Aroa Ventures is the family office of OYO’s founder Ritesh Agarwal, focused on growth-stage businesses. With assets under management totalling ₹418 Cr and a portfolio boasting combined revenues of ₹23,858 Cr, Aroa Ventures is a key player in the industry.

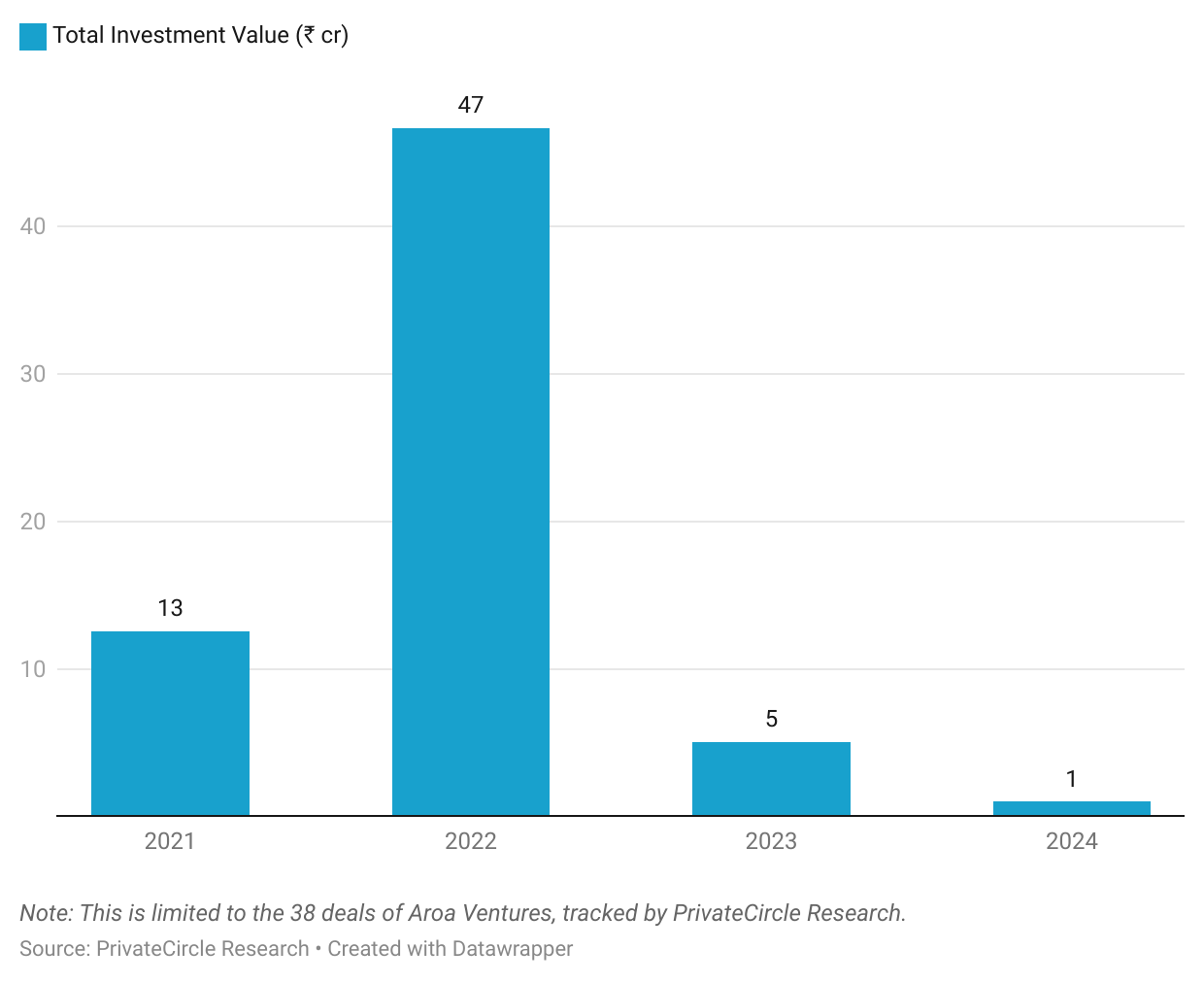

The firm focuses on investments ranging from ₹4 Cr – ₹41 Cr, having made 45 total investments, with ₹5.03 Cr invested in 2023 and ₹1 Cr in 2024. Total Investments – 2023 – ₹5.03 Cr, 2024 – ₹1 Cr.

