Introduction

Welcome to another Comparable Company Analysis, where we delve into the vast expanse of data and insights to bring forth a intriguing exploration of the Indian E-Commerce (electronic commerce) ecosystem.

India, boasting over 800 million internet users, ranks as the second-largest global online market. E-Commerce, contributing 7% to the total retail market at $55 billion in 2021, is a formidable player in the country.

The growth drivers include surging internet penetration, rising smartphone users (expected to reach 1.18 billion by 2026), and the emergence of vernacular content.

Digital infrastructure, featuring UPI, eKYC, and Aadhar, has cut consumer onboarding time by 80%, with government initiatives like the National Logistics Policy poised to enhance rural E-Commerce efficiency.

Explore diverse segments—from Hyperlocal and Mobility to Health Tech, Social Commerce, B2C Marketplace, Payments & Wallets, Travel & Hospitality, B2B, and EdTech – revealing market leaders and deal numbers.

Why E-Commerce?

As E-Commerce firms once again recorded a successful festive season, we turned our focus to the major e-retailers in the country.

To select companies for our comparative analysis report, We have sorted e-commerce marketplaces by valuation using the PrivateCircle Research platform.

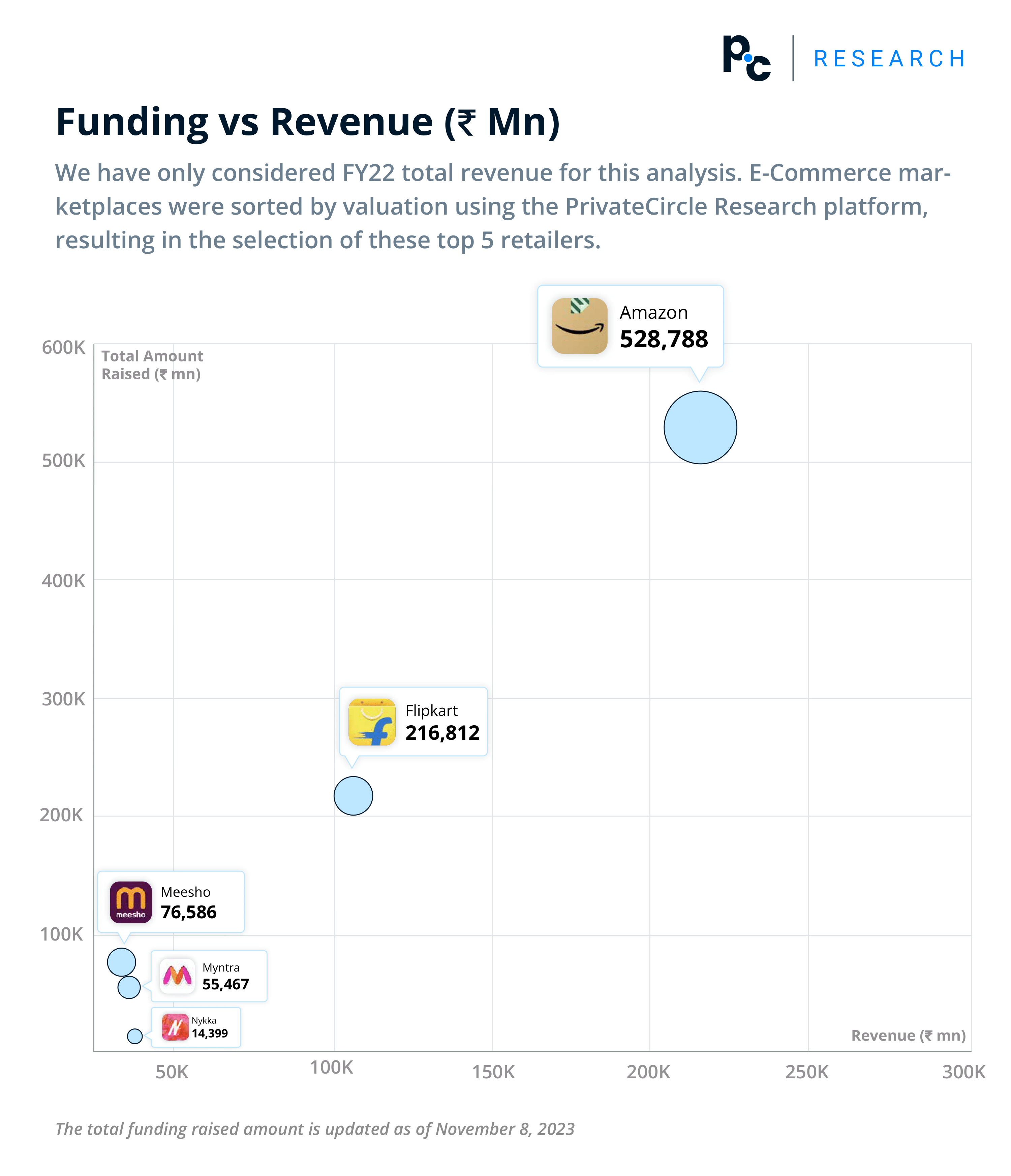

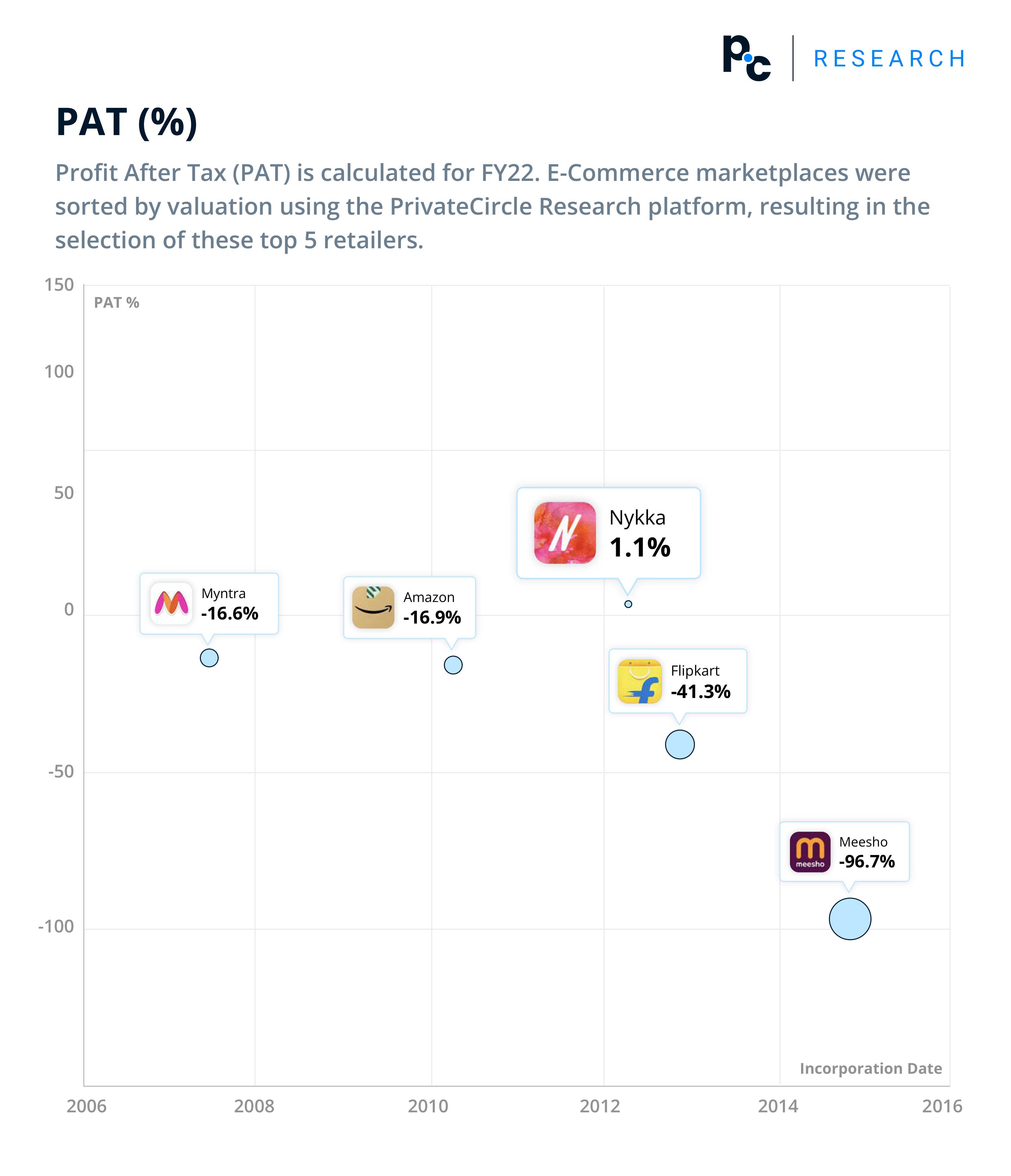

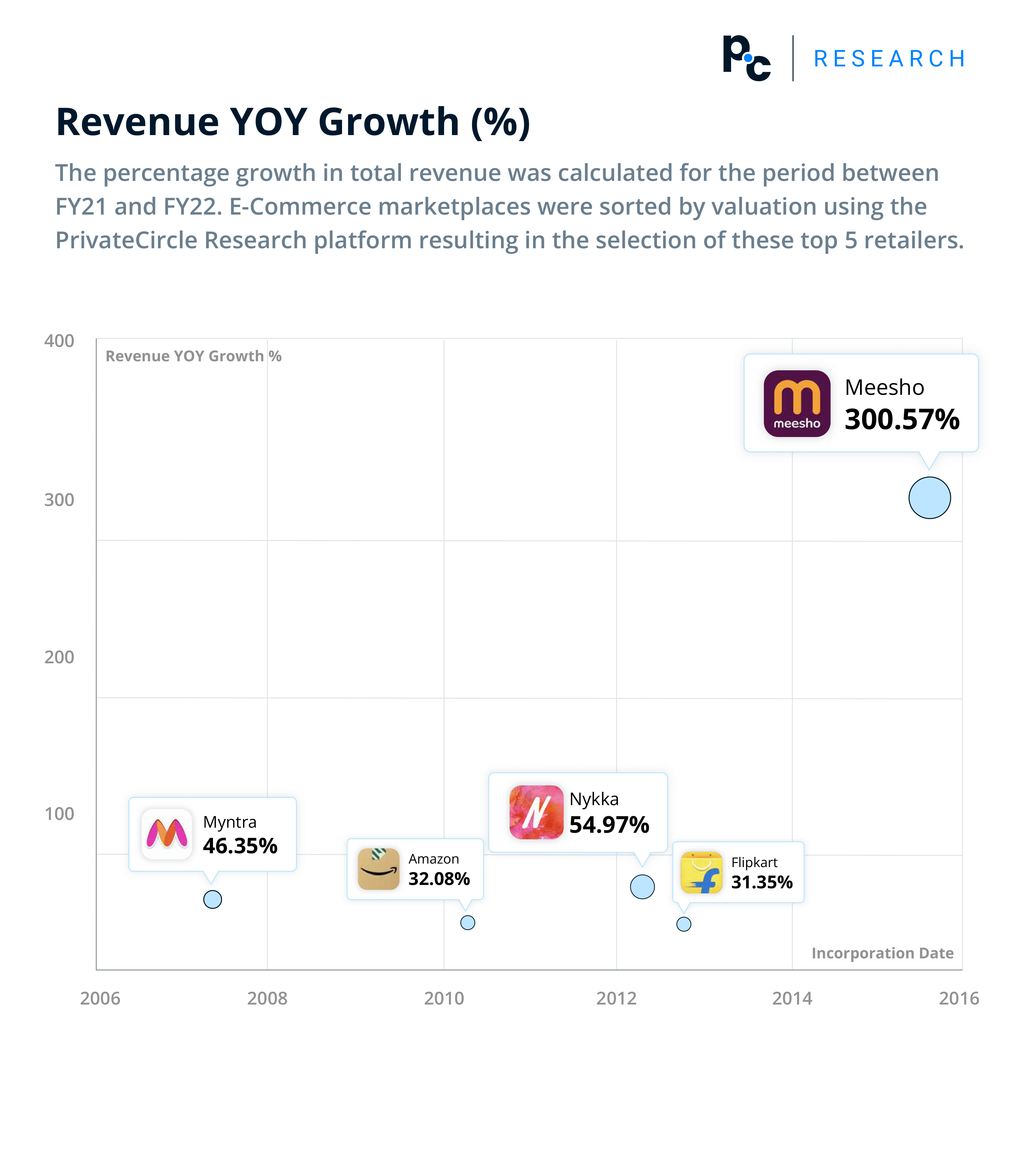

The five companies included in our analysis are Amazon Seller Services Private Limited (Amazon), Flipkart Internet Private Limited (Flipkart), Fashnear Technologies Private Limited (Meesho), Myntra Designs Private Limited (Myntra) and Fsn E-Commerce Ventures Limited (Nykaa).

What is a CCAR?

Comparable Company Analysis Report is our endeavor to delve deeper into a trending sector, all through the lens of data. As a robust data intelligence platform, these reports serve as a testament to the capabilities of the PrivateCircle Research dashboard.

Amazon:

Amazon Seller Services Private Limited facilitates online product sales for sellers in India and globally through Amazon Global Selling. Sellers gain access to 180+ countries, expanding their products’ global reach. Amazon offers essential tools and services for successful online selling.

Flipkart:

Flipkart Internet Private Limited, the operator of the e-commerce portal Flipkart, is a major player in India’s online marketplace. It sources goods in bulk, delivering 8 million shipments monthly, offering a wide range of products like mobiles, electronics, healthcare items, home appliances, apparel, and more.

Meesho:

Fashnear Technologies Private Limited, operating as Meesho, is an Indian social commerce platform. The app empowers small businesses to create online stores through social channels like WhatsApp, Facebook, and Instagram.

Initially facilitating sales, Meesho later organized the Indian long tail supply chain, offering logistical support to its reseller customer base.

