India’s aerospace and defense sector in 2025 signals a structural shift – away from isolated milestones and into a broad, consistent growth narrative. The Aerospace & Defense Sector 2025 truly represents a transformation.

With ₹3,580+ Cr deployed across sub-sectors, a rise in diversified investor participation, and companies posting >70% growth over two years, the signals are loud and clear.

India’s defense story is not just strategic – it’s investable.

Sector Dominance by Value & Volume

In 2025, the Aerospace and Defense sub-sector amassed ₹2,915 Cr in value and 48 deals, vastly outpacing Defense Machinery (₹665 Cr across 10 deals). The outlook for the Aerospace & Defense Sector by 2025 appears robust.

This gap reflects the market’s clear tilt toward aerospace systems, avionics, and dual-use defense technologies.

Growth Surge in Funding Stages

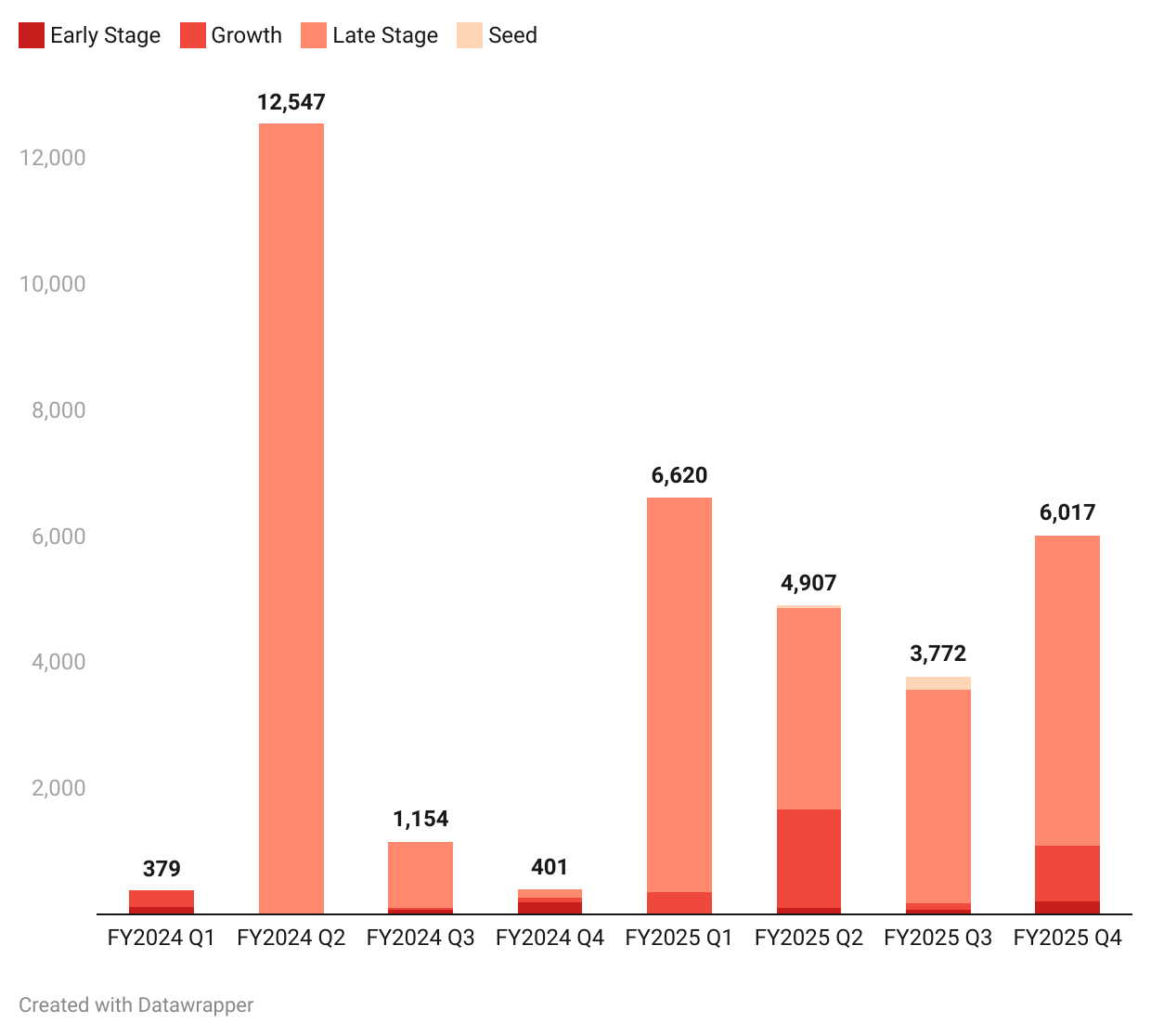

FY2024 Q2 was a blockbuster quarter, clocking ₹12,547 Cr—driven heavily by growth-stage deals. In the Aerospace & Defense Sector, there’s potential for continued upward momentum in 2025.

Though that peak wasn’t sustained, FY2025 marked a stabilized yet healthy funding flow, with all stages—early, seed, late—actively participating.

