Agritech is quietly changing the way farming works in India. Earlier, traditional methods ruled the fields. Today, technology is helping farmers make better decisions, get improved tools, and connect more easily with markets. This change is not just about going digital, it’s about putting farmers and their real needs at the center of progress.

From mobile-based advice to smart logistics, Agritech startups are solving old problems with new ideas. They are making it easier to buy seeds, check soil health, sell crops at the right price, and get loans even in the most remote villages.

Experts believe that if this continues, India’s rural areas will see big improvements, not just in farming, but also in incomes, food supply, and small businesses. In this fast-changing space, five companies stand out. They are not just creating apps, they are building strong, lasting systems to support farmers.

This report highlights five such Agritech startups that are helping rural India grow, by thinking big, working smart, and never leaving the farmer behind.

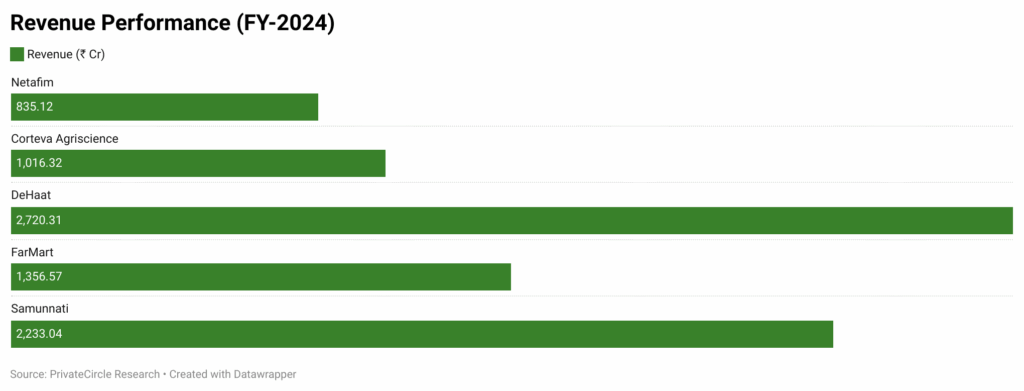

📊 AgriTech Revenue Leaders: An FY24 Snapshot

As per FY24 financial data, the five companies showcased in this report reflect diverse revenue scales, each carving a unique role in the agri-value chain. Here’s a quick comparative analysis:

Key Insights:

- DeHaat leads the table, reflecting its full-stack rural platform model that spans both agri-inputs and crop marketing. Its deep rural reach and multi-state footprint contribute to scale.

- Samunnati, with a financing-first DNA, shows that ecosystem-led models bundled with capital can scale sustainably. Despite being in a complex credit-led space, it has managed to grow consistently.

- FarMart’s revenue surge is notable, particularly for a SaaS-led agri-retail model. It proves the strength of digitizing agri-input retailers instead of bypassing them.

- Corteva, despite being a global player with science-first credentials, ranks below Indian-born DeHaat and Samunnati in topline. However, its consistent margins and capital efficiency make it a high-quality player.

- Netafim, while fifth in revenue, holds strategic importance as a key enabler of water-efficient agriculture. It drives long-term impact, especially in drought-prone regions.

Each company plays a distinct role in India’s AgriTech puzzle. From financing (Samunnati), irrigation (Netafim), and input retail (FarMart), to full-stack platforms (DeHaat) and science-led solutions (Corteva), these ventures are not competing; they complement one another. Their combined revenue footprint shows that AgriTech is no longer about pilots or prototypes; it’s about platforms that scale and sustain.

🌱 Netafim Irrigation India Private Limited (Netafim)

| Metric (₹ Cr) | FY21 | FY22 | FY23 | FY24 |

| Revenue | 991.67 | 582.73 | 634.78 | 835.12 |

| EBITDA | 40.74 | 46.97 | 55.77 | 62.21 |

| EBITDA Margin (%) | 4.11 | 8.06 | 8.79 | 7.45 |

| Current Ratio | 1.0 | 1.3 | 1.7 | 1.5 |

Netafim – Key Financials (FY21–FY24)

Business Overview: A wholly‑owned subsidiary of global irrigation giant Netafim, Netafim India delivers micro‑irrigation, greenhouse, and field automation solutions for sustainable productivity. Netafim India offers agronomic design and after-sales support and collaborates with government programs (e.g., GGRC, APMIP) to reach farmers.

Growth & Scale: Netafim’s revenues have shown a steady recovery since FY22. After a dip in FY22, the revenue grew from ₹582.7 Cr in FY22 to ₹835.1 Cr in FY24 – a nearly 31.6% jump in FY24 alone. Its dealer expansion and focus on high-value crops have driven this rebound. The company’s EBITDA rose from ₹40.7 Cr in FY21 to ₹62.2 Cr in FY24, reflecting both higher sales and improved margin control.

