The Indian food retail landscape is a rapidly growing market with a significant presence of both traditional and modern retail formats. The market is dominated by traditional retail formats such as street markets, mom-and-pop stores, and small grocery stores, which account for the majority of the sales.

However, modern retail formats such as supermarkets, hypermarkets, and convenience stores have been gaining momentum in recent years, particularly in urban areas, as consumers seek out more convenient shopping options.

In addition, online food and groceries delivery is also emerging as a popular option for consumers, with the rise of e-commerce platforms and optimised delivery services.

Highlights:

- 2020 – Between 2016 and 2020, the food and grocery retail market in India had a compounded annual growth rate (CAGR) of 13.2%, reaching total revenues of $611.4 billion.

- The food sector was the most profitable in the market, generating $512.7 billion in revenue, which accounted for 83.8% of the market’s total value.

- The Indian food and grocery market saw a 15.9% growth due to the COVID-19 pandemic, as people increased their purchases as a precaution and shifted their spending from foodservice channels.

- 2021 – The online food delivery market in India was valued at ₹410.97 bn.

- Projected to hit ₹1,845.76 bn by 2027 with a CAGR of 30.00%.

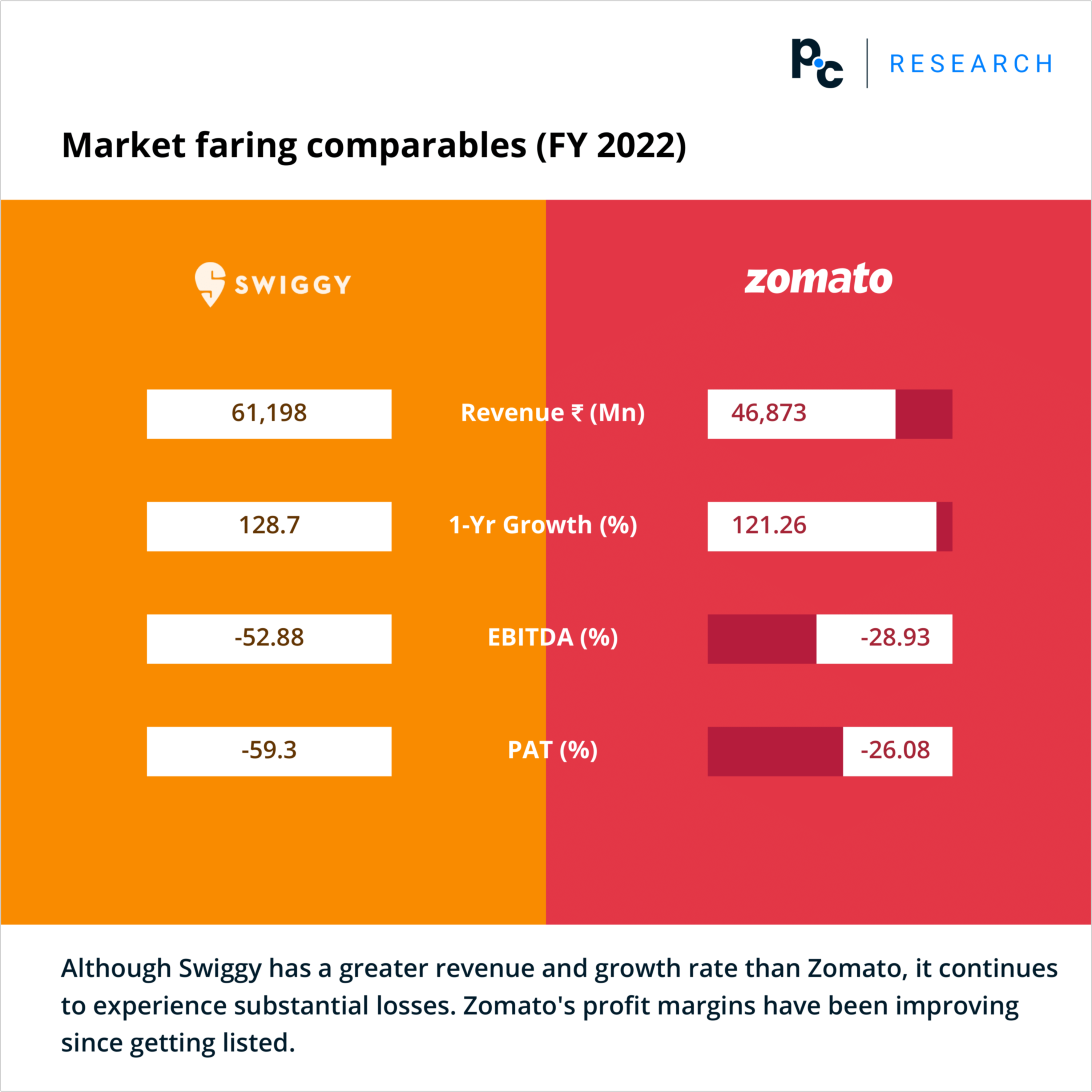

