The two most common fundraising terms that every Indian entrepreneur comes across are “first cheque” and “follow-on cheque(s)”. These terms refer to the initial and subsequent investments made by an investor in a startup respectively.

Raising capital is an integral part of building and scaling a startup in the Indian market. Knowing the differences between the first and follow-on cheque(s), and understanding what drives each is an essential part of fundraising.

In this blog post, we will explore the intricacies of first and follow-on cheque(s) for the Indian startup founders.

The First Cheque:

The first cheque has different meanings depending on which side you’re on. If you are on the investment side, i.e. you are an investor, the first cheque represents your first investment in a company. On the other hand if you are on the fundraising side, i.e. you are a founder, the first cheque would then represent the first investment from a particular investor for the first time in your business/company.

Investors can choose to invest in a company at various stages of its growth, ranging from the early seed stage to later stages such as Series A, B, C, and beyond. While seed funding is the most common starting point for many startups, investors may also provide funding during later stages of a company’s development, depending on the potential return on investment and the perceived risk involved. Some investors may prefer to wait until a company has reached certain milestones, such as achieving product-market fit or generating consistent revenue, before making an investment. Ultimately, the timing and stage of investment depends on the investor’s strategy and the specific opportunities presented by the company.

Typically, first cheques range from a few lakhs to a few crores, depending on the investor and the startup’s stage. Early/seed-stage investments are inherently risky, with unique opportunities and risks that only experienced investors can understand. Investors with a high risk tolerance may be willing to invest larger amounts, while those with a more conservative approach may opt for smaller investments.

First cheques are made by a variety of investors, including angel investors, venture capitalists, and even family and friends.

However, there are many challenges for founders trying to secure a first cheque as well. Investors are typically looking for unique value propositions and teams with the skills and experience needed to execute on their vision. As long as the investor criteria is fulfilled the chances of them trusting founders with their money and investing through the first cheque are higher.

The Follow-on cheque(s):

Follow-on cheque(s) refer to additional investments made by existing investors in a company. Again, these investments can occur at any stage of the company’s growth, and they are often used to provide additional capital to support the company’s continued development and growth.

In some cases, follow-on cheque(s) are made in response to positive developments within the company, such as achieving key milestones, demonstrating strong revenue growth, or attracting new customers or users. In other cases, follow-on checks may be needed to help a company weather a difficult period or overcome unexpected challenges.

Follow-on cheque(s) can be beneficial for both investors and companies. For investors, they provide an opportunity to continue supporting a company that they believe in and that has the potential for significant returns. For founders/companies, follow-on cheque(s) can provide valuable capital that can help fuel growth and expansion, as well as signal confidence from existing investors that can help attract new investors and customers.

However, securing follow-on investment can also be challenging. Founders must continue to demonstrate strong growth and traction to attract follow-on investment. This can require significant effort and resources, including developing and executing on a strategic plan, building and maintaining a strong team, and effectively communicating the startup’s progress to investors.

