Introduction

January 2026 has opened strongly for India’s private markets. Despite global macro uncertainty, capital continues to flow into mobility, fintech infrastructure, housing finance, healthcare, and logistics tech. The month’s top deals highlight a clear investor preference for scalable platforms solving real economy problems, from clean transportation to embedded payments and affordable housing finance.

This report captures the top 10 funding deals of the month, offering a snapshot of where institutional capital is concentrating early in 2026.

A Quick Snapshot of the Month

- Total capital raised (Top 10 deals): ₹4,811+ Cr

- Largest deal: Green mobility & EV transportation

- Active investors: IFC, BII, WestBridge, Bessemer, OrbiMed, Investcorp

- Hot sectors: Mobility, FinTech, Housing Finance, HealthTech, Logistics Automation

- Geographic concentration: Mumbai, Bengaluru, and NCR continue to dominate.

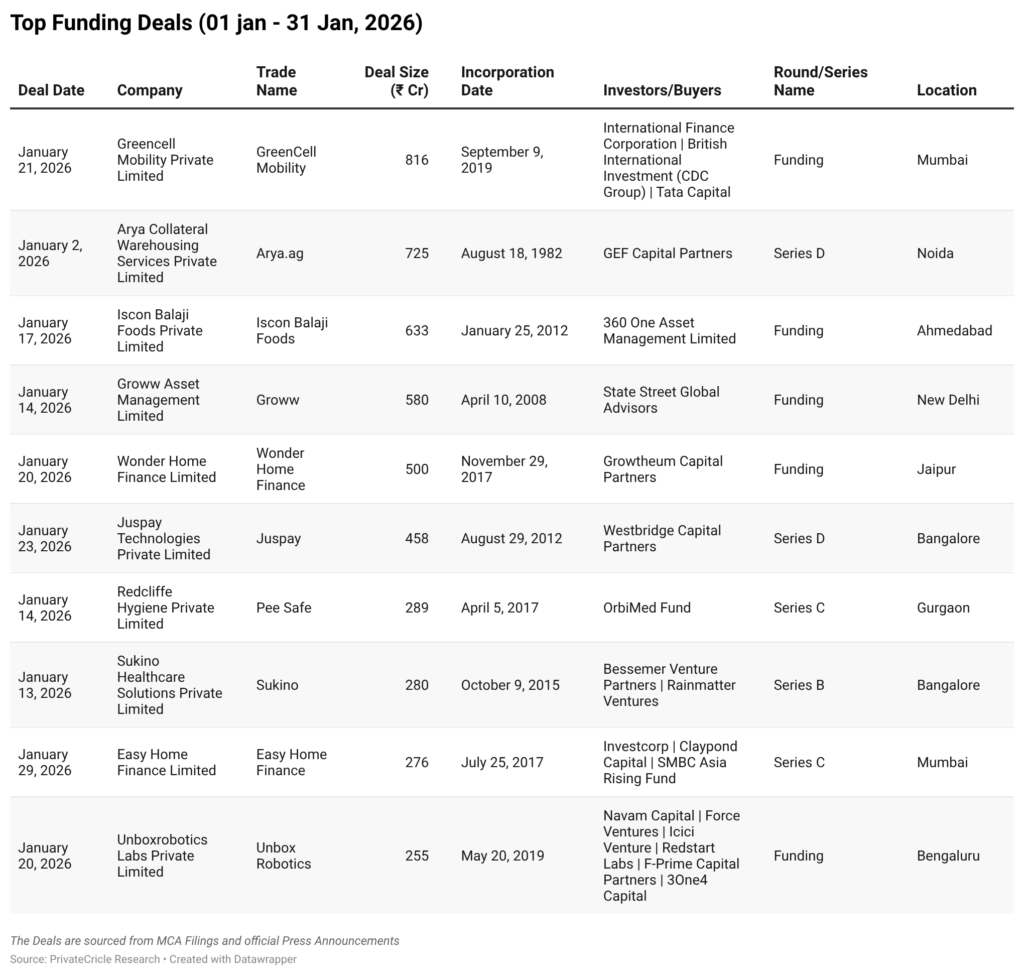

Top 10 Funding Deals of January 2026

Company Highlights (Why These Matter)

- GreenCell Mobility – Reinforces institutional confidence in clean mass transportation and EV-led mobility infrastructure.

- Arya.ag – Signals growing investor belief in agri-supply chain digitisation and collateral-backed financing.

- Groww – Shows continued appetite for retail investing platforms and asset management tech.

- Juspay – Confirms payments infrastructure as a mission-critical backbone for India’s digital economy.

- Unbox Robotics – Highlights automation demand driven by e-commerce and warehousing efficiency.

What This Really Tells Us

- Late-stage capital is active – most deals are Series B or later, or large growth rounds.

- Real-economy platforms win – Mobility, housing, healthcare, and logistics dominate over pure consumer apps.

- Institutional investors are leading – IFC, BII, OrbiMed, and global asset managers are back in deployment mode.

- Infrastructure-first tech is in focus – Payments, warehousing, and asset-backed models attract deeper conviction.

Conclusion

January 2026 sets a strong tone for India’s private markets. Capital is flowing toward platforms with predictable cash flows, regulatory clarity, and large addressable markets. As the year progresses, expect continued momentum in mobility, fintech infrastructure, housing finance, and healthcare-led models.

Stay plugged in to PrivateCircle and never miss a breakout company, investor move, or funding trend again.