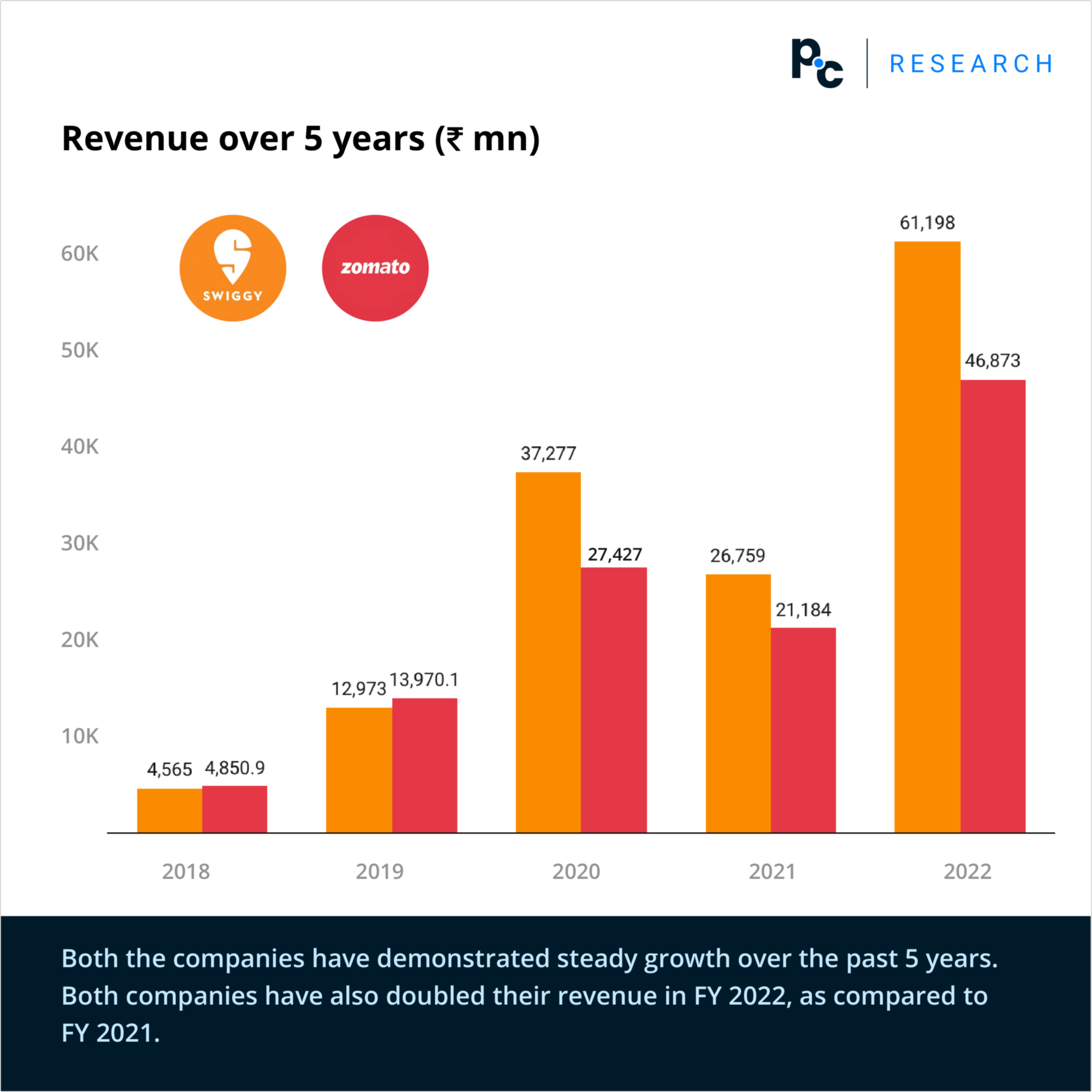

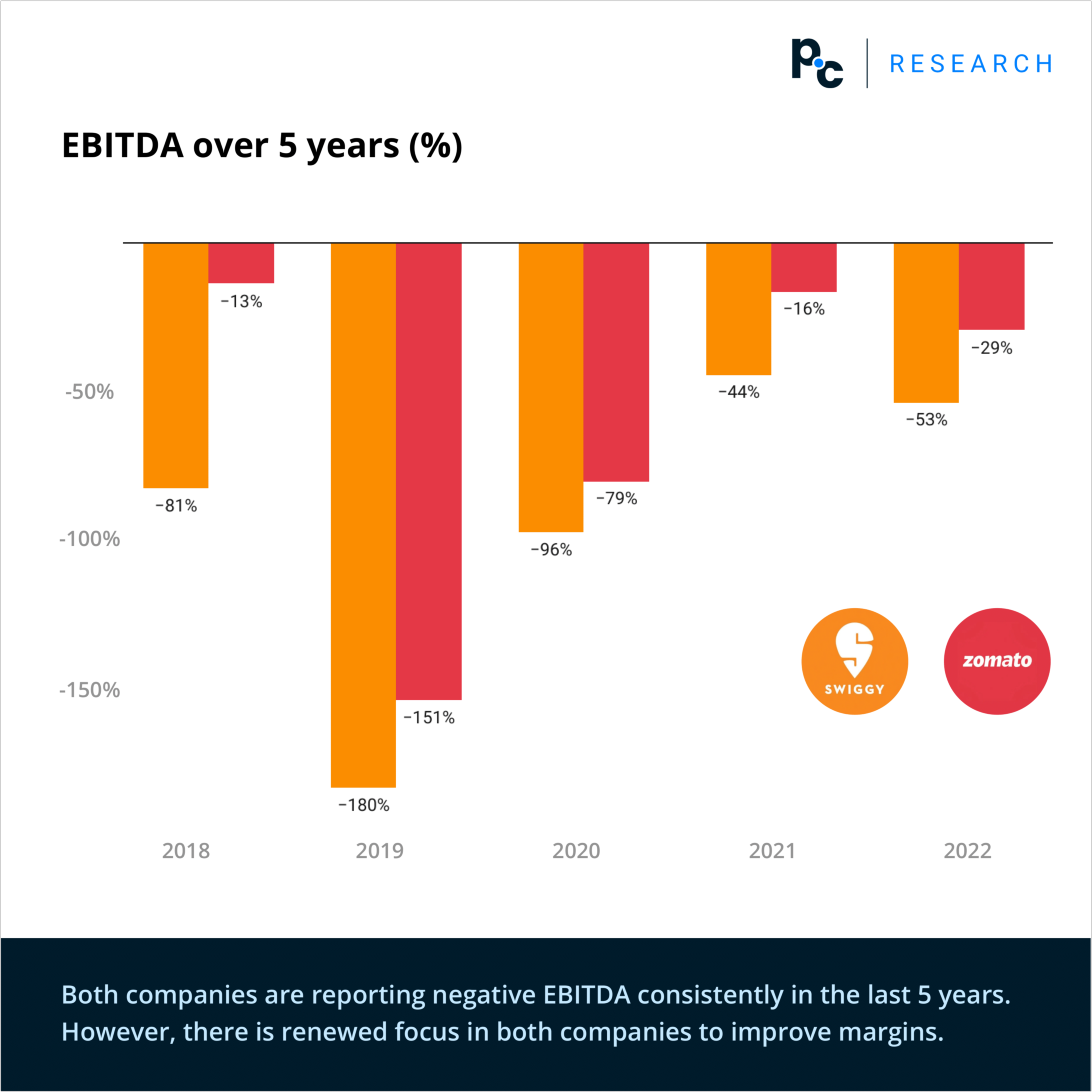

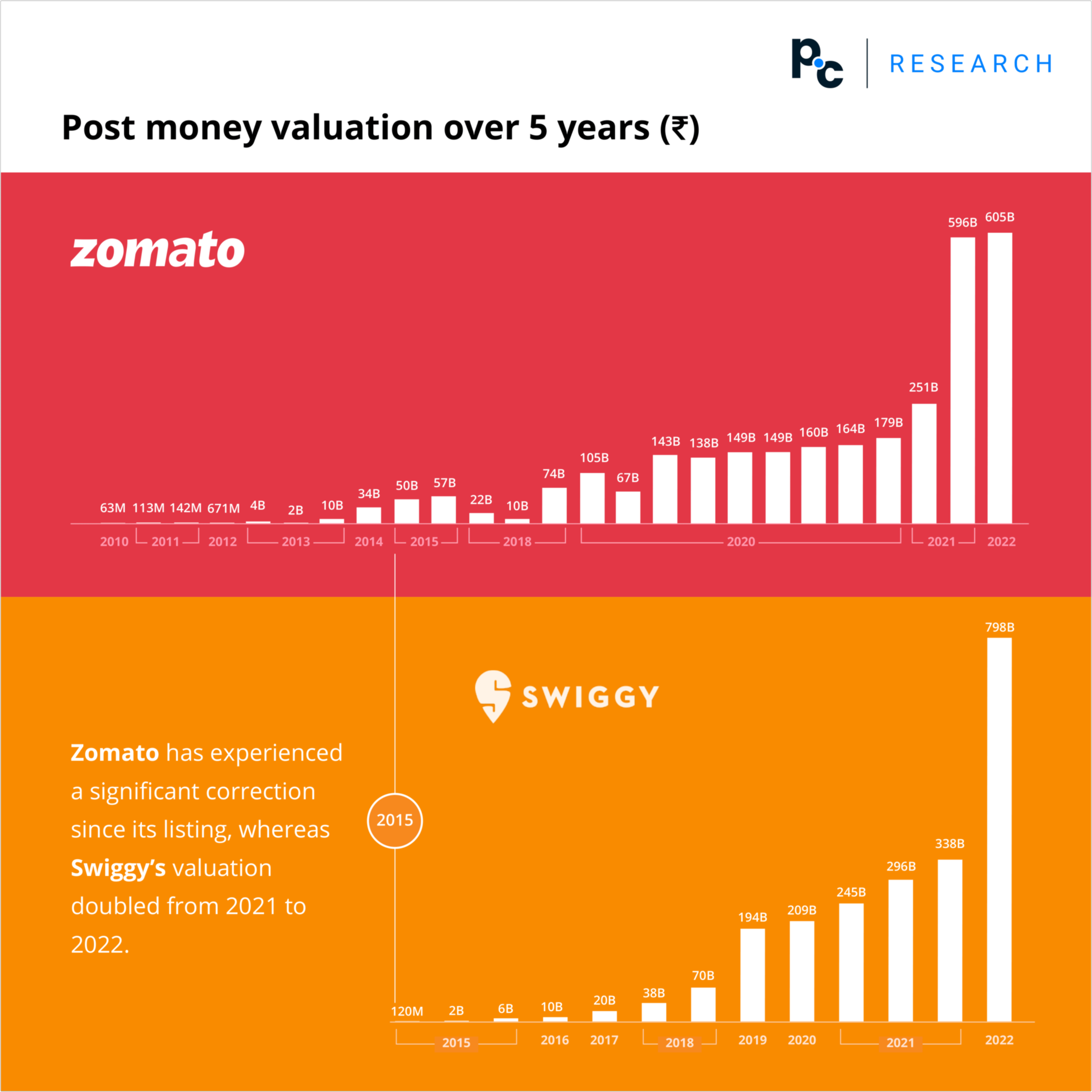

Deep diving into the food aggregators sub sector, this blog brings you the Comparable Company Analysis Report (CCAR) comparing Swiggy vs Zomato.

Table of Contents:

• Market faring comparables

• Revenue over 5 years (₹ mn)

• YoY growth over 5 years (%)

• EBITDA over 5 years (%)

• Post money valuation over 5 years (₹)

