India Startup Funding Snapshot – December 2025

India’s startup ecosystem closed December 2025 with ₹6,779.49 crore raised across 71 deals, reflecting steady investor confidence despite selective capital deployment. Funding activity was anchored by large, late-stage and strategic rounds across energy, healthcare devices, EVs, fintech, and deep-tech.

While deal volumes stayed consistent, capital was clearly concentrated in fewer, high-conviction bets, signalling a continued shift toward scale, profitability, and long-term relevance.

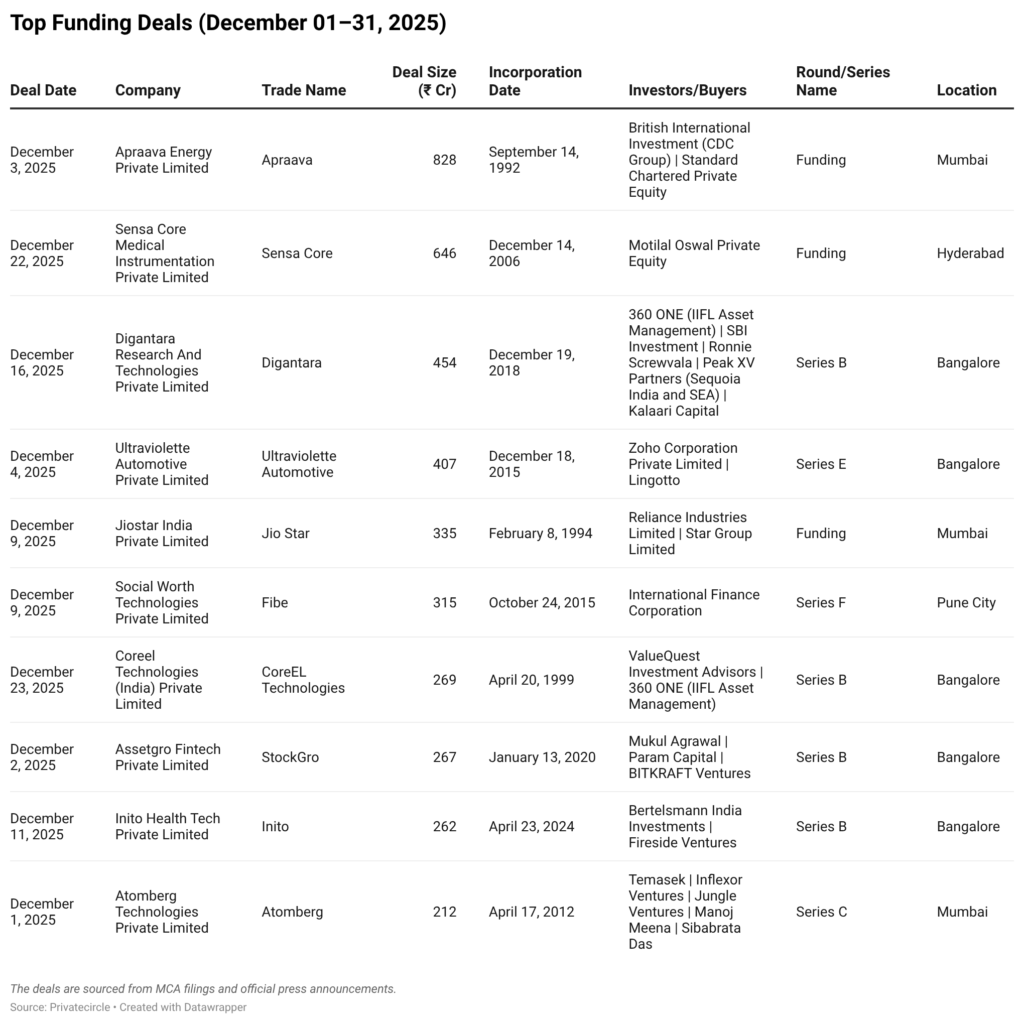

Big Checks Define December’s Funding Landscape

The month saw multiple ₹200+ crore raises, led by energy transition platforms, advanced manufacturing players, and venture-backed tech companies. A strong mix of global institutional investors, strategic corporates, and domestic asset managers participated across funding rounds.

Bengaluru remained the most active hub for large venture deals, followed by Mumbai and Hyderabad.

Top Funding Deals (December 01–31, 2025)

Key Takeaways

- Energy, EVs, and climate-aligned platforms attracted the largest ticket sizes.

- Late-stage venture and growth equity rounds dominated top deals.

- Institutional and strategic investors played a central role in December’s funding momentum.

As 2025 closed, funding activity reflected discipline, selectivity, and long-term conviction, setting a stable foundation for capital deployment in early 2026.

Sector & Investor Trends

December’s funding activity points to three clear trends:

- Energy, EVs, and climate-aligned businesses continue to attract the largest checks.

- Late-stage venture and growth equity rounds dominated top deals, indicating a shift toward capital-efficient scaling.

- Institutional and strategic investors played a larger role than early-stage funds, particularly in infra-linked and manufacturing-led startups.

Bengaluru emerged as the leading hub for high-value venture deals, followed by Mumbai and Pune.

What This Signals Going Into 2026

As 2025 closed, investor behaviour reflected selectivity rather than slowdown. Capital flowed toward businesses with clear revenue visibility, strong unit economics, and strategic relevance, especially in sectors aligned with India’s long-term economic priorities.

With December setting a stable base, early 2026 is expected to see continued momentum in energy transition, deep-tech, healthcare, and financial services.

Track India’s private markets with confidence using PrivateCircle’s MCA-linked data and deal intelligence.

From startups to large unlisted firms, PrivateCircle brings clarity to private capital.