The personal care products in India is a rapidly growing sub sector with a large consumer base. It includes a wide range of products such as skincare, hair care, cosmetics, fragrances, and oral care, among others.

The personal products as a sector has been on an upward trajectory due to factors such as increasing consumer awareness, rising disposable incomes, and a growing conscious preference for premium and natural products. The sector has also been driven by factors such as urbanization, changing lifestyles, and the influence of social media.

It is dominated by both domestic and international players, with a mix of global and local brands competing for market share. The top players in the industry include companies such as Hindustan Unilever, Procter & Gamble, L’Oreal, Colgate-Palmolive, and Dabur, among others.

Highlights:

- The Indian personal care products market is the 8th largest in the world.

- 26%+ growth in exports within this sector in the last 4 years.

- The market size reached US$ 26.3 Billion in 2022, and is expected to reach US$ 38.0 Billion by 2028.

- Expected to exhibit a growth rate (CAGR) of 6.45% during 2023-2028.

Deep diving into the personal care products sub sector, this blog brings you the Company Comparable Analysis Report (CCAR) comparing Mamaearth vs MyGlamm vs SUGAR Cosmetics. These are the top 3 companies having the revenue range between 2 to 10 Bn.

Table of contents;

• Market faring comparables

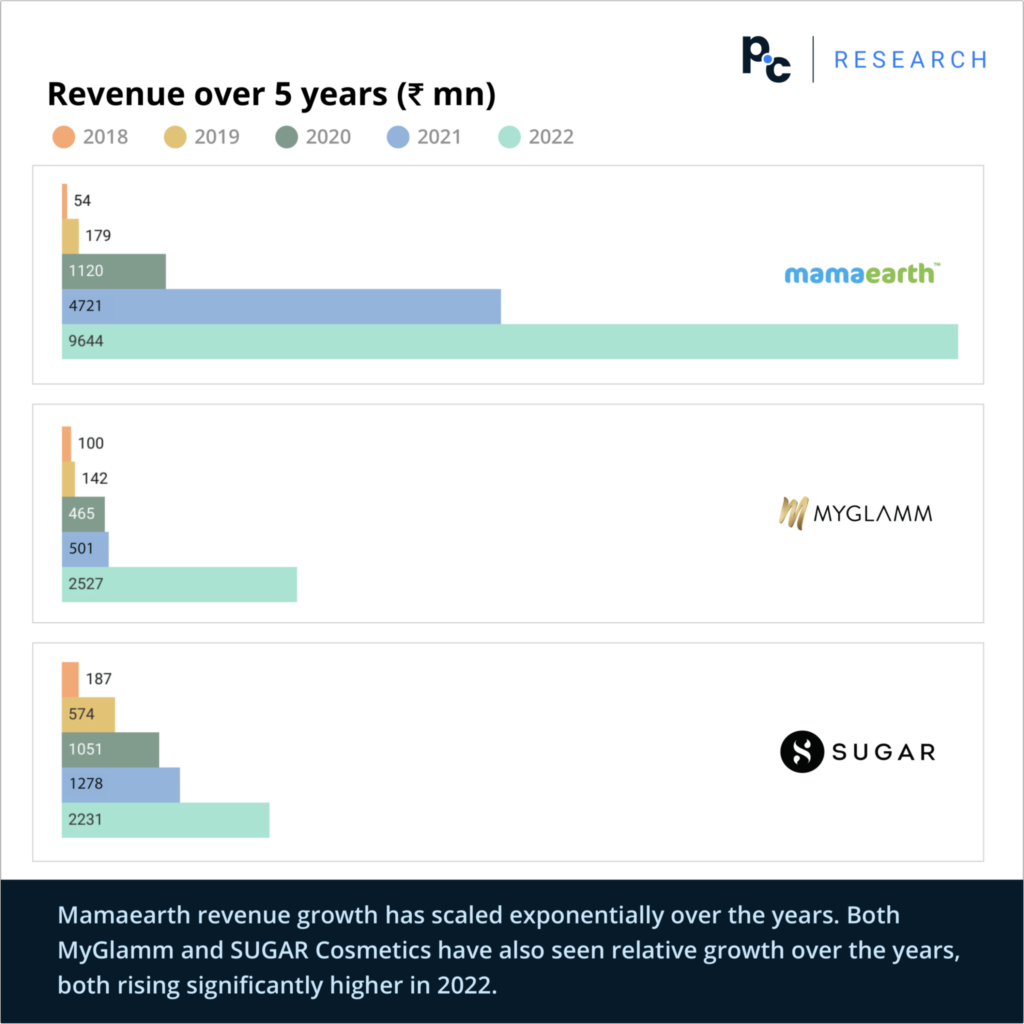

• Revenue over 5 years (₹ mn)