Resilient Roots in Precision Irrigation: Netafim India has emerged as a key force behind precision agriculture in India. Backed by Israeli innovation and a vast domestic network, it delivers micro-irrigation systems that help Indian farmers maximize yield while conserving water. The company’s commitment to sustainability, paired with technical know-how and after-sales support, makes it a preferred partner in India’s journey toward climate-smart farming.

Dealer-Driven Impact: With over a thousand employees and nearly two thousand dealers across the country, Netafim blends physical outreach with agronomic design services and strong government linkages. Whether it’s Gujarat’s GGRC scheme or Andhra’s micro-irrigation push, Netafim is often at the center of execution.

Why It Matters: In an era of erratic rainfall and soil stress, drip irrigation is no longer optional. Netafim’s footprint spans millions of acres, helping farmers grow more with less. And as water-efficient agriculture becomes non-negotiable, companies like Netafim stand tall as enablers of India’s long-term agri-resilience.

🌱 Corteva Crop India Private Limited (Corteva Agriscience)

| Metric (₹ Cr) | FY21 | FY22 | FY23 | FY24 |

| Revenue | 711.45 | 900.84 | 1,282.84 | 1,016.32 |

| EBITDA | 28.54 | 55.20 | 79.04 | 65.10 |

| EBITDA Margin (%) | 4.01 | 6.13 | 6.16 | 6.41 |

| Current Ratio | 3.3 | 2.2 | 1.4 | 1.5 |

Corteva Agriscience– Key Financials (FY21–FY24)

Business Overview: Corteva India, formerly DuPont Services Centre, is a wholly owned subsidiary of Corteva Agriscience, focusing on agricultural chemicals and related products. It supplies seeds, crop protection, and other inputs, leveraging Corteva’s global R&D to serve Indian farmers.

Growth & Scale: Corteva’s revenues surged after a ₹711.45 Cr base in FY21. Standalone revenue jumped from just ₹711.45 Cr in FY21 to ₹900.8 Cr in FY22 and ₹1,016.3 Cr in FY24. This reflects the rapid scale-up of its manufacturing and distribution. Its EBITDA likewise climbed from nil in FY21 ₹28.54 Cr to ₹65.10 Cr in FY24.

Global Science, Local Solutions: Corteva combines deep scientific expertise with strong on-ground execution. As a spin-off from DuPont, it brings decades of seed and crop protection R&D to the Indian farm. Its portfolio helps farmers fight climate risks and unpredictable seasons with greater resilience.

Strong Execution Footprint: From barely operational to a major revenue contributor in under four years, Corteva has scaled rapidly across Indian states. Its hybrid seed business and partnerships with agronomists ensure that advanced inputs reach the right farmer at the right time.

Why It Matters: Modern farming needs modern solutions. Corteva enables predictability in output and productivity in practice. For Indian agriculture to scale up sustainably, science-led platforms like Corteva will play an essential role.

🌱 Green Agrevolution Private Limited (DeHaat)

| Metric (₹ Cr) | FY21 | FY22 | FY23 | FY24 |

| Revenue | 355.59 | 1,287.57 | 1,996.85 | 2,720.31 |

| EBITDA | -433.62 | -1,543.3 | -1,053.30 | -1,079.71 |

| EBITDA Margin (%) | -121.94 | -119.86 | -52.75 | -39.69 |

| Current Ratio | 3.5 | 10.0 | 5.7 | 1.9 |

DeHaat – Key Financials (FY21–FY24)

Business Overview: DeHaat, operated by Green Agrevolution, is one of India’s fastest-growing full-stack AgriTech platforms. It connects over 1.8 million farmers across 12 states with agri-inputs, advisory, credit, and market linkage solutions through a network of “DeHaat Centers.” The company leverages AI-based agronomy, logistics tech, and a distributed rural franchise model to digitize rural agriculture end-to-end.

Growth & Scale: DeHaat has scaled rapidly, with revenue rising from ₹355 Cr in FY21 to ₹2,720 Cr in FY24. While losses remain, the company has optimized its EBITDA margin year-on-year. It aggressively expanded its reach and product portfolio across Bihar, UP, Odisha, and MP. Its platform enables both backward linkages (input sales, crop advisory) and forward linkages (crop procurement and B2B sales).

India’s Rural Operating System: DeHaat is one of the most comprehensive rural commerce platforms in India. It serves farmers through a full-stack approach, from advisory to input to output. Its network of micro-entrepreneurs makes the model both scalable and deeply local.

Community-Driven Scale: Rather than setting up large centralized warehouses, DeHaat scales by empowering local agri-entrepreneurs. This builds both ownership and accountability in rural communities, creating a new-age agri-retail model.