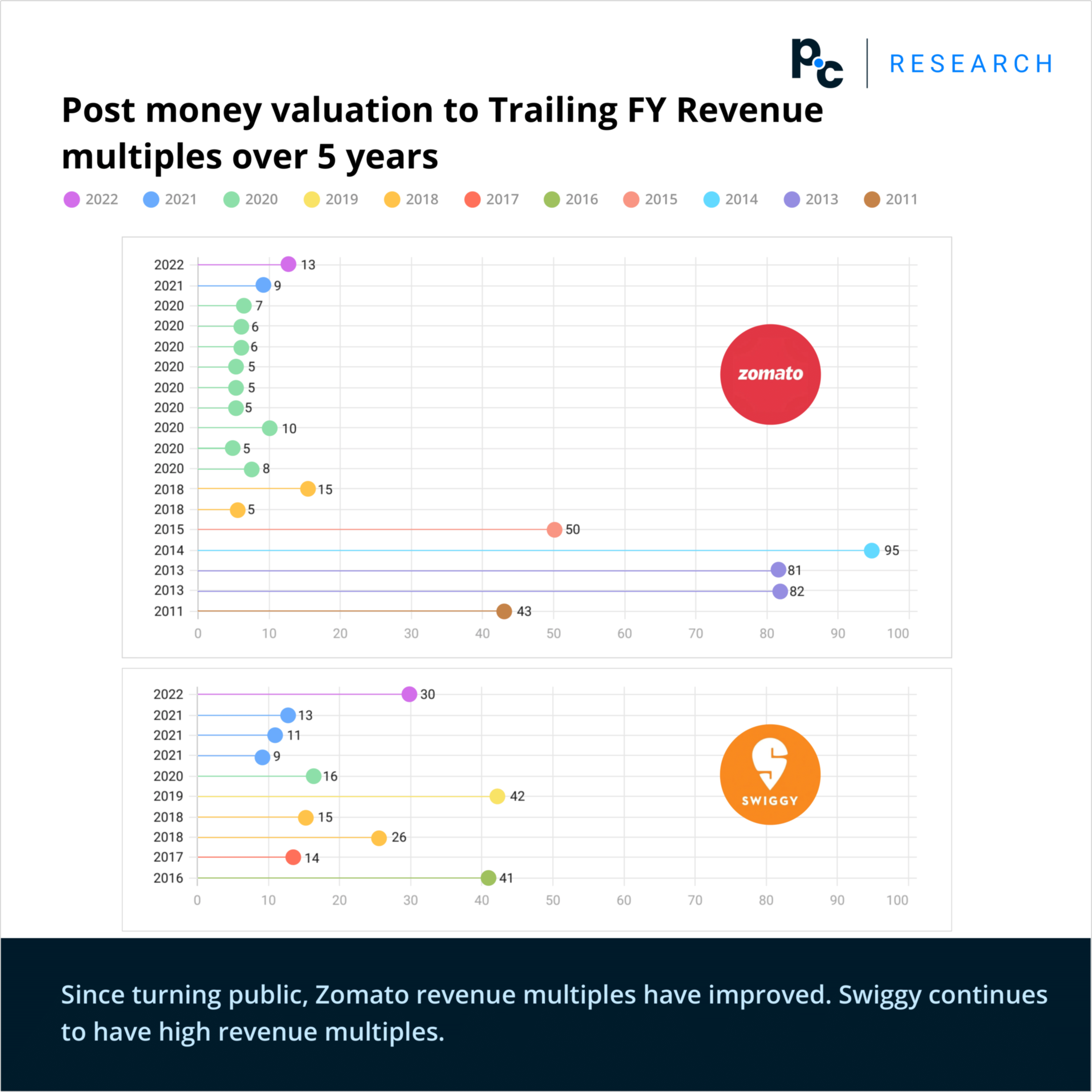

• Post money valuation to Trailing FY Revenue multiples over 5 years