Myntra:

Myntra Designs Private Limited operates the e-commerce platform Myntra, India’s leading fashion and lifestyle destination. Committed to accessibility, Myntra provides a hassle-free shopping experience with a vast range of brands and products.

The platform offers the latest and trendiest clothing, footwear, accessories, jewelry, and personal care items for men, women, and kids.

Nykaa:

Fsn E-Commerce Ventures Limited operates Nykaa, a leading online beauty and wellness hub. Serving both men and women, Nykaa provides top-quality beauty and wellness products at competitive prices.

As India’s largest omnichannel beauty destination, Nykaa boasts over 1200 genuine brands, six warehouses, and a vast selection of curated makeup, skincare, haircare, fragrances, personal care, luxury, and wellness products for a diverse customer base.

Indian E-Commerce Sector Highlights:

- India stands as the second-largest internet market globally with a user base exceeding 800 million.

- The E-Commerce sector in India reached a market size of $55 billion (GMV, 2021), constituting approximately 7% of the total retail market.

- Notably, internet penetration in India has surged, with around 52% of the population (approximately 759 million people) accessing the internet in 2022.

Growth Drivers

Increasing Internet Penetration

- Around 87% of Indian households will have an internet connection by 2025, with 21% rise in duration of internet access through mobiles as compared to 2019.

- Number of online shoppers in India to increase at: CAGR of 22% to 88 Mn in rural India between 2019 – 26; CAGR of 15% to 263 Mn across urban India in the same period.

- India has among the cheapest data prices in the world – one gigabyte (1GB) of data costs ~ $0.17 (₹13.5); driving majority of the population to go online.

Rise in Digital Adoption

- Number of smartphone users to increase from 846 Mn in 2021 to 1.18 Bn by 2026.

- Average data consumption per user per month reached 19.5 GB in 2022, with mobile data traffic increasing 3x from 2018-23.

- UPI accounted for a significant portion of all digital payments in 2022, accounting to ~62 Bn transactions in 2022.

- By 2026, 81% of India’s population will have access to a smartphone, up from 61% in 2021.

Vernacular Content

- Increase in availability of local language/mobile first content.

- 70% of Indians deem local language content to be more authentic than content offered in English.

- ~73% of India’s internet subscribers use Indian languages, with an estimated regional language base of 540 Mn, offering a market size of $53 Bn.

Digital Infrastructure

- Digital infrastructure such as UPI, eKYC, Aadhar has helped reduce the time taken to onboard consumers by 80%.

Rise of rural-led Value E-Commerce

- By 2026, over 60% of value e-commerce demand is expected to be driven by tier 2-4 towns and rural India.

- Government initiatives such as the National Logistics Policy will further smoothen deliveries to the hinterlands of the country, making deliveries and reverse logistics efficient and cost-effective.

Key Segments & Deals

- Hyperlocal – Private Equity/Venture Capital deals worth $1.3 Bn; 17 deals 2022 | Market Leaders – Swiggy & Zomato.

- Mobility – Private Equity/ Venture Capital deals worth $0.18 Bn; 11 deals 2022 | Market Leaders – ANI Technologies (Ola) & Uber.

- Health Tech – Private Equity/Venture Capital deals worth $0.8 Bn, 40 deals 2022 | Market Leaders – PharmEasy, 1mg, & Curefit.

- Social Commerce – $1.7 Bn, 32 deals PE/VC deals 2022 | Market Leaders – Meesho & DealShare.

- B2C (Marketplace) – $2.3 Bn, 74 deals PE/VC deals 2022 | Market Leaders – Flipkart, Amazon India, & Snapdeal.

- Payments & Wallets – $0.5 Bn, 13 deals PE/VC deals 2022 | Market Leaders – Paytm, Mobikwik, & Google Pay.

- Travel & Hospitality – $0.1 Bn, 3 deals PE/VC deals 2022 | Market Leaders in Hospitality – OYO & Fabhotels | Market Leaders in Online Booking – MakeMyTrip & Yatra.com.

- B2B – $1.1 Bn, 33 deals PE/VC deals 2022 | Market Leaders – Indiamart & TradeIndia.

- EdTech – $1.4 Bn, 51 deals PE/VC deals 2022 | Market Leaders – Bjyu’s, Unacademy, & UpGrad.

More CCARs from PrivateCircle Research:

Comparable Company Analysis Report: Indian HR SaaS Companies, 2022

Comparable Company Analysis Report: Indian Personal Care Products, 2022

Comparable Company Analysis Report: Indian Food Aggregators, 2022

Comparable Company Analysis Report: Indian EV Two-Wheeler OEMs 2022

Comparable Company Analysis Report: Indian Spacetech Companies 2023