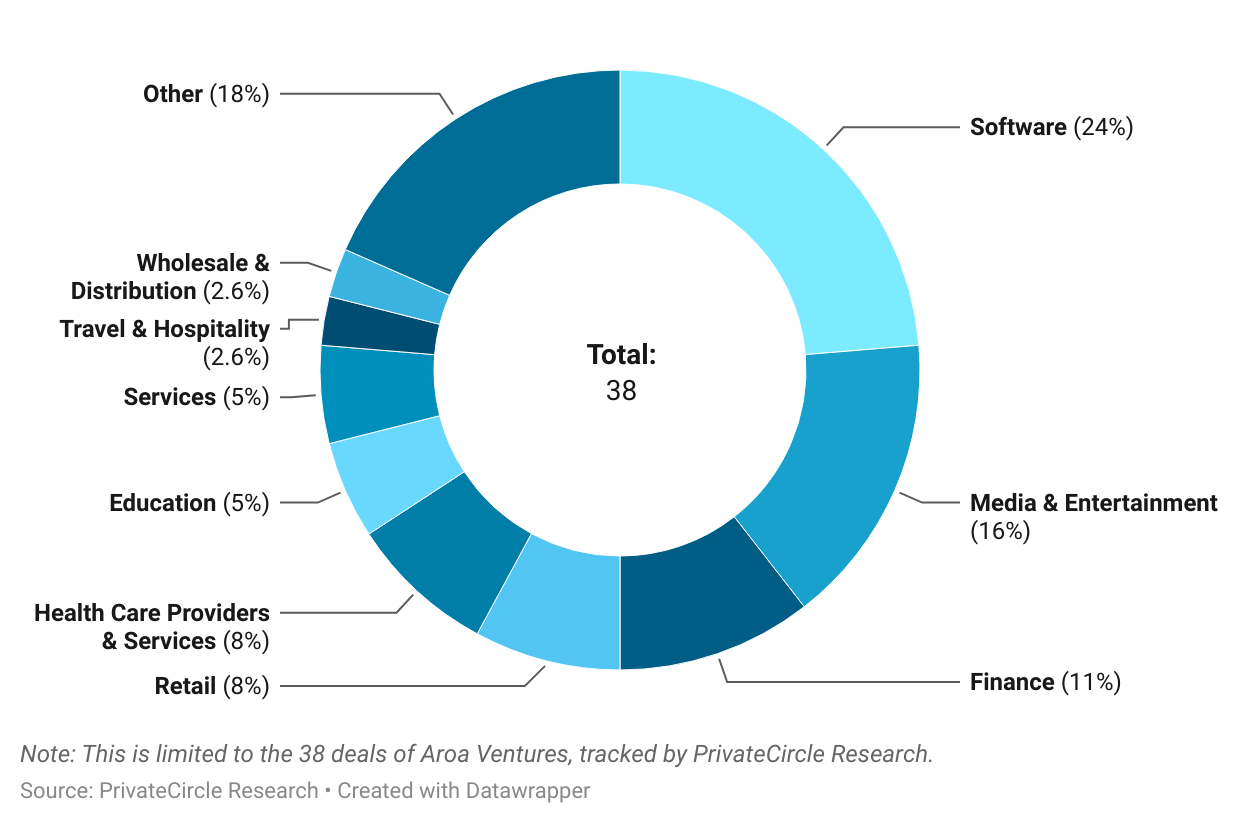

Aroa Ventures has shown a clear preference for certain sectors, as highlighted by their investment distribution: Software 24%, Media & Entertainment 16%, Finance 11%, Retail 8% and others at 43%.

Highlights:

- Combined Revenue of Portfolio Companies

- Year-On-Year Investment

- Sector Investments

- Founders’ Alma Mater

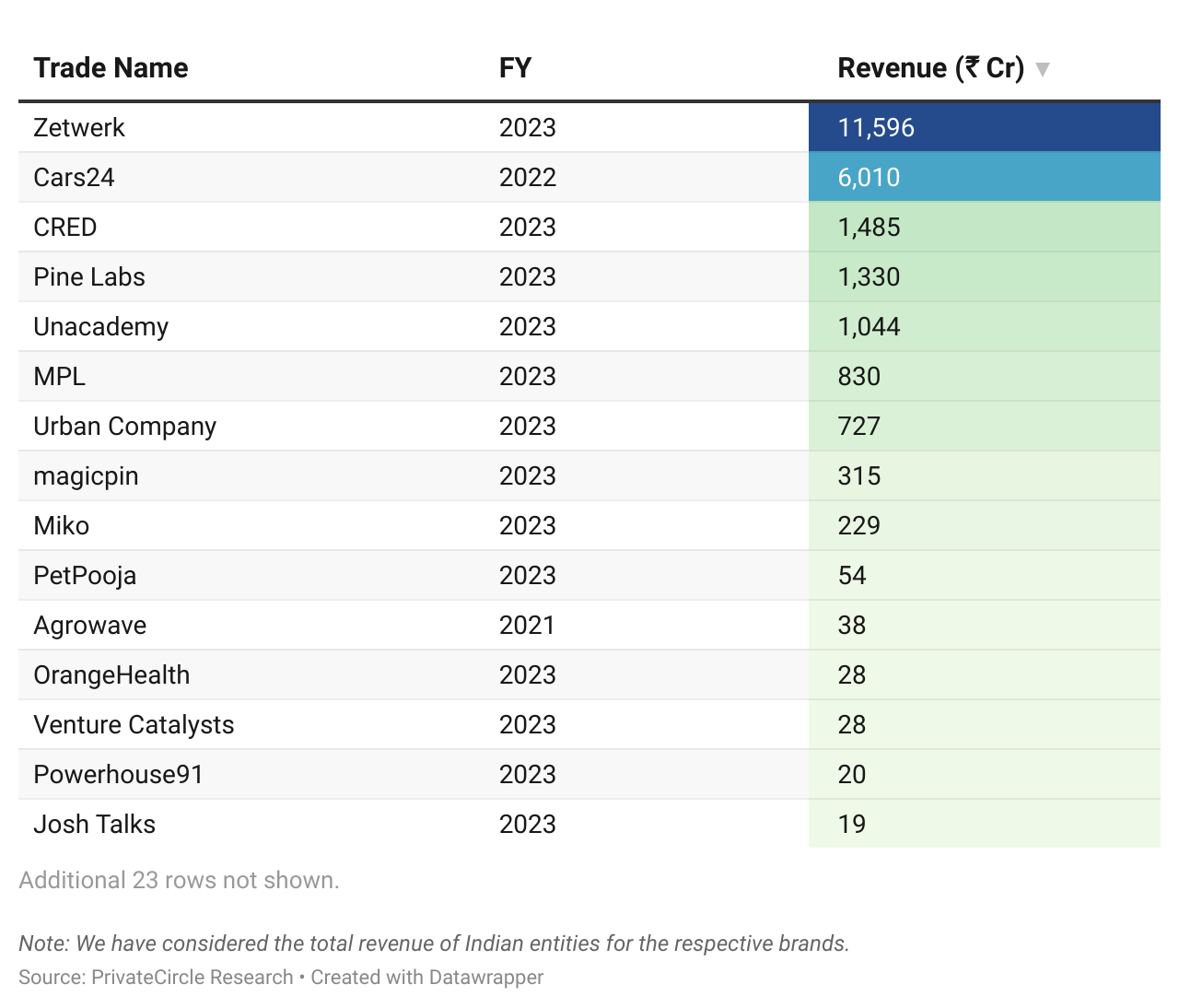

Combined Revenue of Portfolio Companies

Aroa Ventures’ portfolio achieved a combined revenue of ₹23,858 crores. The highest contributor was Zetwerk, followed by Cars24 and CRED.

Year-On-Year Investment

Aroa Ventures’ investments peaked in 2022 with about ₹47 crores being invested in a single year.

Sector Investments

About 24% of Aroa Ventures’ deal activity was in software companies, followed by media & entertainment, finance, and others.