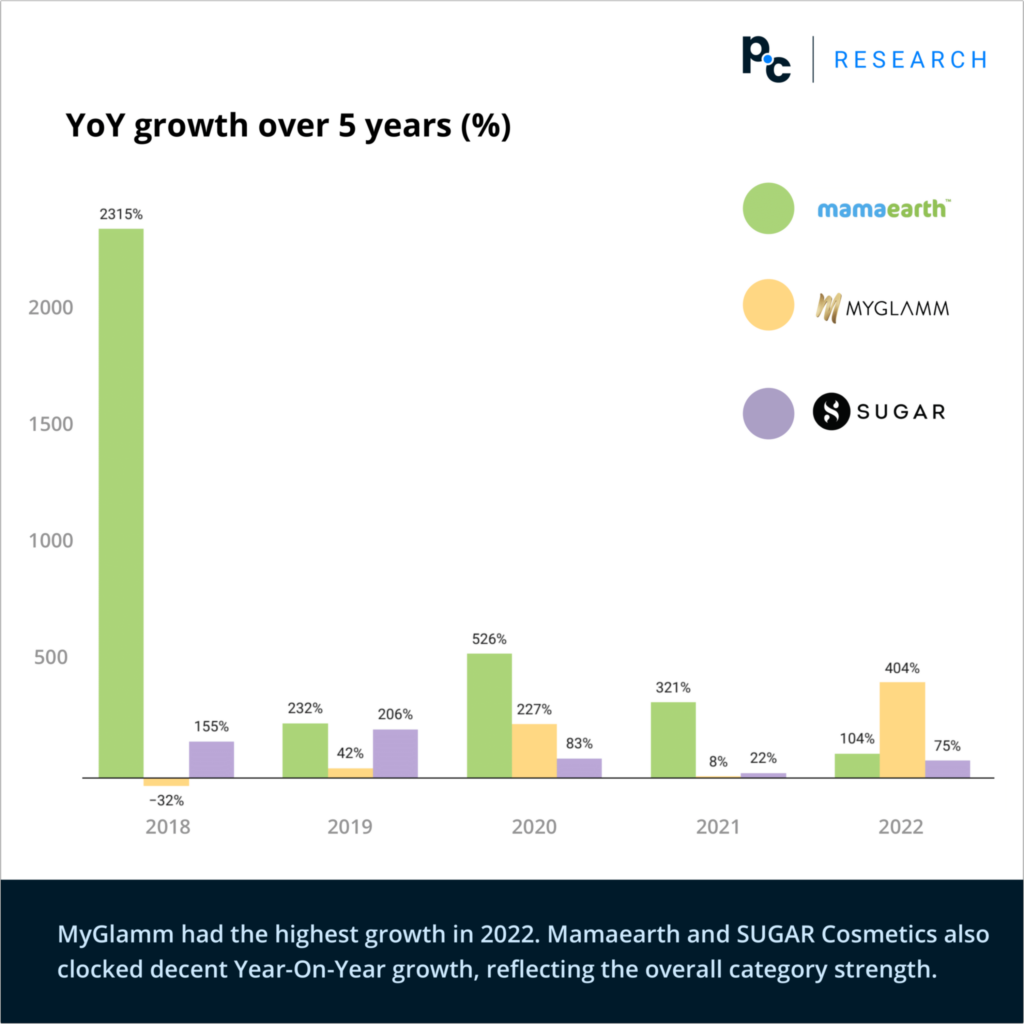

• YoY growth over 5 years (%)