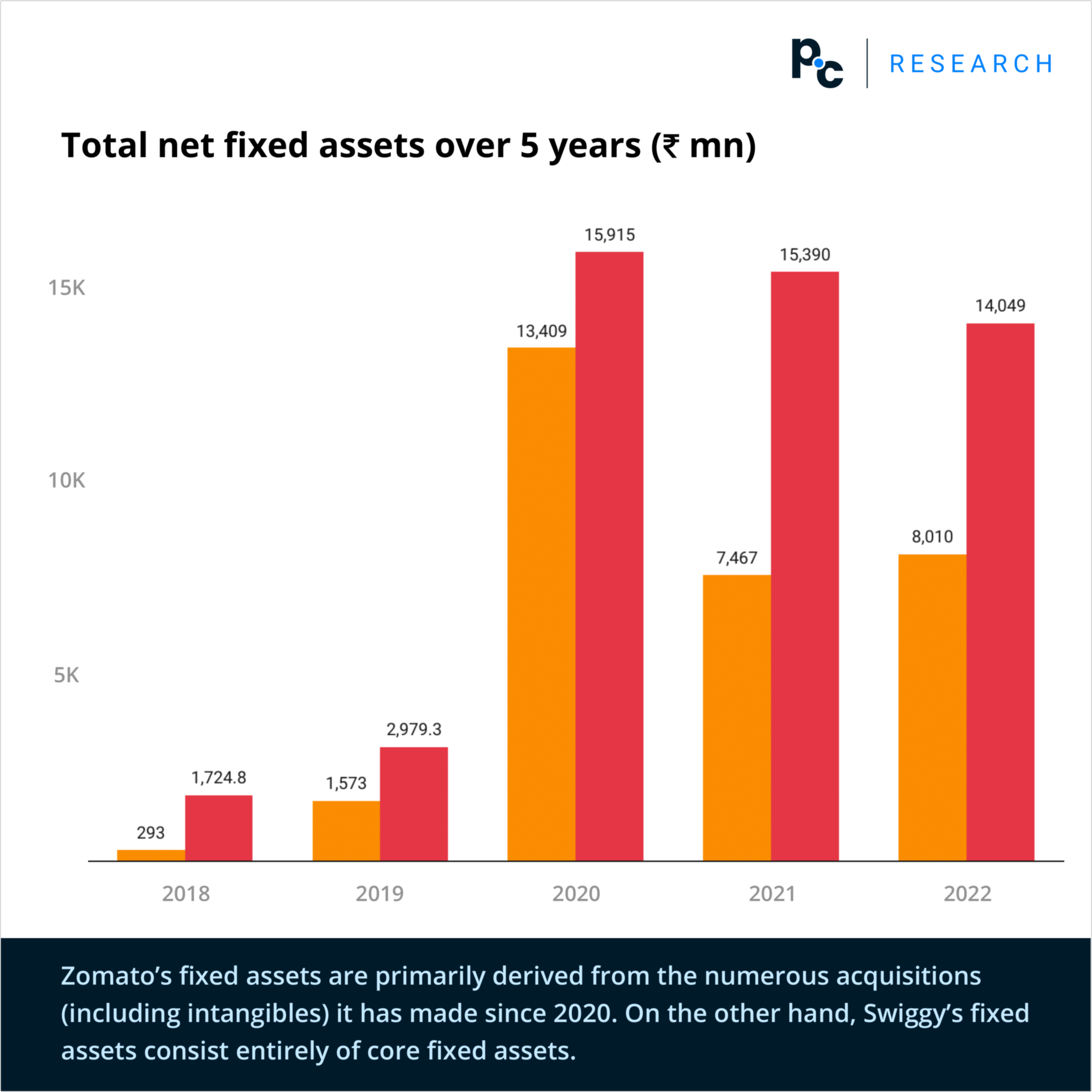

• Total net fixed assets over 5 years (₹ mn)

