The drone manufacturing and management sector in India has gained considerable momentum, driven by regulatory tailwinds, increasing defense and commercial demand, and significant investor interest.

This report provides a detailed analysis of key funding, valuation, and operational trends shaping the sector in 2025.

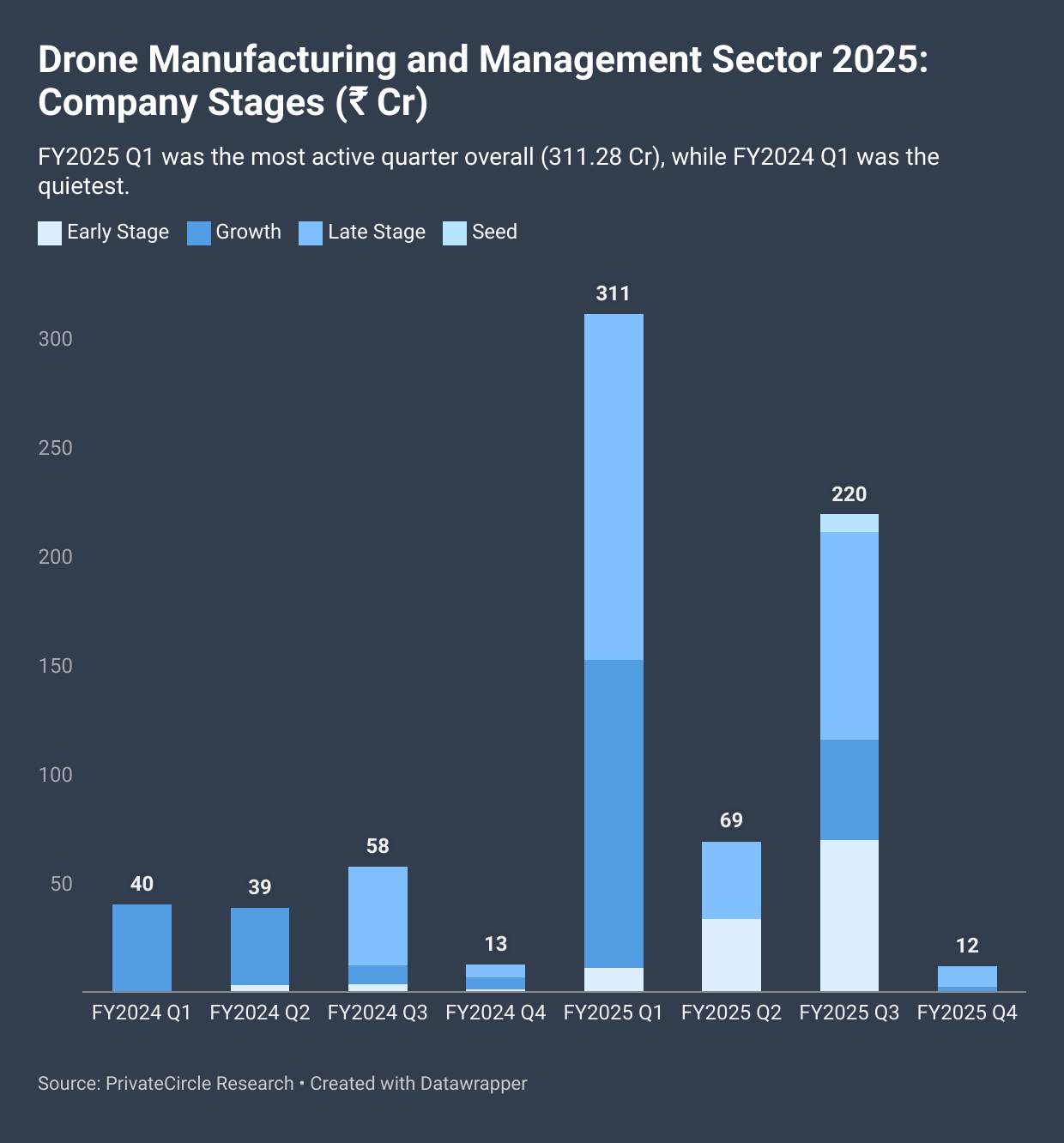

Company Stages: Funding Activity Overview

The first quarter of FY2025 was the most active period, recording total deal value of ₹311.28 crore.

