India’s digital wealth management story just hit another milestone. Groww, one of the most prominent fintech startups in the country, has raised $200 million in a Series F round at a staggering $7 billion valuation, confirming its place among India’s elite unicorns. More importantly, this round comes at a time when They reportedly tripled its profits in FY25, a rare feat in a sector known for its high cash burn.

From Flipkart Alums to Fintech Leaders

Founded in 2016 by former Flipkart executives Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal, Groww, operated by Billionbrains Garage Ventures Ltd, has emerged as one of India’s most influential fintech platforms, democratizing investments across mutual funds, stocks, F&O, fixed deposits, and more. They started as a simple mutual fund investment platform but rapidly evolved into a full-stack wealthtech company.

The core philosophy: ease of use + trust + DIY investing for the next 500 million Indians.

It now operates across verticals, including:

- Broking via Groww Invest Tech Pvt Ltd

- Lending via Groww Creditserv

- Insurance via Groww Insurance Broking

- Payments via Groww Pay Services

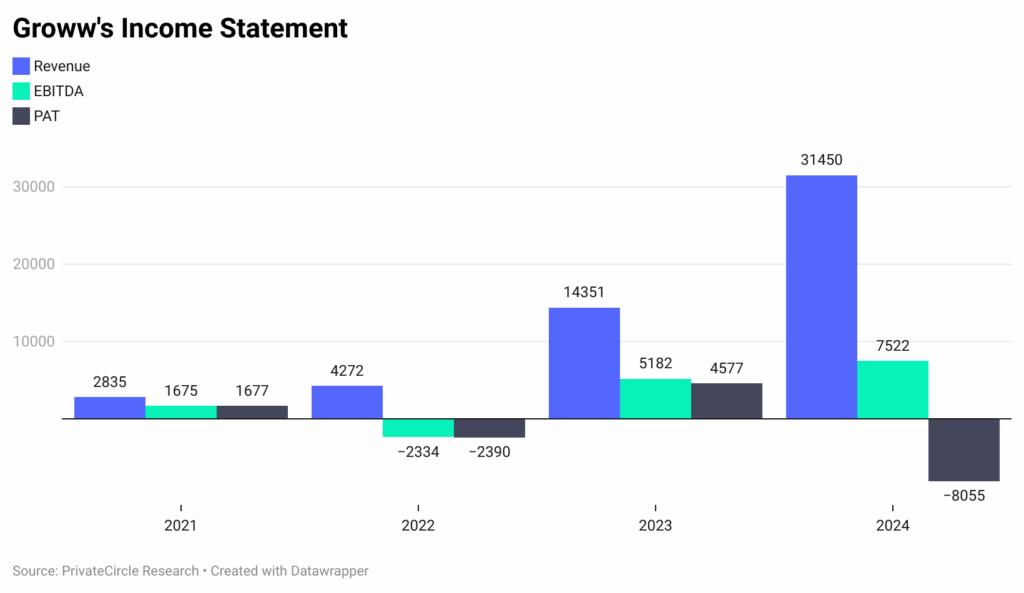

Financial Snapshot (INR Mn)

CAGR (3-year Revenue): 123.02%

FY24 PAT Margin: -25.6%

Filing Type: Consolidated

Groww has scaled 100x in revenue since FY20 (₹55 Mn) while swinging between profitability and controlled losses as it invests ahead of the curve.

