India’s B2B SaaS sector is no longer an underdog. It’s becoming a global standard.

What began as a trickle of outsourcing-led product companies has now evolved into a full-blown ecosystem of SaaS innovators, building for India and selling to the world. Over the last decade, India has nurtured a new generation of software entrepreneurs who combine product craftsmanship with operational frugality.

Unlike flashy consumer startups, these SaaS businesses thrive on sustainable revenue, efficient customer acquisition, and high product retention. They’re solving high-friction, repeatable problems in industries such as logistics, HR, retail, healthcare, and fintech, often through API-first, cloud-native solutions that are easy to adopt and difficult to replace.

Global SaaS buyers are taking note. With the rise of cloud penetration, remote work, and cost-conscious digitization, India’s SaaS platforms are increasingly winning mandates across North America, Southeast Asia, and the Middle East.

In a world that’s shifting from blitzscaling to efficiency-first, Indian SaaS founders are demonstrating what it means to build modern, resilient software businesses from day one.

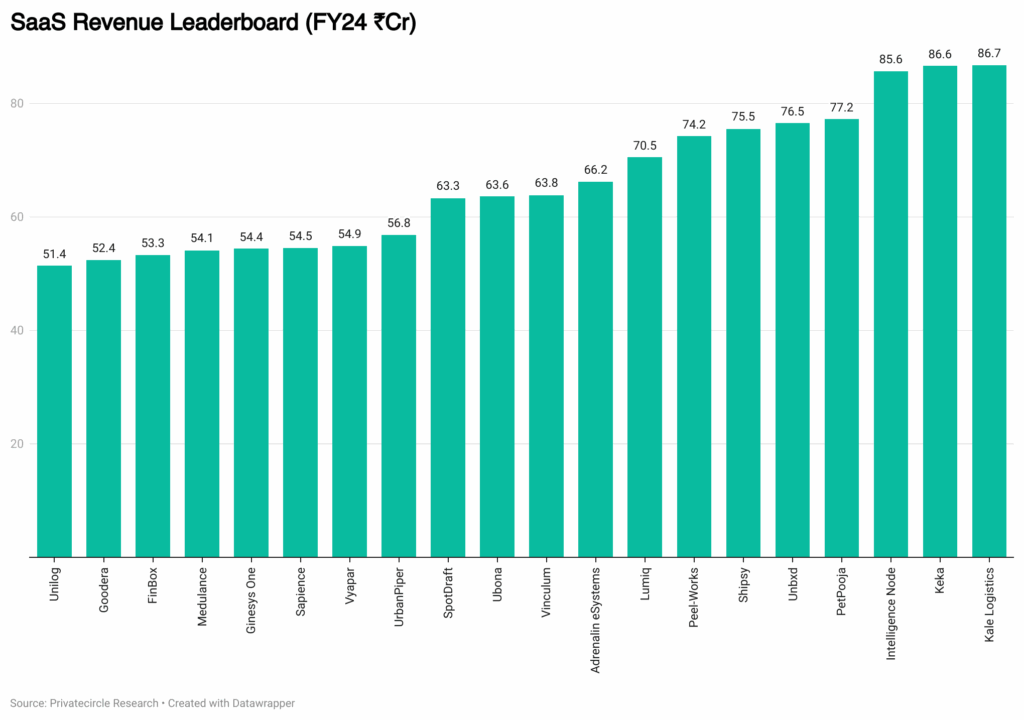

📊 Top 20 B2B SaaS Startups Revenue Leaderboard

Kale Logistics

FY24 Revenue: ₹86.7 Cr

Focus: Logistics SaaS platform focused on digitizing cargo movement at airports and ports. Helps digitize customs, warehousing, and shipment workflows. Known for streamlining multimodal freight operations.

Key Strength: Deployed across 40 countries, serving 5,500+ clients. Solves real-time visibility, congestion, and cost issues in cargo logistics. Built strong integrations with customs and shipping lines.