This marks a significant increase compared to FY2024 Q1, which witnessed minimal funding activity.

The data indicates a healthy maturing ecosystem, with startups advancing beyond seed stages into growth and expansion phases, particularly in defense applications, logistics automation, and agricultural drones.

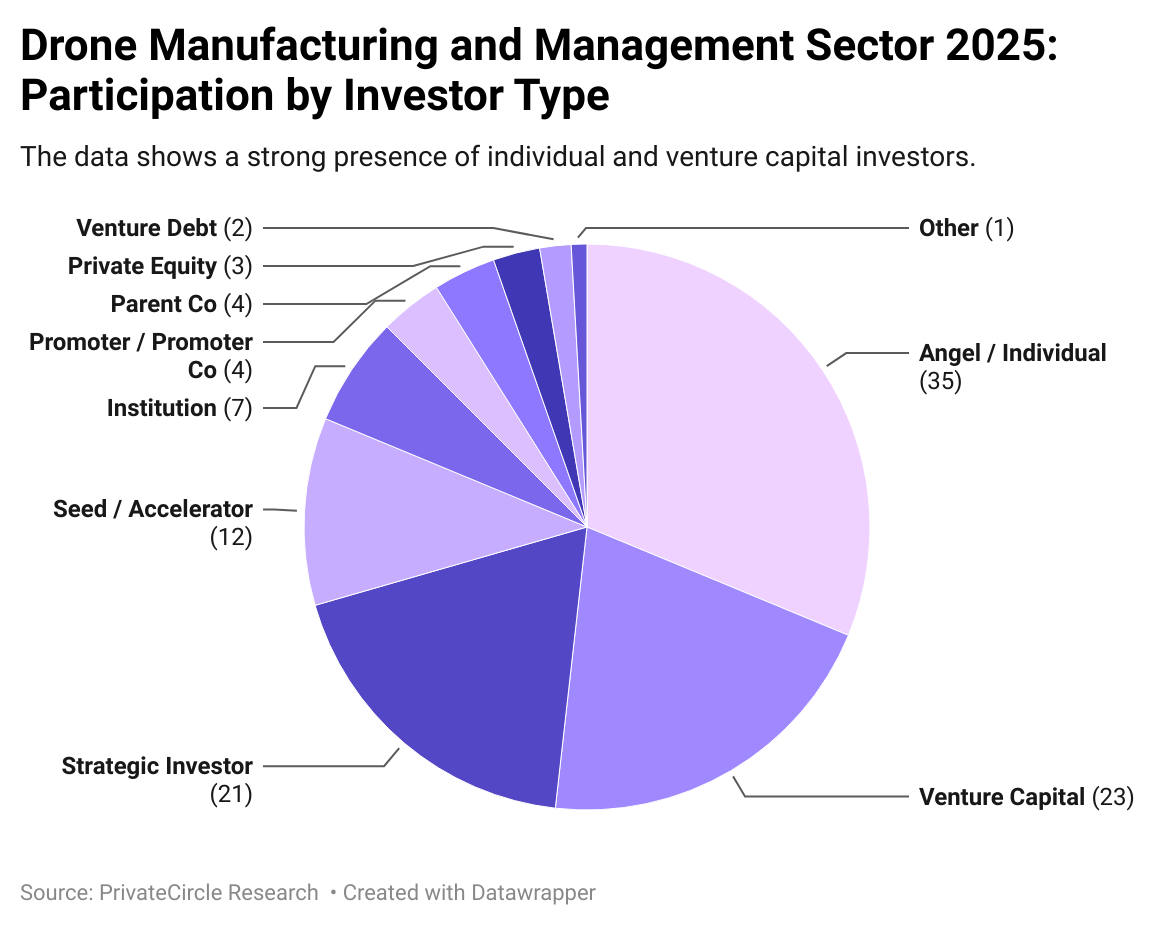

Investor Participation: Capital Sources

The analysis reveals a broad mix of capital sources, with individual investors and venture capital firms accounting for the majority of participation.

While institutional and strategic investors have started to show greater interest, the early-stage ecosystem continues to be driven largely by private venture funds and high-net-worth individuals.