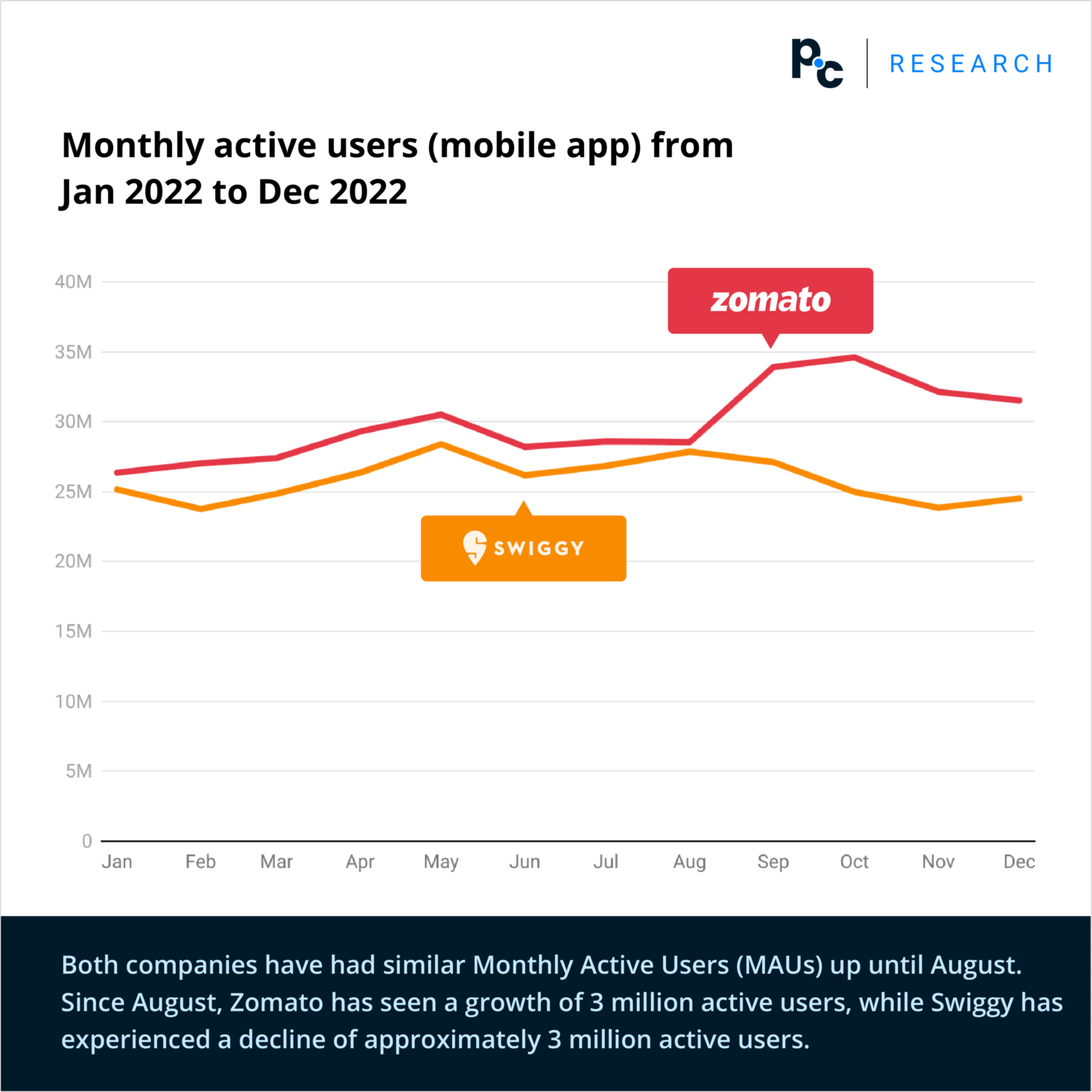

• Monthly active users (mobile app) from Jan 2022 to Dec 2022

The market is experiencing growth due to the increasing popularity of online food delivery services among consumers residing in tier I and tier II cities. This can be attributed to the swift digitalization and its adaptation in various aspects of modern life.

Furthermore, the market is being driven by several factors, including the widespread access to the internet and smartphones, the presence of more working families, particularly women who are actively participating in the workforce, and the fast-paced changes in lifestyle.

Key growth drivers of the market:

The demand for online food ordering through mobile apps in India is being driven by two major factors, 1. The growing number of smartphone users and the increasing use of the internet. 2. The market is experiencing growth due to the rising acceptance and usage of online food delivery mobile applications in both tier I and tier II cities across the country.

To lure customers, various online aggregators have partnered with restaurants to provide combo deals and single-serve meals. Additionally, food delivery platforms have introduced loyalty programs where subscribers can avoid the delivery fees that are typically charged with every order.

In the beginning, the COVID-19 pandemic-induced lockdowns created some hindrances for the progress of the online food delivery industry. However, it has had a favorable effect on the market by satisfying people’s desire to dine out while adhering to social distancing measures.

While there was a decrease in online food orders during the second wave in April 2021, the surge recorded from Q3 2020 has now bounced back to levels observed before the pandemic.

Latest news:

Swiggy sells cloud kitchen business to Kitchens@ – Mar 02, 2023.

Zomato shares: Temasek buys stake via bulk deals – Dec 01, 2022.

Latest deals:

Swiggy – Series K, Pre-money Valuation ₹ 745.5 Bn, Post-money Valuation ₹ 797.7 Bn, Deal Size ₹ 52.2 Bn, Stake Diluted 6.54 % | 24 January, 2022.

Zomato – Secondary Round, Valuation ₹ 531.4 Bn, Deal Size ₹ 16.3 Bn, Stake Sold 3.1% | 01 December, 2022.

Nice blog ! online food and groceries delivery is also emerging as a popular option for consumers