Backers: Creaegis, Inflexor Ventures

Keka

FY24 Revenue: ₹86.6 Cr

Focus: Comprehensive HRMS for small and medium businesses. Provides payroll, attendance, performance, and hiring tools. Focused on employee experience and low-friction HR automation.

Key Strength: Serves 6,500+ businesses; strong word-of-mouth-led growth. High customer retention and product stickiness. Customizable modules for diverse SMB use cases.

Backers: WestBridge Capital

Intelligence Node

FY24 Revenue: ₹85.6 Cr

Focus: AI-driven pricing and retail analytics for global retailers and brands. Enables dynamic pricing, assortment optimization, and competitive benchmarking. Built for real-time e-commerce environments.

Key Strength: Tracks billions of products daily for clients in fashion, CPG, and electronics. Boosts gross margin and sell-through rates. Delivers pricing insights in under 1 second.

Backers: Orios Venture Partners, Blacksoil Group, CSVP Fund

PetPooja

FY24 Revenue: ₹77.2 Cr

Focus: Restaurant management software for billing, inventory, and online orders. Unified dashboard for dine-in, takeaway, and food delivery platforms. Easy-to-use mobile PoS for restaurant staff.

Key Strength: 50,000+ outlets use the platform daily. Reduces manual effort, increases order throughput, and centralizes reporting. Used by cloud kitchens, QSRs, and fine dining.

Backers: Aroa Ventures, GVFL

Unbxd

FY24 Revenue: ₹76.5 Cr

Focus: E-commerce search and product discovery engine powered by machine learning. Helps users find relevant products faster and boosts personalization. Built for catalog-heavy websites.

Key Strength: Recognized by Gartner & Forrester for AI-led product discovery. Processes 35B+ documents/month with ~6 ms query speed. Powerful search, merchandising, and personalization for leading fashion, grocery, and electronics retailers.

Backers: Netcore Cloud Private Limited

Shipsy

FY24 Revenue: ₹75.5 Cr

Focus: Logistics and supply chain optimization software for enterprises. Covers freight, shipment tracking, last-mile delivery, and cost reduction. AI-powered dashboards for planning and exceptions.

Key Strength: Improves visibility across logistics partners. Saves up to 10% logistics cost. Used by large 3PLs, retailers, and manufacturing exporters.

Backers: A91 Partners, Sequoia Surge, Z3 Partners

Peel-Works (Taikee)

FY24 Revenue: ₹74.2 Cr

Focus: Retail distribution platform connecting FMCG brands to kirana stores. Offers order placement, fulfillment, analytics, and credit. Digitizes procurement for small retailers.

Key Strength: Reaches deep urban and semi-urban markets. Helps kiranas increase fill rates and reduce inventory gaps. Scalable through asset-light supply chain partnerships.

Backers: Unilever Ventures, Chiratae, Inventus Capital, CESC Ventures

Lumiq

FY24 Revenue: ₹70.5 Cr

Focus: Data analytics and AI engine for banking and insurance. Offers a full-stack data pipeline from ingestion to model deployment. Solves data fragmentation in large enterprises.

Key Strength: Deep domain expertise in underwriting and fraud prevention. Works with top-tier NBFCs and insurers. Speeds up data-to-insight time drastically.

Backers: Info Edge Ventures, Redstart Labs, Season Two Ventures

Adrenalin eSystems

FY24 Revenue: ₹66.2 Cr

Focus: End-to-end HCM software for payroll, talent management, and compliance. Designed for enterprises with complex org structures. On-premise and cloud delivery options.

Key Strength: 1500+ enterprise clients across BFSI, manufacturing, and government. Flexible workflows, strong security, and robust support. Long product lifecycle and deep feature set.

Backers: WestBridge Capital

Vinculum

FY24 Revenue: ₹63.8 Cr

Focus: Omnichannel SaaS platform for inventory, warehouse, and order management. Integrates across e-commerce, offline stores, and distributors. Optimizes order fulfillment and returns.

Key Strength: Vinculum powers omnichannel retail with a unified platform for order, inventory, and warehouse management. It connects with 150+ marketplaces, ERPs, and logistics partners, enabling real-time inventory sync and automated payment reconciliation.