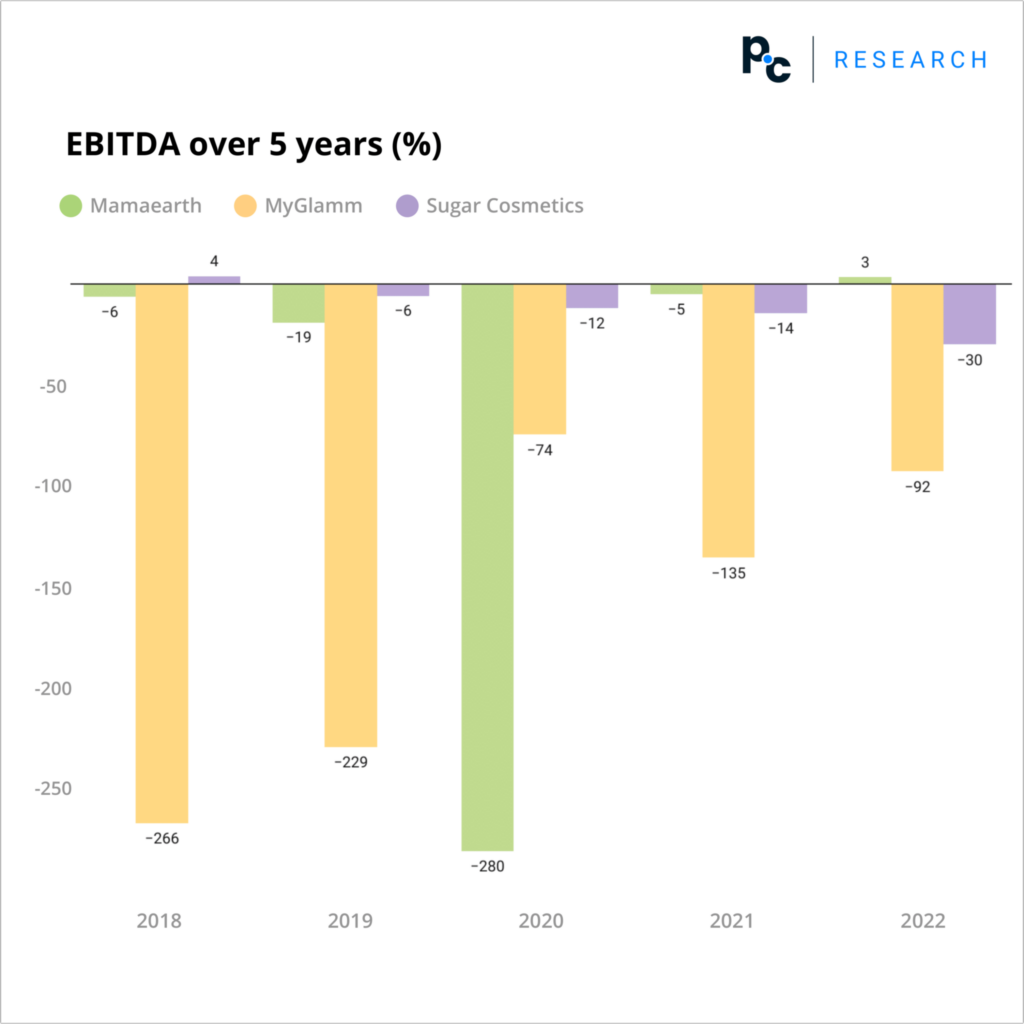

• EBITDA over 5 years (%)