This pattern suggests an appetite for high-risk, high-reward investments amid the sector’s evolving regulatory clarity and commercial viability.

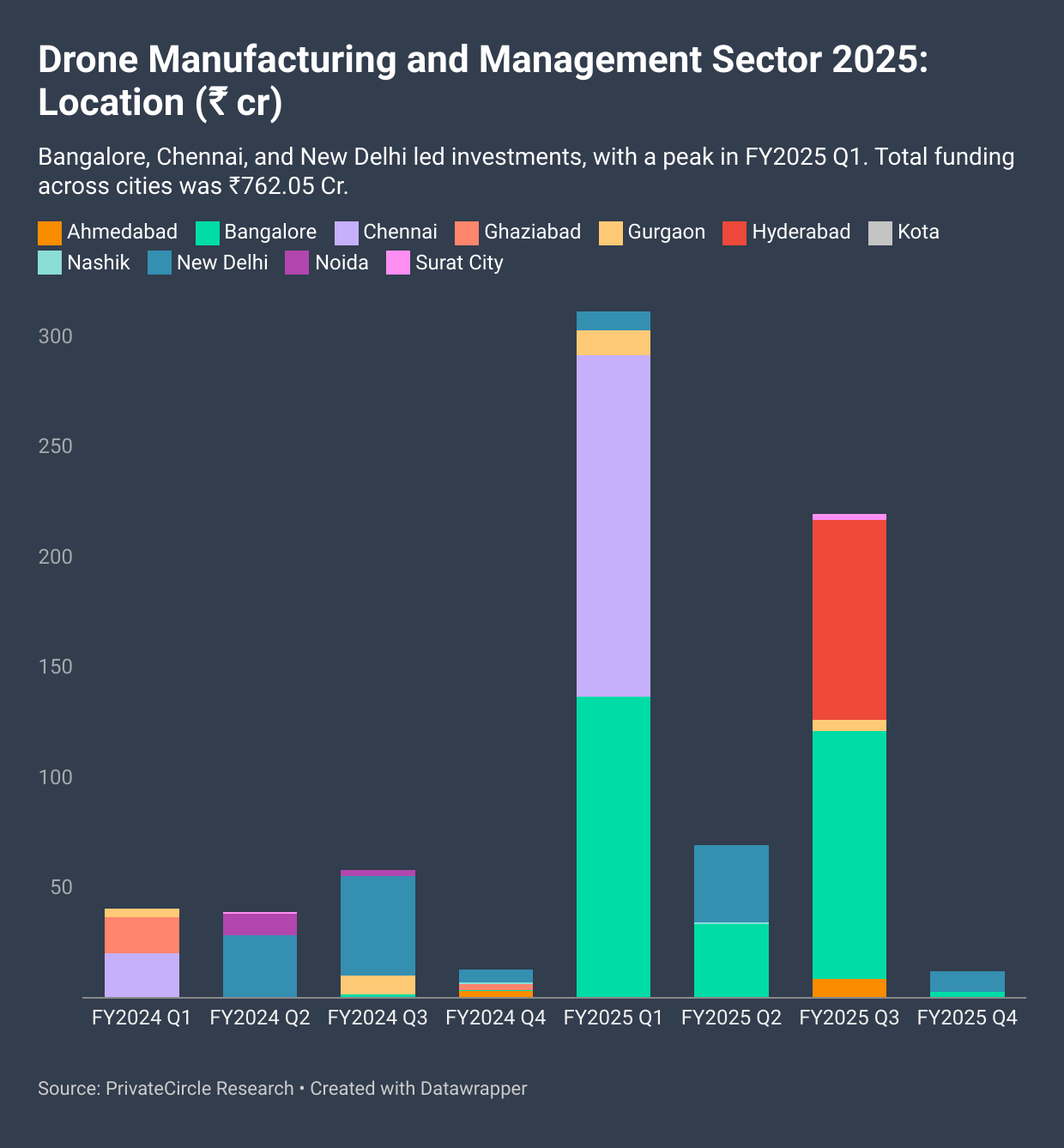

Geographic Distribution: Investment Concentration

Investment remains heavily concentrated in India’s major urban centers:

- Bangalore emerged as the dominant hub, driven by its deep aerospace R&D talent pool and proximity to defense projects.

