terms of operational scale.

Conclusion: Razorpay’s Alumni Footprint

Key Metrics:

- Total startups founded: 39

- Total EPFO-reported employees: 717

- Total valuation (for 23 companies): ~₹1,956 Cr

Razorpay’s alumni are creating a multi-sector founder ecosystem, leveraging operator experience into new ventures. While scale and valuation are concentrated among a few leaders, the pace of spin-offs and breadth of sectors signal a durable and expanding network of founder-led companies, demonstrating Razorpay’s long-term impact on India’s startup landscape.

PrivateCircle is a privacy-first social platform by Razorpay alumni, enabling secure, meaningful connections while capitalizing on rising demand for safe digital interactions.