If cricket is a religion in India, Indian Premier League (IPL) is an important festival for its followers. This Twenty20 cricket league is organised annually where 10 Indian city-based teams compete for the winner’s trophy.

In December 2022, consulting firm D and P Advisory estimated IPL’s valuation at $10.9 billion.

Like any festival, IPL too is a great time for businesses to grow. Brands allocate huge marketing budgets to sponsor IPL teams and run advertisements between matches. From conglomerates like Reliance and TATA to young startups such as Dream11 and Cred spend huge amounts on IPL sponsorships.

So much so that sponsorship revenue, on average, made 17% of IPL teams’ revenue in FY23. We have excluded Punjab Kings, Sunrisers Hyderabad and Gujarat Titans from this analysis, as their sponsorship income was not declared in the annual reports.

Growing IPL sponsorships

Among the teams who did report their sponsorship incomes, Royal Challengers Bangalore (RCB) stood at the top with around ₹83 crores earning in FY23.

They were closely followed by Chennai Super Kings (CSK) at ₹78 crores and Delhi Capitals (DC) at ₹72 crores.

In terms of growth, CSK saw a 19% growth in its sponsorship income in FY23 as compared to FY22. Whereas Lucknow Super Giants (LSG) saw a massive 562% growth as compared to FY22.

It should be noted that LSG team was started in 2021. For other teams, sponsorship revenue in FY23 remained almost the same as FY22 with little or no growth.

As a percentage of total revenue, sponsorship income made 34% of RCB’s total revenue, 27% of CSK, 20% of DC and 21% of Kolkata Knight Riders (KKR). While the sponsorship share for the other two teams was only 3%.

IPL team’s total revenue

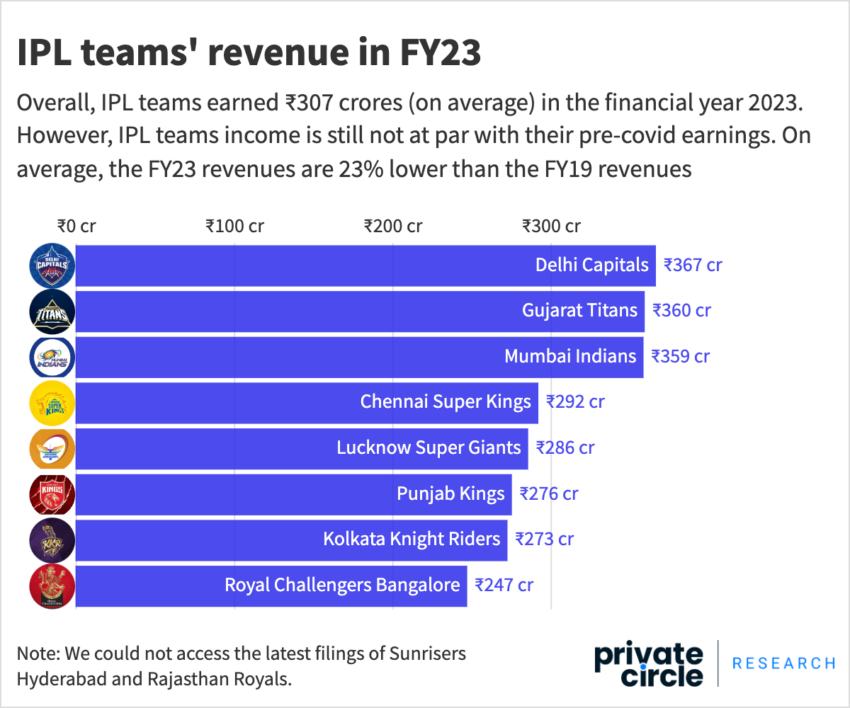

Overall, IPL teams earned ₹307 crores (on average) in the financial year 2023. This was a 23% rise from the previous year’s average team income of ₹251 crores.

DC stood out as the highest revenue grosser team in FY23, by clocking ₹367 crores the financial year.

GT or Gujarat Titans (₹360 crores) took the second place in terms of revenue and Mumbai Indians (MI) (₹359 crores) came in the third position.

Interestingly, the total income of IPL teams is still not at par with their pre-covid earnings. On average, the FY23 revenues are 23% lower than the FY19 revenues. In the case of KKR, the drop is as high as 38% and the least drop of 9% was observed in MI’s revenue.

If we account for inflation, the drop in revenues becomes much more sharp. Assuming a 10% inflation over the last four years, ₹424 crores revenue of DC in FY19 would have been equivalent to ₹621.42 crores.

This would make the team’s drop in total revenue as high as 46.5%. The average drop in earnings for all teams also comes close to 47%, after accounting for inflation.

Conclusion

While there has been a decline in the revenues till FY23, IPL has also seen material changes like sale of IPL media rights. Thanks to this sale of broadcasting rights, IPL stands to generate Rs 48,390.50 crores between 2023 to 2027 (a period not reflected in the available financials). Half of these earnings will go to IPL teams which could result in considerable revenue jump.

In addition to this, IPL teams have also been buying teams in leagues abroad, opening up new avenues for monetisation. Viewership is also seeing record highs, indicating potential to generate more sponsorship revenues.

With contributions from Yeshwant, Dinesh and Rohini of PrivateCircle.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.