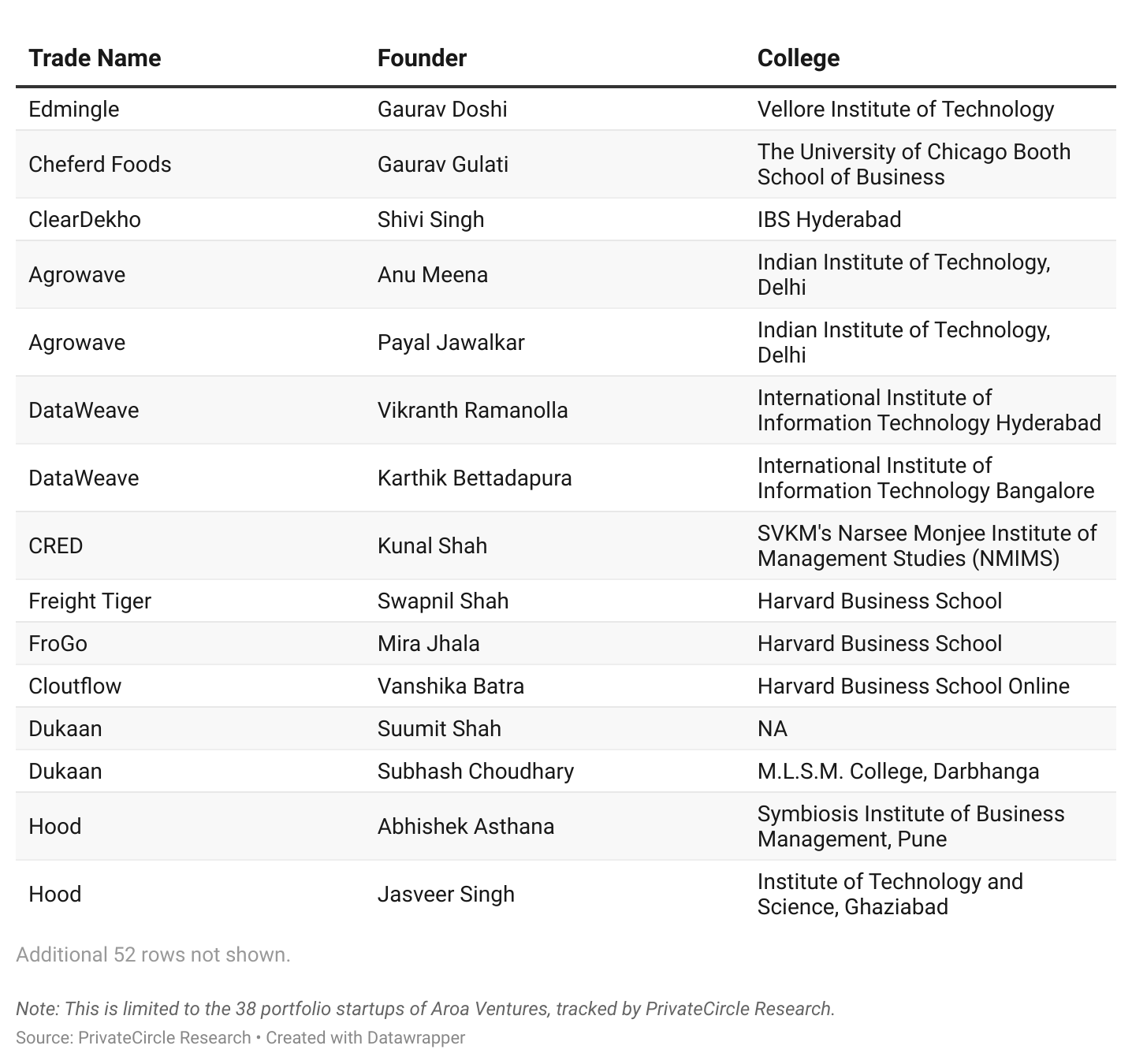

Founders’ Alma Mater

Almost 28% of Aroa Ventures’ portfolio founders come from IITs, followed by 7% from IIMs, 6% from ISB, and the rest from others..

Insights and Implications

Aroa Ventures’ strategic investments highlight its commitment to growth-stage businesses, particularly in technology and digital transformation sectors.

The firm’s diversified portfolio and significant revenue figures underline its effectiveness in identifying and nurturing high-potential startups. The variation in year-on-year investments suggests a responsive and adaptive investment strategy, potentially influenced by market dynamics and emerging opportunities.

Conclusion

Aroa Ventures’ robust investment activity shows their proactive and strategic approach to venture capital investment, focused on sectors poised for substantial growth.

In February 2024, Aroa Venture Partners launched a new $50 million fund focused on investing in technology-driven companies across sectors such as healthtech, fintech, and consumer tech.

This new fund highlights Aroa’s continued commitment to support innovation and entrepreneurship in India, along with providing financial backing and strategic guidance to promising startups.

Sign up on PrivateCircle Research for a free trial and access comprehensive data on 3 million+ Indian private unlisted companies, 4.7K+ VC/PE funds and 400K+ deals across 500+ categories.

Shrink your research and analysis turnaround time from weeks to moments. Empower your startup journey today!

Follow us on social media for latest updates and insights into the dynamic landscape of India Private Markets.