Introduction: A New Era in Financial Simplicity

When Flipkart co-founder Sachin Bansal launched Navi in 2018, he wasn’t trying to build another startup; he was attempting to reimagine how Indians interact with financial products.

Navi’s mission is clear: make financial services simple, accessible, and affordable. In just a few years, the company has transformed from a lending app into a multi-product financial powerhouse, spanning loans, insurance, mutual funds, and advisory services.

Its technology-first approach has helped it reach both urban professionals through digital lending and rural borrowers via its microfinance subsidiary, Chaitanya India Fin Credit. Today, Navi stands as one of India’s fastest-scaling fintech companies, a blend of innovation, execution, and founder conviction.

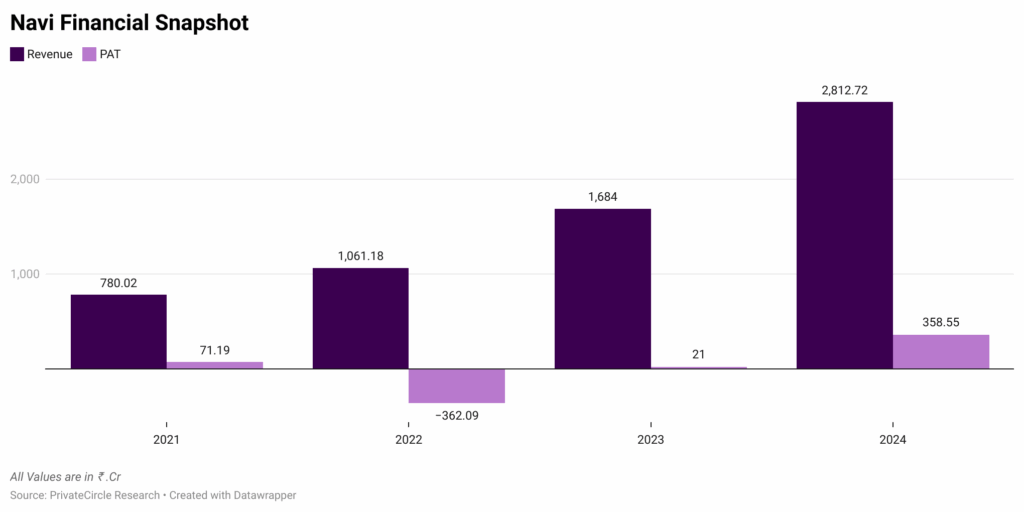

Financial Snapshot: Growth That Defines Momentum

Navi’s financial performance between FY2021 and FY2024 reflects the trajectory of a company moving from startup uncertainty to operational stability.

- Revenue Growth: Increased from ₹780 Mn (FY21) to ₹2,812 Mn (FY24), showing over 3.5x expansion.

- Profit Turnaround: Swung from a ₹362 Mn loss in FY22 to a ₹359 Mn profit in FY24.

- Operational Efficiency: Improved cost management and scalability boosted margins.

- Business Diversification: Growth driven by lending and insurance verticals under Navi’s digital-first model.

- Overall Insight: Navi has evolved from a high-growth fintech into a profitable, sustainable financial services company within three years.

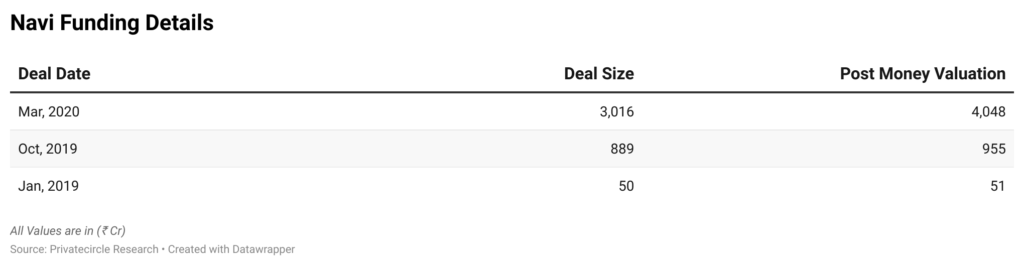

Funding Details: A Case Study in Founder Conviction

- Unlike most Indian startups that rely heavily on venture capital, Navi has grown through founder-led funding. Sachin Bansal has personally infused capital, keeping near-total control of the company.

- Strategic Focus: Initial investments built Navi’s NBFC and microfinance foundation, enabling entry into lending and financial inclusion.

- Ownership Structure (2025): Bansal holds 98.4%, co-founder Ankit Agarwal owns ~1%, and the remainder is with senior team members.

Products: Building India’s Financial Super-App

Navi’s product ecosystem covers every major pillar of personal finance:

- Lending: Instant personal and home loans through Navi Finserv

- Microfinance: Small-scale group loans via Chaitanya India

- Insurance: Health and general insurance policies under Navi General Insurance

- Investments: Mutual funds through Navi AMC, offering low-cost ETFs and index funds

- Advisory & Securities: Digital wealth management via Navi Investment Advisors and Navi Securities

All of these services converge within a single app interface, giving users the ability to borrow, invest, and insure from one platform. This integrated model positions Navi as more than a fintech company, as a digital financial ecosystem.

Conclusion: The Next Phase of Navi’s Evolution

Navi Limited has swiftly transformed from a digital lending startup into a diversified financial ecosystem spanning credit, insurance, and investments. Its tech-first, founder-led approach has driven profitability and scale without heavy external funding. As Navi deepens its offerings and readies for a potential IPO, it stands poised to shape India’s next wave of digital financial inclusion

This report is prepared by PrivateCircle Insights, based on verified company data and financial disclosures.