Backers: Accel, IvyCap, RB Investments

Ubona

FY24 Revenue: ₹63.6 Cr

Focus: Voice AI technology for call centers and IVR systems. Specializes in natural language processing for Indian dialects. Enables automated, conversational customer interactions.

Key Strength: Powers millions of speech interactions monthly. Trusted by telecom and D2C brands for scalable support. Builds domain-specific voice bots and speech recognition stacks.

Backers: Capital18 (Network18)

SpotDraft

FY24 Revenue: ₹63.3 Cr

Focus: AI-powered contract lifecycle management (CLM) platform. Automates drafting, approval, and repository workflows. Built for legal, sales, and finance teams.

Key Strength: 400+ global clients, including large tech firms. 3x annual revenue growth. Speeds up contracting cycles and minimizes risk.

Backers: Prosus Ventures, Premji Invest, Arkam Ventures, Xeed Ventures (021 Capital)

UrbanPiper

FY24 Revenue: ₹56.8 Cr

Focus: Restaurant integration SaaS for delivery platforms. Connects restaurants with Swiggy, Zomato, and food aggregators. Centralizes order management and menu syncing.

Key Strength: UrbanPiper powers 45,000+ restaurants across 30+ countries with a unified platform for orders, billing, and delivery. Its Ordermark acquisition boosts global reach and backend efficiency.

Backers: Sequoia Capital, Tiger Global, Zomato, Axilor Ventures

Vyapar

FY24 Revenue: ₹54.9 Cr

Focus: Accounting and invoicing software for Indian MSMEs. Simplifies GST billing, inventory, and business reporting. Built as a mobile-first tool.

Key Strength: Trusted by 1 Cr+ businesses, Vyapar offers GST billing, inventory tracking, and accounting with offline access. Rated 4.7+ on the Play Store, it simplifies daily operations for Indian SMBs.

Backers: WestBridge Capital, India Quotient

Sapience Analytics

FY24 Revenue: ₹54.5 Cr

Focus: Workforce productivity analytics and employee time tracking. Offers data-driven insights for enterprises to optimize efficiency. Targets IT, BPO, and BFSI sectors.

Key Strength: Patented algorithms track digital activity. Enables hybrid work analysis and productivity benchmarks. Trusted by Fortune 500 clients.

Backers: Sapience Analytics Corporation

Ginesys One

FY24 Revenue: ₹54.4 Cr

Focus: End-to-end retail tech suite for offline brands. Combines ERP, POS, and e-commerce integration in one stack. Enables omnichannel retailing.

Key Strength: Ginesys One serves over 1,200+ retail brands and 50,000+ users across India, empowering omnichannel operations with integrated ERP, POS, e-commerce, and GST compliance capabilities.

Backers: Marathon Edge Partners

Medulance

FY24 Revenue: ₹54.1 Cr

Focus: Emergency response and ambulance tech platform. Aggregates private ambulance networks and offers GPS tracking. Also provides telemedicine and health subscriptions.

Key Strength: Covers 500+ cities with real-time ambulance access. Used by corporates, hospitals, and city governments. First-mover in tech-led ambulance dispatch.

Backers: Alkemi Ventures, LetsVenture

FinBox

FY24 Revenue: ₹53.3 Cr

Focus: Embedded finance infrastructure and API stack. Offers credit decisioning, bank data aggregation, and risk modeling. Serves fintechs, lenders, and BNPL platforms.

Key Strength: FinBox enables platforms to launch embedded credit in under 3 weeks with modular APIs and real-time decisioning. Trusted by 130+ lenders and 2,000+ platforms, it ensures scalable, compliant credit delivery across the customer lifecycle.

Backers: A91 Partners, Flipkart Ventures, Arali Ventures

Goodera

FY24 Revenue: ₹52.4 Cr

Focus: CSR, volunteering, and ESG reporting software. Enables employee engagement in social causes. Offers global impact tracking.

