About the Company

Capillary Technologies is a Bengaluru-based SaaS company offering cloud-based customer engagement, loyalty, and analytics solutions for enterprises globally. Its AI-driven platform enables brands to manage loyalty programs, run personalized campaigns, and gain actionable customer insights. Capillary serves over 410 brands in 47 countries, providing end-to-end solutions through products like Loyalty+, Engage+, Insights+, Rewards+, and a Customer Data Platform (CDP).

IPO: Key Figures & Objectives

Key Figures

- IPO Size: ₹ 877.5 cr (Fresh: ₹ 345 cr, OFS: ₹ 532.5 cr)

- Price Band: ₹ 549 – ₹ 577 per share | Face Value: ₹ 2 | Lot Size: 25 shares

- Issue Dates: 14–18 Nov 2025 | Expected Listing: 21 Nov 2025

- Reservation: QIBs 75%, NIIs 15%, Retail 10%

Objectives / Use of Funds

- Cloud Infrastructure & R&D: ~₹ 270 cr for scaling technology and product development

- Computer Systems & General Corporate Purposes: ~₹ 10–65 cr

- Inorganic Growth / Acquisitions: Strategic expansion

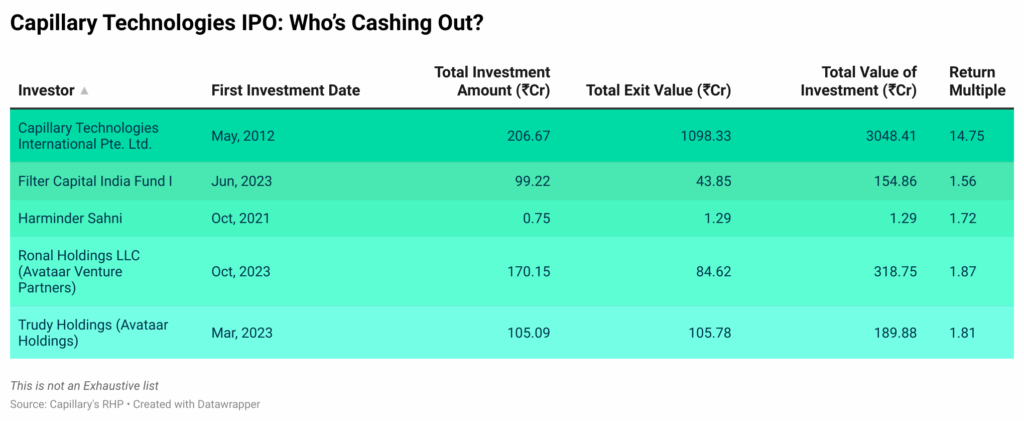

Investor Exits at IPO

Key Insights

- Early investors realize significant returns: Capillary Technologies International Pte. Ltd. achieves a 14.75x multiple.

- Recent investors see moderate gains: 2021–2023 investors, including Avataar Holdings and Filter Capital, realize 1.56x–1.87x multiples.

- IPO structure balances capital raising and liquidity: Fresh issue funds strengthen infrastructure and R&D, while OFS provides exits to existing investors.

- Institutional focus: 75% allocation to QIBs indicates strong institutional interest, while retail participation is modest.

- Growth-driven allocation: Majority of funds are earmarked for technology, product development, and strategic acquisitions, highlighting Capillary’s focus on scaling globally.

Conclusion

Capillary Technologies’ IPO provides a dual advantage: fueling the company’s growth ambitions while allowing early investors to monetize part of their holdings. The combination of fresh capital for R&D and infrastructure, along with the partial exit for existing shareholders, demonstrates a balanced strategy to support both innovation and liquidity. Investors gain exposure to a fast-growing SaaS platform in customer engagement and loyalty management, though execution, competitive landscape, and scaling efficiency will remain key factors post-IPO.

Get exclusive, data-driven insights into Capillary Technologies’ IPO, investor exits, and growth strategy curated for informed decision-making. PrivateCircle delivers actionable intelligence so you stay ahead in India’s high-growth SaaS investment landscape.