- Chennai and New Delhi also attracted significant funding, supported by strong industrial ecosystems and government collaborations.

The total funding recorded across cities stood at ₹762.05 crore, highlighting increasing localization of drone manufacturing and services capabilities.

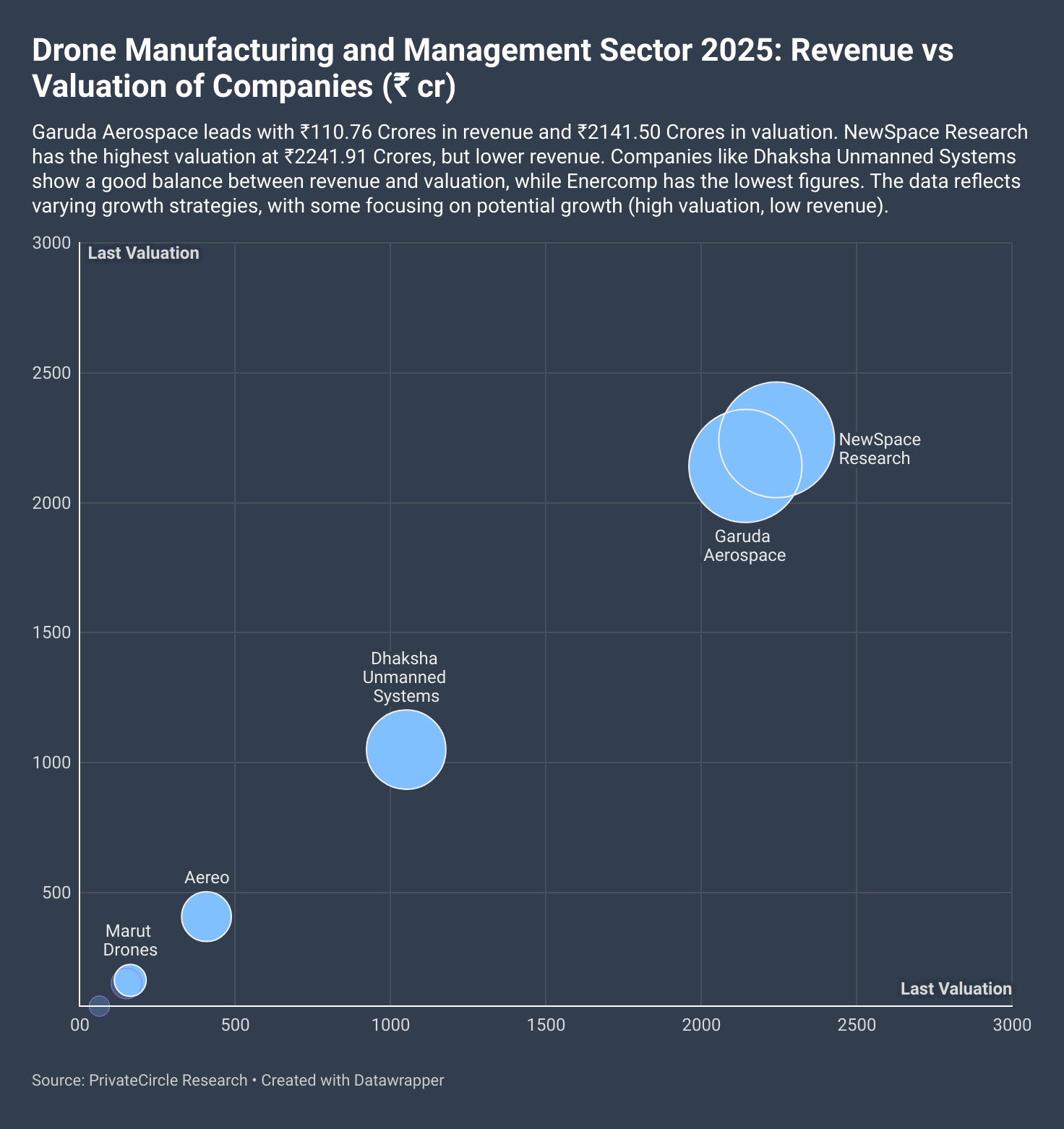

Revenue vs Valuation: Company Positioning

A comparison of revenue and valuation data offers insights into company strategies:

- Garuda Aerospace reported revenue of ₹110.76 crore against a valuation of ₹2141.50 crore, indicating strong operational performance relative to its peers.

