Exponent Energy, an Indian startup redefining electric vehicle (EV) technology, recently raised $26 million in a Series B funding round.

This round saw participation from marquee investors, including Eight Roads Ventures, TDK Ventures, 3one4 Capital, and others.

Here’s a comprehensive look into Exponent Energy’s innovation, financials, and growth story, powered by insights from the PrivateCircle Research dashboard.

Revolutionizing EV Charging: What Makes Exponent Energy Stand Out?

Founded in 2020 by Arun Vinayak and Sanjay Byalal Jagannath, former executives at Ather Energy,

Exponent Energy is on a mission to solve one of the most significant challenges in EV adoption – charging time. Their proprietary technology enables EVs to achieve a full charge in just 15 minutes, compared to the industry standard of three or more hours.

Key innovations include:

- Unique Battery Pack Design: Tailored to handle rapid charging without overheating.

- Bespoke Battery Management System: Ensures that battery cells deteriorate at half the industry average rate.

- Full-Stack Energy Solutions: The company offers everything from battery packs to charging stations and connectors, creating a seamless ecosystem.

Financial Performance: What Do the Numbers Say?

While Exponent Energy is still in its early stages, the company’s financials provide a glimpse into its progress:

- FY22 Revenue: ₹21 lakhs

- FY22 Net Loss: ₹2 crores

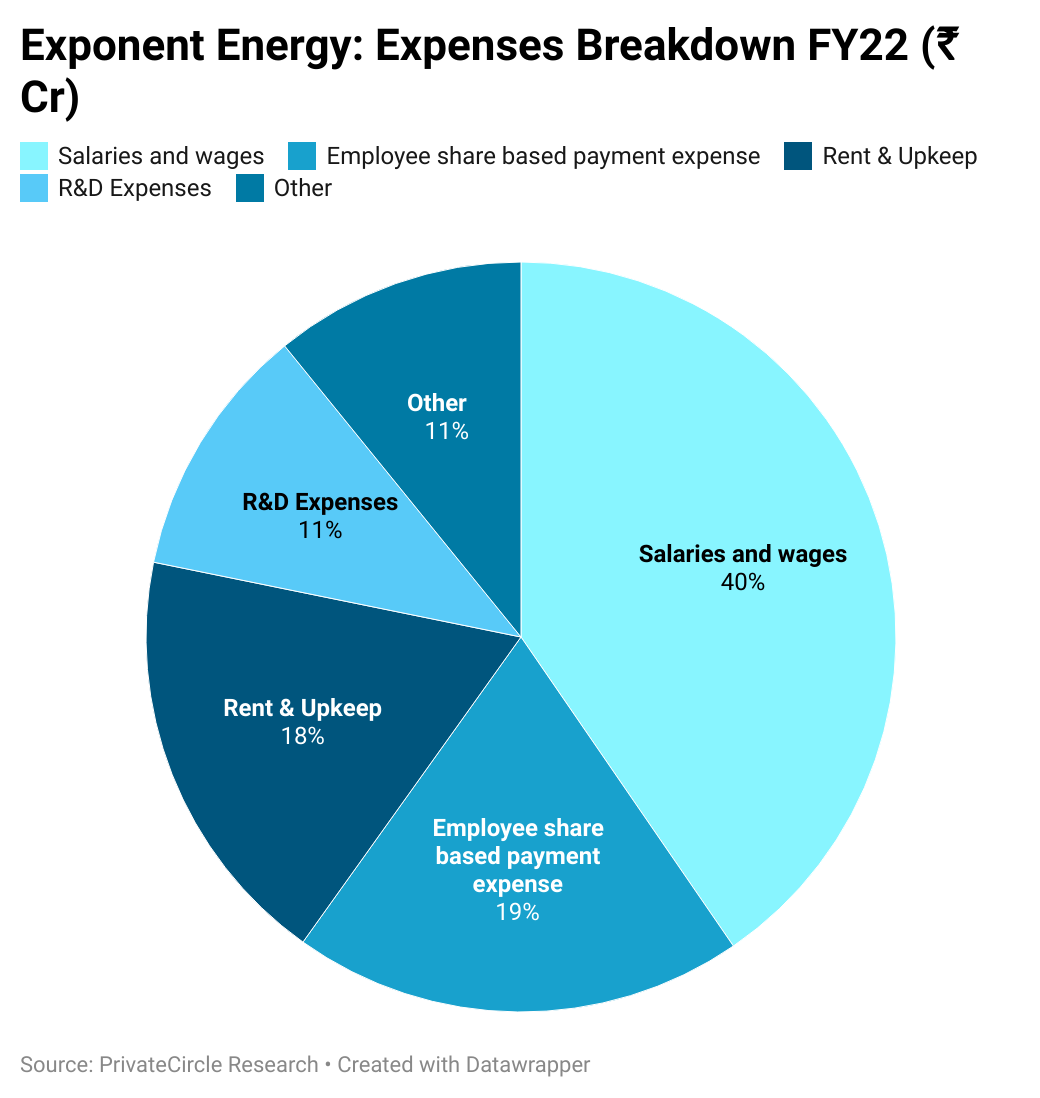

The losses can be attributed to high R&D expenses, a common trend for deep-tech startups in their formative years. However, the absence of FY23 and FY24 filings limits a more recent financial evaluation.

Funding Journey: Building Investor Confidence

Exponent Energy has successfully raised ₹360 crores since its inception, with notable support from 3one4 Capital, which participated in all three funding rounds:

- Pre-Series A (May 2021): The initial validation of their vision.

- Series A: Consolidating their innovation.

- Series B (2024): Expansion and scaling of their ecosystem.

Why Are VCs Betting Big on Exponent Energy?

To gain deeper insights, we spoke with Sonal Saldanha, VP Investments at 3one4 Capital, a fund known for backing companies like Licious, Open, Inc42, Yulu, and Jupiter.

Highlights from the Interview:

- Market Potential: Rapid charging solutions can accelerate EV adoption, especially in markets like India where charging infrastructure remains a bottleneck.

- Competitive Edge: Exponent’s end-to-end ecosystem differentiates it from other players.

- Future Trajectory: Post-Series B, Exponent is poised for aggressive growth, focusing on technology scaling, partnerships, and market penetration.

Team and Shareholding: The Foundation of Success

Behind Exponent Energy’s success is a growing team of dedicated professionals. As of September 2024:

- Employee Count: 229 (per EPFO data, excluding contractual staff).

- Shareholding:

- VC Firms: Combined 41.8% stake.

- Co-Founders:

- Vinayak: 15.3%

- Sanjay Jagannath: 7.5%

Investment in talent has been a key focus, with salaries being the company’s largest expense in FY22.

The Road Ahead for Exponent Energy

As the EV industry reaches a critical inflection point, startups like Exponent Energy are paving the way for broader EV adoption.

By drastically reducing charging times and addressing battery longevity issues, the company is creating a compelling case for the future of EVs.

With $26 million in fresh capital, Exponent Energy is well-positioned to scale its technology and build a robust infrastructure for EVs in India and beyond.

Their journey is a testament to how innovation, when supported by strategic investment, can create transformative impact.

Follow Us for More Insights

For more deep dives into India’s top private market deals, subscribe to our updates at PrivateCircle.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.