India’s leading home services marketplace, Urban Company, is heading to the public markets, marking a significant moment for the company and the country’s broader service-tech ecosystem. Backed by years of operational refinement and strategic recalibration, this IPO is less about cashing out and more about scaling up.

Industry Outlook: Home Services on a High-Growth Trajectory

The home services sector in India is on a steep upward curve. The market is projected to grow from ₹5,000 Bn in 2024 to ₹8,300 Bn by 2029. Globally, it’s expected to surpass $1 trillion by the end of the decade. Urban lifestyles, digital trust, and rising expectations of professional service delivery fuel this transformation, making platforms like Urban Company increasingly indispensable.

The Journey: From UrbanClap to Urban Company

Launched in 2014 by Abhiraj Singh Bhal, Varun Khaitan, and Raghav Chandra, UrbanClap rebranded as Urban Company in 2020. Since then, it has expanded to 59 cities in India and built a growing international footprint in the UAE and Singapore.

The Full-Stack Model

Urban Company operates a vertically integrated marketplace with verified, trained professionals offering standardized services across:

- Beauty & Wellness

- Repairs & Maintenance

- Cleaning & Pest Control

- Painting & Smart Products (under its proprietary brand, Native)

The company supports over 48,000 professionals, backed by 25+ training centers, with over 80% repeat usage from its customer base. Gig partners benefit from financing, insurance, and structured upskilling, earning an average of ₹25,000/month.

Operational Scale and Digital Strength

- Cities Covered: 59 (India)

- International Presence: UAE, Singapore

- Daily Orders: 40,000+

- Total Customers: 13 million+

- Platform: Real-time booking, digital payments, partner-facing tools, and standardization via UC toolkits

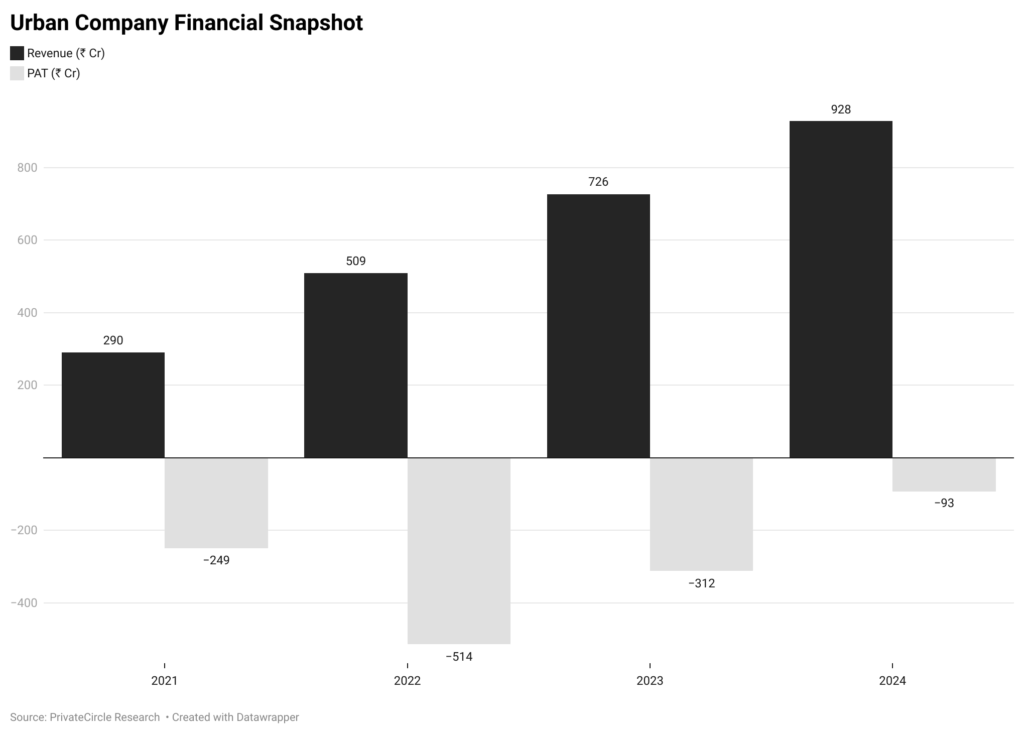

Financial Snapshot: Marching Toward Profitability

Urban Company tripled its revenue from ₹290 Cr in FY21 to ₹928 Cr in FY24, while cutting net losses by over 60%. The sharp improvement in cost efficiency signals a clear path to profitability ahead of its IPO.