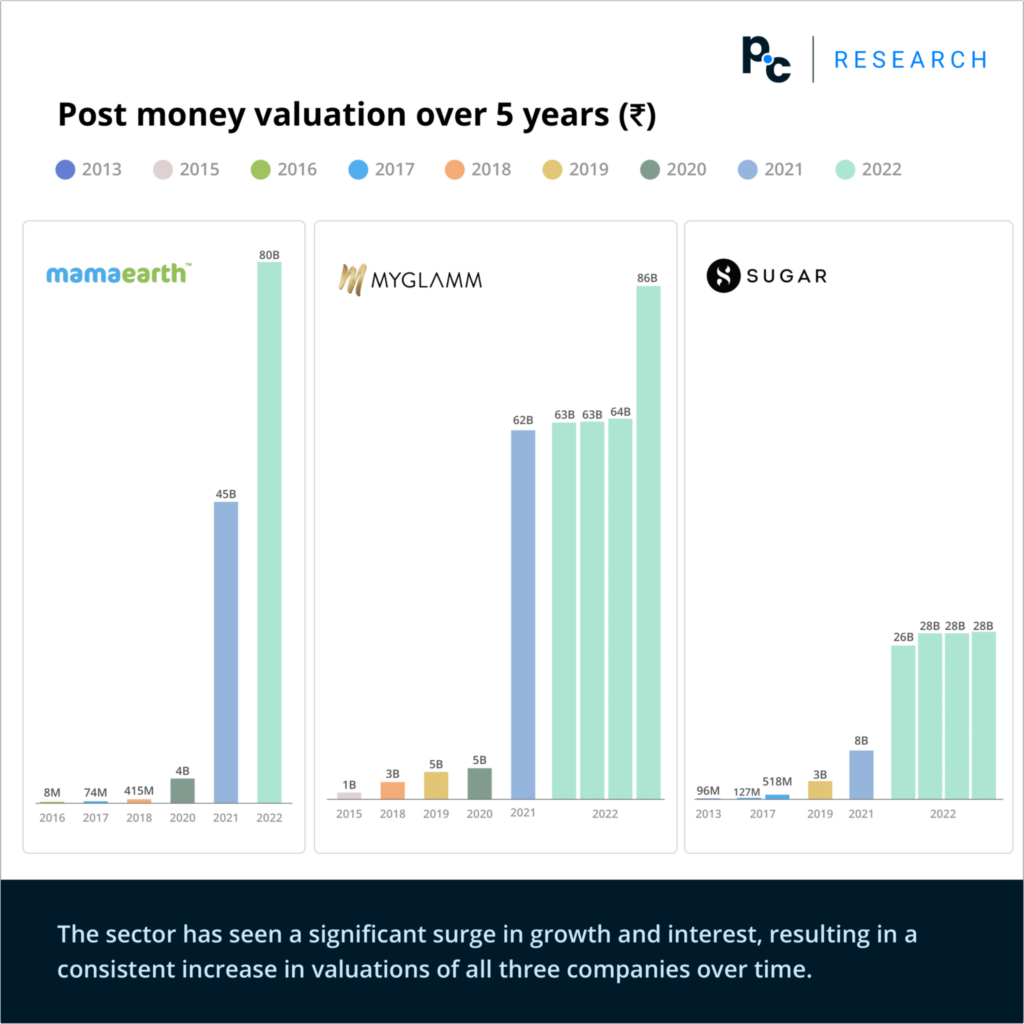

• Post money valuation over 5 years (₹)