Why It Matters: DeHaat’s model thrives not just on technology but on trust. It shows that high-tech need not come at the cost of high-touch, and that community-led digitization is possible even in India’s most underserved regions.

🌱 Farmart Service Private Limited (FarMart)

| Metric (₹ Cr) | FY21 | FY22 | FY23 | FY24 |

| Revenue | 1.01 | 208.72 | 1,044.31 | 1,356.57 |

| EBITDA | -2.64 | -14.79 | -43.36 | -45.22 |

| EBITDA Margin (%) | -262.55 | -7.09 | -4.15 | -3.33 |

| Current Ratio | 0.1 | 2.2 | 2.3 | 1.7 |

Farmart – Key Financials (FY21–FY24)

Business Overview: Farmart is a rural retail-tech platform helping agri-input retailers digitize their stores and operations. It provides software, procurement tools, and inventory management systems to agri-input retailers, turning them into efficient local supply chain hubs. It currently serves thousands of retailers across Uttar Pradesh and Madhya Pradesh.

Growth & Scale: Farmart has scaled significantly, growing its revenue more than 1300x between FY21 and FY24, reaching ₹1,356.57 Cr in FY24. This growth is largely driven by retailer onboarding, repeat input purchases and value-added software modules that create ecosystem stickiness.

Digitizing the Village Retailer: Farmart transforms rural agri-stores into tech-enabled retail engines. Instead of building new supply chains, it empowers the existing ones with tools that boost visibility, predict demand, and streamline transactions.

Tech-First, Trust-Backed: By partnering with input retailers rather than replacing them, Farmart gains faster market penetration and trust. The retailers retain their relationships with farmers, only now, they run smarter shops.

Why It Matters: There’s a tech opportunity in every offline challenge. Farmart proves that the next wave of rural digitization may not be direct-to-farmer but via the trusted village shopkeeper.

🌱 Samunnati Agro Solutions Private Limited (Samfin)

| Metric (₹ Cr) | FY21 | FY22 | FY23 | FY24 |

| Revenue | 770.25 | 2,123.90 | 1,711.05 | 2,233.04 |

| EBITDA | 8.43 | -108.40 | -11.20 | 32.79 |

| EBITDA Margin (%) | 1.09 | -0.51 | -0.07 | 1.47 |

| Current Ratio | 1.3 | 1.0 | 1.2 | 1.1 |

Samunnati – Key Financials (FY21–FY24)

Business Overview: Samunnati is a specialized agri-finance company focused on enabling FPOs, agri-SMEs, and farmer networks with working capital and supply-chain financing. It operates at the intersection of finance and agri-value chains, offering customized credit products, market linkage, and advisory services through its NBFC and enterprise arms.

Growth & Scale: Samunnati’s topline grew from ₹770 Cr in FY21 to over ₹2,233 Cr in FY24. Its unique value-chain approach, where financing is bundled with market access, helped scale across multiple crop ecosystems.

Finance Meets Inclusion: Samunnati is a social enterprise at its core, operating at the intersection of agriculture and financial empowerment. It provides working capital, market linkage, and risk-mitigation tools for FPOs and agri-enterprises.

Enabling Ecosystems, Not Just Loans: What makes Samunnati unique is its platform thinking. Beyond credit, it builds networks of buyers, sellers, and service providers, creating a more transparent and collaborative agri-value chain.

Why It Matters: Rural finance is often transactional. Samunnati makes it relational. It believes trust, transparency, and shared value creation are the true enablers of rural prosperity.

Conclusion

India’s AgriTech sector has evolved from a niche to a critical engine of rural transformation. This report highlights how five standout startups are reshaping agriculture through scale, innovation, and inclusion.

Netafim and Corteva are bringing global technologies to Indian farms, achieving operational efficiency and steady margins. In contrast, DeHaat and Farmart are digitizing grassroots agri-commerce, signaling long-term bets despite short-term losses. Samunnati, with its finance-first model, is building a strong backbone for FPOs, offering capital, connections, and credibility in one platform.

More than technology, this transformation is about restoring dignity and predictability to the lives of millions of farmers. These startups combine innovation with empathy to create systems rooted in accessibility, trust, and long-term impact.

Whether through smart irrigation, input digitization, or embedded credit, they are tackling old problems with new thinking. Their strength lies not just in revenue growth, but in their ability to build scalable, sustainable infrastructure for rural India.

As India’s growth ambitions expand, it’s clear the path to national prosperity runs through its villages. These AgriTech leaders remind us that inclusive innovation, grounded in trust and rural realities is not just viable, but vital.

🔍 Report powered by PrivateCircle Research

Want to explore company financials, growth trends, and sector insights on thousands of Indian startups?

PrivateCircle gives investors, operators, and ecosystem enablers a powerful edge, with verified data on unlisted companies, revenue, ratios, compliance, and more.