Key Strength: Goodera powers volunteering programs for 400+ clients, including 60+ Fortune 500 firms, across 100+ countries. It enables impact at scale through 50,000+ nonprofit partners and centralizes ESG data for seamless reporting and audits.

Backers: Elevation Capital, Nexus Venture Partners, Omidyar Network

Unilog

FY24 Revenue: ₹51.4 Cr

Focus: B2B e-commerce platform for manufacturers and distributors. Offers product information management and web storefronts. Focused on the US market.

Key Strength: Large US customer base with multi-year SaaS deals. Enables quick digital transformation for legacy distributors, strong B2B UX, and integrations.

Backers: Kalaari Capital

🔧 Business Model Deep Dive: Grouped by Revenue Archetypes

| Business Model Name | Core Revenue Logic | Customer Type | Startups Under This Model |

| Core Ops SaaS (HR, Logistics, Analytics) – Subscription-Led | Recurring SaaS fees for workflow automation | SMBs, Enterprises | Keka, Shipsy, Lumiq, SpotDraft, Sapience, Ubona, Adrenalin, Ginesys One |

| Transaction & Commission-Based Platforms | Revenue via PoS, order commissions, or usage fees | Restaurants, Hospitals | PetPooja, UrbanPiper, Medulance, Peel-Works |

| Freemium-Tiered MSME SaaS | Free plan with paid upgrades | Micro & Small Businesses | Vyapar |

| API & Usage-Metered SaaS | Revenue from API usage and volume billing | Fintechs, Data Platforms | FinBox, Intelligence Node |

| Enterprise SaaS with Licensing + Custom Integration | Upfront license + integration + support | Large Enterprises | Vinculum, Lumiq, Adrenalin, Unilog |

| CSR/Impact Bundled SaaS + Delivery | Dashboard + project implementation services | Corporations, NGOs | Goodera, Kale Logistics |

🛠️ Tech Stack & Infra Strategy: Grouped by Deployment Model

| Infra Strategy Name | Key Tech Features | Interface Preference | Startups Using This Stack |

| Cloud-Native Infra & Elastic Scaling | AWS/GCP/Azure infra, scalable backend | Web + API | Kale Logistics, Shipsy, Lumiq, FinBox, Goodera, Unilog |

| API-First Plug-and-Play Framework | Modular APIs, SDKs, third-party integrations | Developer Portal | FinBox, UrbanPiper, Vinculum, PetPooja, SpotDraft |

| AI/ML Automation & Decisioning Engine | Real-time AI insights, ML models, analytics pipelines | Dashboards | Intelligence Node, Unbxd, Sapience, Lumiq, SpotDraft |

| Mobile-First UX for MSME & Field Ops | Android-first apps, lightweight UX | Android App | Keka, Vyapar, PetPooja, Peel-Works |

| Hybrid/On-Prem Deployments for Regulated Clients | Optional local deployments, hybrid cloud | Web, Private Cloud | Adrenalin, Vinculum, Ginesys One |

| Voice-NLP & GPS Dispatch Platforms | NLP, voice automation, GPS-linked real-time control | Voice, Web + GPS | Ubona, Medulance, Kale Logistics |

✅ Conclusion: India’s Next SaaS Champions Are Quiet, Focused, and Built to Endure

This cohort of sub-₹100 Cr revenue SaaS startups isn’t chasing headlines; they’re compounding value in silence. Their growth is grounded in real revenues, durable use cases, and laser-sharp execution. These are not MVPs looking for validation; they are mature products solving complex business problems in HR, logistics, healthcare, retail, and fintech.

- Lean teams with high output

- Plug-and-play architectures for fast deployment

- Global ambition with India-first resilience

They’re proving that you don’t need to raise hundreds of crores to build a world-class SaaS company. You need customer obsession, smart infra choices, and the ability to scale without waste.

As the global SaaS market shifts toward profitability and sustainable growth, these startups are already there, efficient, sticky, and ready to lead. India’s SaaS story is entering its next chapter, and it’s being written by companies that value retention over virality and resilience over hype.