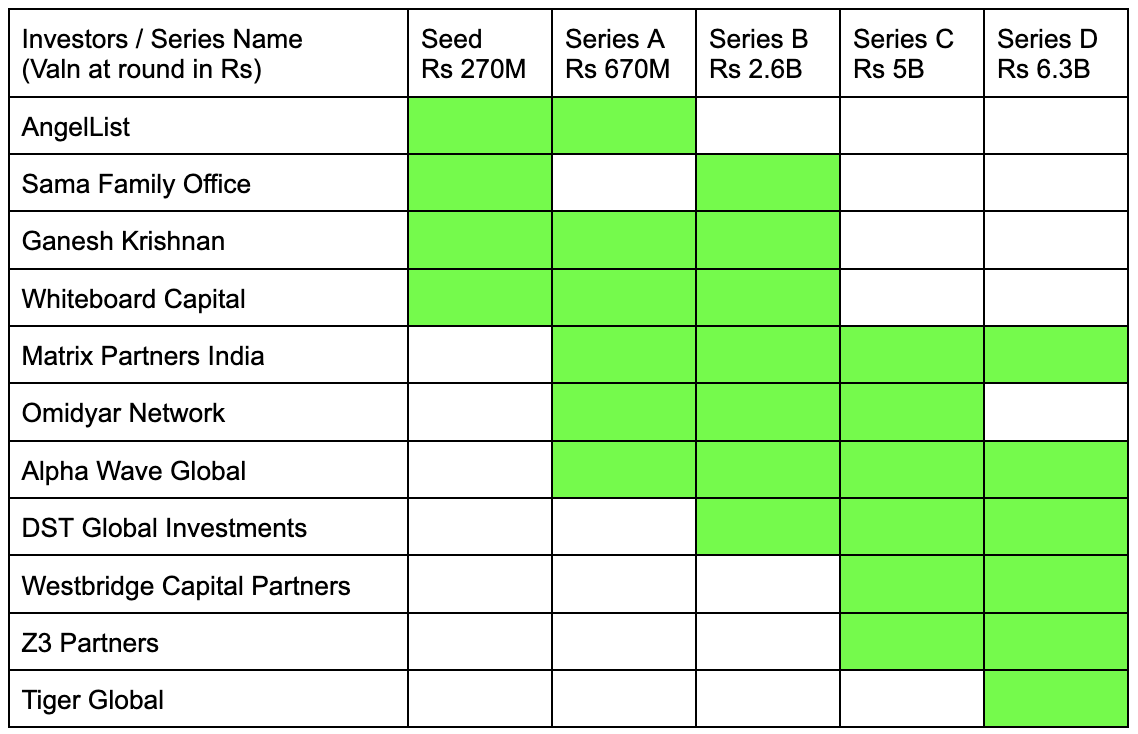

Let us trace the first and follow-on cheque(s) in Dealshare, which is late stage and has gotten all kinds of investors over its lifecycle.

Clearly in the above example, early stage investors like HNIs or syndicates in AngelList have not followed on beyond Series B. This in itself is rare, primarily because the ticket sizes and entry valuation preferences for different investor types vary. Large ticket size investors like Westbridge, Z3 have first come in during the late stage (post Series B) and continued to follow on.

Here are few key factors that greatly influence the first and follow-on cheque(s):

- Investment Thesis: The investment thesis or a formula of an investor plays an integral part in the investments, whether it is their first or a follow-on cheque(s). The investment thesis outlines the goals and objectives of an investor and should align with the company’s goals and plans.

- Market Potential: The first and follow-on cheque(s) and their sizes almost always reflect the market potential of the company. A large market size is usually a positive indicator that the company can grow rapidly, which is attractive to investors.

- Ticket size: The HNIs and syndicates are usually considered early stage investors. Due to the small ticket size at the early stage and high risk associated with investing in startups, these investors may not be able to follow on at the institutional / post series A level of funding given their ticket size. Further down the line, as the ticket sizes increase, larger institutional investors come and possibly take the company public allowing their exit. The larger investors also tend to be more confident about the startup’s prospects and therefore are willing to come in and stay invested past the Series level funding.

- Financials: The company’s financials, including its valuation, revenue, cash flow, and burn rate represents the financial health and may play a role in the size of the cheque by new or follow-on investors. A company with a low burn rate and a healthy revenue stream may need less capital than a company with a high burn rate and limited revenue.

- Founders and Team: The founding team and its network can influence the cheque(s). A strong and experienced founding team for example with investment banking or private equity experience can give investors confidence in the company’s ability to execute its plans and achieve its goals and hence may warrant a higher ticket size.

Conclusion:

First and follow-on cheque(s) are critical to the success of startups in the Indian ecosystem. Founders must understand the nuances of these terms and work towards securing the first cheque(s) and maintain good relationships with their investors to attract follow-on investments. With the right strategy and a solid team, startups can secure the funding they need to achieve their goals and succeed in the competitive Indian startup ecosystem.

Disclaimer: The content provided in this article is for educational and informational purposes only and does not constitute professional financial advice. The opinions expressed herein are those of the author and do not necessarily reflect the views of the company or organization. Please consult a qualified financial professional prior to making any financial decisions.

SEO by Anshi Agarwal Article by Ananth Monnappa & Murali Loganathan