- NewSpace Research recorded the highest valuation at ₹2241.91 crore, though with comparatively lower revenues — reflecting a valuation premium on future growth potential.

Conversely, companies like Dhaksha Unmanned Systems demonstrated balanced fundamentals, while early-stage companies such as Enercomp remain in nascent growth phases.

The sector shows a clear bifurcation between revenue-backed scaling and innovation-driven future value.

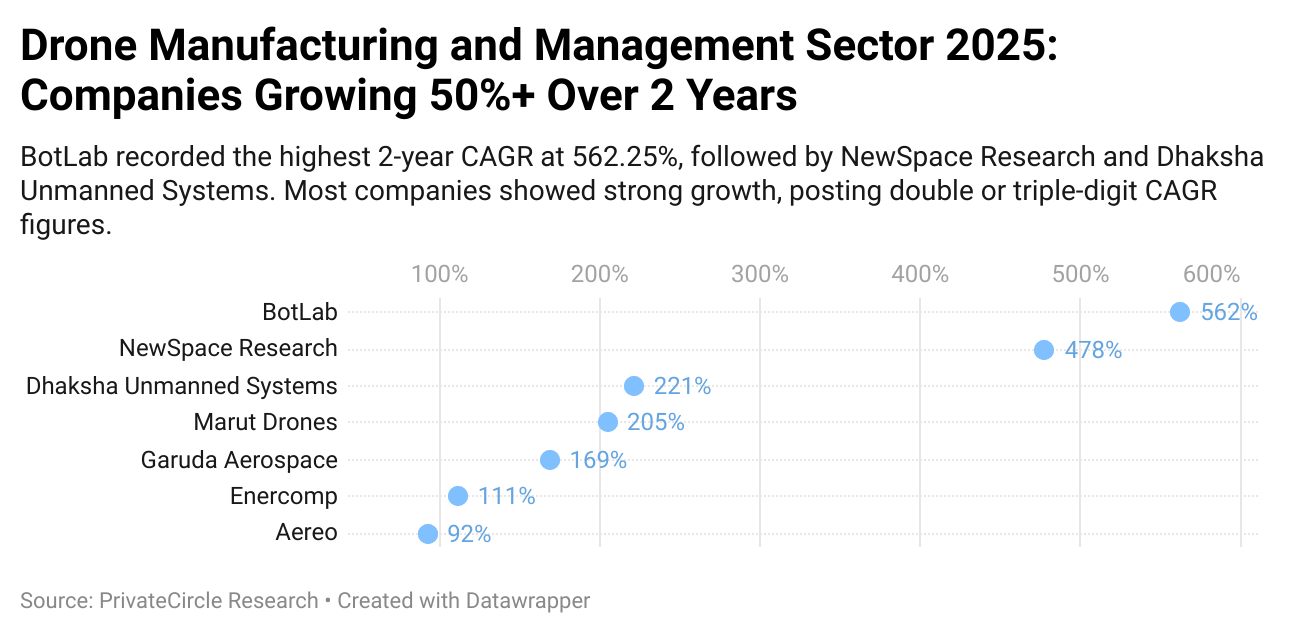

Growth Metrics: Top Performing Companies

Two-year CAGR analysis indicates robust growth across the sector:

- BotLab Dynamics recorded a remarkable 562.25% CAGR, the highest among its peers.

- NewSpace Research and Dhaksha Unmanned Systems also posted strong double and triple-digit growth rates.

The strong CAGR figures affirm the sector’s high-growth trajectory, positioning these companies as key players to watch as the industry evolves toward commercial and defense-scale deployments.

Conclusion

The Indian drone sector is entering a critical growth phase.

Backed by progressive government policies, expanding defense requirements, and rising commercial use cases across agriculture, infrastructure, and surveillance, the sector is poised for sustained long-term growth.

Strategic investors and corporate acquirers are expected to play a larger role in the coming quarters as the sector consolidates and scales.

Stakeholders should closely monitor companies demonstrating both operational scalability and innovation-led valuation expansion as the sector matures into a strategic pillar of India’s technology and defense economy.