Introduction

Corporate borrowing in India touched historic highs in 2025 as unlisted companies tapped large-scale debt to fund infrastructure expansion, real estate development, energy transition, and group-level restructuring.

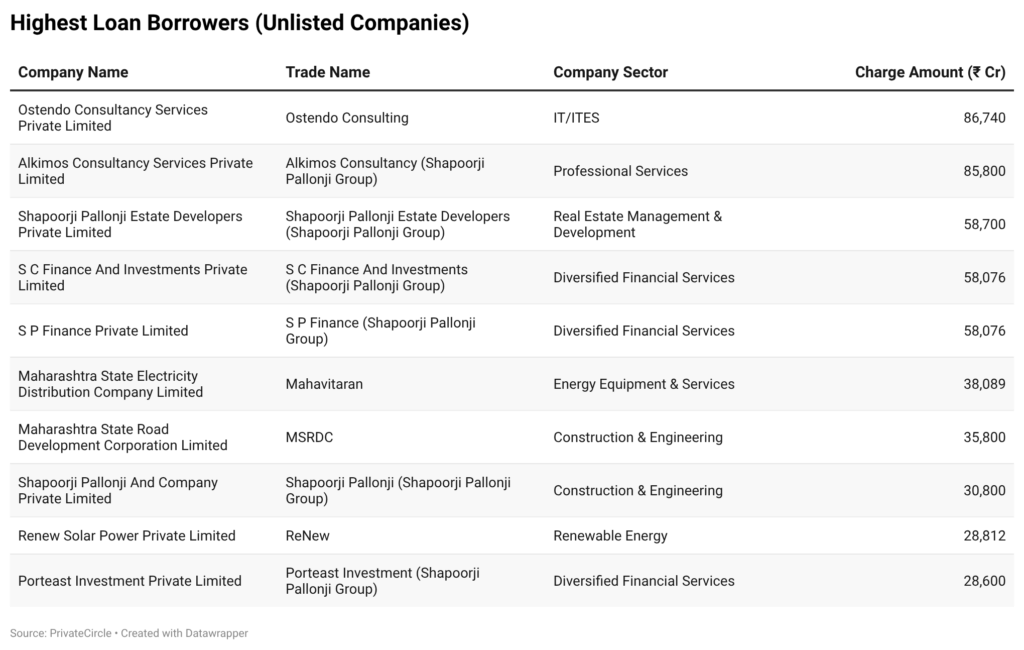

Using MCA charge filings and sector classification data, this report highlights the Top 10 unlisted Indian companies with the highest loan borrowings in 2025, offering a clear view into where large private capital flows were concentrated and which business groups dominated institutional lending.

A striking trend emerges: group-led financing and infrastructure-heavy sectors accounted for a majority of the year’s largest borrowings.

Top 10 Borrowers Among Unlisted Companies – 2025

Key Takeaways

1. Shapoorji Pallonji Group dominates private borrowing

Six out of the top ten borrowers belong to the Shapoorji Pallonji ecosystem, reflecting large-scale group refinancing, real estate development funding, and balance-sheet restructuring.

2. Infrastructure and utilities remain debt-heavy sectors

Public utility and infrastructure entities such as Mahavitaran and MSRDC continued to rely on large institutional borrowings to fund power distribution upgrades and highway development.

3. Renewable energy maintains a strong debt appetite

ReNew’s presence among the top borrowers highlights sustained lender confidence in clean energy platforms, driven by long-term project financing and capacity expansion.

4. Financial holding entities play a key role in group-level funding

Multiple finance and investment arms appear in the list, indicating centralised borrowing structures within large conglomerates.

Conclusion

The 2025 borrowing landscape among unlisted Indian companies was shaped by large business groups, infrastructure expansion, and financing for the energy transition.

With over ₹4.8 lakh crore raised by just the top ten borrowers, institutional credit remained heavily concentrated among capital-intensive sectors and promoter-led groups.

As India enters a new capex cycle, monitoring private borrowing patterns will remain critical to understanding balance-sheet risks, group-level leverage, and sectoral credit exposure.

From funding trends to corporate charges, PrivateCircle streamlines India’s private market intelligence.

Stay ahead with accurate data you can trust.