• Post money valuation to Trailing FY Revenue multiples over 5 years

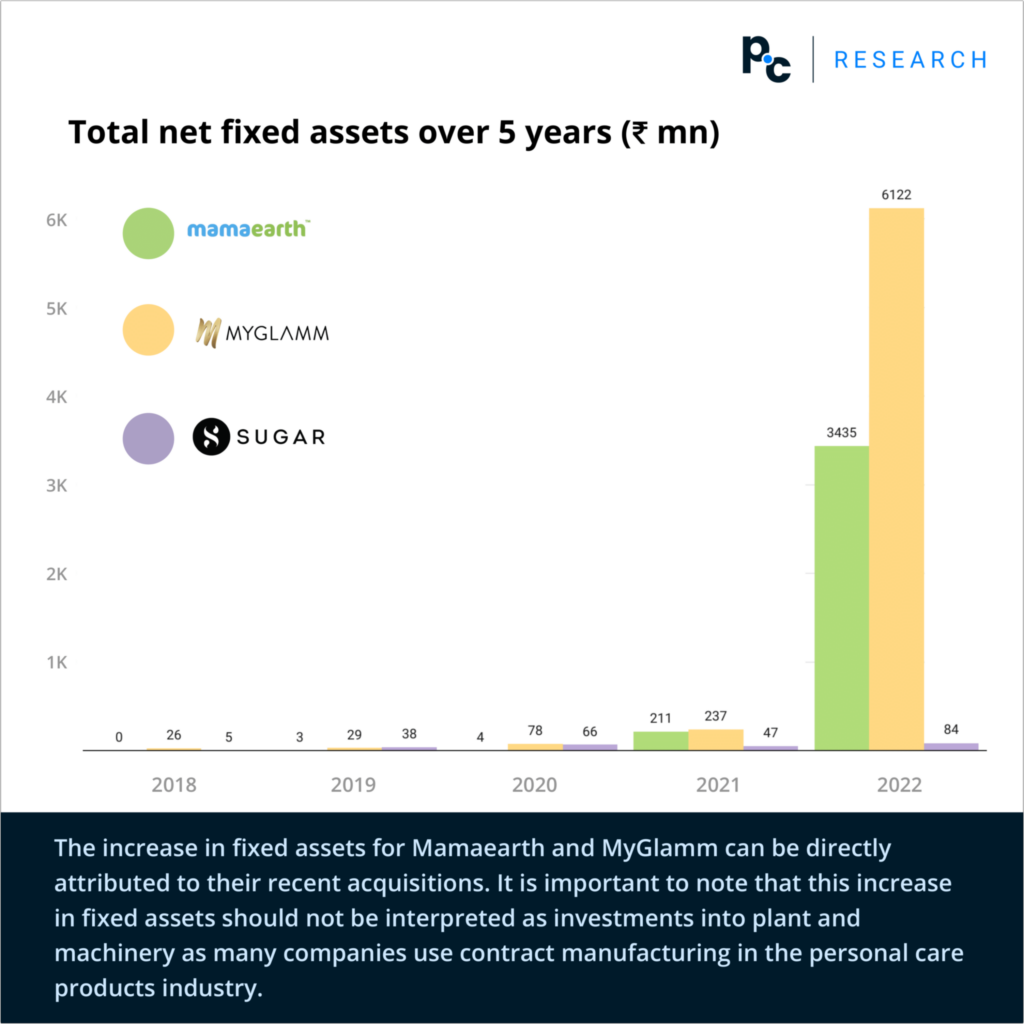

• Total net fixed assets over 5 years (₹ mn)

