Introduction

Corporate borrowing trends often act as a real-time barometer of economic confidence. In 2025, India Inc’s loan activity, captured through MCA charge filings, reveals a year marked by sharp spikes, cautious mid-year behaviour, and a pronounced year-end slowdown.

This month-wise analysis highlights how companies raised debt across the year and what it signals for credit appetite, capital deployment, and macro sentiment.

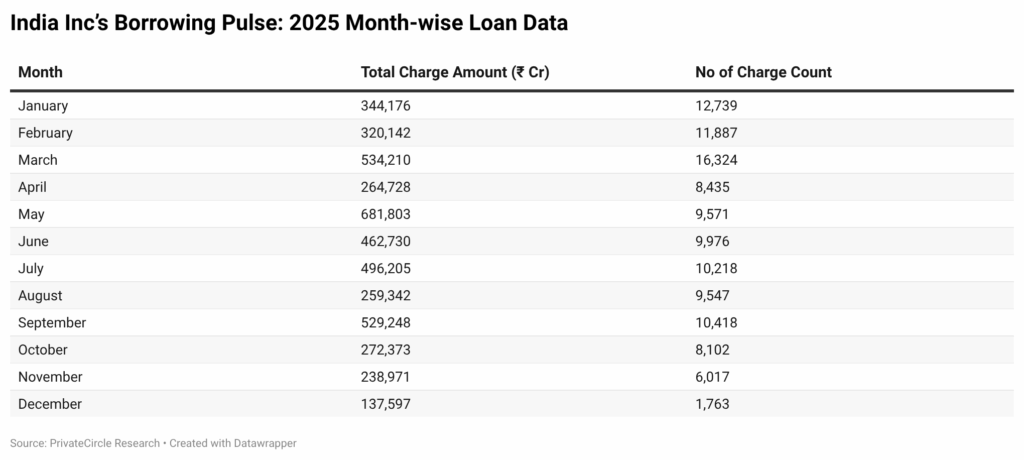

2025 Month-wise Loan Data Snapshot

Indian companies raised significant debt in early and mid-2025, with total charge amounts crossing ₹6.8 lakh crore at peak. The year started strong, accelerated rapidly in Q1, peaked in May, and gradually tapered off toward the final quarter.

Key Takeaways

- Borrowing was front-loaded in 2025, with Q1 and early Q2 accounting for a disproportionate share of total debt raised.

- Large-value loans dominated peak months, suggesting infrastructure, energy, telecom, and capital-intensive sectors drove borrowing.

- Charge count and loan value diverged in several months, indicating fewer but larger deals in high-value periods like May and September.

Trends & Decline Analysis

The second half of 2025 reflects a clear moderation in borrowing activity. From ₹5.29 lakh crore in September, loan volumes nearly halved by October and continued sliding through November and December.

This decline can be attributed to:

- Tighter credit underwriting and selective lender appetite

- Completion of major capex cycles earlier in the year

- Year-end balance sheet optimisation by corporates

- A wait-and-watch approach amid macro and interest-rate uncertainty

The sharp drop in December, both in value and number of charges, suggests postponement of borrowing rather than a structural slowdown.

Conclusion

India Inc’s borrowing pattern in 2025 tells a story of early confidence, mid-year consolidation, and late-year caution. While the year witnessed strong debt-led expansion, the visible slowdown toward the end highlights growing prudence in capital allocation.

As we head into the next cycle, the timing, size, and sector mix of corporate borrowing will be key indicators to track, especially for lenders, investors, and policymakers watching the health of India’s private sector balance sheets.