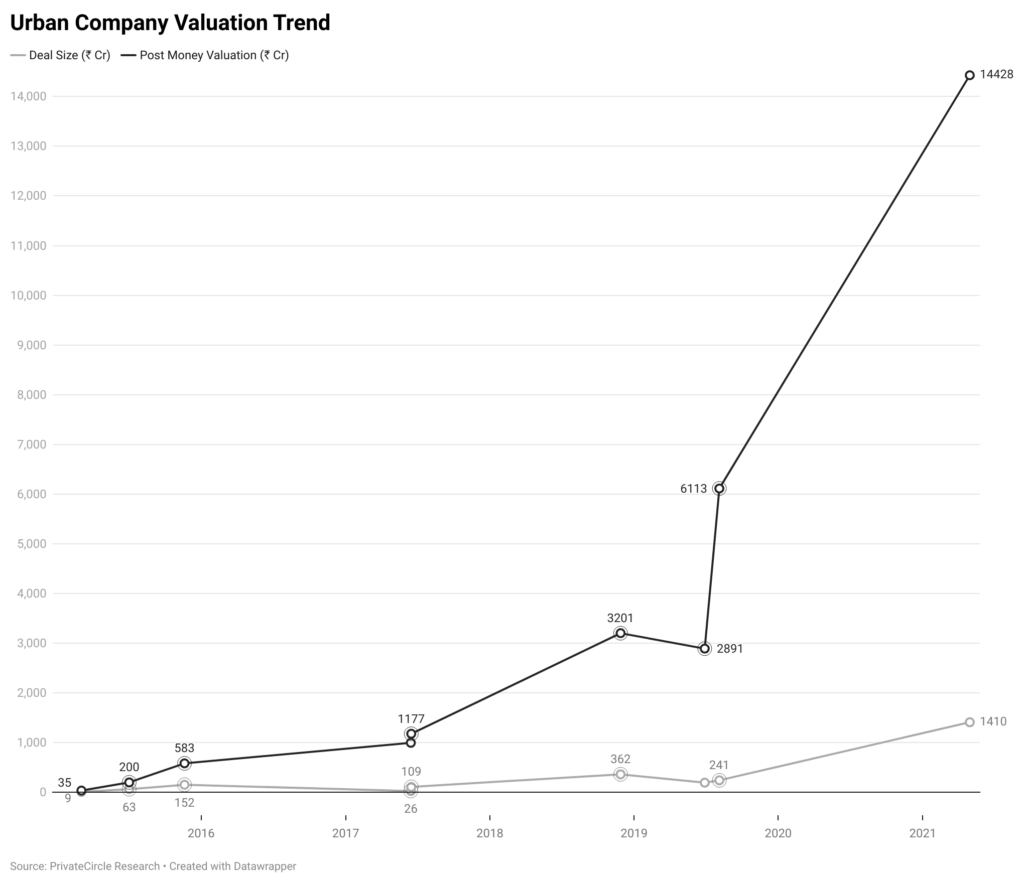

Funding History & Investor Backing

Key Investors in Urban Company

Urban Company has secured backing from top-tier investors across stages:

- Tiger Global, a consistent supporter since Series B.

- Prosus Ventures led the Series F round; Dragoneer and Wellington joined in later rounds.

- Accel and Elevation Capital invested early (Series A).

- Growth rounds saw participation from Steadview, Vy Capital, and Bessemer.

- Ratan Tata invested personally in the early stages.

- Temasek/Think Investments, Arohi, and Dharana Capital entered via pre-IPO secondaries.

Competitive Advantage: How UC Stacks Up

| Feature | Urban Company | Housejoy | Bro4u | Sulekha / Justdial |

| Cities Covered | 59 | 15+ | 6–8 | 30+ |

| Intl Presence | UAE, Singapore | None | None | None |

| Daily Requests | 40,000+ | 3,000–5,000 | <2,000 | NA |

| Customer Base | 13M+ | 2–3M (est.) | 1M+ (est.) | Directory model |

| Trained Partners | 48,000+ | Small pool | Few vendors | Not applicable |

| Training Centers | 25+ | Limited | None | None |

| Avg Partner Income | ₹25K/month | ₹12–18K (est.) | NA | NA |

Pre-IPO Playbook: Strategic Resets Ahead of the Listing

Over the past two years, Urban Company has made deliberate moves to prepare for the IPO:

- Secondary Sales gave liquidity to founders and early investors without disrupting ownership

- Governance Upgrades included onboarding leaders like Deepinder Goyal (Zomato) and Ireena Vittal

- Valuation Reset in line with global market reality, now pegged at $2.0–2.5B in recent trades

- IPO Size revised to ₹1900 Cr (₹429.Cr fresh issue, ₹1471. Cr OFS), with potential increase to ₹528. Cr

Cap Table Restructuring

A wave of secondary transactions between late 2024 and early 2025 reshaped the shareholder base:

- Founders sold ₹780. Cr worth of shares, not for personal exit, but to settle capital calls from previous rights issues, ensuring clear ownership ahead of IPO.

- Top VCs like Accel, Elevation, Tiger Global, Bessemer, and Steadview trimmed holdings.

- New entrants like Prosus, VY Capital, Dharana Capital, Think Investments, and Arohi Asset Management took their place.

Global Focus: Depth Over Breadth

In a rare but disciplined move for Indian startups, Urban Company exited Saudi Arabia and had previously pulled out of the USA and Australia. Rather than chasing vanity geographies, the company has now focused on:

- India, UAE, and Singapore as high-performing hubs

- Joint Ventures and Local Partnerships as the model of choice for any future international expansion

The ‘Native’ Strategy: Product + Service Play

Urban Company also launched ‘Native’, its proprietary product line offering tools, beauty products, and water purifiers. This unlocks:

- New revenue streams

- Better service standardization

- Deeper consumer engagement

However, this expansion introduces inventory and warranty risks, marking a pivot toward a hybrid product+service model, an area that will need close monitoring post-IPO.

Risks to Watch

- Gig Worker Classification may inflate costs if regulations shift

- Labor Agitations around pay and unionization could disrupt service

- New Entrants like Swiggy Home Services add competitive pressure

- Operational Complexity at scale remains a challenge

Final Word

Urban Company’s IPO represents more than just a capital raise, it marks a pivotal moment in the evolution of India’s consumer-tech services sector. Backed by insights from PrivateCircle, it’s clear that the company’s focus on profitability, governance, and operational discipline positions it not as a hype-driven startup, but as a long-term value creator ready for public markets