🌐 Indian Luggage & Travel Accessories Industry

The Indian luggage market, with brands like Mokobara and Nasher Miles, is shifting from legacy, price-driven products to design-led lifestyle and value-focused mass-market travel solutions. Key growth drivers include:

- Rising air travel and domestic tourism.

- Increased aspirational consumption among millennials and Gen Z.

- Digital-first shopping trends are accelerating D2C and marketplace sales.

Market Data & Trends:

- The Indian luggage market size is estimated to grow at an 8–10% CAGR over the next decade, driven by urbanisation, growth in disposable income, and lifestyle-driven purchases.

- Emerging trends:

- Design-led premium products are gaining traction.

- Hybrid offline + online presence is becoming critical.

- Warranty & experience-focused offers influencing customer loyalty.

🏢 Company Origins & Brand Positioning

Mokobara

- Founded in 2019 in Bengaluru as a design-first lifestyle luggage brand.

- Brand meaning: “Moko” (identity) + “bara” (to carry), representing the idea of carrying one’s personality.

- Products: luggage, backpacks, duffels, totes, crossbody bags, & travel accessories.

- Key features: long warranties (up to 6 years) and 30-day trial on select products.

Nasher Miles

- Mumbai-based luggage brand offering a wide variety of travel bags, trolley luggage, backpacks, and accessories.

- Focus on free delivery, hassle-free returns, quality-tested products, and customer-first service.

- Known for vibrant designs and broad SKU coverage across hard and soft luggage.

- Milestones: 8.71 lakh+ products sold and 6.68 lakh+ customers.

📊 Distribution & Go-To-Market

| Metric | Mokobara | Nasher Miles |

| Core Channel | D2C-first → higher brand control | Marketplace-first → faster scale |

| Marketplace Strategy | Selective to protect the premium | Wide presence for volume |

| Offline Role | Experience-led brand stores | Reach-led retail network |

| Customer Acquisition | Storytelling & community | Price, availability & promos |

| Growth Trade-off | Slower scale, stronger loyalty | Faster scale, lower control |

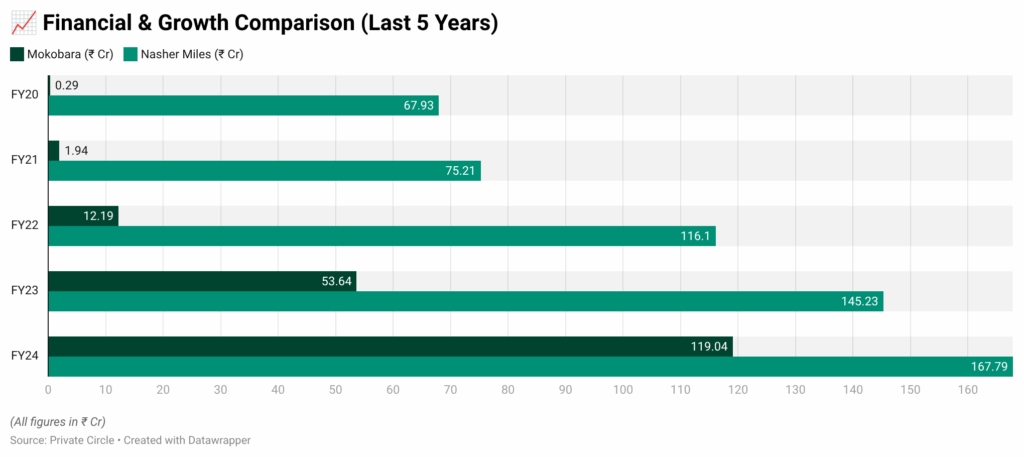

📈 Revenue Evolution Over Five Years

Note: FY25 excluded as Nasher Miles filings are not yet available

Insights:

- Mokobara exhibits rapid revenue growth (~352% 5-year CAGR), reflecting its aggressive investment in brand-building and direct-to-consumer (D2C) expansion.

- Nasher Miles shows steady, incremental growth (~25% 5-year CAGR), emphasising operational efficiency and controlled losses.

💸 Funding & Ownership Comparison

| Metric | Mokobara | Nasher Miles |

| Funding Type | Fully VC-backed | Promoter & individual investors |

| Total Raised | ~₹187.50 Cr | ~₹45.38 Cr |

| Key Investors | Peak XV, Sauce.vc, Saama Capital & more | Promoter-driven, with limited outside investors |

| Last Valuation | ₹676.31 Cr | ₹227.39 Cr |

💡 Brand, Product & Competitive Edge

| Dimension | Mokobara | Nasher Miles |

| Brand Positioning | Design-first, lifestyle-led brand built around identity and experience | Utility-driven, value-focused brand built for mass adoption |

| Product Strategy | Selective, design-led product lineup supported by long-term warranties | Wide product assortment across hard and soft luggage in multiple styles and colours |

| Pricing Approach | Premium pricing supported by branding and storytelling | Mass premium pricing focused on affordability and volume |

| Target Customer | Urban millennials & Gen Z with high repeat and cross-sell potential | Mass, family-oriented, and value-conscious consumers |

| Core Differentiation | Brand-led differentiation enabled by experiential retail and venture-backed innovation | Deep distribution strength backed by operational efficiency and scale stability |

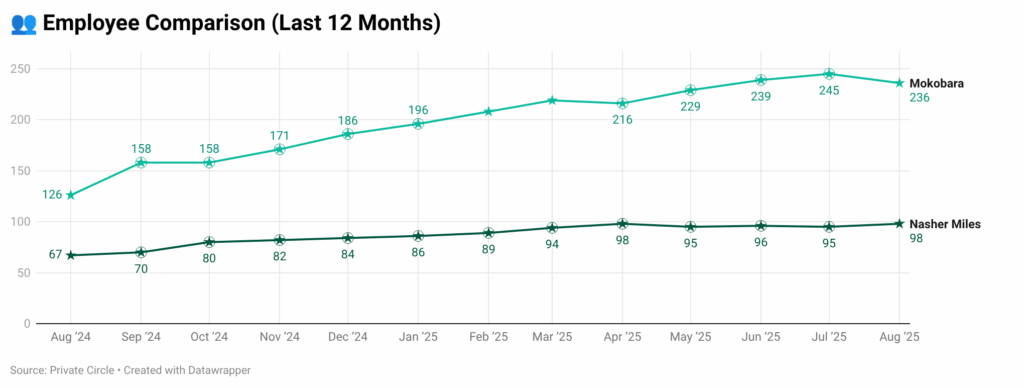

👥 Workforce Growth Comparison ( Last 12 Months)

🔮 Conclusion

- Mokobara and Nasher Miles represent two distinct approaches in the luggage market.

- Mokobara follows a VC-backed, design-led D2C model focused on rapid revenue growth, premium marketing, and aggressive scaling.

- Nasher Miles is a promoter-led, value-focused business, growing steadily through wide distribution, operational efficiency, and controlled expansion.

- The two companies highlight contrasting strategies: brand-first (Mokobara) vs scale-first (Nasher Miles).

- Their success demonstrates that different business models can thrive in India’s travel and luggage sector.

Private Circle’s report compares Mokobara and Nasher Miles, showing how brand-first vs scale-first strategies succeed in India’s luggage market. Get key insights on growth, funding, and consumer trends for smarter decisions.