Introduction

The International Finance Corporation (IFC), the private-sector arm of the World Bank Group, has played a quiet yet influential role in India’s capital market journey. Unlike traditional venture or private equity investors chasing hyper-growth, IFC’s mandate strikes a balance between development impact and sustainable financial returns.

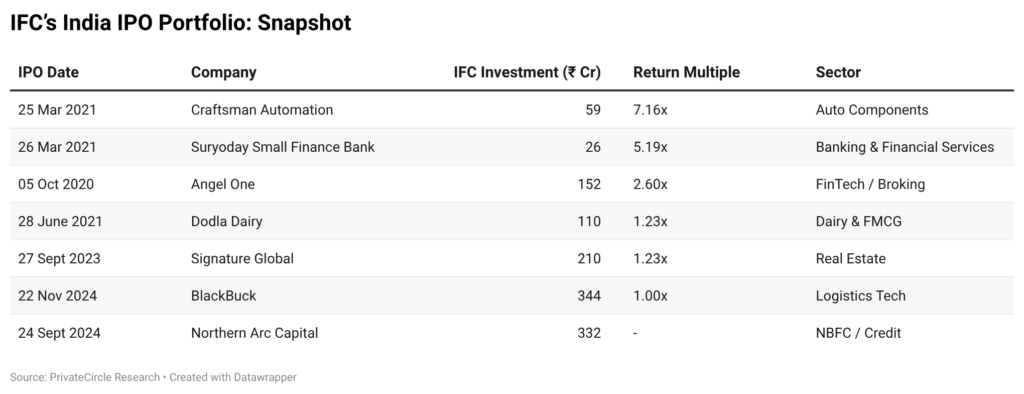

As several IFC-backed companies transitioned from private ownership to public markets over the last few years, their IPO outcomes provide valuable insight into how institutional development capital performs at public-market exits.

This report analyses IFC’s India IPO portfolio, focusing on invested capital, return multiples, and sectoral performance.

About IFC

The International Finance Corporation (IFC) is the largest global development institution focused on the private sector in emerging markets.

Key Highlights:

- Member of the World Bank Group

- Operates in 100+ countries

- Focus areas: Financial inclusion, MSMEs, manufacturing, infrastructure, housing finance, and sustainability

- Investment approach: Long-term, governance-led, institution-building capital

In India, IFC has consistently backed companies that combine scale, compliance, and systemic importance, often ahead of IPO readiness.

IFC’s India IPO Portfolio: Snapshot

Key Investment Insights

1. Manufacturing & Core Economy Deliver the Best Returns

- Craftsman Automation (7.16x) stands out as IFC’s most successful IPO outcome.

- Reflects IFC’s strength in backing export-oriented, capital-efficient manufacturing platforms.

2. Financial Inclusion Plays Age Well

- Suryoday Small Finance Bank (5.19x) highlights how early-stage financial inclusion bets can mature into strong public-market outcomes.

- Reinforces IFC’s long-term thesis around banking access and regulated lending.

3. Platform Businesses Show Moderate IPO Upside

- Angel One (2.6x) delivered respectable returns, but significantly lower than manufacturing-led investments.

- Indicates that market cycles heavily influence platform-led IPO outcomes.

4. Late-Stage Tech & Credit Bets Face IPO Compression

- BlackBuck (1.0x) and Northern Arc reflect valuation resets seen across tech and lending IPOs post-2022.

- IFC’s role here leaned more toward balance-sheet strengthening and governance than financial multiple expansion.

What Do These Outcomes Indicate?

- IFC optimizes for resilience, not hype: Higher returns came from asset-heavy, cash-generating sectors.

- Development capital is cycle-resistant: Even sub-1x exits preserved capital in volatile IPO markets.

- IPO timing matters: Pre-2021 listings significantly outperformed post-2022 IPOs.

- Governance-first investing pays off long term, even when short-term multiples compress.

Final Takeaway:

IFC’s India IPO track record reinforces a critical truth: patient, development-led capital behaves differently from venture or growth equity. While not every investment generates outsized multiples, IFC’s portfolio demonstrates capital preservation, selective outperformance, and systemic impact across cycles.

As India’s IPO market matures, institutions like IFC will continue to shape companies not just for listings, but for longevity as public enterprises.

More deep dives into India’s smartest IPO investors are coming your way. Follow PrivateCircle for the next breakdown.