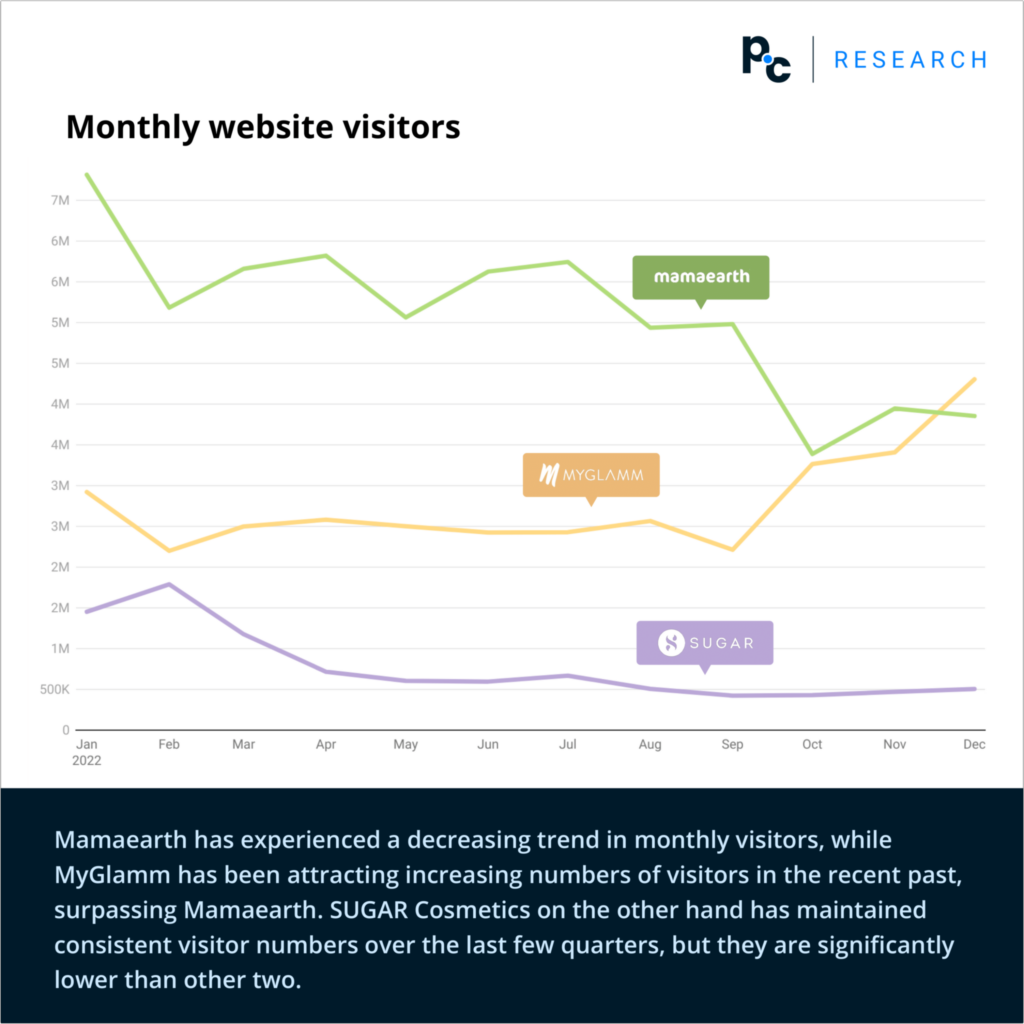

• Monthly website visitors

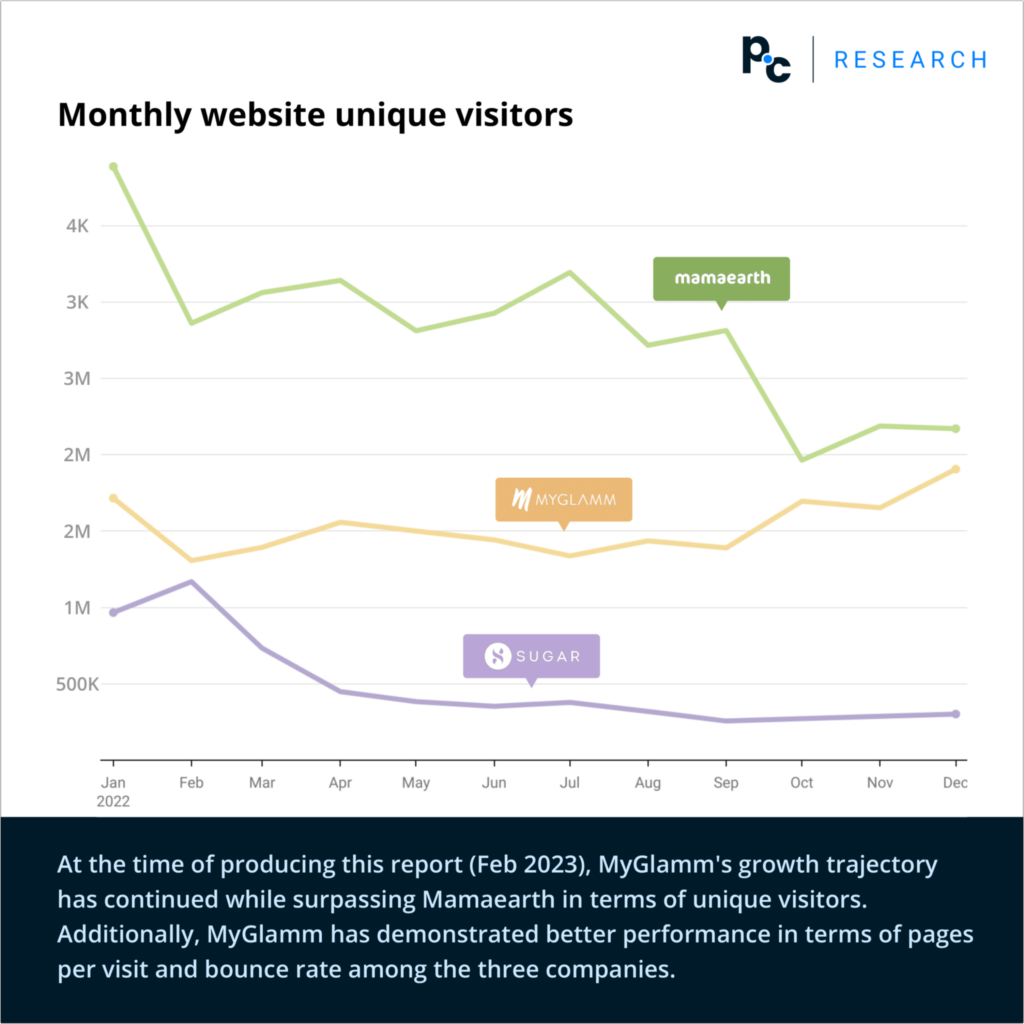

• Monthly website unique visitors

From a market outlook, the demand for beauty and personal care products in India is being driven by several key factors. One of the primary drivers is the increasing focus on personal health and hygiene, which is leading consumers to seek out products that can help them maintain their hygiene and appearance.

This trend is being further supported by initiatives from the government and private organizations aimed at promoting awareness of the importance of feminine and personal hygiene. For instance, the Ujjwala Sanitary Napkin initiative launched by the Odisha state government in 2018 has helped to improve access to basic hygiene products and create employment opportunities for women.

In addition, rising incomes and a growing interest in beauty products are fueling demand for customized, organic, and premium product variants. Social media is also playing a significant role in promoting this trend.

To capitalize on these trends, physical store retailers are adopting innovative strategies such as creating beauty studios with personalized beauty advisors to drive customer engagement and improve the shopping experience. Overall, the market for beauty and personal care products in India is expected to continue to grow as consumers become increasingly health and beauty conscious.

Data Curation & Report - Joslin Sequeira Visualisation - Shradha Naik SEO - Anshi Agarwal Article - Ananth Monnappa

References: