India’s K–12 EdTech Industry: From Consumer Apps to School Infrastructure

India hosts the world’s largest K–12 student population, with over 250 million school-going students, making education one of the country’s most scalable digital opportunities. The EdTech market, valued at nearly $750 million in 2020, is projected to grow to approximately $4 billion by 2025, with K–12 education serving as the primary growth engine.

However, the sector is undergoing a structural shift. The next phase of growth is moving away from pure B2C tutoring platforms toward school-integrated EdTech solutions that strengthen communication, engagement, and learning outcomes within formal education systems.

This evolution has opened up a new category: EdTech infrastructure platforms for schools, and this is where Uolo Edtech Private Limited is positioning itself.

About the Company: Uolo Edtech Private Limited

Incorporated in January 2020, Uolo Edtech Private Limited is a Gurgaon-based K–12 EdTech company focused on digitising and unifying the school ecosystem.

Uolo partners directly with private K–12 schools, enabling them to bring their academic, communication, and engagement workflows onto a single, mobile-first platform. The platform connects schools, teachers, parents, and students, creating a continuous feedback and learning loop beyond classroom hours.

Core Offerings

- English communication programs

- Computational thinking modules

- Life-skills and after-school learning programs

By embedding itself deeply into school operations, Uolo follows a B2B2C business model, enabling scalable distribution, predictable engagement, and long-term retention. This positions Uolo as a school infrastructure enabler, rather than a traditional content-led EdTech company.

Financial Performance: Rapid Revenue Scale-Up

Uolo’s financial trajectory reflects a company in a high-growth expansion phase, prioritising market penetration and school adoption.

Revenue Growth

- FY21: ₹0.57 Cr

- FY22: ₹1.45 Cr

- FY23: ₹6.14 Cr

- FY24: ₹27.95 Cr

Between FY21 and FY24, Uolo delivered an impressive ~266% revenue CAGR, driven by the rapid onboarding of partner schools and the increasing monetisation of its platform.

While the company continues to report losses, this aligns with its investment-heavy phase, which is focused on product development, curriculum expansion, and institutional partnerships.

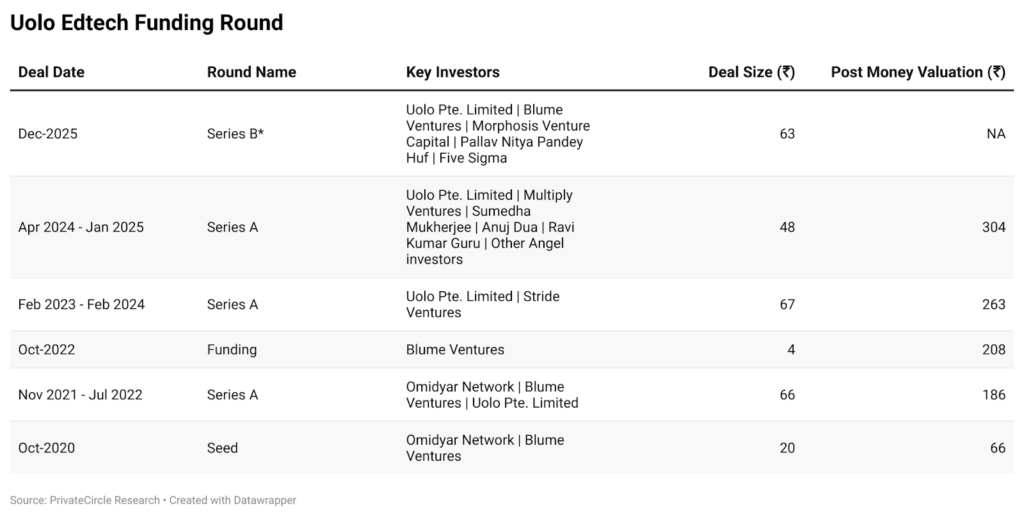

Funding Journey: Insider-Led, Disciplined Capital Raising

Uolo’s funding story is marked by strong insider conviction and measured valuation growth.

.

- From a ₹65.9 Cr Seed valuation (2020) to ₹300+ Cr by 2024–25

- Early backing from Omidyar Network and Blume Ventures

- Continued capital support from Uolo Pte. Limited

- Entry of growth-focused investors like Morphosis Venture Capital and Five Sigma in the Dec-2025 Series B*

This funding pattern reflects a shift from survival and scale to efficiency-led expansion.

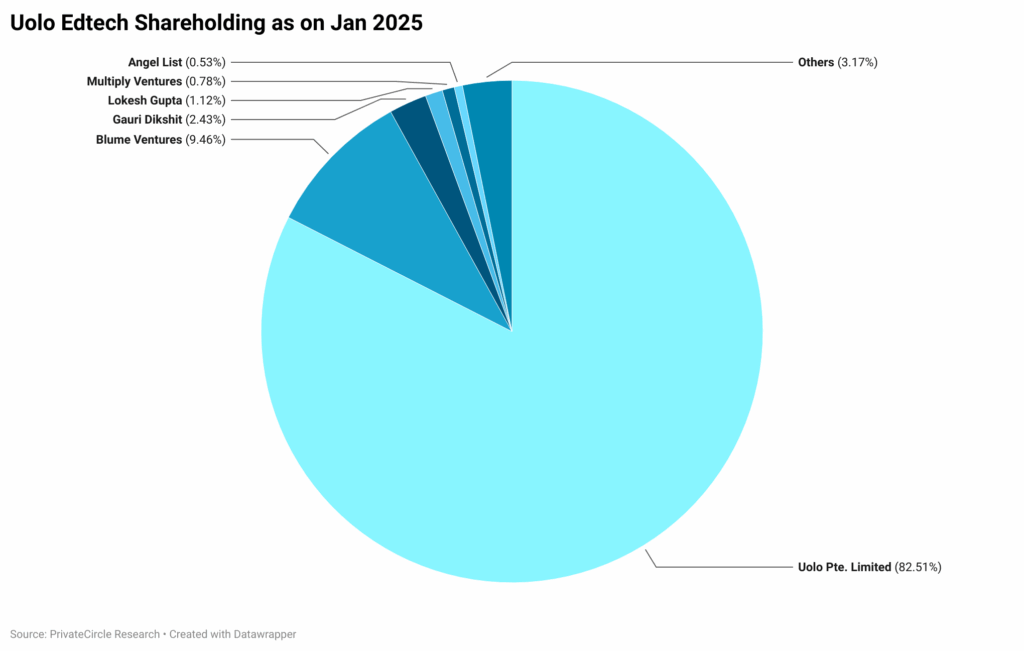

Shareholding Structure: Promoter-Led Ownership

Uolo’s ownership remains highly concentrated, reinforcing long-term strategic control.

- Uolo Pte. Limited: 82.49%

- Blume Ventures: 9.46%

- The remaining stake is held by founders, angels, and early investors

The limited dilution highlights high insider confidence and a long-term operating outlook.

Conclusion: Uolo’s Role in India’s K–12 EdTech Future

Uolo Edtech is emerging as a foundational infrastructure layer in India’s K–12 EdTech ecosystem. Rather than competing for consumer attention, the company is embedding itself into the daily workflows of schools, teachers, and parents.

Key Strengths

- Deep integration with private school networks

- Strong revenue growth despite an EdTech slowdown

- Institutional and promoter-led backing

- Clear focus on long-term ecosystem value creation

As India’s EdTech sector matures, school-first SaaS platforms like Uolo are likely to gain prominence over purely content-driven models, making Uolo a compelling case study in sustainable, infrastructure-led growth.

Trusted by investors and institutions, PrivateCircle enables faster, data-backed decisions across India’s private markets.