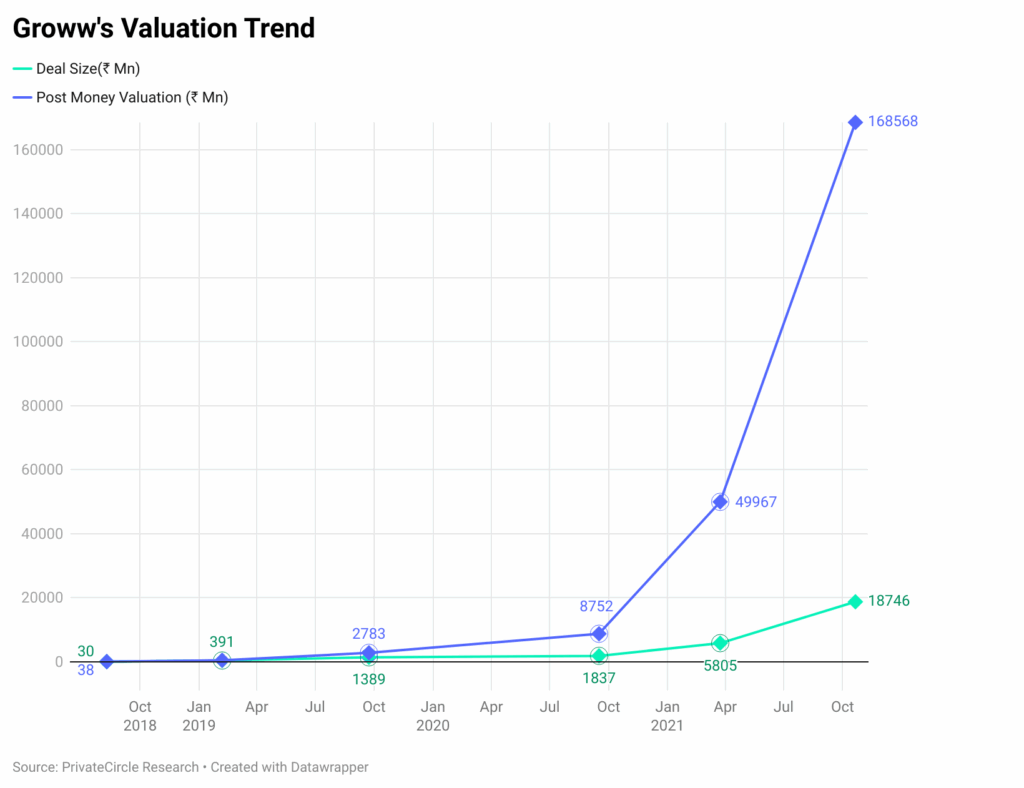

The Funding Trail: Deep Pockets, Global Confidence

Groww has raised a cumulative ₹33.5 Bn ($ 400 M+) across several rounds via Groww Inc (US parent), with marquee investors like:

- Y Combinator

- Tiger Global

- Ribbit Capital

- Peak XV Partners (Sequoia India)

- Alkeon Capital, Steadfast, ICONIQ Capital, and more

Key Rounds:

- Jun 2025 – Series F: ₹17.3 Bn (~$200M) led by GIC Singapore & ICONIQ, at a $7B valuation

- Oct 2021 – Series E: ₹18.8 Bn (~$250M) at $3B

- Apr 2021 – Series D: ₹6.1 Bn (~$83M) at $1B+

Notable Investors: Satya Nadella, Mukesh Bansal, and Ankit Nagori participated.

Note: In May 2024, a scheme of amalgamation between Billionbrains Garage Ventures Limited and Groww Inc. resulted in the cancellation of equity shares, leading to a 79.54% decline in Groww’s valuation.

Deep Pockets, Big Bets

Groww isn’t just scaling, it’s acquiring and investing:

- Acquisitions:

- Groww Creditserv, Groww Wealth Tech, Groww Insurance

- Minority investments in Digiotech(Digio), Bigital Technologies(Nimbbl), and the Metropolitan Stock Exchange(MSE).

- Strategic equity infusions from founders, Lalit, Harsh, Ishan, and Neeraj, still own over 70% in common shares, signaling skin in the game

- EBITDA-positive in FY23 and FY24, despite PAT losses, indicative of controlled operating spend vs marketing-led burn

- ROACE of 24.36% in FY24 – solid for a private tech player scaling rapidly

What’s Next? IPO Watch

With a $7B valuation and consistent EBITDA generation, Groww is arguably the most IPO-ready fintech in India after Paytm.

Signals:

- Mature cap table with late-stage institutional funds (GIC, ICONIQ, Alkeon)

- Strong revenue base and operating leverage

- Diversified financial stack (broking, lending, insurance)

Expected timeline: 18–30 months, depending on market conditions

📢 Final Thoughts: The Wealthtech Wars

Groww’s rise isn’t just a story of valuations and funding; it’s a blueprint for what’s possible when product simplicity meets relentless execution. With a founder-led vision, deep user focus, and the momentum of a retail investing revolution behind it, Groww has evolved from a YC-backed upstart to a ₹31,000 crore powerhouse.

As it prepares for the next chapter, its IPO Groww stands as a symbol of India’s maturing fintech ecosystem, proving that scale, sustainability, and stakeholder alignment can co-exist. It’s not just building a company; it’s powering a movement.

At PrivateCircle, we believe Groww’s journey reflects the broader story of Indian fintech: driven by data, shaped by trust, and led by founders who understand the pulse of a new generation of investors.