About the IPO

Shadowfax Technologies, one of India’s largest hyperlocal and last-mile logistics platforms, is stepping into the public markets with a much-anticipated IPO. The offering combines a fresh issue to fund future growth and a significant Offer for Sale (OFS) by early and late-stage investors.

For the Indian logistics-tech ecosystem, this IPO marks a defining moment, bringing a scaled, asset-light, tech-led delivery network into the listed universe, alongside peers like Delhivery and Blue Dart.

About the Company

Founded in 2015, Shadowfax operates a tech-enabled crowdsourced logistics platform that powers hyperlocal, same-day, and next-day deliveries across India.

Key Highlights

- Founded: 2015

- Headquarters: Bengaluru

- Business Model: Asset-light, gig-partner-led delivery network

- Core Verticals:

- E-commerce last-mile logistics

- Hyperlocal & quick commerce

- Reverse logistics

- SME delivery solutions

- E-commerce last-mile logistics

- Clients: Flipkart, Meesho, Nykaa, Dunzo, Swiggy, Instamart, and leading D2C brands

- Network Scale: 2+ million delivery partners across 18,000+ pin codes

Shadowfax’s strength lies in its unit economics-driven scaling, regional penetration, and deep integration with India’s booming e-commerce and quick-commerce infrastructure.

Journey to the IPO

Shadowfax’s IPO journey reflects a classic Indian startup growth arc: early experimentation, VC backing, platform scaling, and late-stage capital infusion.

Key Milestones

- 2015–2017: Launched hyperlocal delivery platform; built early enterprise client base

- 2018: Series C funding led by Qualcomm Ventures, Nokia Growth Partners, Mirae Asset, and IFC

- 2019: Strategic investment from Flipkart, strengthening e-commerce integration

- 2020–2022: COVID-era surge in hyperlocal and grocery deliveries

- 2023: Profitability-focused restructuring and route-density optimization

- Feb 2024: Late-stage investment by TPG NewQuest

- 2026: IPO filing to provide partial exits and growth capital

This steady progression from venture-backed scale-up to public-market-ready logistics player has positioned Shadowfax as a credible IPO candidate.

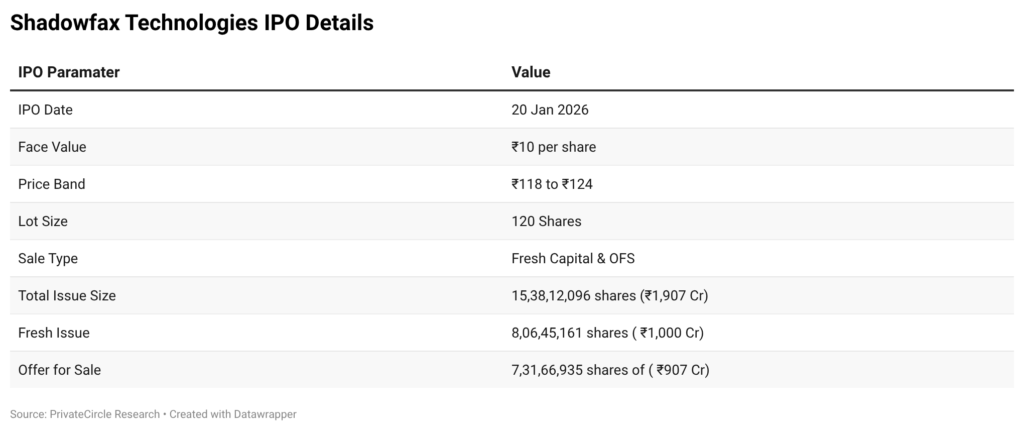

IPO Key Details

Who’s Cashing Out? – OFS Shareholder Returns Snapshot

Interactive Insights

- Early VC Wins: Eight Roads delivers the biggest exit at 8.17x, reflecting strong early-stage risk-adjusted returns.

- Strategic Bet Pays Off: Qualcomm Ventures and IFC clock 3.7x–4.2x, validating the logistics-tech thesis.

- Late-Stage Reality Check: TPG NewQuest’s 2.19x return shows more modest upside for late-stage PE capital.

- Strategic Synergy: Flipkart’s 2.83x underscores how platform-aligned investments outperform passive capital.

- Return Compression Trend: Entry timing clearly mattered more than check size in maximizing exit multiples.

What the IPO Signals

1. Logistics Tech Is IPO-Ready

Shadowfax’s listing signals that India’s logistics-tech stack, beyond traditional courier firms, is now mature enough for public markets.

2. Hyperlocal Is No Longer Experimental

Quick commerce, reverse logistics, and SME delivery are now core infrastructure plays, not loss-leader experiments.

3. Investor Appetite Is Back

The IPO shows renewed investor confidence in profitable, unit-economics-driven tech businesses.

4. Exit Path for Early VCs

Shadowfax reinforces that long-horizon patience (8–10 years) can still deliver 4x–8x outcomes in India.

Conclusion

The Shadowfax IPO is more than just a liquidity event; it’s a structural validation of India’s hyperlocal logistics economy. With strong investor returns, strategic partnerships, and a scalable asset-light model, Shadowfax is entering the public markets at a time when efficiency and profitability matter more than pure growth.

For early investors, it marks a rewarding exit. For public market investors, it offers exposure to the backbone of India’s e-commerce and quick-commerce boom. And for the startup ecosystem, it proves that logistics-tech can now graduate from venture capital stories to long-term listed infrastructure assets.

Stay tuned for more deep-dive IPO and startup intelligence. Follow PrivateCircle for data-driven insights on India’s growth economy.