Investor Mix: Strategic + Angel Fuel

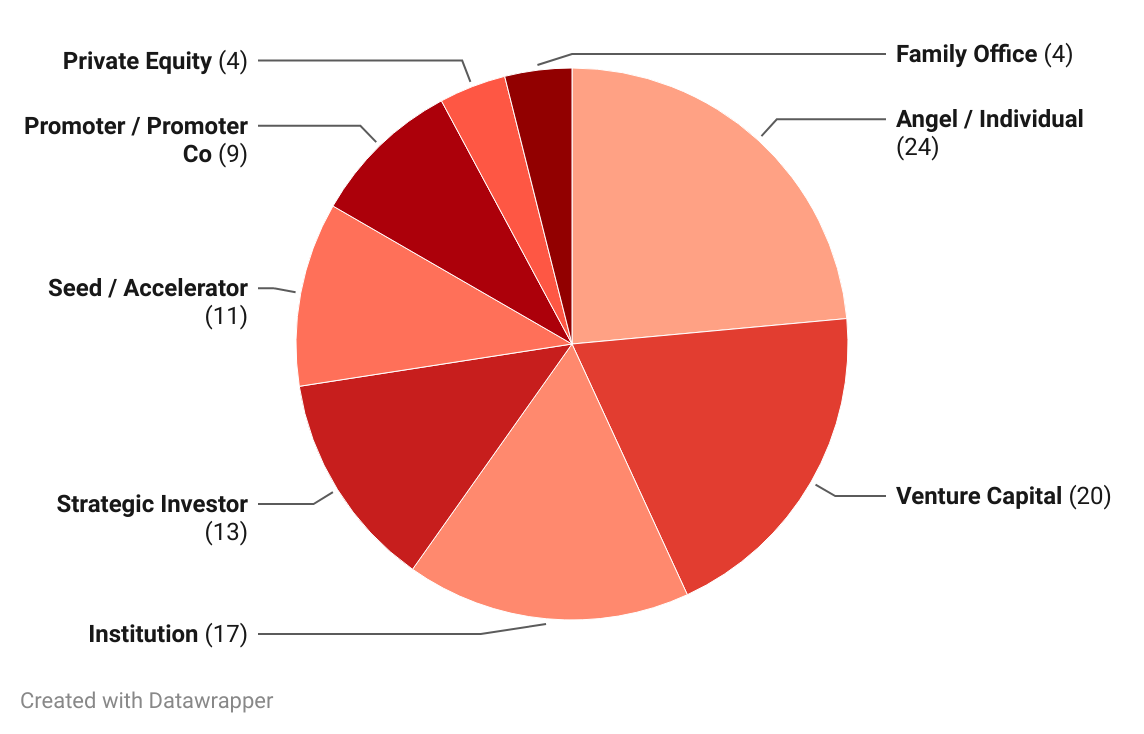

Funding wasn’t just voluminous—it was strategically distributed.

This shows a strong blend of early believers and deep-pocketed, long-term players betting on Indian defense.

The Geography of Capital

While Uttar Pradesh and Telangana dominated in FY2024 Q2, the following quarters saw a more even spread across Pune, Bengaluru, and New Delhi, indicating regional depth in India’s defense innovation hubs.

The Aerospace & Defense Sector in 2025 could soon see more regional balance.

Valuation vs Revenue: India Optel Leads

India Optel topped the valuation chart at ~₹6,000 Cr, despite modest revenue—suggesting strong IP, defense linkages, or order book confidence.

Rangsons Aerospace and Vem showed modest revenue-to-valuation ratios, pointing to early-stage optimism.

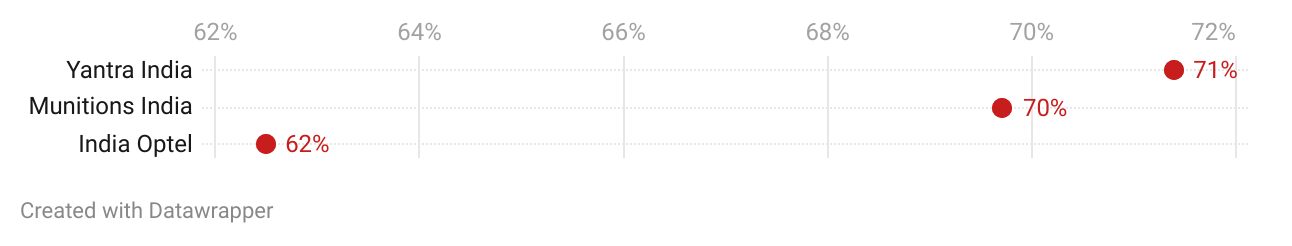

Breakout Growth: 50%+ CAGR Champions

Over two years, three firms showed explosive growth.

These growth rates are strong indicators of India’s maturing defense manufacturing base.

Final Take

2025 made one thing clear: India’s defense sector is no longer reliant on policy tailwinds alone. It now stands on real revenues, high-growth companies, and global investor validation.

As geopolitical dynamics intensify, this sector could define the next decade of Indian manufacturing and innovation. The Aerospace & Defense Sector should be watched keenly as 2025 approaches.

Explore more with PrivateCircle

Get access to real-time insights across 3Mn+ Companies | 4.7K+ VC/PE Funds | 400K+ Deals

What are the key indications that India’s aerospace and defense sector has undergone significant transformation by 2025?

Regard fik